Stay up to date with the latest news, announcements, and articles.

Load-bearing benchmarks used in this piece: staking reward ranges from major L1 networks (stakingrewards/CESR), DeFi total-value-locked (TVL) metrics, centralized and decentralized lending yields, and observed crypto savings / interest account APYs .

Method 1 — Staking Coins on Proof-of-Stake Networks

Mechanic. Staking converts idle token balances into consensus-security contributions; validators (or delegated validators) lock tokens to participate in block proposal/attestations and receive reward emission proportional to stake and protocol issuance rules. Rewards = block issuance + MEV/transaction-fee rebates (protocol-dependent), minus validator commission and slashing adjustments.

Benchmarks. Native staking yields vary by protocol: Ethereum staking yields have clustered in the low-single digits (recent composite rates ~3–5% depending on validator performance and effective stake), while alternative PoS networks (Solana, Avalanche, Cardano) typically advertise nominal staking rates in the mid-single digits to low double-digits. Use staking-market aggregators to compare live APYs before committing.

Operational considerations.

- Validator selection: prioritize uptime > 99.9%, transparent commission structure, reputable operator keys, and slashing history.

- Custody tradeoffs: self-staking requires node ops (or a validated third-party host); liquid staking derivatives (LSDs) give tradability but introduce counterparty and peg risk (e.g., rETH/wstETH).

- Lockups & unbonding: model unbonding periods (e.g., 7–84 days) into liquidity buffers, these windows create market-exposure gaps if prices move sharply.

Principal risks. Slashing (misbehavior or downtime), validator insolvency (if using custodial providers), LSD depeg risk, and concentration risk if too much protocol stake is delegated to a few operators.

Staking is structurally similar to running a fixed-income instrument that pays protocol issuance; the right operational posture combines high-availability validators, monitoring telemetry, and conservative exposure sizing to limit slashing/exposure windows.

Method 2 — Yield Farming and Liquidity Mining in DeFi

Mechanic. Yield farming supplies liquidity to AMMs, lending pools, or incentive programs and receives trading fees + protocol reward tokens. Effective yield = trading-fee revenue + token emissions − impermanent loss (IL) − gas costs (for on-chain compounding).

Benchmarks. TVL recovery and allocation levels drive yield opportunities; as DeFi TVL has rebounded, sustainable fee-based yields across major AMMs are often in the low-single digits for mature pools, while new incentive programs temporarily create high nominal APYs (sometimes triple-digit) that compress as TVL grows. Always decompose headline APY into its fee vs token-emission components .

Operational considerations.

- Impermanent loss modeling: simulate price divergence scenarios and use IL formulas to compute break-even time for token incentives.

- Gas & batching: on-chain compounding imposes gas friction; layer-2s or gas-efficient pools (concentrated-liquidity designs) improve net yield.

- Exit liquidity: ensure your position can be unwound without market impact, check on-chain depth and slippage at target bps.

Principal risks. Smart-contract risk, economic attack vectors (oracle manipulation), incentive program cliff effects, and IL during volatile regimes.

Yield farming can be highly accretive but requires simulation of token emission decay, rigorous smart contract review, and active monitoring to avoid transiently attractive but structurally unsustainable APYs.

Method 3 — Lending Crypto on Lending Platforms

Mechanic. Lenders deposit assets into centralized (CeFi) custodial platforms or decentralized lending markets (e.g., Compound/Aave) and receive interest derived from borrower demand, collateral-liquidity dynamics, and protocol risk models.

Benchmarks. Lending APYs vary sharply by asset and platform. Stablecoin lending often yields higher APYs (3–12% observed across providers), while native BTC/ETH lend yields are typically lower (2–7%) but asset-dependent. Centralized platforms may offer promotional/loyalty rates for native tokens .

Operational considerations.

- Counterparty credit risk (CeFi): evaluate custodian solvency, regulatory status, proof-of-reserves transparency, and withdrawal cadence.

- Smart-contract counterparty (DeFi): assess overcollateralization ratios, liquidation mechanisms, and oracle security.

- Collateral composition and LTV: lower LTV reduces liquidation risk but reduces capital efficiency.

Principal risks. Custodial insolvency (historical CeFi collapses), smart-contract bugs, liquidation cascades during volatility, and platform withdrawal freezes.

Lending is attractive for predictable yield but demands distinct risk-management, either rigorous counterparty diligence for CeFi or composable-risk analysis for DeFi markets.

Method 4 — Earning Dividends via Dividend Tokens or Revenue-Sharing Tokens

Mechanic. Some tokens distribute protocol revenues, fees, or dividends to token holders either via native protocol mechanisms (on-chain revenue share) or off-chain legal constructs (equity tokens). Yield is tied to protocol economic throughput rather than inflationary issuance.

Benchmarks. Revenue-sharing yields are heterogeneous: mature platforms that capture transaction-fee economics can produce sustainable single-to-mid-digit yields, but many projects allocate only a share of revenues and retain treasury buffers. Legal-structure tokens in regulated jurisdictions may provide clearer payout rules. Monitor on-chain fee distribution metrics and treasury revenue streams.

Operational considerations.

- Tokenomics audit: verify contractual code that distributes fees (check vesting, burn, treasury allocations).

- Legal exposure: revenue-sharing tokens with off-chain legal rights require securities-law analysis.

- On-chain distribution lag: payouts may be batched or contingent on governance triggers.

Principal risks. Regulatory classification (securities risk), protocol revenue volatility, and governance capture that changes distribution terms.

Dividend/revenue tokens are potentially high-quality yield sources when the protocol’s fee model is proven and legally robust, but they require legal diligence and active monitoring of revenue telemetry.

Method 5 — Running Masternodes or Validator Nodes

Mechanic. Operating a masternode or a full validator provides network services (consensus participation, governance, special services) in exchange for block rewards and service fees. This requires up-front collateral and continuous infrastructure availability.

Benchmarks. Reward economics vary by network; masternode returns are often advertised in double-digit nominal yields but are net of operator costs (infrastructure, bandwidth, maintenance) and are contingent on uptime and governance rules.

Operational considerations.

- Infrastructure SLAs: implement redundant peers, automated monitoring, auto-restart, and secure key management (HSM or air-gapped signing).

- Collateral & burn: model the opportunity cost of locked collateral and ensure diversification across operators.

- Governance exposure: some node operators must participate in governance; delegation of votes may reduce operational burden.

Principal risks. Key compromise, hardware failure (downtime slashing), and obsolescence of protocol reward schedules.

Node operation is a technical, operational business, profitable for technically competent operators who can sustain high-availability infra and secure key custody.

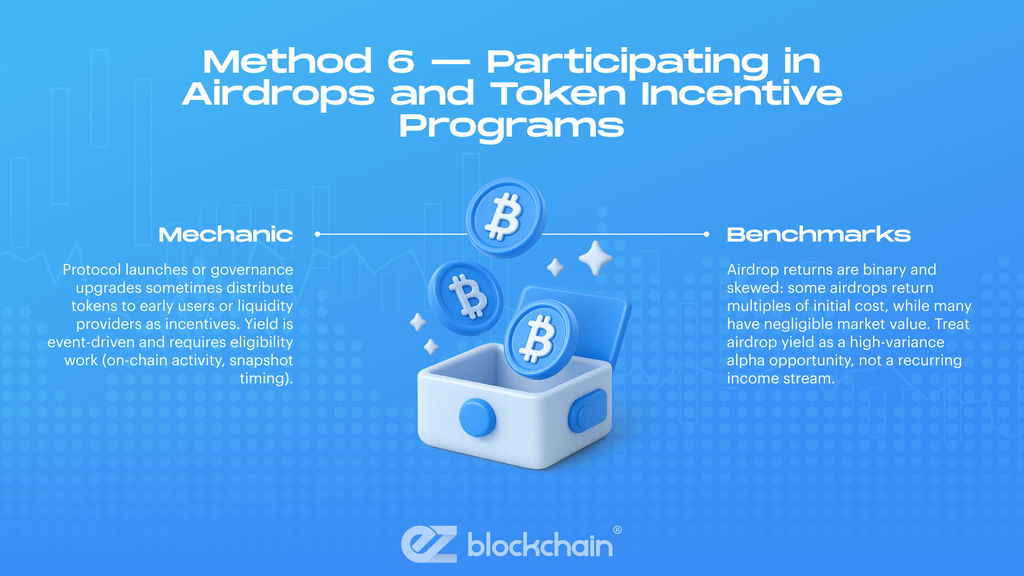

Method 6 — Participating in Airdrops and Token Incentive Programs

Mechanic. Protocol launches or governance upgrades sometimes distribute tokens to early users or liquidity providers as incentives. Yield is event-driven and requires eligibility work (on-chain activity, snapshot timing).

Benchmarks. Airdrop returns are binary and skewed: some airdrops return multiples of initial cost, while many have negligible market value. Treat airdrop yield as a high-variance alpha opportunity, not a recurring income stream.

Operational considerations.

- Eligibility tracking: maintain an index of snapshot dates and on-chain eligibility criteria; use automated scripts to validate wallet participation.

- Tax & regulatory accounting: airdrops may be taxable on receipt; maintain records of FMV at the receipt timestamp.

- Sybil-resistance cost: perform cost-benefit analysis — avoid gaming mechanisms that carry legal risk.

Principal risks. Low-value distribution, tax liabilities, and regulatory scrutiny for manipulative behavior.

Airdrops are opportunistic and should be pursued as a targeted alpha channel with strict documentation and conservative valuation assumptions.

Method 7 — Using Crypto Savings Accounts or Interest-Bearing Wallets

Mechanic. Centralized platforms and specialized savings providers offer interest-bearing accounts by deploying deposited assets across lending markets, staking, or treasury strategies. They abstract operational complexity in exchange for custodial control.

Benchmarks. Interest-bearing accounts for stablecoins commonly advertise APYs from ~3% to >10% (platform and term dependent); BTC/ETH rates are usually lower. Promotional rates and native token loyalty tiers can materially change yield profiles .

Operational considerations.

- Withdrawal terms: check lockups, notice periods, and withdrawal caps.

- Insurance & proof-of-reserves: evaluate publicly auditable reserves or third-party insurance coverage (rare and often capped).

- Yield source transparency: require a breakdown of revenue sources (lending, staking, treasury investments).

Principal risks. Counterparty insolvency, withdrawal freezes, opaque allocation of depositor funds, and promotional-rate cliffs.

Interest-bearing accounts are attractive for convenience but concentrate counterparty and liquidity risk; reserve conservative allocation sizing and due diligence.

Comparative Snapshot of Expected Net Yield Ranges

| Method | Typical net yield (range) | Primary risk vector |

| Staking (L1 validators / LSD) | 2% – 12% (protocol dependent) | Slashing, lockup |

| Yield farming (AMM incentives) | 0% – 100%+ (high variance) | Smart-contract + IL |

| Lending (DeFi/CeFi) | 2% – 15% | Counterparty / liquidation |

| Dividend/Revenue tokens | 1% – 10% (depends on throughput) | Revenue volatility, legal |

| Masternodes/validators | 5% – 20% (operator costs) | Uptime, key compromise |

| Airdrops/incentives | 0% – asymmetric upside | Nonrecurring, tax |

| Savings accounts | 1% – 12% | Custodial insolvency |

Use this table as an operational starting point, net yield must be adjusted for fees, tax drag, compounding cadence, and your own operational cost (infra, gas, custody).

Tax Implications and Legal Considerations for Passive Income

Tax regimes vary by jurisdiction, but common principles apply:

- Staking rewards, lending interest, and airdrops are usually taxable on receipt at fair market value. Maintain timestamped TXIDs and USD valuations.

- DeFi activity (swaps, LP withdrawals) may trigger realized gains/losses that complicate bookkeeping; use automated tax tools and on-chain export scripts.

- Revenue-sharing tokens may carry securities classification risk; consult counsel and treat distributions conservatively.

Tax and legal regimes are evolving rapidly; include tax provisioning in yield modeling and engage counsel for larger facilities or legal-structure tokens.

Tips for Maximizing Yields While Minimizing Risk

A concise operational checklist for practitioners:

- Diversify across methods rather than concentrating in one protocol or counterparty.

- Stress-test liquidity scenarios: size positions so forced liquidation doesn’t cascade losses.

- On-chain telemetry & alerting: set SLA-style alerts for validator downtime, abnormal TVL flows, or oracle price drifts.

- Model net yield: include gas, slippage, platform fees, tax, and operational costs.

- Use whitelisted counterparties: for CeFi, prefer licensed custodians with transparency and sane withdrawals.

- Document everything: TXIDs, contractual terms, and custody agreements for audit and tax purposes.

Passive crypto income is a discipline of continuous engineering, treat it like running a financial production system: instrument, simulate, and enforce governance and limits.

Final Takeaway

Passive crypto income is accessible through multiple plumbing layers. Consensus-layer staking, protocol-level farming, lending markets, node operation, and off-chain custodial programs. Each yields different reward profiles and risk vectors; the prudent allocator will codify exposure limits, maintain robust telemetry and SLAs, and continuously reprice model inputs (APY, gas, TVL changes, regulatory shifts). Market data and industry benchmarks indicate that sustainable yields exist but are conditional on active risk management and operational rigor.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.