Stay up to date with the latest news, announcements, and articles.

No matter your mining stack’s performance health, maintenance consistency, or overall reliability — power failures can happen, your coin’s market price may plummet, and industry-wide regulations may switch.

Thankfully, proper crypto mining insurance is here, and we can’t but explore and highlight its main ins and outs based on the real-world BTC-denominated insurance provider’s case. But let’s start from the beginning.

What is BTC-Denominated Insurance?

Unlike most entities and businesses, facilities, and enterprise infrastructures of today, crypto miners don’t really get a lot in the way of gaining protection from volatile conditions and unexpected situations, i.e., an opportunity to get insured.

This is why right now the most forward-minded crypto enthusiasts are focused on exploring BTC-based business interruption insurance offers, and BTC-denominated insurance policies in general.

As a real-world instance, Relm Insurance ltd. has been developing solutions tailored to cryptocurrency-focused businesses (plus Web3, and other advanced niches not yet covered by proper insurers). Relm helps owners of mining stacks and facilities alike get a legit, profiled insurance for both their equipment and mining assets.

To get a geeper understanding of BTC-denominated insurance, let’s take a look at this novel concept from the perspective of its firsthand provider.

Relm Insurance: Pioneering BTC-Denominated Policies

Relm Insurance, Bermuda-based insurers, stand out in that they have a very diverse insurance spectrum, with a major focus on innovative alternative risk solutions. At the same time, Relm are among the few insurers globally to provide BTC-denominated insurance solutions specifically for digital asset businesses.

With policies designed around the cryptocurrency market’s volatility, Relm Insurance allows Bitcoin miners and other crypto entities to hold insurance in BTC.

Why BTC-denominated policies are unique

- Coverage in BTC: Policies are structured so that premiums and claims are denominated in Bitcoin.

- Volatility mitigation: Unlike fiat-based policies, BTC-denominated coverage protects against fiat-to-crypto conversion losses.

- Revenue stream alignment: Insured miners receive payouts in BTC, which matches their earnings model.

But there’s more than that — shifting towards BTC-denominated insurance reimubursals is simply more profitable. Cost-saving, to be exact. By holding insurance and getting reimbursals in crypto, you can actually avoid fiat conversions that can erode value.

- Here’s an example: Suppose, a Bitcoin mining company based in Texas faces a storm or, God forbid, hurricane that damages their facility. While they had standard business interruption insurance, the payout was in USD. By the time the claim was processed, BTC had appreciated by 20%. The result? Considerable loss of revenue post-conversion.

With BTC-denominated insurance, the company could have avoided such losses and would have received the claim in BTC from the get-go, aligning their claim with revenue and operational costs.

Understanding Business Interruption Insurance for Miners

Business interruption insurance is essential in most industries, but for miners, it’s a lifeline. Specialized Bitcoin mining insurance would reimburse miners for lost income when operations halt or fail unexpectedly. An insurer thus provides critical financial support to help the client facing potentially dire financial consequences continue paying operational costs and avoid layoffs.

Common interruptions in Bitcoin mining

- Equipment failures: ASIC miners, which is the top choice for mining today in our opinion, are quite reliable but are still susceptible to breakdown, and fixing one can cost a pretty penny.

- Power outages: Efficient mining requires focused, uninterrupted power intake. Outages can hinder operations and provoke felt revenue loss.

- Natural disasters: Mining facilities may also face risks of storms, floods, or fires, especially in mining hubs and regions prone to extreme weather.

- Regulatory actions: In some regions, mining operations are disrupted due to changing regulations and, particularly, growing regulatory pressure and concern for crypto-based operations in terms of legal control.

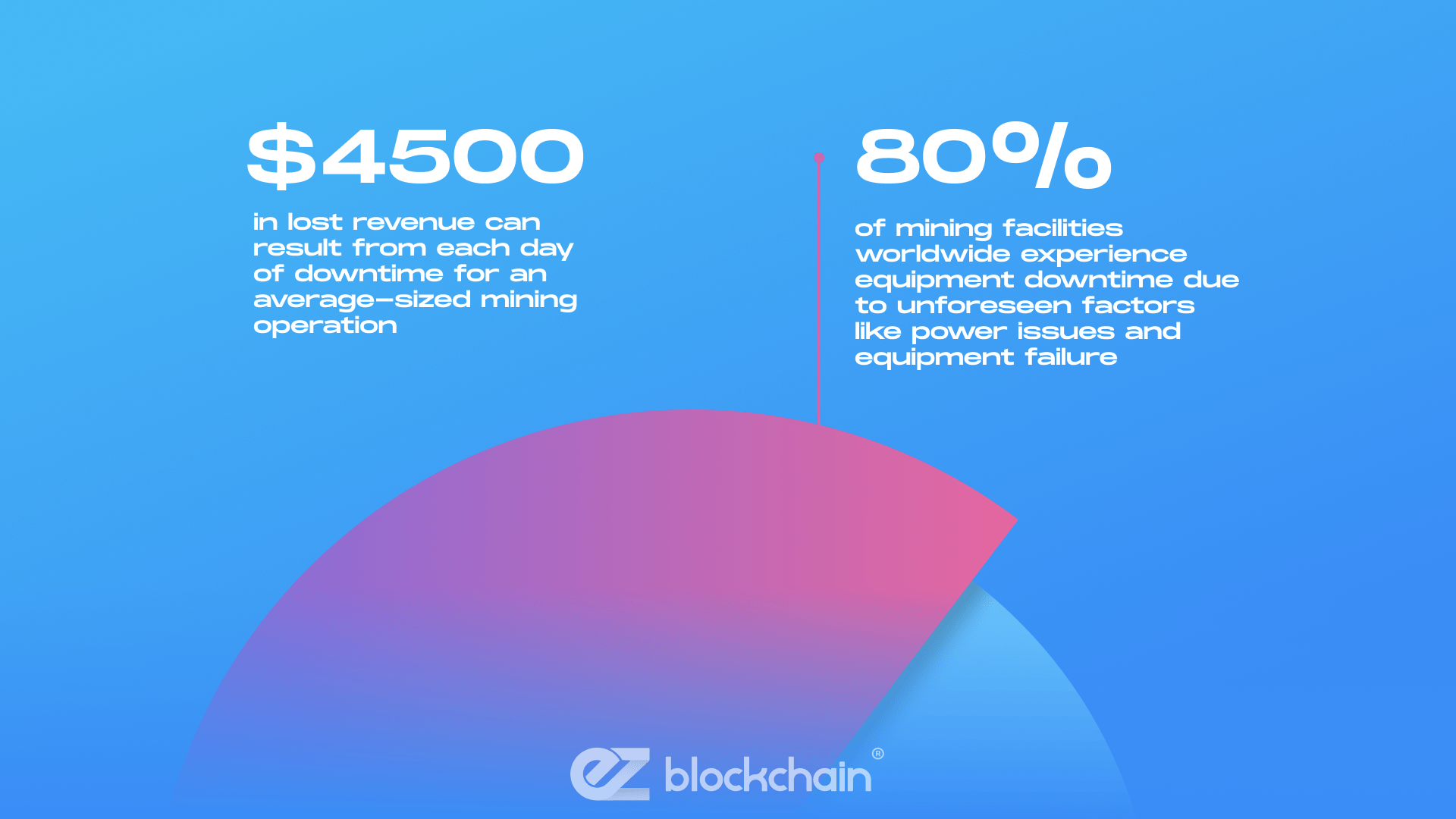

Statistics

- 80% of mining facilities worldwide experience equipment downtime due to unforeseen factors like power issues and equipment failure.

- For an average-sized mining operation, each day of downtime could result in up to $4,500 in lost revenue.

BTC-denominated business interruption insurance for cryptocurrency mining, like that from Relm Insurance crypto offerings, helps make sure that claims are made in BTC. For miners, this provides a financial cushion in the very asset they depend on.

The Impact of Bitcoin Mining Interruptions

Mining Bitcoin is capital-intensive, and the slightest interruption can have visible financial repercussions. Unplanned outages in mining operations slow down the overall productivity and cause felt monthly revenue dips. Interruptions like these create both short-term and long-term impacts for miners, like:

- Immediate revenue loss: Lost mining time means fewer blocks mined and a direct hit to revenue.

- Difficulty adjustment risks: Bitcoin’s difficulty adjusts approximately every two weeks, so even minor disruptions can impact mining yield relative to competitors.

- Delayed maintenance: Costly repairs or replacements can take longer without immediate BTC access from claims, extending downtimes and financial strain.

With BTC-denominated insurance, miners avoid currency conversion delays and can use the claim payout directly for purchasing equipment, paying power bills, or other BTC-accepted expenses.

Why BTC-Denominated Insurance Matters for Bitcoin Miners

Good old fiat-denominated insurance policies are a financial problem for Bitcoin miners simply because the currency mismatches. BTC-denominated insurance for crypto mining is designed to bridge this gap through policies that match BTC’s valuation.

Benefits of BTC-denominated insurance

- Natural hedge against volatility: Policies that adjust with BTC’s value help miners avoid currency losses.

- Immediate liquidity: Claim payouts in BTC allow miners to respond swiftly to operational needs, avoiding delays and costs associated with fiat transactions.

- Lower cost of coverage: Since premiums are also BTC-denominated, miners benefit when BTC’s price appreciates.

Challenges for Miners: Navigating Halving and Market Volatility

Bitcoin halving events occur roughly every four years, cutting block rewards by half and straining everybody’s mining operations, lowering income for those unprepared. Combined with omnipresent market volatility, halving can undermine both profitability and sustainability.

Auxiliary tools for halving and volatility

- BTC-denominated policies: Enable miners to lock in BTC value, buffering against revenue fluctuations.

- Flexible premiums: BTC-based premiums adjust with market rates, helping miners manage costs effectively.

- Enhanced recovery time: Policies from Relm Insurance allow miners to respond quickly post-halving without strong fiat dependency.

Protecting Against Physical Damage: A Crucial Component

Bitcoin mining requires specialized hardware and facilities. Physical damage to these assets, whether through fire, flooding, or other environmental events, can cripple operations. BTC-denominated property insurance policies provide financial protection specifically designed for the needs of crypto miners.

- Example scenario: A large mining farm in Iceland suffered significant fire damage in 2021. Traditional property insurance only covered repairs in fiat, which delayed their ability to buy new equipment due to BTC-fiat conversion fees. Bitcoin mining property insurance from Relm Insurance offers immediate BTC payouts, allowing miners to replace damaged assets more quickly.

The Growing Role of BTC-Denominated Financial Solutions

BTC-denominated financial solutions are expanding rapidly, and miners increasingly rely on them for smoother, conversion-free operations. These solutions are attractive for businesses heavily invested in digital assets, as they create a BTC-native financial environment where transactions are simpler and quicker.

Key BTC-denominated financial solutions

- BTC-denominated insurance: Covers interruptions, property damage, and equipment breakdowns in BTC.

- Crypto-backed loans: Allow miners to leverage BTC without liquidation for operational expenses.

- Asset protection services: BTC-based services are designed to help miners keep high-value assets secure and liquid.

BTC-Denominated Insurance as a Financial Lifeline for Miners

With BTC-denominated insurance, miners get an advanced, adaptable financial tool. By providing coverage in BTC, these policies offer liquidity, simplify claims processing, and reduce currency conversion costs — all crucial in an industry built around Bitcoin. Relm Insurance Ltd. continues to be a leader in providing BTC-aligned protection, helping miners focus on scaling their operations, even amid market volatility.

Takeaways

- Cryptocurrency mining insurance helps match financial tools with miners’ revenue structure, cutting out tons of conversion issues.

- Relm Insurance’s BTC-based solutions provide business interruption, property damage, and volatility protection in one place.

- BTC-denominated financial solutions are increasingly essential for miners’ stability and operational agility.

Relm Insurance’s Class IIGB License: A Key to Innovation

All of the abovementioned goodies make us wonder — what exactly do other insurance providers lack in order to start covering crypto insurance cases? The Innovative Insurer General Business license.

The Class IIGB license grants Relm Insurance the flexibility to cover digital assets, making it a unique insurer equipped to provide BTC insurance services. On top of that, Bermuda’s regulatory framework for digital assets allows Relm to maintain high compliance standards.

So if we want to see more global offerings for your crypto mining operations insurance, more agencies must set their sights on gaining innovative licensing and making reimbursals and accounts crypto-native, or at least crypto-friendly.

Other Bitcoin Insurance Providers Like Relm

Right now, there are only a handful of providers offering BTC-denominated insurance options. Each company grants a certain extent of coverage for crypto operations and/or allows holding insurance in Bitcoin.

Use this as your cheat sheet when seeking volatile market protection and financial reimbursement guarantees for your crypto endeavors.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.