Stay up to date with the latest news, announcements, and articles.

It’s the highest network difficulty in Bitcoin’s entire sixteen years of history. This figure also means a high level of computational challenge miners must solve to validate new blocks. Yet it is also an indicator of miner competition, hardware sophistication, and the growing global confidence in BTC’s long-term role.

Let’s try and figure out the main reasons the 136T difficulty threshold came into being, what are its effects and causes, and what you can do to adapt and turn this into profits.

Factors Affecting Difficulty

But first, what forms and influences the Bitcoin network difficulty today? To understand that, let’s recap:

- The difficulty exists to keep the network’s mining pace balanced, keep miners competitive, and regulate block rewards based on the Proof-of-Work principles.

- BTC’s mining difficulty adjusts roughly every two weeks to keep block times near ten minutes.

- When more hashpower floods the network, the protocol automatically scales up the difficulty.

- When miners leave, it scales down.

At 136T, it’s clear: the network is seeing one of its most competitive eras yet. So as you can see, the Bitcoin difficulty chart is shaped by a couple of main components:

Network hashrate

The first and most obvious difficulty driver is the rising network hashrate — the total computational power securing Bitcoin. Over the past few months, new mining farms have gone live across the US, Kazakhstan, and Latin America. And many such operations use high-efficiency ASICs like the Antminer S21 or Whatsminer M60, pushing the hashrate to all-time highs. The stronger the network’s hashrate, the higher the difficulty climbs.

New Miners and ASICs

Mining hardware is becoming ever-closer to the mass use and solo application. The latest ASICs deliver up to 200+ TH/s per unit while consuming less energy per terahash. As these newer models replace outdated rigs, total network capacity expands even without more operators joining. Combine that with post-halving optimizations and large-scale hosting operations, and you can see why the growing Bitcoin network difficulty now.

Protocol Adjustments

Apart from those market-driven and organic factors, there are also a bunch of internal, critical maintenance adjustments and re-configurations that are carried out in the BTC network. Every so often, the entire chain is hit with halvings and must redistribute hash.

The main events that drive the current Bitcoin difficulty on a deeper level include the following ones:

- Automatic difficulty retargeting — the mentioned regular adjustment that happens about every 2,016 blocks;

- Halving events — another regular event is dedicated to halving the BTC mining rewards, stimulating the competition and tech demand among miners. April 2024’s halving reduced the block subsidy from 6.25 BTC to 3.125 BTC, immediately cutting miner revenue by 50%.

- Congested mempools and free market dynamics — Activity spikes from protocols like Ordinals, Runes, and BRC-20 tokens have boosted transaction fees. During such congestions, block rewards are temporarily increased and more miners are incentivized to join the network.

- Hashrate redistribution — can happen post-regulation, e.g., in some regions crypto regulations are tightened (China, russia), while in others (the US, El Salvador, Paraguay, etc.) new pro-mining policies are being introduced, calling for more hashrate directed there.

These underlying BTC network shifts should give you a fuller picture. Yet another important question is how all of that impacts real-world mining operations?

Impacts on Miners

There are several ways miners can either suffer from or leverage the latest Bitcoin network difficulty level. For every contributor to the BTC mining community, the 136T mark is both an achievement and a stress test.

But the main points of influence and challenges include:

- Tighter profit margins — With higher difficulty, the same hashpower earns fewer BTC per block, and the profitability is eaten unless you offset it through lower energy costs or higher BTC prices.

- Higher competition — The BTC network is pretty crowded at this time, so the miners with next-gen ASICs (or cost-efficiency energy sources) stand out as “privileged top dogs” of the chain right now.

- Industry pressure to upgrade — As a result of the above point, outdated, poorly powered, or otherwise inefficient rigs are quickly becoming unprofitable.

- Energy optimization is foundational — Electricity is the main survival factor for any miner today, which means you want to leverage low-cost grids, search for budget-friendly energy contracts, or try alternative power sources.

- Market reshaping — Due to growing tech and efficiency demands, smaller players must either shut down or merge into hosting and pool operations. All the while, large-scale farms simply purchase upgrades and retain the dominance.

Profitability Changes

While certainly backing up the extreme demand and profitability of bitcoins, today’s Bitcoin mining difficulty is also a major tectonic shift for the whole industry. Because higher difficulty means fewer rewards per hash, the profitability rates of BTC are impacted in major ways.

Even with stable BTC prices, solo and smaller miners will feel the spike in power bill expenses. For many, profitability is now nearly impossible to achieve without ultra-efficient cooling, savvy energy sourcing, and strategic timing of operations.

“..for miners with access to cheaper and/or renewable power, the high difficulty is a great window of opportunities.”

However, for miners with access to cheaper and/or renewable power, the high difficulty is a great window of opportunities. Those mining farms that were optimized thoroughly will be getting a more than decent ROI.

To give you an outlook of the profitability dynamics over the years, here are some of the former milestones:

| Year | Approx. profit per TH/s per day | |

| 2015 | ~$2.98 per TH/s/day | The early ASIC era was marked with lower difficulty. |

| 2017 | ~$2.08 per TH/s/day | Relatively high profitability kept for several years. |

| 2019 | ~$0.37 per TH/s/day | Rising difficulty prompted forced hardware upgrades. |

| Aug 2024 | ~$0.05 per TH/s/day | Halvings lowered BTC rewards further, while the total hashrate grew. |

Right now, the profitability is recovering thanks to BTC’s upward price momentum and expensive fees. But it is still very individual. Calculating the profitability from mining in today’s Bitcoin mining difficulty is impossible without actually setting up the operation and considering many moving parts and aspects.

Here’s what reputable crypto sources say:

According to CoinWarz, a profitability margin between ~$5 and ~$10 can still be maintained. That is, if we take a miner that operates at about a 390 TH/s capacity and consumes up to 7,000 W of energy at $0.05 per kWh electricity cost. Such a miner would generate up to $18,58 of daily revenue, which is $9,92 of profit per day after power costs.

On Hashrate Index, daily profit rates for new ASIC rigs packing 500 TH/s at 6,750 W is indicated at about $14,22 per day (in a specific scenario). Lastly, on BitInfoCharts the average profitability is estimated at about $0,047 per TH/s/day across the network.

All in all, your profit margin can realistically amount to $10 daily if your miner packs about 400 TH/s hashrate capacity and runs at very low electricity cost (around $0.05 per kWh). For higher expense baselines or lower efficiency, profitability rates may drop dramatically. For many cases, the daily profitability keeps under $0,05.

Mining Strategy Adjustments

Bitcoin’s 136T difficulty topline tells us that the network has become stabler, more secure, and more competitive than ever before. Yet it also tells us that good mining hardware must not only be purchased, but also strategized accordingly. This includes efficiency considerations, smarter energy use, and staying on your toes in operations long-term.

Intuitive miners are already adapting. Some diversify revenue streams they get from mining with the help of hosting services, liquid-cooled or immersive systems, or AI implementations. Others optimize by relocating to low-cost energy regions or finding subscription-based or bulk energy contracts.

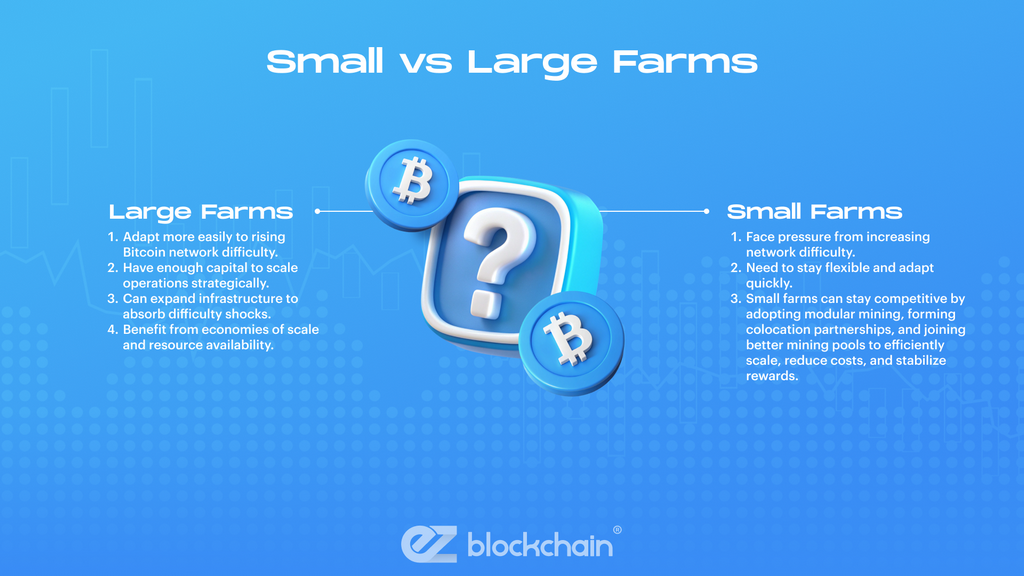

Small vs Large Farms

Last but not least, there is a gradually widening divide between small and large miners due to the current Bitcoin network difficulty. For instance, many big players are adapting simply by scaling up and absorbing the difficulty shocks. That’s because they wield sufficient capitals and can afford to carry out a strategic expansion.

Meanwhile, smaller farms must keep in tune and stay nimble. The best bet right would be to start embracing modular mining (simple yet efficient scaling of ASICs), consider colocation partnerships (for stabler rewards at lower operational costs and effort), or seek better pools.

Future Predictions

If Bitcoin’s difficulty has reached 136T now, what’s next?

We can safely expect the upward trend to come in stages, especially if the BTC’s price also grows accordingly. More miners will be eager to join mining pools as it climbs, which will accumulate the network’s total hashrate. However, we’ll also probably see certain corrections in the difficulty as older equipment becomes unprofitable and, e.g., drops offline.

In the long run, we anticipate Bitcoin mining to industrialize and become much more diverse geographically. This should help balance out the on-chain dynamic and focus more on economic realism. In all reality, the 136T record is the new baseline. In this high difficulty era one must heed their efficiency metrics, double down on long-term strategies, and stay sharp and forward-looking.

Need help adapting to the dynamic crypto situation? Talk to EZ Blockchain’s experts for profitability estimation, consultation, and selection of a hosted ASIC device for mining.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.