Stay up to date with the latest news, announcements, and articles.

Cryptocurrency mining has long been a way to earn digital coins, but for 2024, it’s also emerging as a surprisingly effective tool for managing your tax bill. As governments worldwide tighten their grip on crypto regulation, miners are discovering that strategic tax planning can protect their earnings as well as help reduce tax liabilities.

Let’s explore how savvy miners can turn crypto mining into a tax-smart venture and direct crypto mining tax deductions in their own favor.

Why Taxes Are Heating Up for Miners in 2024

If you’re a crypto miner — or thinking about becoming one — you’ve probably noticed that governments are paying a lot more attention to cryptocurrency. In 2024, this translates into stricter tax obligations for miners and a potentially more complex and structured crypto mining income tax:

- Crypto income scrutiny: Many authorities across the world now require (or starting to require) miners to report every coin earned as taxable income.

- Hobby or business? Differentiating between casual mining and a business operation is more important than ever.

- Prioritized record-keeping: Claiming deductions? You’ll need solid proof to back them up.

But while a tax oversight of cryptos may seem intimidating, it also creates opportunities for miners who understand the tax rules. Thus, you can keep more of your hard-earned crypto if you comply and, more importantly, leverage deductions.

The Financial Dynamics of Crypto Mining

Crypto mining isn’t just about plugging in rigs and watching coins roll in — it’s a business with serious investments, testing challenges, and, now, specific tax implications. That wasn’t a thing, yes, but we must adapt in time. Here’s what you need to know about the crypto mining business tax specifics:

- Taxable income: The moment you mine a cryptocurrency, its fair market value is deemed as income and must be reported.

- Depreciation and expenses: But don’t fret, from mining rigs to electricity bills, many costs can be deducted so that you could lower taxable income.

- Tax categories matter: Hobby miners and business miners are looking at different tax obligations, so it’s important to know where you fit.

These financial elements must be figured out if you want to make sure you’re not leaving money — or deductions — on the table. We’ll help you out, read on.

Tax Perks That Make Mining Worthwhile

Of course, new taxations do not make crypto mining all just about overcoming financial challenges — on the flip side of things, we get a slew of major tax benefits that could be leveraged to balance out the tax coverage situation in your favor. So if you play your cards right, you can cut your tax bill and boost your net earnings.

Now, let’s see the exact ways how you can do that.

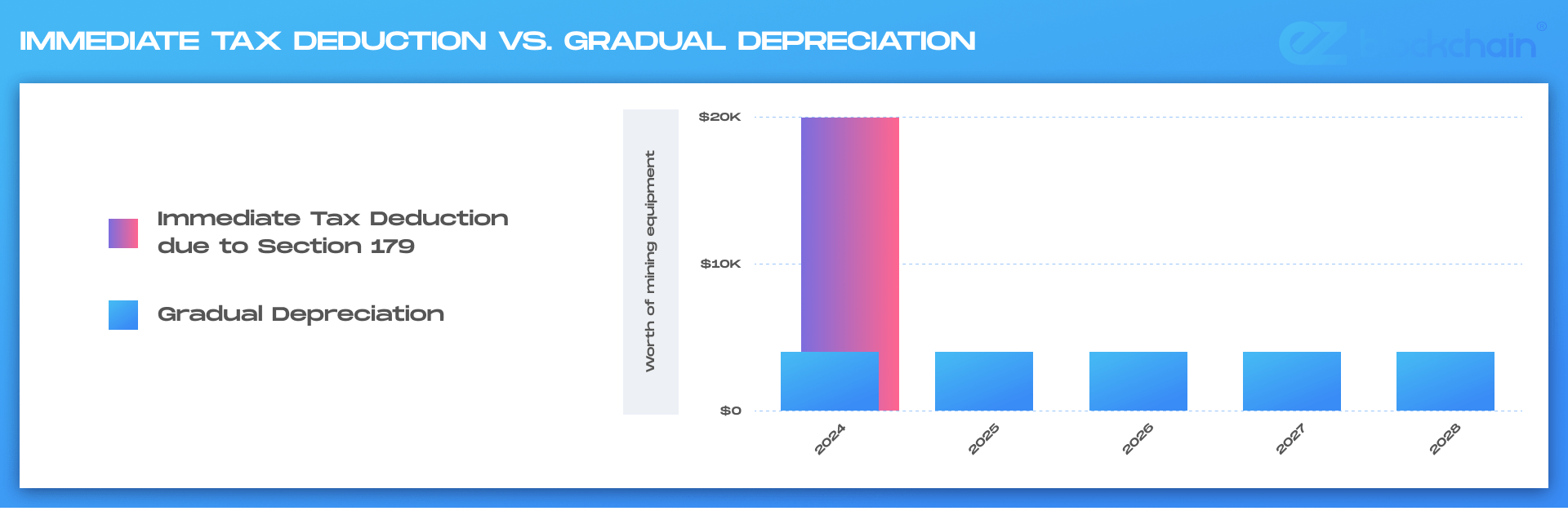

#1 Depreciation: Get the most out of your gear

Mining equipment doesn’t come cheap, but the tax code lets you deduct its cost over time. Depreciating your rigs allows you to offset the expense year by year.

- How it works: Equipment loses value over time, and you can write off that decline as a deduction.

- Quick wins with section 179: In some cases, you can deduct the entire cost upfront instead of spreading it out.

- Stay on schedule: Keeping a depreciation log will help you keep track of all these valuable deductions.

Section 179 of the U.S. tax code provides a powerful tool for crypto miners looking to maximize their tax savings. Designed primarily for small to medium-sized businesses, Section 179 gives businesses immediate deduction — instead of depreciating your mining rigs over a 5-year schedule (the typical lifespan for this type of equipment), Section 179 allows you to claim the entire cost upfront.

Example: If you purchase $20,000 worth of mining equipment in 2024 and it qualifies for Section 179, you can deduct the full $20,000 from your taxable income that same year.

#2 Operational costs: Deduct what you spend

Running a mining setup comes with plenty of expenses, many of which are tax-deductible. Some examples include:

- Electricity: A major expense, especially for energy-intensive operations.

- Repairs: Fixing your rigs to keep them running smoothly? Deductible.

- Internet services: Essential for staying connected to the blockchain.

- Home office: Running your setup from home? You might qualify for a home office deduction.

Careful documentation is your everything here — tax authorities always require detailed proof of expenses. So save those receipts and keep detailed records of every expense and crypto mining tax write-off tied to your mining activities.

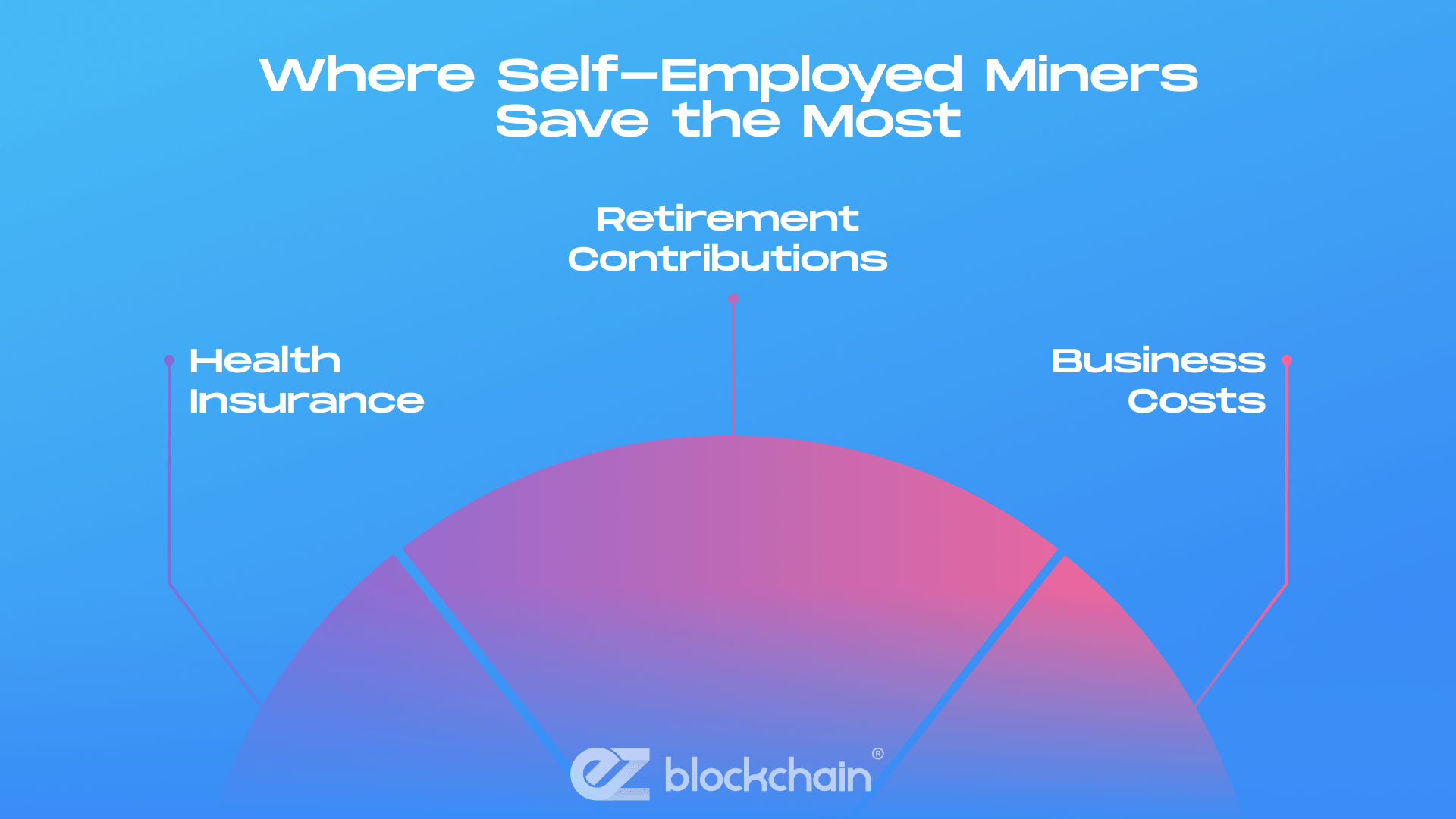

#3 Business deductions for self-employed miners

If you’ve turned mining into a business, the tax perks get even better. As a self-employed miner, you may be eligible to deduct:

- Health insurance: Self-employed individuals can write off premiums, leveraging crypto mining tax write-offs to their benefit.

- Retirement contributions: Contribute to a SEP IRA and lower your income tax on crypto mining (Simplified Employee Pension Individual Retirement Account allows contributions of up to 25% of your net earnings from self-employment or $66,000 for 2023 (expected to increase in 2024), whichever is lower).

- Business costs: Marketing, software, professional fees — if it’s necessary for your mining business, it’s most probably all deductible.

Key insight: Classifying your operation as a business rather than a hobby can enable a range of extra deductions, but it comes with greater reporting responsibilities as well.

Crypto Mining Tax Regulations to Watch in 2024

As the tax environment around crypto continues to get more structured and complex, staying compliant is non-negotiable. For profitable crypto mining in 2024, here are some critical crypto mining tax treatment principles and rules miners should keep in mind:

- Report mining income promptly: Every mined coin must be reported at its fair market value on the day it’s received.

- Plan for capital gains: Selling your mined coins? You’ll owe capital gains tax on the difference between the sale price and the coin’s value when mined.

- Don’t skip estimated taxes: If you’re self-employed, quarterly tax payments are a must to manage if you wish to avoid penalties.

Failing to follow these rules will result in audits, penalties, and other possible costly headaches. So the easiest way to protect your earnings is to stay informed and compliant across the board.

Maximizing Your Mining Profits with Smart Tax Planning

Crypto mining can be quite profitable, but in order to actually keep those profits, one must figure out how to calculate one’s tax advantages. Here’s what you should analyze:

- Revenue vs. costs: Your earnings minus deductible expenses like electricity and equipment depreciation determine your taxable income.

- Explore incentives: Some states offer tax breaks for miners, particularly in regions with abundant energy resources.

- Go beyond basics: Use available deductions to lower your effective tax rate and maximize net earnings.

Staying within the bounds of the law while retaining more of your hard-earned crypto assets is possible if you keep things maintained.

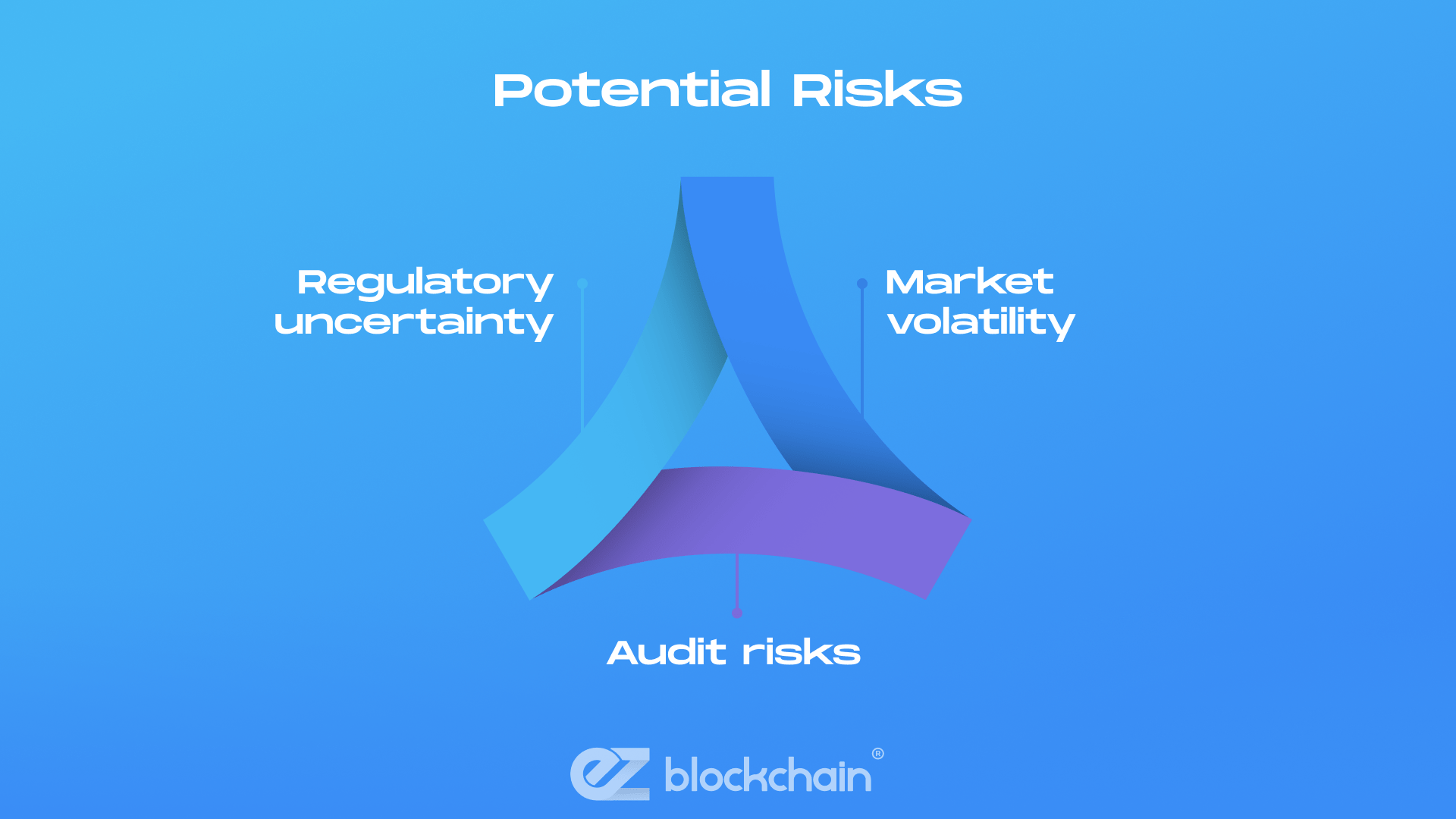

Potential Risks (and How to Dodge Them)

Crypto mining isn’t without its risks, some of which directly affect its taxation principles. Here are a few challenges to be aware of — and how to mitigate them:

- Regulatory uncertainty: Tax laws around crypto are constantly changing. Stay updated to avoid surprises.

- Market volatility: Crypto prices can swing wildly, affecting your profitability. It’s a good idea to always keep your hand on the market’s pulse.

- Audit risks: Poor record-keeping can trigger audits. Keep detailed documentation of income and expenses to avoid penalties.

Pro tip: Working with a tax professional familiar with cryptocurrency is one of the best ways to ensure compliance and optimize your tax strategy.

Is Mining Right for You in 2024?

With the ever-growing electricity costs and stricter tax regulations, mining crypto in 2024 may not be for everyone. Before jumping in, consider:

- Your startup costs: Quality hardware can be pricey. Make sure you’re ready for the initial investment.

- Your energy rates: Affordable electricity boosts profitability, and vice versa.

- Your tax savvy: Handling crypto mining tax deductions calls for some know-how, but the rewards can be worth it.

For those willing to put in the effort, crypto mining can offer both financial rewards and meaningful tax advantages.

Conclusion: Mining Smarter in 2024

In 2024, crypto mining is about more than just earning cryptocurrency — it’s about being strategic with your finances. By taking advantage of tax deductions for equipment, operational costs, and self-employment, miners can offset rising financial obligations and tax burdens in 2024, boosting profitability at the same time.

Success in this space depends on staying informed, compliant, and reactive. With careful planning and the right approach, mining can be both lucrative and tax-efficient.

So, if you’re ready to mine smarter and not harder, starting out with crypto mining in 2024 might just be your shot. We’ll help you start on your journey — the specialists at EZ Blockchain will guide your tax deduction efforts.

Contact us to discuss the best-fitting opportunities that you can leverage today.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.