Stay up to date with the latest news, announcements, and articles.

Choosing Mining Hardware Wisely

The single most important metric in miner selection is efficiency, typically expressed as Joules per Terahash (J/TH) or equivalently Watt per TH. Efficiency determines the long-run marginal cost of producing hashes and therefore the sensitivity of your unit economics to electricity price and difficulty increases. But you must evaluate efficiency in context: delivery of nominal TH/s at rated voltage is different from delivered TH/s under your local ambient, site voltage drop, and cooling constraints.

A practical procurement checklist:

- Verify nominal hash rate and tested hash rate under your target operating voltage and ambient temperature.

- Compare total system power (ASIC + PSU + fans or pump) — include auxiliary loads (network switches, controllers, lighting).

- Inspect firmware maturity and upgrade cadence (vital for stability and efficiency tuning).

- Confirm warranty, serial-level traceability, and spare hash-board availability.

- Map mechanical envelope (rack density, height, airflow) to your data-center or container design.

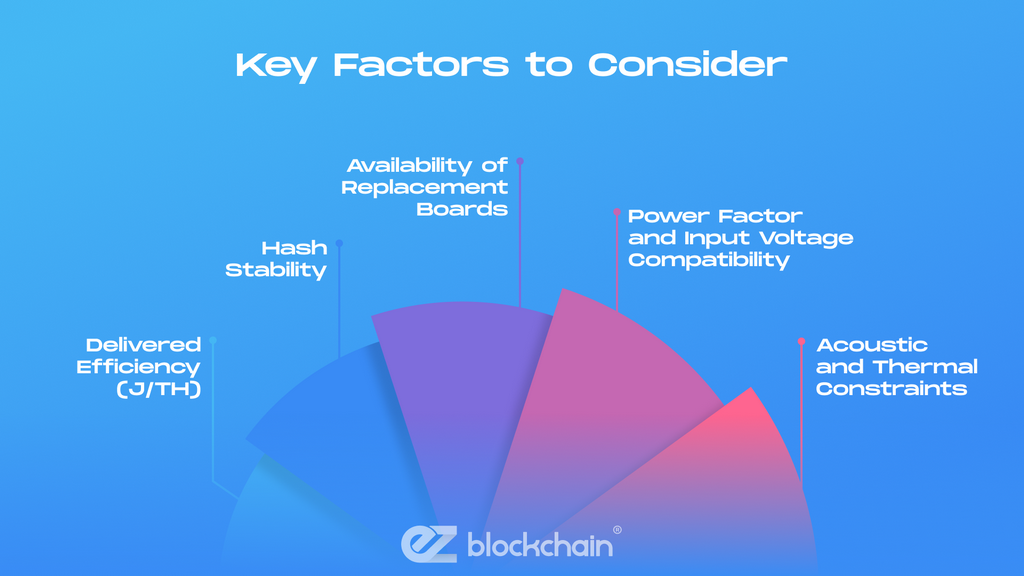

Key Factors to Consider

When selecting mining hardware, evaluate six domains: performance (hashrate), energy (J/TH), thermal (cooling strategy), operational (MTBF, serviceability), financial (CAPEX, expected depreciation), and supply/logistics (lead time, spares). Each domain affects the break-even horizon and sag sensitivity of ROI.

Quantitatively prioritize these metrics:

- Delivered Efficiency (J/TH) — measured under your operating conditions.

- Hash Stability — variance in hashrate under prolonged runs (affects revenues).

- Availability of Replacement Boards — mitigates downtime.

- Power Factor and Input Voltage Compatibility — avoid converters that add parasitic losses.

- Acoustic and Thermal Constraints — determine whether immersion, closed-loop water, or high-volume air cooling is required.

A decision rule of thumb: for non-hydro/immersion deployments, if two models differ by <10% in J/TH, choose the one with better serviceability (modular hash boards, hot-swap PSUs) and stronger firmware support.

Understanding Hashrate and Power Efficiency

Hashrate (TH/s) is raw throughput. Efficiency (J/TH) is how many joules you expend to perform one terahash. Convert between representations with:

- Efficiency (J/TH)=Power (W)Hashrate (TH/s)\text{Efficiency (J/TH)} = \frac{\text{Power (W)}}{\text{Hashrate (TH/s)}}Efficiency (J/TH)=Hashrate (TH/s)Power (W)

- Power (W)=Efficiency (J/TH)×Hashrate (TH/s)\text{Power (W)} = \text{Efficiency (J/TH)} \times \text{Hashrate (TH/s)}Power (W)=Efficiency (J/TH)×Hashrate (TH/s)

Example: A 200 TH/s miner at 16 J/TH uses 200×16=3,200 W200 \times 16 = 3{,}200\text{ W}200×16=3,200 W.

To estimate daily electricity cost:

- Daily kWh=Power (W)×241000\text{Daily kWh} = \frac{\text{Power (W)} \times 24}{1000}Daily kWh=1000Power (W)×24

- Daily Electricity Cost=Daily kWh×Price ($/kWh)\text{Daily Electricity Cost} = \text{Daily kWh} \times \text{Price (\$/kWh)}Daily Electricity Cost=Daily kWh×Price ($/kWh)

Include PUE (Power Usage Effectiveness) overhead: effective kWh = kWh × PUE. PUE captures extra HVAC and facility losses; for air-cooled container farms PUE often ranges 1.10–1.35; immersion deployments can lower PUE toward 1.05–1.15 but add mechanical parasitics (pumps).

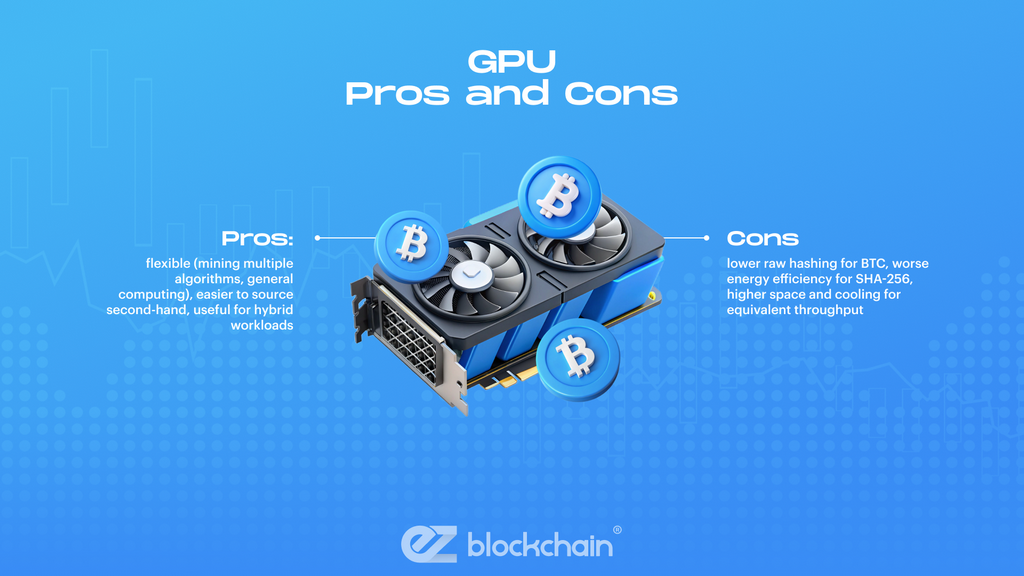

ASIC vs GPU: Pros and Cons

ASICs (Application Specific Integrated Circuits) are purpose-built for SHA-256. GPUs are general-purpose accelerators. The trade space:

ASICs:

- Pros: orders-of-magnitude higher TH/s per device, significantly better J/TH, rackable, mature firmware, lower long-term OPEX per TH.

- Cons: single-purpose (no repurposing), supply chain concentration, faster obsolescence as new ASIC generations appear.

GPUs:

- Pros: flexible (mining multiple algorithms, general computing), easier to source second-hand, useful for hybrid workloads.

- Cons: lower raw hashing for BTC, worse energy efficiency for SHA-256, higher space and cooling for equivalent throughput.

For bitcoin mining specifically, ASIC bitcoin mining hardware is nearly always the correct choice unless you have a multi-algorithm, research, or developer requirement.

Popular Models and Brands

Market leaders typically include Bitmain (Antminer family), MicroBT (WhatsMiner family), and emerging vendors producing immersion-native or modular designs. When comparing brand+model, evaluate:

- Manufacturer-published specs vs independent bench tests.

- Firmware ecosystem and community-supported optimizations.

- Proven spare-parts availability and third-party repair networks.

Avoid buying solely on advertised TH/s — insist on third-party bench reports showing stability under continuous load.

Financial and Technical Aspects

Good procurement ties technical metrics to financial models. Build an NPV model that includes: initial CAPEX (purchase, shipping, customs), installation (racks, PDUs, breakers), expected useful life (months), residual value (resale market), electricity cost schedule (escalation), and difficulty growth assumptions. Typical inputs:

- CAPEX per unit (USD)

- Nominal TH/s and tested J/TH

- Electricity ($/kWh) and PUE

- Difficulty growth (% / year — model scenarios: conservative 20%, base 30%, aggressive 50%)

- Downtime (% per year due to failures/maintenance)

Compute payback (months) and IRR; sensitivity to three variables (BTC price, difficulty, electricity) will show break-even robustness.

Electricity Costs and ROI

Electricity is usually the largest recurring cost. Small changes in $/kWh or J/TH translate to large ROI effects. Example sensitivity:

- For a 200 TH/s @16 J/TH unit (3,200 W) at $0.06/kWh (PUE 1.15):

Daily kWh = 3.2×24×1.15=88.323.2 \times 24 \times 1.15 = 88.323.2×24×1.15=88.32 kWh → Daily cost ≈ $5.30.

If BTC price or difficulty changes reduce daily revenue by $4, marginal economics swing drastically.

Always model worst-case electricity increases and difficulty shocks — miners that assume static difficulty or electricity will be surprised.

Cooling and Noise Management

Cooling strategy depends on density and ambient. Options:

- High-volume air (fans, CRAC units): simple but high fan power and noise; PUE impact.

- Closed-loop liquid / rear-door heat exchangers: reduces fan power, increases complexity.

- Immersion cooling: greatly reduces fan power and noise, permits denser packing but requires dielectric handling and heat rejection design.

Noise: acoustic emissions from large air-cooled farms can exceed 80–90 dB at 1 m. For urban or shared sites, immersion or very heavy acoustic mitigation is necessary.

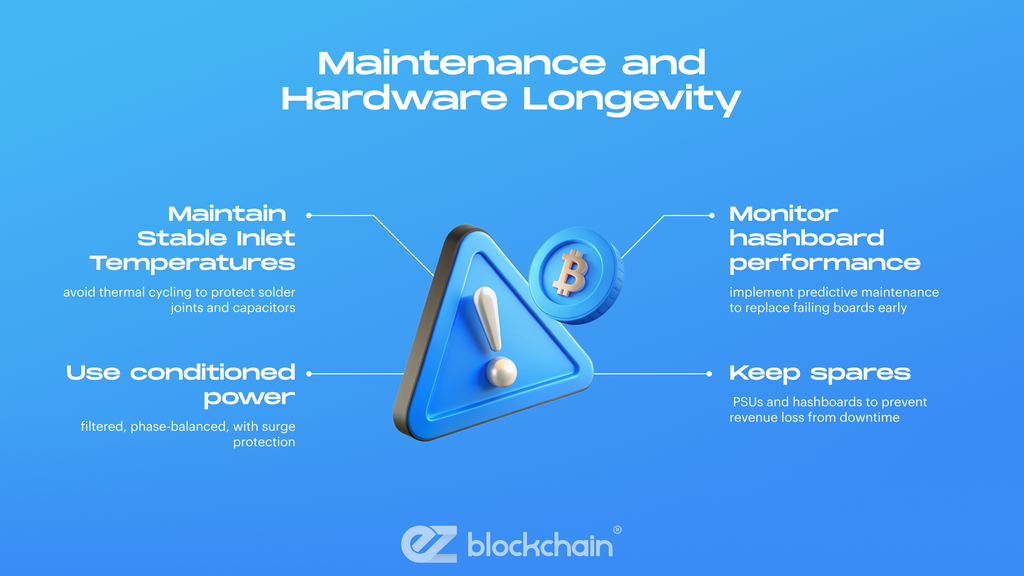

Maintenance and Hardware Longevity

Hardware longevity correlates strongly with thermal cycling, dust exposure, and power quality. Key best practices:

- Maintain stable inlet temperatures and avoid frequent temperature ramps (thermal cycling stresses solder joints and capacitors).

- Use filtered, conditioned power with correct phase balancing and surge protection.

- Log hashboard performance and implement predictive maintenance (replace boards showing rising error rates before catastrophic failure).

- Keep spare PSUs and hash boards; a single rack unit down for days results in unacceptable revenue loss.

Estimate MTBF and maintain a spare parts pool sized to meet your target availability (e.g., 99% uptime target → maintain spares to limit repair time).

Budgeting for Mining Equipment

Budget for more than the miner: include PDUs, breakers, power cabling, racks, pest control, network gear, fire suppression, and compliance. When calculating total landed cost, add:

- Freight and insurance (often 2–6% of hardware cost)

- Customs, VAT, or import duties (vary by jurisdiction)

- Electrical infrastructure upgrades (transformer, panel, meter)

- Commissioning & burn-in (run each unit for 24–72 h to detect infant mortality)

Rule: allocate 15–30% of hardware CAPEX for deployment and infrastructure in moderate builds; for containerized or large builds, economies of scale reduce that percentage.

Setup and Installation

Installation checklist:

- Verify site single-line diagram and ensure breaker capacity and cable sizing for continuous load.

- Design rack PDUs for balanced phase distribution; avoid daisy-chaining.

- Implement environmental monitoring (temperature, humidity, airflow, leak detection).

- Commission with burn-in tests, firmware baseline, and remote management setup (SNMP/HTTP APIs).

Document everything — serials, bin codes, firmware version, power draw at nominal and peak — and store logs for warranty claims and forensic debugging.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.