Stay up to date with the latest news, announcements, and articles.

The big question is — what if you’re interested, but can’t afford to purchase the equipment, order hosting services, or buy expensive custom expertise? Well, you’re still in luck! With techniques like staking and today’s cloud capacities, you can start profiting from crypto without investing a single penny into hardware, hosting services, or expensive expertise.

The staking allows you to profit off cryptocurrency simply by having a crypto wallet. And with cloud-based mining, you can set up a remote ASIC hardware that you’ll only have to manage via software dashboards.

So, should you stake crypto or should you mine it through the cloud? Both options can be viable for passive income.

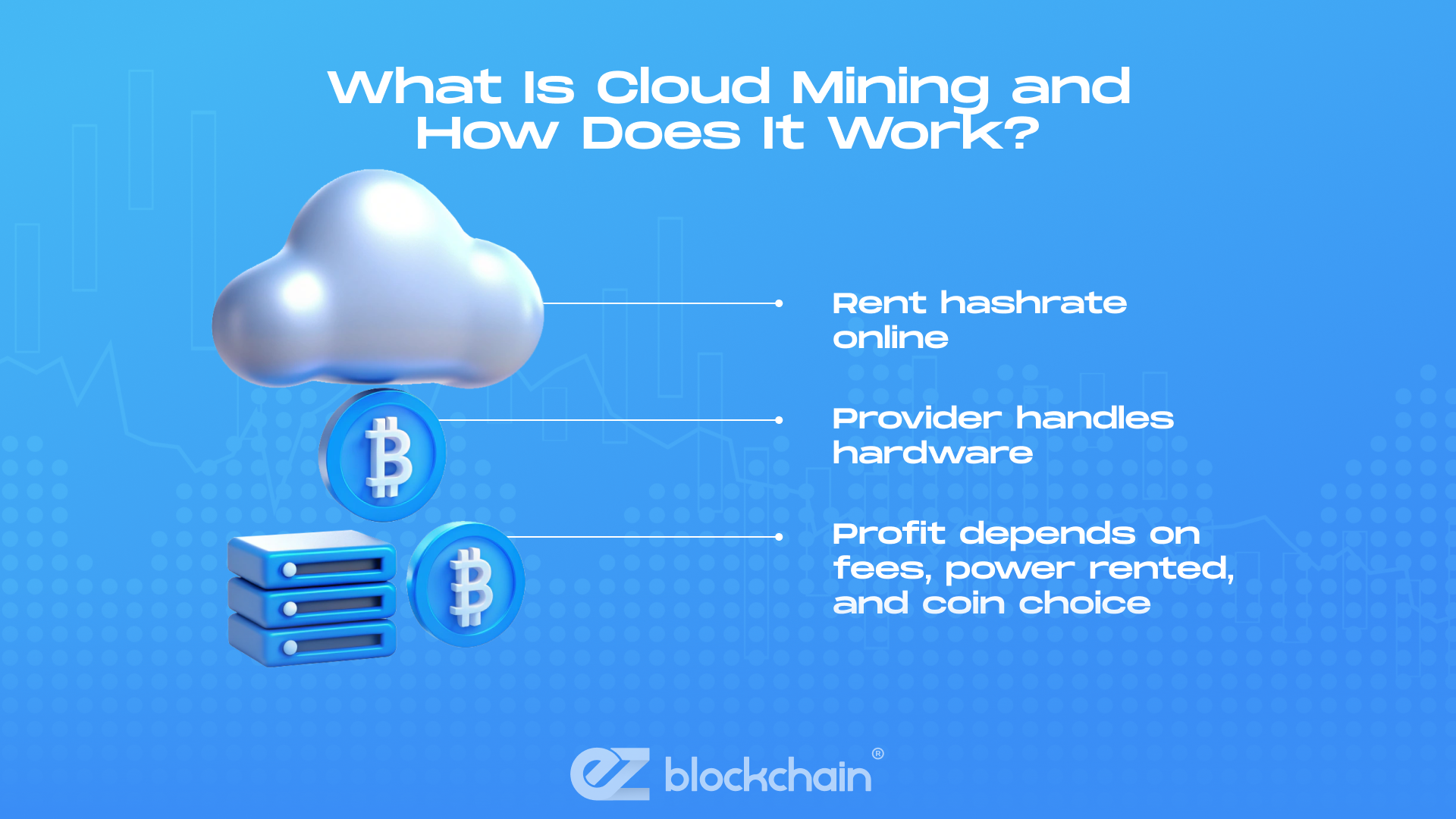

What Is Cloud Mining and How Does It Work?

Thanks to cloud platforms that we all know and use today, you can start mining cryptocurrency without running your own mining setup. If you don’t want or can’t, you don’t need to invest in any hardware whatsoever — you can rent its power (i.e., hashrate) and manage it via the cloud profile.

For this, remote data centers offer subscriptions or contracts, renting out the required hashrate and providing the software for managing your miner. This allows you to avoid buying miners as well as handling their maintenance — hardware, electricity, cooling,and other operational details are all covered by the provider.

The data service deducts fees for their services, after which you get your net crypto mining earnings. This and the choice of the coin you are looking to mine (Bitcoin, Ethereum, etc.) what shape the overall crypto profitability that you can achieve.

What Is Crypto Staking and How Does It Work?

Crypto staking is an alternative way to generate passive income from any crypto tokens that you already have in the wallet. Staking platforms allow you to lock in the tokens in their blockchains, monetizing your services as an on-chain validator, and pays you commissions.

By staking cryptocurrency, you help support PoS-based blockchains — the crypto chains that run on the Proof-of-Stake mechanism. Thus, instead of running energy-intensive mining hardware, you stake (or delegate) crypto to validator nodes, which help validate transactions in the PoS network. In return, the staking platform pays you rewards based on how much you stake and for how long your tokens remain useful to the validator (the lock-up period).

The level of profits achievable through crypto staking is largely shaped by what type of staking you decide to indulge in exactly:

- Solo staking: Possible if you run your own validator node (for networks that support this). Requires meeting minimum token requirements and keeping high uptime.

- Delegated staking: More common. You delegate your tokens to a validator and share the rewards. No need to manage node infrastructure yourself.

- Liquid staking / staking derivatives: Allows you to stake and still retain some liquidity via derivative tokens, so your staked assets can still be used in DeFi or traded.

Your staking earnings may also be affected by the validator’s commission fees, risks of slashing (which happens in cases the validator misbehaves), and variability of yields in the network.

Comparing Profitability in 2025: Cloud Mining Vs Staking

In the search for the ultimate answer to what is profitable for you, you may discover that things may vary a lot from experience to experience. But we’ll try to dig in and achieve more clarifications.

To sum up in dry yet approximate figures, here’s how different mining approaches and crypto staking differ in baseline terms:

| Strategy | Approximate Yield in 2025 | Nature of Returns | Liquidity |

| Cloud mining | 5%–10% APR | Moderate and platform-dependent | Locked during contract |

| PoS staking | 3%–11% APR | Predictable and from diverse networks | Varies — can be locked or liquid. |

Now, for a little deeper dive.

Expected ROI for Cloud Mining

A lot depends on the cloud provider. Platforms like ECOS and MiningToken are among the more reputable ones in 2025 and they offer cloud mining contracts that yield 5%–10% APR, depending on the size of your investment and the terms of the contract. This is after costs related to electricity, hashrate difficulty, and maintenance are factored in.

There are also cloud crypto mining platforms like XRP, which offer high-risk, unrealistic offerings, advertising returns in the 100%–800% APR range. We’d recommend watching out for such networks due to common hidden fees, poor transparency, or even potential scams.

Expected ROI for Crypto Staking

In 2025, the staking yields and ROI vary across networks, mostly based on protocol inflation, validator fees, and overall network usage. For instance, Solana is offering around 6–8% APY, while Ethereum staking is in the 3–5% APY range, and other chains like Cosmos or Polkadot can sometimes offer 8–14% of returns.

And, of course, staking Bitcoin can be most profitable, if you have any BTC to stake. As of the middle of September 2025, the staking returns for major networks range as follows:

- Bitcoin — up to 16% APY and 1% APR

- Ethereum ~5% APY

- Solana ~6%–7% APY

- Cardano ~4%–6% APY

- NEAR ~9%–11% APY

- Cosmos — up to 18% (about 6% net on exchanges)

- Liquid staking — up to 10%–12% APY with added liquidity.

Beyond the stated APYs and APRs, if you want to maximize returns from staking, it’s crucial to also consider the individual factors, like:

- Fees: Maintenance, electricity, cooling, and sometimes “hardware replacement” or “maintenance surcharges” can take a big bite out of revenues. Contracts often state “return before fees,’ but net payout after fees can be much less.

- Mining difficulty jumps: Over time, mining becomes harder (especially for Proof-of-Work networks like Bitcoin), meaning more hash power or energy is needed for the same rewards. That eats into profits.

- Volatility of the coin price: Potential profits can be diminished in reality due to market swings and unexpected coin price drops.

- Outdated hardware: Providers using older or inefficient hardware will have higher electricity / maintenance costs, lower efficiency, and so lower effective ROI.

Which Option Is More Consistent?

If we are talking purely about the consistency of rewards, staking has the upper hand. As opposed to cloud mining, the staking rewards are more predictable, there are fewer operational risks and more transparency in processes. Staking profits are also less dependent on external market shocks.

To sum up, take a look yourself:

| Factor | Staking | Cloud mining |

| Reward predictability | High, since staking is tied to protocol rules | Variable, depending on fees, power costs, and uptime |

| Provider and operational risk | Moderate (only validator misbehavior and coin slashing) | Higher due to hidden fees, provider insolvency, or market volatility. |

| Liquidity / flexibility | Better with liquid staking | Less flexibility due to locked contracts |

| Transparency | More due to protocol + validator metrics | Only the provider-chosen metrics |

| Resilience to external shocks | Stronger | More vulnerable to energy, network difficulty, and contract issues |

Risks and Challenges of Cloud Mining

Choosing crypto staking vs mining, it’s also important to weigh in all the risks and hardships that you may encounter with each approach.

For cloud mining, the most common challenges include:

- Platform risks:

- Beware of scams, turn only to reputable data centers and hosting providers;

- Provider insolvency is another risk that certificate-less companies may incur;

- Look out for opaque contracts with hidden details or things left unsaid.

- Fees:

- Management costs

- Energy costs

- Possible maintenance charges

- Rigidity: Keep in mind that your crypto capital is locked for the duration of the contract with the cloud provider.

Risks and Challenges of Crypto Staking

For crypto staking practices, the hardships that you should be ready for include:

- Slashing risks: Validator errors can be punished with penalties in the chains, harming your returns.

- Lock-up periods: Some staking networks restrict withdrawals for days or longer.

- Token volatility: Market coin price spikes and drops can offset or exceed yields accordingly.

- Complexity: For self-staking, you will need to set up a node, while liquid/delegated staking adds smart contracts, with their own risks and challenges.

Which Option Is Better for Beginners?

The bottom line for 2025: If you want simplicity and quick access, cloud mining is tempting — but you need to stay cautious and avoid deals that seem too good to be true. For clarity, sustainability, and long-term resilience, staking (especially liquid staking) is the preferable route. Choose based on your risk tolerance, technical comfort, and long-term goals.

- Cloud mining is easy to start: no hardware or tech know-how is needed. It also has a real promise of big passive income, especially when cloud mining Bitcoin. However, you must find that one reliable cloud hashrate provider and depend on coins.

- Staking can be done via exchanges or liquid platforms, which is, perhaps, slightly more complex, but safer and more sustainable over time. Especially with regulated Staking-as-a-Service offerings, popular cryptocurrencies, and regular staking.

Still don’t know which to choose? Talk to EZ Blockchain’s experts for consultation, guidance, and crypto mining hosting services that can enable profitable mining for you.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.