Stay up to date with the latest news, announcements, and articles.

How to earn crypto rewards? Among the most prominent methods are staking, lending, yield farming, and play-to-earn platforms. Staking involves participating in Proof-of-Stake (PoS) networks by locking up a certain amount of cryptocurrency to support network operations, earning rewards in return.

Lending platforms allow users to lend their crypto assets to borrowers in exchange for interest, while yield farming entails providing liquidity to decentralized finance (DeFi) protocols to earn rewards. Additionally, play-to-earn platforms offer users the opportunity to earn cryptocurrency by participating in blockchain-based games. Each of these methods presents unique opportunities and challenges, necessitating careful consideration and informed decision-making to effectively navigate the evolving crypto landscape .

1. Staking: Earn Rewards by Supporting Blockchain Networks

Staking is a process that allows cryptocurrency holders to participate in the operations of a blockchain network by locking up their assets to support activities such as transaction validation and security. In return, participants earn rewards, typically in the form of additional tokens. This mechanism is fundamental to Proof-of-Stake (PoS) and its variants, including Delegated Proof-of-Stake (DPoS), which are designed to be more energy-efficient compared to traditional Proof-of-Work (PoW) systems. By staking, users contribute to the decentralization and security of the network while generating passive income.

The rewards from staking can vary based on several factors, including the amount of cryptocurrency staked, the duration of the staking period, and the specific blockchain’s reward structure. For instance, platforms like Kraken and Coinbase offer staking services where users can earn up to 17% annual rewards on their staked assets.

What Is Staking?

What is crypto rewards? Staking involves locking up cryptocurrency in a blockchain network to support consensus operations such as transaction validation. In proof-of-stake (PoS) and delegated proof-of-stake (DPoS) systems, stakers earn rewards for securing the network.

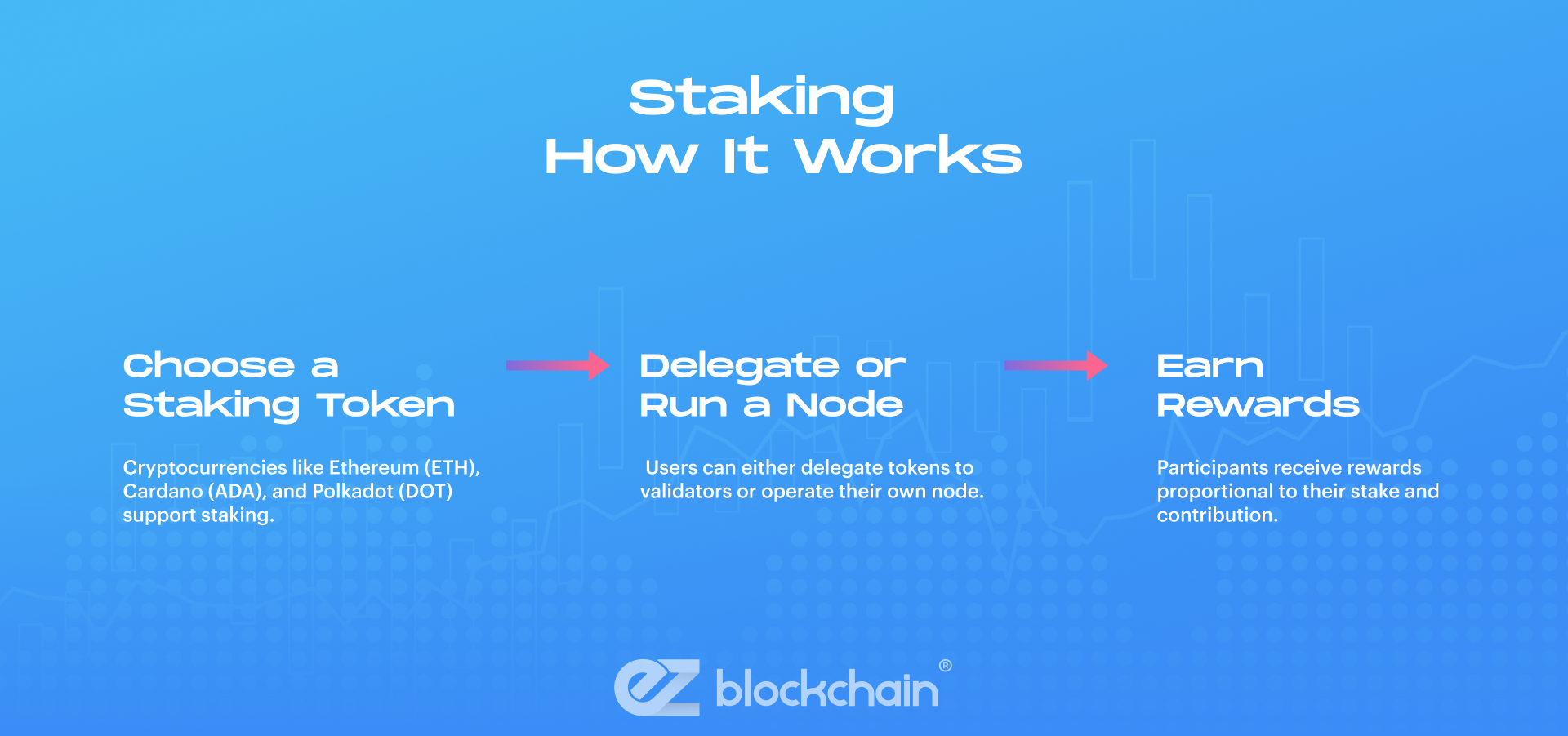

How It Works

- Choose a Staking Token – Cryptocurrencies like Ethereum (ETH), Cardano (ADA), and Polkadot (DOT) support staking.

- Delegate or Run a Node – Users can either delegate tokens to validators or operate their own node.

- Earn Rewards – Participants receive rewards proportional to their stake and contribution.

Potential Returns and Risks

- Returns: Staking yields range between 4–12% annually, depending on the blockchain.

- Risks: Lock-up periods, validator misbehavior, and price volatility may affect returns.

“Staking aligns user incentives with network security, rewarding participation while

reinforcing decentralization “

The assertion that “staking aligns user incentives with network security, rewarding participation while reinforcing decentralization” is well-supported by research and practical implementations in blockchain ecosystems. Staking, particularly within Proof-of-Stake (PoS) and its variants, incentivizes participants to lock up their tokens, thereby securing the network and validating transactions. This mechanism not only rewards users but also promotes decentralization by distributing validation power across a broad base of participants, reducing the risk of centralization. For instance, Ethereum’s transition to PoS has seen over a million validators, indicating a low risk of centralization and enhancing network security.

2. Yield Farming: Maximizing Returns in DeFi Protocols

Yield farming has become one of the most innovative yet complex methods of earning cryptocurrency rewards in decentralized finance (DeFi). At its core, yield farming involves providing liquidity to decentralized exchanges (DEXs) or lending protocols in return for interest, governance tokens, or transaction fees. Unlike traditional savings accounts, where interest rates are fixed and relatively low, DeFi protocols dynamically adjust yields based on demand and liquidity availability.

According to Liu et al. (2022) [5], yield farming effectively incentivizes users to allocate capital to protocols, creating efficient liquidity pools that sustain DeFi ecosystems. These incentives not only provide participants with potentially high returns but also fuel the growth of decentralized exchanges such as Uniswap and lending platforms like Aave and Compound.

However, while yield farming can offer annual percentage yields (APYs) that far exceed traditional financial products, it is not without substantial risks. One of the most prominent risks is impermanent loss, which occurs when the value of deposited tokens diverges significantly during the farming period, reducing returns compared to simply holding the assets. Moreover, vulnerabilities in smart contracts expose liquidity providers to potential hacks or exploits, as highlighted by Werner et al. (2021) [6], who emphasized the prevalence of protocol breaches and their impact on DeFi participants.

Additionally, fluctuating token incentives can lead to unsustainable yields, meaning that early entrants may benefit disproportionately compared to long-term participants. Therefore, while yield farming remains a powerful tool for maximizing returns, careful protocol selection, risk management strategies, and continuous monitoring are essential for sustainable participation.

What Is Yield Farming?

Yield farming involves providing liquidity to decentralized finance (DeFi) protocols in exchange for rewards. These rewards often come from trading fees, governance tokens, or lending interest.

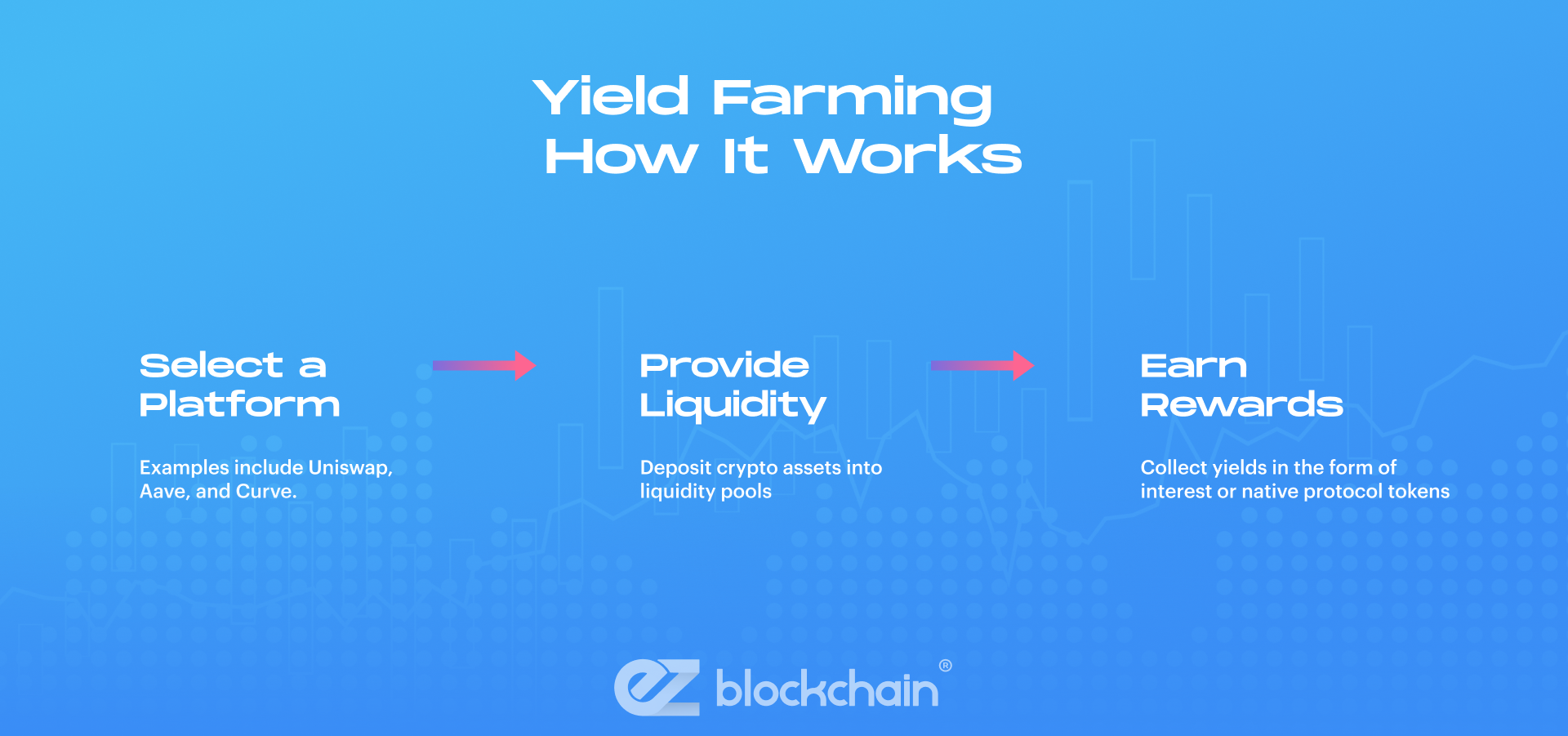

How to Start

- Select a Platform – Examples include Uniswap, Aave, and Curve.

- Provide Liquidity – Deposit crypto assets into liquidity pools.

- Earn Rewards – Collect yields in the form of interest or native protocol tokens.

Benefits and Challenges

- Benefits: High yields, portfolio diversification, and access to governance tokens.

- Challenges: Impermanent loss, smart contract vulnerabilities, and high gas fees.

“Yield farming incentivizes liquidity provision, but its sustainability depends on careful

risk management by participants“

3. Crypto Cashback and Rewards Programs

These programs, however, are not without challenges. Studies highlight that while they drive adoption, they also introduce risks tied to market volatility, regulatory uncertainty, and the long-term sustainability of rewards models. Some cashback platforms peg rewards to volatile cryptocurrencies, meaning that earned assets can fluctuate in value dramatically. Others rely on partnerships with payment processors and merchants, which may be subject to changing regulations across jurisdictions. Still, for users seeking a low-risk introduction to crypto, cashback and rewards programs provide an attractive mechanism to engage with digital assets while performing routine financial activities.

Crypto Credit/Debit Cards

Financial institutions and exchanges now offer an earn crypto rewards credit card that provide cashback in Bitcoin and other cryptocurrencies.

- Examples: Coinbase Card, Crypto.com Visa Card, BlockFi Rewards Card.

- Features: Cashback rewards, no foreign transaction fees, and flexible redemption.

Online Shopping and Cashback Services

Platforms partner with merchants to provide earn Bitcoin rewards for online shopping.

Some services integrate with browsers to automatically grant crypto cashback.

Benefits

- Passive crypto accumulation.

- Similar to traditional rewards but with blockchain integration.

- Convenient for users already engaged in digital payments.

Limitations

- Rewards may fluctuate with market volatility.

- Users must understand are crypto rewards taxable in their jurisdiction.

- Acceptance is limited compared to traditional cashback cards.

4. Play-to-Earn Games and Blockchain-Based Platforms

Play-to-Earn (P2E) games have emerged as a major innovation within the blockchain ecosystem, enabling players to earn cryptocurrency and digital assets as rewards for their in-game participation. Unlike traditional video games, where rewards are confined to the game environment, blockchain-based platforms allow players to retain, trade, or monetize their digital assets in secondary markets. According to a study by Park and Kim (2022), P2E models leverage tokenized economies to create real-world financial value from gaming activity, thereby blurring the line between entertainment and income generation.

What Are Play-to-Earn Games?

Play-to-earn (P2E) games reward users with cryptocurrency or tokens for active participation. Blockchain ensures transparency of rewards distribution.

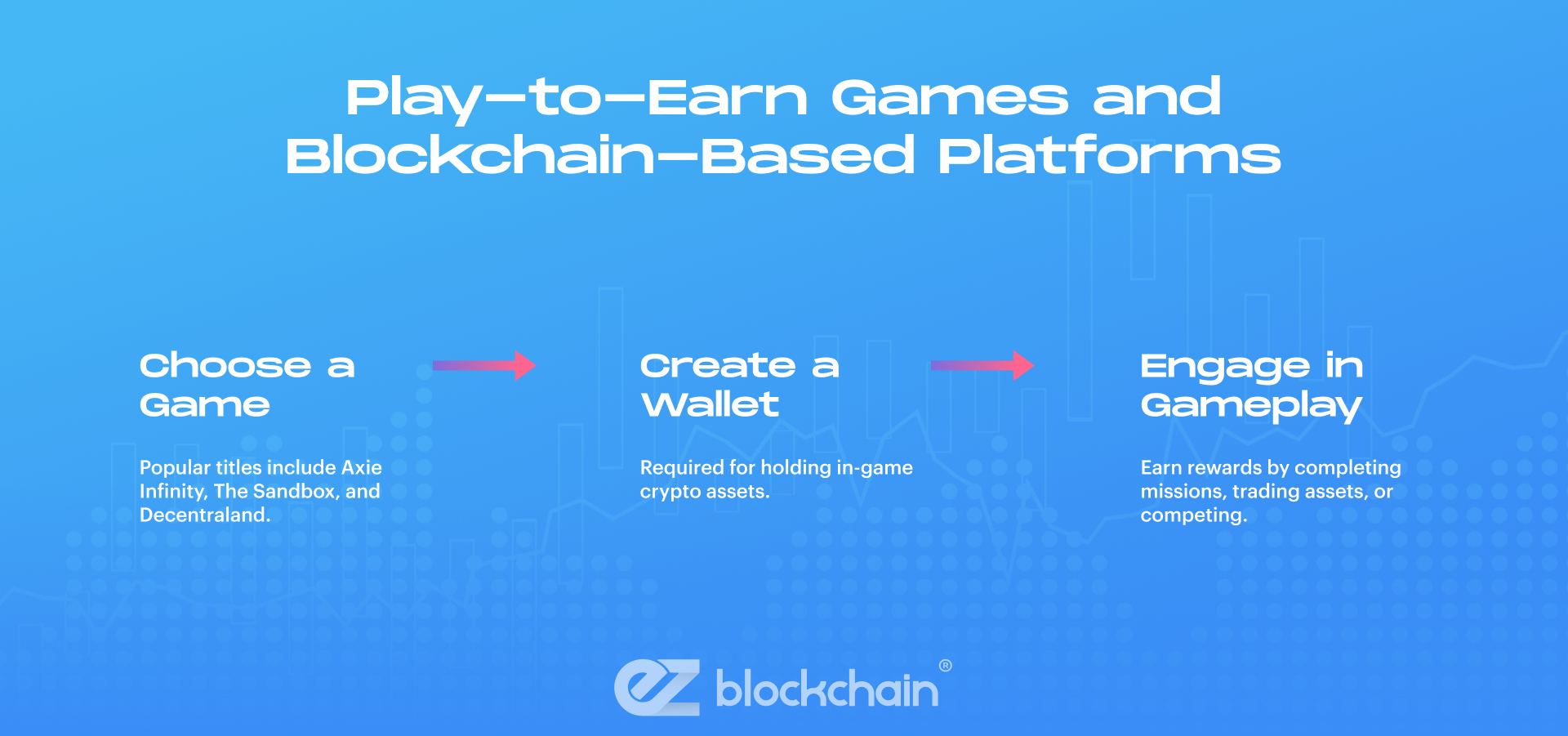

How to Get Started

- Choose a Game – Popular titles include Axie Infinity, The Sandbox, and Decentraland.

- Create a Wallet – Required for holding in-game crypto assets.

- Engage in Gameplay – Earn rewards by completing missions, trading assets, or competing.

Advantages and Considerations

- Advantages: Gamified passive income, ownership of digital assets (NFTs), and community participation.

- Considerations: Entry costs, time commitment, and regulatory uncertainty.

| Method | Mechanism | Average Returns | Risks | Best For |

| Staking | Locking tokens to validate transactions | 4–12% annually | Lock-ups, slashing, volatility | Long-term investors |

| Yield Farming | Providing liquidity to DeFi protocols | 10–50% (variable) | Impermanent loss, smart contract risk | Advanced DeFi users |

| Cashback Rewards | Crypto rewards credit cards and shopping platforms | 1–5% cashback | Taxation, volatility, acceptance | Everyday spenders |

| Play-to-Earn | Earning tokens via gameplay | Varies widely | Entry costs, time, regulatory risks | Gamers and digital asset owners |

Conclusion

The crypto ecosystem offers multiple ways to earn crypto rewards, from staking and yield farming to cashback cards and play-to-earn platforms. Each method comes with distinct benefits, risks, and potential returns. Whether using an earn crypto rewards credit card, exploring how to earn Bitcoin rewards, or experimenting with learn and earn crypto rewards programs, users must balance profitability with risk management.

Platforms like EZ Blockchain can help users monitor their mining operations and crypto holdings more effectively, providing tools to track rewards, calculate potential earnings, and optimize overall participation in the blockchain economy.

Taxation also plays a critical role: users should understand how to report crypto rewards on taxes in their jurisdiction. Ultimately, combining multiple strategies can diversify passive income streams and optimize participation in the blockchain economy.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.