Stay up to date with the latest news, announcements, and articles.

Above all, it indicates that for ETH, 2025 is the year of the highest consistent value, with the coin hovering between $4,000–$4,800 for three months. For Ethereum, this is the first since the record pricing of $4,800 back in 2021.

And although it hasn’t yet broken its historical price ceiling ($4.8K in 2021 was more money than it is in 2025 due to inflation), ETH has certainly turned the market sentiment and may now be showing bullish tendencies.

Still, the global market remains cautious and doesn’t rush to invest in and inflate the ETH asset, which is indicated by the gradual price drop. How come? What stands behind this Ethereum price boost? And what to expect next? Let’s figure it all out.

Current State of the Ethereum Market

For the Ethereum network, in general, pandemic years were the hardest: ETH kept well below $2K in 2022–2023. After that, Ethereum had a fairly turbulent streak in 2024 and early 2025 — the price has been surging sharply up and down since March 2024:

Source: Statista

We saw the sharpest drop in the early 2025 — all the way down to the mid-pandemic levels. However, most interestingly, it went up sharply to the $4.8K mark. The current price of Ethereum is hovering in the $2,800–$2,900 range.

Such dynamics, demand shifts, and overall price stabilization tell us one thing — ETH is in the spotlight, again. The renewed market interest is also indicated by global market signs, such as:

- Fresh hype for spot ETH ETFs

- More and more institutional inflows in ETH reserves

- ETH exchange reserves are at multi-year lows

- Larger players accumulate more ETH according to some on-chain analyses

Bullish ETH traders follow as the main driver of the ETH price dynamics. But let’s try to figure out what drives them (traders and investors) in the first place.

Why Traders Are Turning Bullish

Ethereum has always been a go-to platform for custom crypto projects, boasting extensive technological potential that still hasn’t been fully unleashed to date. This is why ETH trader sentiment is influenced the most by tech innovations and novel niches that involve the ETH. But there’s more.

“If ETH climbs back up to and sustains above $4,000… … we’ll see its bullish breakout level.” — EZ Blockchain

Among the main influencers of the latest ETH price stabilization, we can point out:

- Institutional inflows and demand for ETFs: Reportedly, novel spot ETH ETFs have reached hundreds of millions USD in investments over some months. This alone has impacted ETH’s long-term value and stimulated more market confidence in the coin.

- Supply constriction and token accumulation trends: On-chain data shows that centralized exchanges now hold significantly less ETH. In turn, large-volume wallets continue accumulating tokens. If the trend persists and the ETH supply tightens, its price will only grow more appreciated over time, attracting bullish investors.

- Improved technical base: Recent price action and the Ethereum price today have pushed ETH to reclaim market support at $2,500–$2,550, form higher lows, and break out on rising volume. This tells us that Ethereum is moving away from the bearish trends of previous years.

Technical Indicators Supporting Optimism

On top of the market sentiment and value shifts, there are certain technical points of impact. For instance, technical analysis and audit charts of the market, coupled with trading data, tell us:

- The recovery from ~$2,472 to above $2,600 with strong volume suggests that ETH token buyers have set sights on long-term accumulation. This can be an automatic setup for the next big ETH rally.

- Institutional inflows have coincided with ETFs peaking in demand. Historically, rising institutional and government interest foreshadows future growth trends (if that interest aligns with general sentiment and is backed by efficient innovations).

- With exchange-held ETH supply nearing multi-year lows, a supply shock may also ensue. As more ETH holders choose to accumulate the value, demonstrating resistance to active trading and investments, the imbalance in circulation will further boost the ETH price.

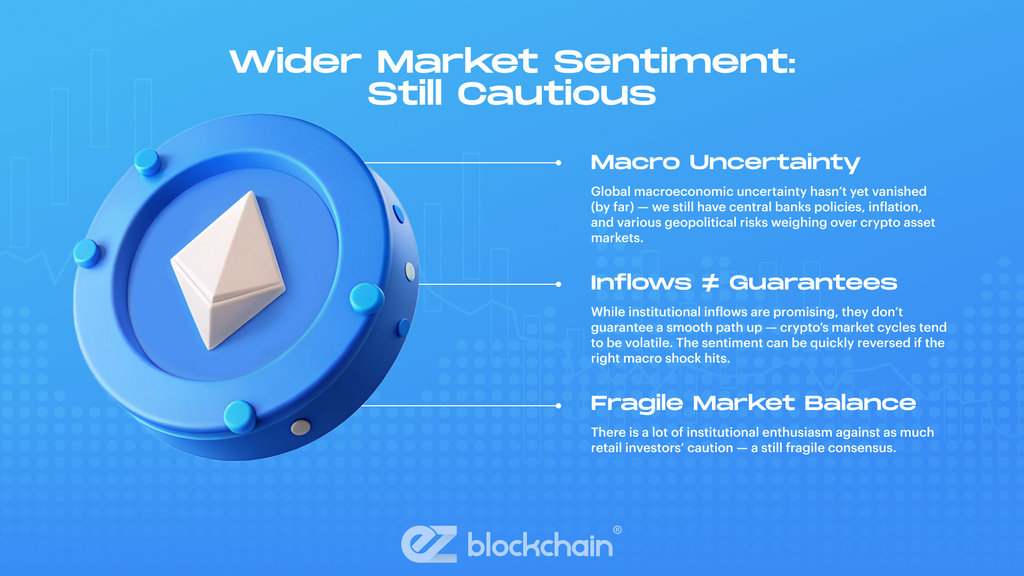

Wider Market Sentiment: Still Cautious

Now, for the most intriguing — confusing even — part. Looking at the ETH price dynamics, the core insight we can draw is that despite a seemingly spiking bullish rise, the market remains very tempered in its general ETH sentiment. That’s due to several reasons:

- Global macroeconomic uncertainty hasn’t yet vanished (by far) — we still have central banks policies, inflation, and various geopolitical risks weighing over crypto asset markets.

- While institutional inflows are promising, they don’t guarantee a smooth path up — crypto’s market cycles tend to be volatile. The sentiment can be quickly reversed if the right macro shock hits.

- There is a lot of institutional enthusiasm against as much retail investors’ caution — a still fragile consensus.

Factors Holding Back Broader Growth

With such an upward momentum, it can be difficult to understand why the Ethereum USDT price couldn’t break out further. What constrained it?

- Rising interest rates, global economic tension, and tighter liquidity conditions dampened risk-asset flows, including crypto.

- Governments grew enthused about crypto in some aspects, and doubled down on stifling regulations in others, slowing down general institutional adoption.

- While supply is tightening, high volatility remains — a double-edged sword that can scare off retail investors even if long-term holders remain bullish.

- With many blockchains and altcoins competing for investor attention, ETH must continue demonstrating unique value to stand out.

Institutional Involvement in ETH

As you see, institutional activity appears to be a major catalyst behind the ETH dynamics and growing bullishness:

- Recent analyses estimate that over 10% of circulating ETH supply is now held by corporate treasuries, ETFs, and institutional wallets.

- ETFs and professional investors are increasingly treating ETH not just as a speculative token, but as a medium- to long-term strategic asset (e.g., due to DeFi use cases and staking yields).

- The expanding institutional demand is seen by many traders as a sign that ETH’s bull cycle may have deeper structural backing than purely retail-driven rallies.

Key Price Levels to Watch

Another big question is what Ethereum price prediction we can make, and when do we understand it’s time to ride a new bullish momentum? If you want to grow your chances, it’s important to watch the ETH price zones:

- $2,500–2,550 is the so-called support zone — “price bounce areas” that indicate the persistent lows and thus bullish momentum potential.

- $2,800–$2,900 is the near-term resistance zone.

- $4,000–$4,200 is the psychological and structural resistance zone, where ETH tests its previous highs.

- If ETH climbs back up to and sustains above $4,000, with a potential upward of $5,000–$5,700, we’ll see its bullish breakout level.

Potential Scenarios for 2025-2026

If we summarize all of the above and share some of our own projections, we can yet see three different scenarios unravel for ETH:

| Bullish breakout | Will happen if the institutional inflows continue, the macroeconomic environment improves, and ETH staking demand grows. | Will result in ETH pushing toward ~$5,000–$5,700, or even above $6,000 if crypto market allows. |

| Moderate growth or consolidation | Will happen if inflows come from mixed sources, retail investors are stable but slow, and macro uncertainty remains. | Will result in ETH trading between $3,200–$4,200, consolidating gains (good time to prepare for the next move). |

| Bearish correction | Will happen if macro rates grow and liquidity tightens, large holders take over most profits, and retail interest weakens. | Will result in ETH probably dropping to its current support zone of $2,500–$2,800, or dipping below depending on pressure. |

Conclusion

The more we dig into Ethereum insights, the more visible and feasible its potential next bull run becomes. There is a reinforced institutional demand, supply that’s out of balance, and technical foundation that only improves. That is why ETH traders are growing bullish.

If ETF inflows continue and staking adoption persists, ETH can break out beyond its resistance price zones, rising to $5,000 in price and higher in 2026. However, for now, all we can do is watch and hope that ETH turns less risky and speculative yet clearer and broader in its use.

Have more questions about ETH specifics? Turn to EZ Blockchain for a consultation and full-cycle crypto services — from an ASIC miner purchase and operational assistance to hosting and management.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.