Stay up to date with the latest news, announcements, and articles.

How Tax Loss Harvesting Reduces Your Taxable Gains

At its core, tax loss harvesting realizes capital losses by selling assets at a loss and using those realized losses to offset taxable capital gains (and in certain cases ordinary income). In the U.S., capital losses first offset capital gains dollar-for-dollar; any remaining net capital loss can offset up to $3,000 of ordinary income per year for individual filers, with excess losses carried forward indefinitely .

Because U.S. federal tax treats cryptocurrency as property (not currency or a security for most purposes), sales, exchanges, and dispositions of crypto generate capital gain or loss events that are reported on Form 8949 and Schedule D. That property designation is the legal foundation that allows crypto TLH today .

Two operational consequences flow from these rules:

- Realized crypto losses can reduce a tax bill produced by contemporaneous gains in equities, crypto, or other capital assets.

- If you lack capital gains in the year, losses still have immediate value: up to $3,000 of net capital loss reduces ordinary taxable income, and any surplus loss is carried forward to future years .

In practice, TLH converts ephemeral paper losses into a quantifiable tax asset recorded on your return, an asset you can spend in future tax calculations, year after year.

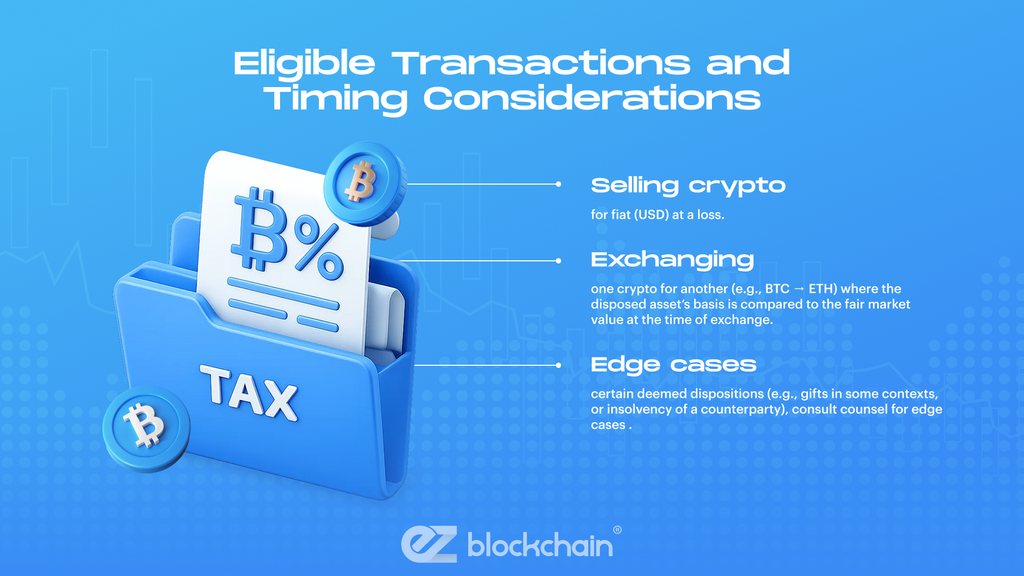

Eligible Transactions and Timing Considerations

Not every transaction produces a usable tax loss; you must execute a realized disposition. Eligible events typically include:

- Selling crypto for fiat (USD) at a loss.

- Exchanging one crypto for another (e.g., BTC → ETH) where the disposed asset’s basis is compared to the fair market value at the time of exchange.

- Certain deemed dispositions (e.g., gifts in some contexts, or insolvency of a counterparty), consult counsel for edge cases .

Timing considerations are crucial. Unlike many securities, the traditional 30-day “wash sale” rule that disallows losses when you repurchase a “substantially identical” security within ±30 days currently applies to securities and not to property categories treated as non-securities.

Because the IRS treats crypto as property, the wash-sale prohibition has historically not applied to cryptocurrencies, meaning taxpayers could, in many cases, sell at a loss and immediately reacquire the same token without auto-disallowance of the loss. That said, analysts and tax advisors caution that legislative or IRS rule changes could alter that status, so treat the existing gap as opportunistic but potentially ephemeral .

TLH requires (a) a genuine sale or disposition recorded on-chain/exchange, and (b) careful timing, the current regulatory environment permits close re-buys, but that gap may close with future rulemaking.

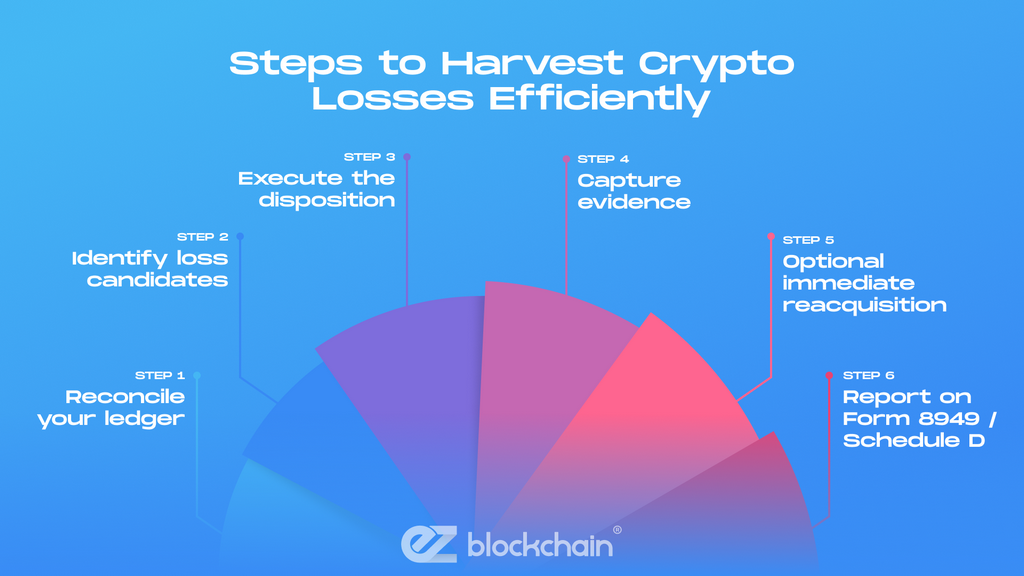

Steps to Harvest Crypto Losses Efficiently

Below is an operational workflow you can plug into your year-end or intra-year tax process. Treat it as a checklist for execution and documentation.

- Reconcile your ledger – aggregate TXIDs, timestamps, and USD valuations for all disposals during the tax year. Export exchange statements and on-chain proofs.

- Identify loss candidates – calculate realized vs unrealized positions; prioritize large unrealized losses with clean provenance and no pending custody disputes.

- Execute the disposition – sell (or exchange) the loss asset on a venue that provides a timestamped trade and a transaction ID; for on-chain transfers to self-custody, ensure there is a taxable event (e.g., selling it for USD or exchanging for another token).

- Capture evidence – download trade receipts, TXIDs, and exchange withdrawal confirmations; save screenshots and exchange CSVs; record the USD FMV used.

- Optional immediate reacquisition – if you intend to remain market-exposed, rebuy the asset (or a closely correlated but different token) immediately while documenting both trades. Be mindful of potential future rule changes that could retroactively impact wash sale treatment .

- Report on Form 8949 / Schedule D – list each disposition with cost basis, date acquired, date sold, proceeds, and gain/loss; attach supporting docs to your tax file. Use the IRS instructions for Form 8949 for correct reporting .

That procedural loop, reconcile, identify, sell, document, and report, is the repeatable core of tax loss harvesting. Automation and disciplined record retention convert TLH from an ad-hoc tactic into a repeatable tax optimization.

Using Losses to Offset Capital Gains

Mechanically, realized losses offset realized gains in the same tax year. If you harvested losses beyond your realized gains, apply the $3,000 annual offset rule for ordinary income and carry forward any remaining loss. Keep in mind holding-period classification (short-term vs long-term), matching short-term losses against short-term gains first preserves the more favorable long-term gain treatment where possible.

The IRS forms (Form 8949 and Schedule D) require you to categorize and subtotal these buckets before deriving the net taxable outcome.

Smart harvesting is not only about maximizing the nominal loss. It’s about sequencing disposals so that you preserve the tax character (short vs long) of gains you wish to shelter.

Reporting Requirements and Documentation

The IRS expects robust documentation. Required and recommended items include:

- Exchange/export CSVs with trade timestamps, trade IDs, counterparty details where available.

- On-chain TXIDs for peer-to-peer or self-custody dispositions.

- USD fair market value (FMV) at time of sale — use reliable timestamped price sources.

- Cost basis records showing acquisition date and original USD cost (including fees).

- Form 8949 entries with appropriate code boxes and adjustments where applicable.

Software can automate much of this work, but do not rely solely on vendor screenshots if you might need to substantiate items in an audit. The IRS has been explicit: taxpayers must report digital-asset transactions and answer the digital-asset question on Form 1040; be prepared to show supporting source data.

Treat your TLH packet as an audit bundle. If you would not be comfortable sending it to a revenue agent, it is not sufficiently documented.

Risks and Pitfalls of Tax Loss Harvesting

Key dangers to manage:

- Regulatory change risk – statutory or administrative changes could retroactively constrain TLH benefits (e.g., extending a wash-sale-like rule to property or crypto). Plan conservatively .

- Counterparty & custodial failure – losses realized on a non-custodial venue that later becomes insolvent may be harder to substantiate or recover. Maintain local copies of statements.

- Reacquisition cost / market timing risk – rebuying immediately can lock in replacement costs that exceed future price recovery, undermining the economic rationale.

- Tax reporting complexity – high-frequency TLH without disciplined records increases audit exposure and tax-prep costs.

TLH is a tax optimization tactic that introduces operational overhead and regulatory risk; its net benefit must be modeled against these costs before execution.

Tools and Software to Track Gains and Losses

Several tax-tech vendors integrate exchange APIs and chain analytics to produce Form 8949 outputs and audit-ready workpapers. Leading options include CoinLedger, Koinly, CoinTracker, and TokenTax, each supports multiple exchanges, NFT/DeFi transaction types, and carryforward loss tracking. Evaluate vendors on (a) chain/exchange coverage, (b) reconciliation accuracy, (c) audit documentation exports, and (d) rule-update cadence .

A good tax-tech stack reduces manual errors and creates the immutable audit trail the IRS expects, indispensable for scalable TLH practices.

Impact on Long-Term Investment Strategy

TLH is not a substitute for sound allocation. Harvesting should be integrated into an investment plan that prioritizes risk management, rebalancing policy, and liquidity needs. Over-harvesting (selling high-quality core holdings solely for tax reasons) can impair long-term returns; conversely, selective harvesting of tactical positions or small, underperforming tranches can both reduce near-term tax bills and preserve strategic allocations. Use TLH as portfolio maintenance, not as the primary alpha engine.

The optimal approach blends tax optimization with investment discipline, harvesting opportunistically, but letting your strategic asset allocation drive major decisions.

Comparing U.S. Rules with Other Jurisdictions

In the UK, HMRC treats crypto disposals as capital transactions and allows capital losses to offset gains; losses carried forward must generally be registered within specified timeframes and used against future gains. The UK has also ramped enforcement and data collection on crypto holdings, increasing the operational risk of non-compliance. Other OECD jurisdictions vary in detail (some treat certain crypto activity as income rather than capital gains), which affects TLH applicability and timing. Always consult local guidance before applying U.S. TLH playbooks abroad .

TLH is jurisdictionally sensitive. A U.S.-centric method may not port directly to the UK, EU, or other tax regimes where characterization, timing, and reporting rules differ materially.

Conclusion: Maximizing Tax Efficiency in Crypto

Tax loss harvesting is a high-value operational discipline for crypto investors who have realized gains elsewhere or expect gains in the near term. Under current U.S. rules, crypto’s property classification enables TLH strategies that can materially lower tax liabilities, but their effectiveness depends on precise record-keeping, correct Form 8949/Schedule D reporting, and careful attention to regulatory evolution.

Use automated tax software to create audit-grade workpapers, sequence disposals intelligently to preserve holding-period tax advantages, and treat any immediate repurchases as policy decisions made with an eye toward possible future wash-sale-style rule changes.

If you follow a rigorous process, reconcile ledger data, execute clean taxable disposals, capture USD FMV and TXIDs, and produce Form 8949 entries, TLH can convert volatility into a reproducible tax asset that smooths realized-tax outcomes across years. For complex portfolios, involve tax counsel to align TLH execution with broader compliance programs.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.