Stay up to date with the latest news, announcements, and articles.

If you would like to tap into it, you can. The question is whether it’s really your cup of tea. So with this article, we’ll try to figure out both worlds, list the unique sides of crypto and regular investments, and answer questions like “is Bitcoin better than stocks?”

Introduction to Cryptocurrencies

Before figuring out the difference between crypto and stocks, we should first introduce both.

What is cryptocurrency?

Cryptocurrencies are digital or virtual assets built on cryptography and decentralized networks. The main thing that sets them apart from regular money is that they are not issued or regulated by banks. Instead, everything holds on the principles of blockchain and tokenomics (i.e., token-based economics).

Blockchain allows creating decentralized ledgers that can store existing and generate new crypto coins. All underlying processes in a blockchain, from coin issuance and storing to transactions and other applications, are intertwined. This ecosystem of operations enables the decentralization at the heart of the blockchain as a system.

How cryptocurrency works (Blockchain and tokens)

Blockchain’s decentralization enables immutability — everything in the system works only by mutual consent of all parties, which allows for reinforced data security. The data written in blockchains simply cannot be changed or tempered with in other ways without the permission of all secret key holders.

The distributed ledger groups crypto transactions in blocks. Then, miners or validators (or both) help validate these blocks through the consensus mechanism. The blocks are then chained together. Tokens are issued on top of the formed blockchains, which hold the value, access rights, and rewards for validators.

The tokens are the cryptocurrency in question. To set the tokenized crypto further in motion, e.g., to use it for transactions or creation of dApps, blockchain uses smart contracts. The smart contracts make tokens programmable, which enables more practical applications for them.

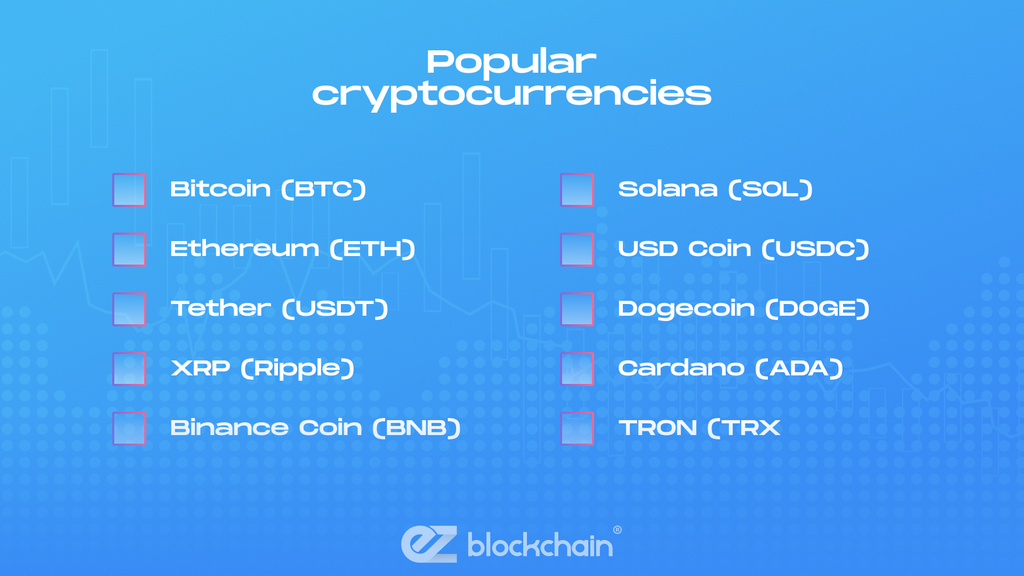

Popular cryptocurrencies

- Bitcoin (BTC) — The original cryptocurrency, so-called digital gold that dominates by the market cap, community trust, and store of value.

- Ethereum (ETH) — Used for the creation of decentralized apps, DeFi solutions, and NFTs.

- Tether (USDT) — A major stablecoin pegged to the US dollar, which is used widely for trading and moving funds between exchanges.

- XRP (Ripple) — Designed for fast, cross-border payments and remittances, with an upper hand in regulatory and institutional usage.

- Binance Coin (BNB) — Originally the native token of Binance exchange.

- Solana (SOL) — Another core token for dApps and DeFi/NFT operations, known for high throughput.

- USD Coin (USDC) — Another major stablecoin for stable digitization of the dollar.

- Dogecoin (DOGE) — A unique meme-coin turned into widely recognized crypto.

- Cardano (ADA) — A coin focused on research-driven development, proof-of-stake, sustainability, and community governance.

- TRON (TRX) — A token at the core of a scalable platform for dApps and content sharing.

Introduction to Traditional Stocks and Bonds

Corporate, government, and municipal bonds, business stocks, and company shares are the original non-money assets. They represent a certain value or even potential value and can be invested in to get returns from that value. However, stocks and bonds are slightly different in nature. Let’s take a look.

What are stocks?

Stocks, or equities, represent ownership shares in a company. When you buy a stock, you own part of the business, with rights to a portion of profits, which are usually provided via dividends. You can also get a share in gains (or losses) from the company’s performance, as a more long-term protected return. This way, you benefit when the company grows, its revenues or profits increase, or it becomes more demanded in the market. That may not happen, however, which can make stock investments a little risky (depending on the budget)

What are bonds?

Bonds are like loans that are given to an entity by either a government utility, corporation, or municipality. In return for buying a bond, you are promised to get paid interest at regular intervals, Most bonds are meant to return the principal amount that you invested at company’s or project’s maturity. Bonds are also generally considered less risky than stocks, because of fixed payments. As opposed to stocks, bonds can be used to preserve income or generate new capital almost from scratch.

How stocks and bonds generate returns

Stocks generate returns through what’s called a capital appreciation — if the price for a stock goes up, you get the returns. The stock price can be affected by a myriad of factors, like market and investor demand, net profits, etc. Sometimes, you can also get dividends.

Bonds, in their turn, generate income via periodic interest. They are less volatile and offer more predictable cash-flow, which allows returning fixed interests at planned intervals. Although, the upside price for bonds is usually lower compared to stocks (or potentially crypto).

Key Differences Between Crypto and Traditional Investments

With all the above being said, what is the difference between crypto and stocks? Both are value-holding assets that you can invest in and get returns based on various ROI factors. Well, that must be the only thing these types of assets have in common. In fact, cryptos and regular shares differ in all of the below aspects.

Ownership and control

With stocks, you basically get to own part of a company — an entity with regulations, financial reports, governance, boards. Purchases of stocks or bonds are contractual and very sensitively regulated on a legal side.

Crypto is another world — you don’t need to be a legal entity, investor, or have a special budget to own a token. Once you either mine it, buy or trade, or acquire it in any other way, you gain access to the protocol or network rules — not ownership of a business in the traditional sense.

So with a token, you tend to retain more control due to the self-custody and decentralization, but you also hold more personal responsibility for profits and face volatility risks.

Regulation and legal oversight

Stock markets are heavily regulated, there are laws, disclosures, regular auditing by third-party agents, and centralized oversight. Stocks and bonds are processed by lawyers and registered legally in banks and notaries.

Crypto is much less consistent globally in terms of laws. Some nations treat crypto like property, some like securities, others ban it altogether. This means legal protections in case of force-majeurs may differ a lot. This should make things clearer when asking what’s the difference between crypto and stocks?

Volatility and risk

Crypto is famous for sharp demand dynamics, price swings, and asset unpredictability. Bitcoin, for example, can gain or lose large percentages in days. And while such volatility can be leveraged for large potential rewards, there ensuing risks of full loss.

Stocks tend to be steadier, especially if you buy shares of a mature or blue-chip company. You still fall subject to market risks and economic cycles, but they are usually more predictable and expectable. Bonds are usually the least volatile due to fixed payments and percentage return guarantees.

Liquidity and trading hours

Crypto markets operate without stopping, every day, globally — they are online and digital. You don’t need to wait for the market to open, and you can trade even on weekends or holidays. In contrast, stock and bond markets have set trading hours, limited weekends and holidays.

Then there’s liquidity, which marks the ease of buying or selling assets. Big stocks and bonds are usually very liquid. But for smaller cryptos, liquidity can vary widely and is never in place.

Income potential

Is crypto better than stocks for you specifically? It depends on how much and how easily you can earn with each. Stocks can offer dividends — regular payments that the paying company sets up individually. Bonds have fixed interest payments.

Crypto doesn’t usually work like that, but there are options like staking, yield farming, or interest-bearing crypto products. But these come with additional risks, including smart contracts, counterparty, and platform risks.

Investment Strategies and Considerations

If you are deciding to invest in cryptocurrency vs stock market, everything depends on your goals, risk tolerance, and timeline. Here are a couple of pro tips for you:

- If you prefer stability, regular income, and regulation, stocks and/or bonds will probably be better for you.

- If you accept higher risk, want high growth potential, believe in decentralization or new tech, crypto is there to explore for you.

- Diversification is crucial today, so many investors mix both — use stocks for base investments and crypto for high-upside ventures.

- Make sure to consider fees, tax implications, custody conditions, and whether you’re comfortable with high volatility, before choosing crypto vs stock. .

Market Trends and Performance

Just in recent years, Bitcoin and other large cryptos have made an extremely huge return as compared to many stocks, albeit with big swings. For example, in 2024 Bitcoin outperformed major US indices by a large margin. Today, the BTC price went beyond the historical record mark and now holds steadily above $100,000.

In comparison, the biggest and most demanded bonds offered modest returns during the same time period of the new crypto rise. Also, regulations are tightening, and with more regulatory clarity, crypto may become less volatile and more attractive to institutional money.

Conclusion

Ultimately, what’s the difference between stocks and crypto? It all comes down to your specific goals and expectations. Do you seek regulations and guarantees or financial freedom and risky yet paying-off opportunities? How much risk are you ready to put into potential rewards? Make a checklist with these questions and choose.

Is crypto the same as stocks? It certainly is not, and we hope this article clarifies it. As for the final choice, it is yours to make.

Need help figuring out your investment options? Contact EZ Blockchain for an individual consultation, choice of crypto, and launch of your crypto mining journey.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.