Stay up to date with the latest news, announcements, and articles.

Right now, it’s more important than ever to stay flexible and adapt in whichever way possible. For that, every miner has to have a clear outlook on the market, know the main triggers affecting the Bitcoin output, and keep up with the situation.

This article provides just that — the latest Bitcoin mining hashrate statistics, sources of today’s crypto volatility, outcomes, and ways to bear through mining difficulty spikes and Bitcoin minting drops.

Monthly Bitcoin Output: What the Latest Data Shows

Bitcoin’s monthly output has dipped slightly since the April 2024 halving. Namely, the global production of the coin reduced to around 13,500 BTC/month. For the Bitcoin chain, this should help balance out the mining difficulty and stimulate the competition among miners, as well as not run out of Bitcoin too fast.

But for miners this can be an intimidating event, especially when looking through the latest on-chain data. Thus, the halving has introduced new minor block-time delays, cutting the coin’s output by 2–3% month-over-month in early 2025.

Decline in BTC Mined Month-over-month Since Early 2025

Following the halving of April 19, 2024, most existing, active miners, if not all, felt the pressure of rising Bitcoin hashrate demands. While there are plenty of other reasons for today’s miners to double down on their mining efficiency and ROI ratio, this halving is like a “cherry on top”, calling for not just temporary workarounds but sensitive, long-term decisions.

Currently, we have the following situation:

- In dry numbers, block rewards dropped from 6.25 BTC to 3.125 BTC

- Anticipated daily issuance was cut from ~900 BTC to ~450 BTC (≈13,500 BTC/month).

In practice, the raised network difficulty briefly outpaced the hashpower poured into it, even as the average hashrate was growing. This provoked slight fluctuations in block times, which is the main reason Bitcoin’s monthly output went down by around 2–3% between January and April 2025.

Post-halving Impact

[Bitcoin halving is a pre-programmed event in the Bitcoin protocol that cuts in half the reward miners receive for validating new blocks, occurring every 210,000 blocks (roughly every four years). This mechanism slows the rate at which new bitcoins are created, enforcing scarcity and helping make sure the total supply never exceeds 21 million coins.]

The halving instantly halved miner revenue potential, which forced everyone in the business to sit down and do a big, industry-wide cost review. Yes, the halving helped keep the protocol issuance stable. However, due to a jump in mining difficulty, some rigs fell idle while others shifted to mining pools, where you can get higher returns for a fraction of your rig’s hashrate.

So despite the overhauled crypto difficulty and chain stability, the real-world Bitcoin mining production output dropped also due to some unprecedented hashrate shifts.

Current Estimates of Global Daily and Monthly Output

To date, we get the following estimates of how much Bitcoin is available to mine by day and month:

- Daily: ~450 BTC (144 blocks × 3.125 BTC)

- Monthly: ~13,500 BTC (450 BTC × 30 days)

This is the new, somewhat limiting reality for crypto miners. Limiting because, due to sustained declines in mined Bitcoin availability, marginal mining operations may no longer justify the operational expense. For some rigs (especially solo rigs), overhead mined profits are just enough to cover power bills, generating next to no net profits.

What was the immediate reaction of the global mining community? Quite interesting hashrate shifts, among other things.

The Hashrate Surge

Bitcoin’s current hashrate has exploded, approaching 800 EH/s (ExaHash per second) by April 2025. The halving prompted mass launches of next-gen ASIC rigs. This, and new low-cost jurisdictions introduced in certain regions, additionally pushed the difficulty and squeezed smaller miners.

New Generation ASIC Miners

The release of Bitmain’s Antminer S21 Pro (234 TH/s, 15 J/TH) in March 2024 and the S21+ series (216–319 TH/s at ~15 J/TH) in late 2024 has super-charged Bitcoin’s global network capacity. This enabled a significantly higher mining throughput. However, older rigs’ share has eroded as a result, driving most solo and small-scale miners to re-assess their capacities and join up in mining pools.

Expansion by Large-scale Mining Operations

While smaller rigs and owners of solo operations struggled to keep up, professional installations and enterprise-scale farms doubled their hashrate capacity in 2025. For one thing, such miners had the budget to level out equipment supply risks, often being vertically integrated with both hardware providers and energy producers. They also leveraged economies of scale to secure ultra-low power contracts.

Entry of New Mining Regions With Cheap Energy

As expectedly more loyal alternative locations, new mining hubs have emerged across Scandinavia, Canada, and the U.S. western grid. As a result, tons of mining rigs that are trying to avoid falling under Asian import restrictions have relocated to these destinations. Because of that, the global hashrate was diversified immensely, and swelled up to near 800 EH/s.

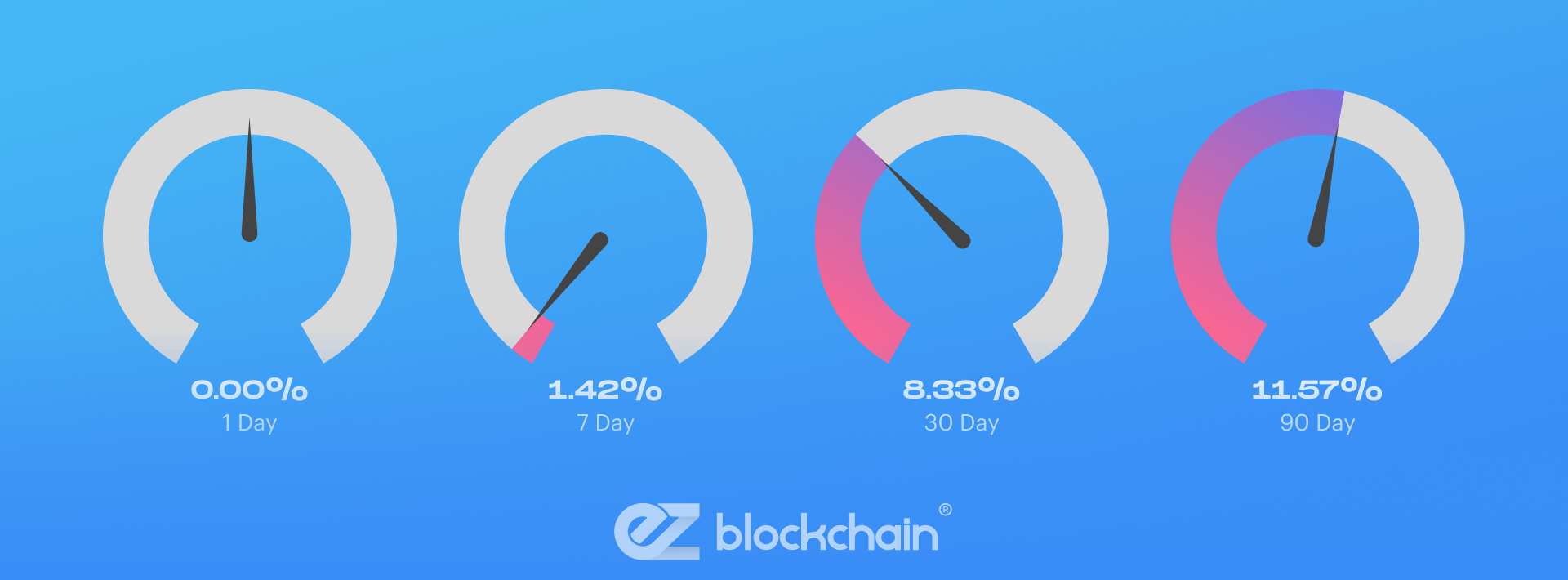

Why Miners Are Struggling to Keep Up

According to Coinwarz, Bitcoin mining difficulty grows slightly every day, boosting by almost 9% every thirty days. It can be naturally hard to keep up with this pace, especially for solo miners that fail to timely optimize their rigs in line with the mining difficulty growth. For mining farms and rigs that are above small- to mid-scale level, this means more ongoing investments, long-term planning, and proactive reaction to hashrate paradigm shifts.

In parallel, mining costs are rising right along with increasing power bills in previously leading mining destinations (like the US). Of course, that is mostly due to extreme import tariffs imposed by President Trump and retaliatory taxes by Asia and Europe. Thus, ASIC prices jumped 30% under import restrictions, and U.S. grid tariffs have climbed to $0.08–$0.10/kWh, cutting into margins.

These are the main reasons the whole Bitcoin mining arena becomes especially demanding for small- and mid-scale mining operations, but there’s more.

Performance Drop Among Small and Mid-Scale Miners

It all comes down to the ideal Bitcoin miner hashrate set too high for a moderate-scale miner to handle. Here’s a quick calculation of the hash power you’d need today to mine about 1 BTC per day:

- Current network hashrate: ~ 925.76 EH/s

- Block reward: 3.125 BTC per block (post-April 2024 halving)

- Blocks per day: 24 hours ÷ 10 minutes per block ≈ 144 blocks/day

- Daily BTC issuance: 144 blocks × 3.125 BTC = 450 BTC/day

- Required share: 1 BTC ÷ 450 BTC ≈ 0.002222 (0.222%) of the network

- Your hashrate: 0.002222 × 925.76 EH/s ≈ 2.06 EH/s

So, if you are mining solo, running an operation in a 24-hour period under today’s conditions, the required hashrate to mine 1 bitcoin would be 2 exahashes per second (2 × 10¹⁸ H/s) of sustained power. This translates to about 2 million TH/s (2,000 PH/s) for mining hardware.

On top of that, independent operators have noticed sub-optimal uptime in blocks, with older ASICs facing sharp difficulty spikes. The block time averaged 10.92 minutes in late April 2025, which is above the 10-minute target — this slashed the daily mining yield by ~8% for non-optimized rigs.

As a result, smaller-tier miners are resorting to centralized mining, with pool communities widening and centralized hashrate mounting. The top five pools now control over 60% of hashrate, making solo success ever rarer.

This only speaks in favor of readymade platforms and providers that help either optimize farms and rigs or help centralize the existing hashrate.

How EZ Blockchain can Help Optimize Output

EZ Blockchain is one of such platforms, providing a range of qualified, custom-tailored services, tools, advice, and opportunities to maximize your mining potential and balance out the resulting ROI.

Platforms like EZ Blockchain offer:

- real-time performance monitoring via a feature-rich, adjustable dashboard

- omnichannel KPI and power tracking and analysis for improvements

- energy billing and payments right inside a dedicated app

- individual ASIC maintenance state and performance tracking

- pool-switching recommendations and personal consulting

Specialists at EZ Blockchain can consult your next step, help understand terms of the industry, and achieve the best hashrate for mining Bitcoin without going bankrupt.

Strategies to Survive the Hashrate War

If you have time and desire to explore more alternative methods that may help you bear through this “hashrate war”, you can also try these methods:

- Join low-fee pools: Browse popular Bitcoin solo mining pools, look for sub-1% fees, and join to gain a chance to lock in steady payouts even at moderate hashrate output.

- Optimize energy usage: Time-shift operations to off-peak rates or integrate renewable energy sources to beat $0.10/kWh ceilings.

- Merge networks or mine Altcoin: Explore merged mining or high-ROI altcoins to leverage existing ASICs and avoid idling.

- Scale up hardware: You can also try to resell older mining units to secondary markets and reinvest in high-efficiency models (≤15 J/TH).

_________________________________________________________________________

Don’t know which strategy to pick for your mining case? Contact seasoned specialists at EZ Blockchain for an individual consultation and advice on picking the best long-term options.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.