Stay up to date with the latest news, announcements, and articles.

If you’re into blockchain and crypto, you know how digital currencies can already make a viable alternative for regular financial systems. But how well do you understand the essential difference between crypto and fiat money?

This article goes into depth on what exactly sets fiat money apart from digital cryptocurrencies, giving you just enough insight to plan a reliable financial future.

But, first things first — the definitions.

What is Fiat Money?

Fiat money is your usual currency, minted, issued, and regulated by the government. Fiat currencies also don’t have to rely on any back-up assets, like gold. Its value is built on the stability, value-efficiency, and social trust for the issuing authority. Your regular cash, bank deposits, and physical currency notes — all are categorized as fiat.

Key takeaways:

- Government-issued and legal tender: Fiat money is issued and authorized by a central government. Formally, it is recognized as legal tender for anything a person might need to compensate for (including regular payments, debts and loans, utilities, etc.).

- Centralized control and regulation: Fiat money’s supply and value are managed by central banks, its flow being directed through a range of governmental monetary policies.

- Dual nature — physical and digital: Fiat money exists both as tangible cash (coins and banknotes) and as digital currency, which can be kept on bank accounts and transferred online.

Governments control the flow of fiat money with the help of numerous regulatory bodies, specialized policies, and institutions. To give you some real-world instances, these include:

Central banks

- The US Federal Reserve: Sets interest rates, controls money supply by enabling public market operations, and provides last-resort landing opportunities.

- European Central Bank (ECB): Manages the euro and the Eurozone’s monetary policies, as well as financial stability policies in member countries.

Regulatory bodies

-

- U.S. Securities and Exchange Commission (SEC)

- Financial Industry Regulatory Authority (FINRA)

Both oversee a range of aspects in financial markets that impact the flow and stability of money.

What is Cryptocurrency?

Cryptocurrency is a currency that exists only digitally. It is virtual, yet fulfills the same monetary function as any other fiat currency. Based on its name, cryptos aren’t minted — they are the result of a range of cryptographic operations taking place in the blockchain network.

Today’s crypto maximizes the benefits of blockchain — the immutable records of fully visible transactions, smart contracts for decentralized, secure deals, and innovative coin supply mechanisms for a stable flow of currency.

Key takeaways:

- Digital-only nature: Cryptocurrencies exist in digital form. They automatically remove the need for physical cash, which is considered their main trait.

- Limited supply mechanisms: For many digital currencies, such as Bitcoin, there is a capped supply built into the protocol, which can create scarcity and potential long-term value retention.

- Programmability: Many cryptocurrencies, such as Ethereum, leverage smart contracts, which are a self-executing code that automates and enforces agreements without intermediaries.

With cryptocurrencies like Bitcoin leading the charge, these digital assets promise greater autonomy, faster transactions, and a novel way for users to manage value without intermediaries. But there’s more.

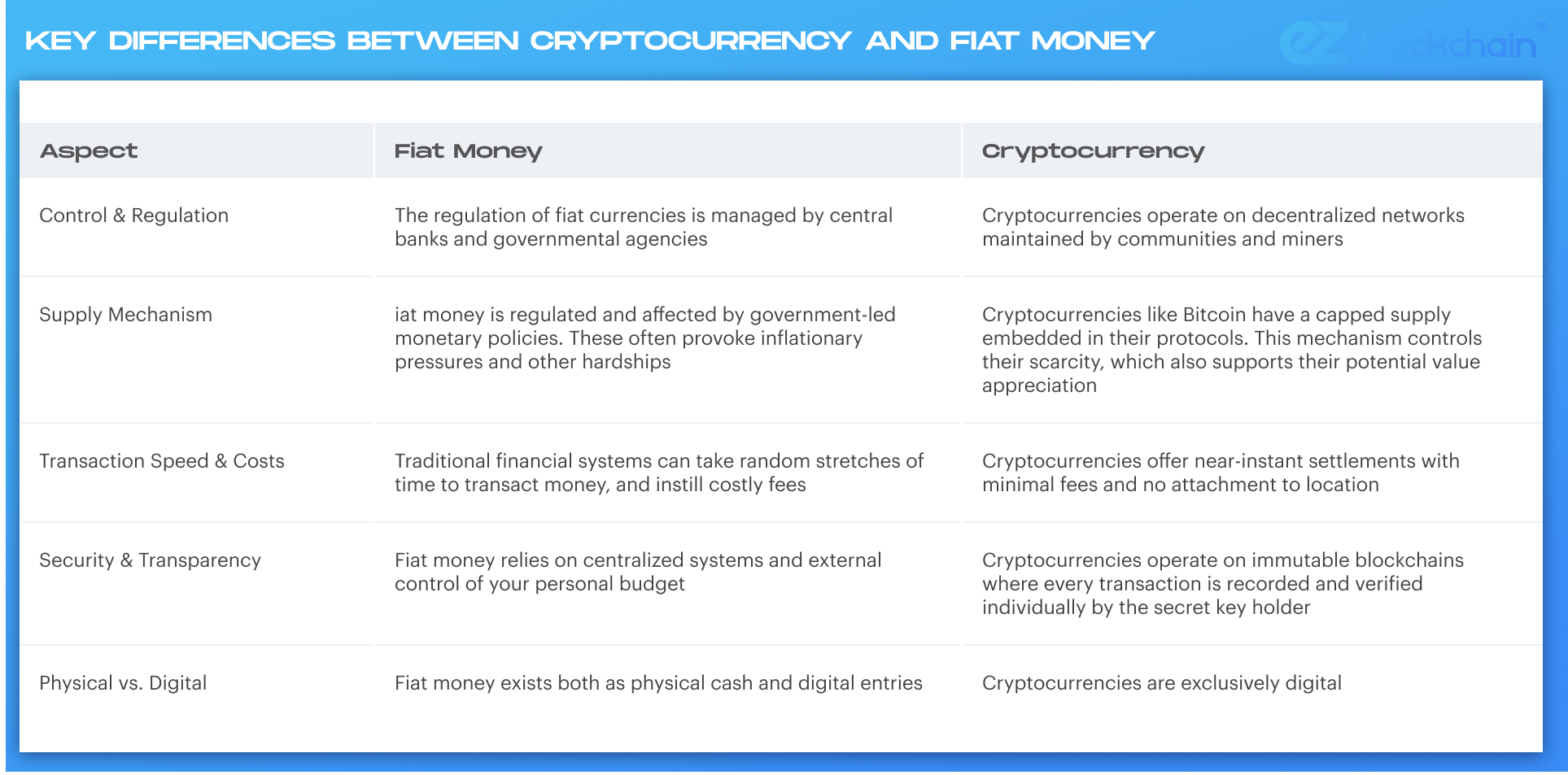

Key Differences Between Cryptocurrency and Fiat Money

While it’s easy to set cryptos apart from fiat knowing their baseline definitions, there is more depth to the difference between these two modern formats of currency. Let’s get into a bit more detail here — it can help you weigh out your options for business or personal financial management purposes.

Control & Regulation

→ The regulation of fiat currencies is managed by central banks and governmental agencies.

→ Cryptocurrencies operate on decentralized networks maintained by communities and miners.

This significant shift in control sparks lively debates on fiat currency vs cryptocurrency dynamics and how authority is redefined in our digital world. For cryptos, the lack of large, official regulatory bodies is the bane of existence and main reason why they cannot possibly replace fiat money to full extent.

Although, some countries are making advances in developing legal sides of maintaining the crypto assets flow. We also have the upcoming EU AI Act, which prompts some of the first ever tangible regulations for cryptos on a government level.

Supply Mechanism

→ Fiat money is regulated and affected by government-led monetary policies. These often provoke inflationary pressures and other hardships.

→ Cryptocurrencies like Bitcoin have a capped supply embedded in their protocols. This mechanism controls their scarcity, which also supports their potential value appreciation.

Keep in mind, a disadvantage of fiat currency is that its supply can rapidly increase, but its value dilute over time. This is where cryptos take on a more progressive approach, albeit an experimental one at that.

Namely, individual crypto networks set a supply cap for coins they mint, which is much easier to manage and regulate (and implement in the first place) with digital tools and personalized platforms.

Transaction Speed & Costs

→ Traditional financial systems can take random stretches of time to transact money, and instill costly fees.

→ Cryptocurrencies offer near-instant settlements with minimal fees and no attachment to location.

Notoriously, physical transactions can take as long as “2 to 99 business days”. Then, there are commissions, especially when processing international transactions. This and the overall fragility of regular money are other points that make fiat rather inferior to cryptos.

A primary talking point in discussions comparing crypto vs fiat systems is how cryptos have the potential to dramatically speed up and cheapen cross-border money transactions by removing the physical attachment entirely.

Security & Transparency

→ Fiat money relies on centralized systems and external control of your personal budget.

→ Cryptocurrencies operate on immutable blockchains where every transaction is recorded and verified individually by the secret key holder.

Now, the question of ultimate security and reliability of choosing, say, Bitcoin vs fiat assets, is where the discussion branches out. Yes, centralized financial institutions may be susceptible to manipulations and practices that are invisible to you. But crypto networks also have their risks, especially being all-digital and going online to carry out most operations.

One thing’s for sure, there are enough technological opportunities and best practices available to reinforce the security of crypto wallets, and you should certainly turn to them proactively if you’re into crypto.

Physical vs. Digital

→ Fiat money exists both as physical cash and digital entries.

→ Cryptocurrencies are exclusively digital.

This radical difference creates a paradigm where traditional banknotes and coins face off with blockchain-verified digital assets — an essential discussion in fiat money vs cryptocurrency debates. Right now, both fiat and crypto currencies exist simultaneously. But if it comes down to it, what will we choose — a well-proven, familiar option or a novel alternative? Only time will tell.

Advantages of Cryptocurrency Over Fiat Money

We still have yet to see whether crypto is a viable alternative to replace money completely, but in places it is used right now, it is on a steady rise. There is a huge cryptocurrency market that is worth an insane $2.71 trillion, and to its adopters, cryptocurrency offers a bunch of compelling benefits, like:

- Decentralization: Cryptos allow bypassing any intermediaries, like banks or money transfer agencies, which is a fresh perspective when considering cryptocurrency vs fiat currency models.

- Cost- and speed-efficiency: Low transaction fees and near-instantaneous transfers reshape global commerce, particularly beneficial in cross-border transactions.

- Reinforced transparency and security: Blockchain’s open ledger system safeguards against corruption and malicious hacker intents, and boosts user confidence with sensitive verification.

- Digital-native integration: As economies move further into the digital realm, integrating cryptocurrency fiat systems enables seamless connectivity and financial innovation.

- Borderless transactions: Cryptocurrencies enable fast, low-cost transfers across borders. They also help avoid exchange fees issued by most services handling such transfers today.

The Future of Money: Will Cryptocurrency Replace Fiat?

As we forge ahead, the discussion around cryptocurrency vs fiat can be larger than we think. We are talking about a new financial ecosystem, after all. One that may as well become our future norm.

Right now, we can say for sure that with undying trends, highly advanced cybersecurity achievements, and total efficiency of digital currencies, we get a glimpse into a more democratized economic landscape of the future.

Whether comparing bitcoin vs fiat in terms of value storage or assessing the fiat money pros and cons, the future likely holds a blended approach. Rather than replacing, digital assets will rather complement — and potentially transform — the established monetary system.

For companies and entrepreneurs looking to inspect the forefront of these progressions, it is essential to stay in the know. The insights provided here are meant to equip you with the knowledge to take on an insightful approach to money as a whole, and gain confidence for your innovative crypto strategies.

Hope they come in useful!

Bottom Line

Questions like “is bitcoin fiat money?’ still arise all over the web, underscoring just how fundamentally different these systems are. You should have your knowledge straight by now. All in all, while fiat money remains the backbone of today’s economies, the transformative advantages of cryptocurrency are paving the way for a future.

The future where you gain principally more control, transparency, and efficiency over your finances. To embracing these shifts to the max, you may need a reliable tech and software partner. Let the seasoned specialists at EZ Blockchain help you pick the best digital transformation directions — consult with us!

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.