Stay up to date with the latest news, announcements, and articles.

Below we survey top-tier analytics tools in 2026 (both free and commercial), compare their strengths and weaknesses, and illustrate how to embed them into a professional crypto strategy.

Comparing Features, Pricing, and Ease of Use

Here’s a quick breakdown of what major crypto‑analytics platforms offer as of 2025–2026, across different types of data use-cases (on‑chain, market data, sentiment, technical charts, and mining/ profitability tracking):

Crypto Analytics Tools — What They Do

- CoinMarketCap: Global price and market‑data aggregator: real‑time price, volume, liquidity, supply, exchange listings.

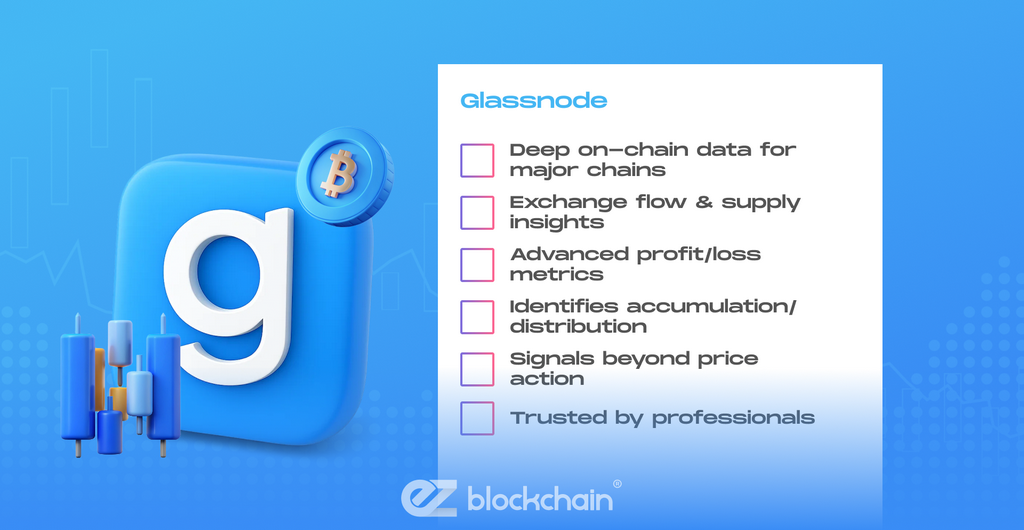

- Glassnode: On‑chain analytics, network health, supply & demand signals, exchange flow data, investor behavior analytics (e.g. holder age, realized/unrealized profit, HODL‑waves, SOPR, NUPL) .

- Messari. Research platform combining token metadata, project fundamentals, on‑chain data, liquidity/volume charts, news feed, and alert systems .

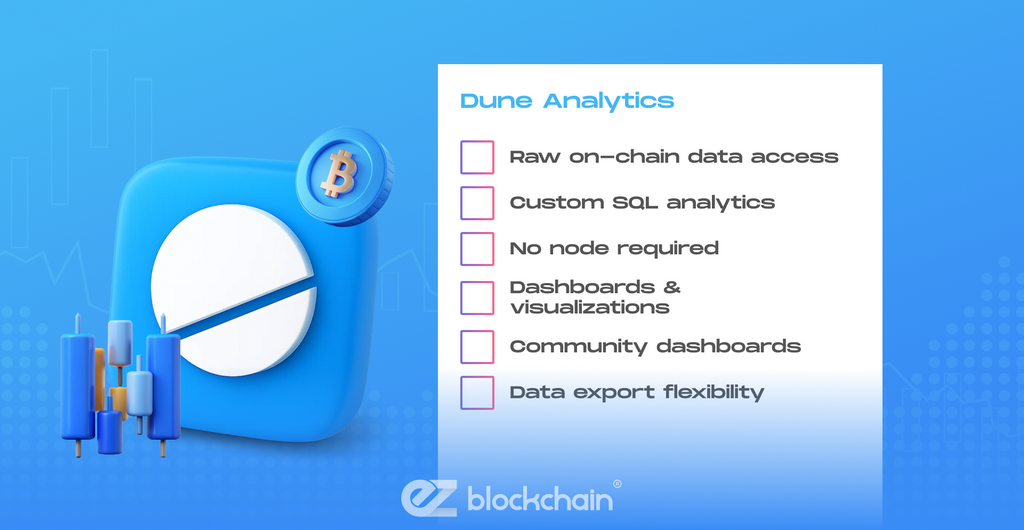

- Dune Analytics. SQL‑powered, blockchain‑agnostic querying and customizable dashboards for on‑chain activity, protocol‑level metrics (TVL, users, smart‑contract interactions), custom queries, community‑shared dashboards .

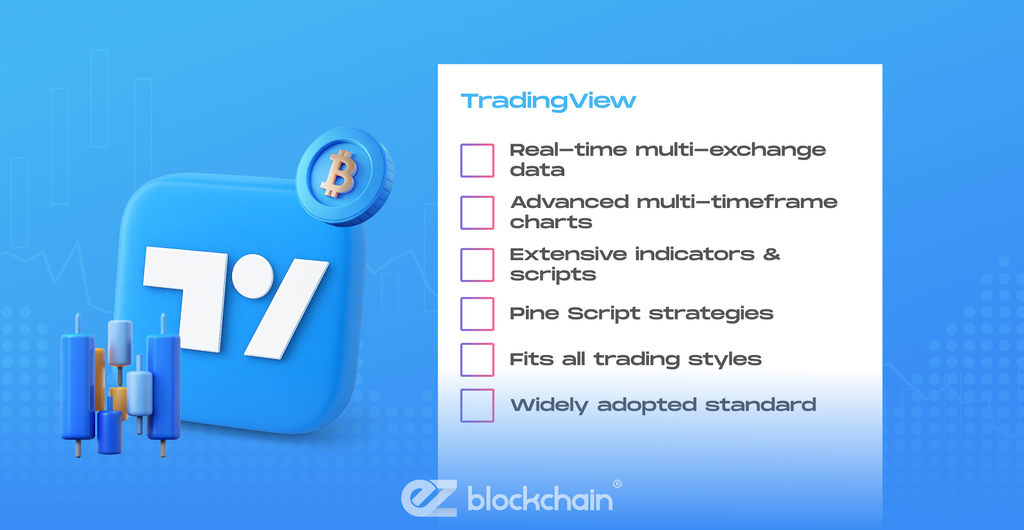

- TradingView: Advanced technical‑analysis charting, multi‑asset support, user‑defined indicators/scripts, multi‑timeframe layouts; serves crypto alongside traditional markets .

- Santiment: Combines on‑chain metrics with sentiment analysis: social signals, developer activity, whale activity, token supply flow & behavioral data — giving market‑psychology context beyond pure price/volume .

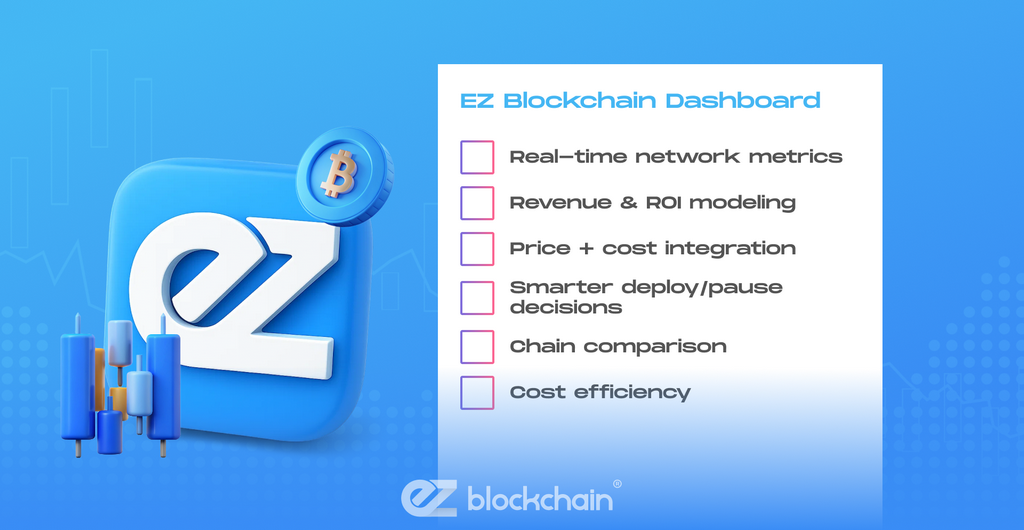

- EZ Blockchain Dashboard: Real-time mining and profit analytics, integrating blockchain‑level mining data, hash‑rate and difficulty feeds, coin‑price feeds, and expense modelling (electricity, hardware) for mining ROI tracking.

The table below offers a consolidated view of these tools.

Comparative Overview of Major Crypto Analytics Tools

| Tool / Platform | Primary Focus & Data Type | Strengths | Weaknesses / Notes |

| CoinMarketCap | Market data: price, volume, liquidity, supply | Broad coverage of coins/exchanges; free; easy UI | Limited on‑chain/behavioral depth |

| Glassnode | On‑chain analytics & network health (BTC, ETH, others) | Deep metrics (wallet flows, SOPR/NUPL, supply data), network‑level insight | Limited off‑chain/trading‑data; subscription tiers |

| Messari | Research + fundamentals + market data | Token metadata, project insight, alerts, news + data | Some data gated by paywall; less customizable than raw‑data tools |

| Dune Analytics | Custom on‑chain query + analytics across multiple chains | Fully customizable, SQL queries, community dashboards, multi‑chain | Requires SQL competence; some performance/latency tradeoffs |

| TradingView | Technical analysis, charting, cross‑asset data | Custom indicators, multi‑timeframes, community scripts, exchange integration | Focused on price/volume — not on‑chain/fundamental data |

| Santiment | Combined on‑chain + sentiment + behavioral analytics | Adds social/developer/whale data layer, early‑trend detection potential | Data interpretation requires care; signal noise |

| EZ Blockchain Dashboard | Mining & profit analytics (hashrate, difficulty, cost vs revenue) | Useful for miners — integrates chain-level data + cost models, ROI dashboards | Requires accurate input of costs; limited to mining use-case |

No single tool is “best” in all dimensions. For complete coverage, on‑chain intelligence, market data, TA, sentiment, and mining economics, a layered stack combining several tools provides the most robust analytical foundation.

How to Integrate Tools Into Your Trading or Mining Strategy

Building a data‑driven workflow is about orchestration, using the right tool for the right job, and combining outputs in a repeatable, quantitative process. Here’s a recommended integration workflow:

- Price & market data baseline: Use CoinMarketCap to monitor token universe, exchange listings, liquidity, and supply metrics, helps you define the “universe of investable assets.”

- On‑chain health check: For tokens or chains you consider, switch to Glassnode or Dune to assess network health, e.g. wallet distribution, exchange flows, turnover, supply aging, active addresses.

- Fundamental & project due diligence: Use Messari to read tokenomics, audit history, team, roadmap, liquidity, and historical metrics, useful before allocating medium-to-long-term capital.

- Sentiment & behavioral overlay: Use Santiment to monitor social chatter, developer activity, whale moves, net supply flow, which can provide early signals ahead of price moves.

- Technical trade execution: Use TradingView to perform TA, chart support/resistance, set entries and exits, backtest strategies, overlay on‑chain or sentiment signals as context.

- Specialist analysis or mining economics:

- For DeFi builders, protocol analytics or smart‑contract flows, build custom dashboards on Dune.

- For miners or validators, run profitability models via EZ Blockchain Dashboard (or equivalent tool), combining hashrate, difficulty, price, and operational cost feeds to evaluate ROI/reinvestment.

- For DeFi builders, protocol analytics or smart‑contract flows, build custom dashboards on Dune.

- Risk & position monitoring: Combine exchange‑flow and wallet data (Glassnode) with TA and sentiment signals, build monitoring dashboards and automated alerts for large outflows, abnormal on‑chain behavior, or sentiment‑based warnings.

A multi‑tool stack, price baseline, on‑chain analytics, sentiment overlay, TA charts, and mining economics, enables a full‑spectrum view. That’s critical when dealing with volatile markets, unpredictable sentiment shifts, or mining profitability swings.

Crypto Analytics Tools

Below is an expanded analysis of each tool named above, what it offers, who benefits most, and what to watch out for.

CoinMarketCap

CoinMarketCap remains the most widely used aggregator for baseline market data. It tracks thousands of tokens, their circulating and total supply, 24‑hour volumes, exchange pair listings, and more. For high-level screening, especially when beginning research into new tokens, CMC provides a fast, searchable, and free entry point.

Because it aggregates trade-volume across many exchanges, it helps surface liquidity anomalies (e.g., tokens with low volume but high perceived hype). However, CMC does not provide on-chain wallet flow data or network-health metrics, so use it strictly as a universe scanner and initial filter.

Glassnode

Glassnode is widely regarded as a “go‑to” tool for on‑chain intelligence. It provides dozens of metrics for major chains (Bitcoin, Ethereum, many alt‑chains), including exchange inflows/outflows, supply distribution, HODL‑waves, realized vs unrealized profit/loss (NUPL), SOPR (spent output profit ratio), active address counts, and more.

These metrics allow experienced analysts to spot structural shifts: accumulation by long-term holders, exchange deposit spikes (potential sell pressure), or divergence between price and on-chain demand, valuable leading indicators that price charts alone cannot reveal.

However, Glassnode is less suited for fine‑grained protocol‑level data (e.g., DeFi‑protocol positions) or for small-cap alt‑coins on niche chains. Its depth is maximized on major networks.

Messari

Messari merges traditional financial‑style research (project fundamentals, tokenomics, market capitalization, risk scores) with on‑chain and market data. It allows users to screen tokens by criteria (volume, supply distribution, liquidity, risk scores), set custom alerts, and read in-depth project reports.

For medium‑ and long‑term investors, particularly those allocating over multiple projects, Messari’s blend of fundamentals, data, and alerts is valuable. Be aware that some of the deeper data is gated by subscription.

Dune Analytics

Dune brings raw blockchain data into a queryable environment. Users can write SQL against pre‑indexed blockchain datasets (contracts, transfers, token holders, block/time data), then visualize results in dashboards, charts, or CSV exports. Many public dashboards exist covering DeFi TVL, NFT activity, bridge flows, token distribution, and more.

Best for quant‑oriented users, analysts, funds, or developers, you don’t need to run your own node; Dune handles indexing and data normalization. The tradeoff is time/skill: meaningful custom queries require SQL fluency, and complex queries cost more computation time.

TradingView

TradingView remains the dominant charting platform across asset classes. For crypto, its strength lies in real-time data feeds across multiple exchanges, extensive community scripts and indicators, multi-timeframe charting, and a powerful custom scripting language (Pine Script) for building automated or semi-automated strategies.

Traders, whether scalpers, swing traders, or long-term, use TradingView to overlay price action with on-chain or sentiment signals from other tools. Its versatility and broad adoption make it a de facto standard.

Santiment

Santiment blends on‑chain data (supply flows, token distribution, whale activity) with social and behavioral data (social mentions, developer activity, community sentiment) to produce composite metrics that attempt to model market psychology.

For traders and allocators who want a behavioral overlay, early detection of hype cycles, social‑media driven pumps, or early whale accumulation. Santiment adds a dimension beyond pure charting or chain‑level data. As always with sentiment data: interpret with caution; signals can be noisy and short-lived.

EZ Blockchain Dashboard

For miners or validator operators, price and market data alone aren’t enough. Profitability depends on hash rate, network difficulty, block rewards, electricity cost, hardware efficiency, and opportunity cost. A dedicated dashboard, like the EZ Blockchain Dashboard, that ingests live chain data (hash‑rate, block intervals, reward schedule) plus external price feeds and your cost base is critical for realistic ROI modeling.

By comparing projected revenue to cost benchmarks in real time, miners can make data-driven decisions about when to deploy, when to pause rigs, or when to switch chains.

Why This Matters Now: 2026 Market Dynamics & Data Explosion

Several industry trends in 2024–2026 have increased the importance of robust analytics:

- As institutional adoption grows, on‑chain flow data (exchange inflows/outflows, supply concentration, locked supply) has become a prelude to large moves. Platforms like Glassnode are now considered essential for institutional desks.

- DeFi growth remains fragmented, multi‑chain, and dynamic. Customizable analytics (via Dune) often deliver data long before price reacts, giving early movers a structural advantage .

- Sentiment and behavioral signals (social, developer, NFT‑market flow) regained relevance after 2023–2024 cycles, increasing demand for platforms like Santiment that combine on‑chain and off‑chain data sources.

- Mining economics remain tight in some Proof-of-Work networks due to rising hash‑rate, energy cost inflation, and reward halving cycles; tools that model actual ROI (not just price) are essential for miners’ survival, not “nice‑to-have.”

As crypto evolves, so does the data landscape, opacity no longer favors investors; data-driven clarity does. Using robust tools is no longer optional for serious participation, but foundational.

Final Thoughts: Investing Intelligence and Data Intelligence

In 2026, the competitive edge in crypto isn’t just having capital, it’s having superior data intelligence. Price charts are table stakes; understanding on‑chain supply dynamics, investor behavior, social sentiment, protocol‑level liquidity, and mining economics differentiates rational allocators from speculative gamblers.

For serious traders, miners, or institutional allocators in 2026, a data‑first posture is not optional, it is fundamental to surviving volatility, avoiding avoidable losses, and spotting structural shifts ahead of the curve.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.