Stay up to date with the latest news, announcements, and articles.

The market value of Bitcoin, mining difficulty, electricity usage, and equipment prices are the four main determinants of mining profitability. By pooling your computing capabilities with those of other miners, joining a mining pool improves your chances of receiving rewards. The key details for launching your cryptocurrency mining business are covered in this guide. In contrast to more erratic cryptocurrency alternatives, ASIC crypto mining offers proven security and incentive systems.

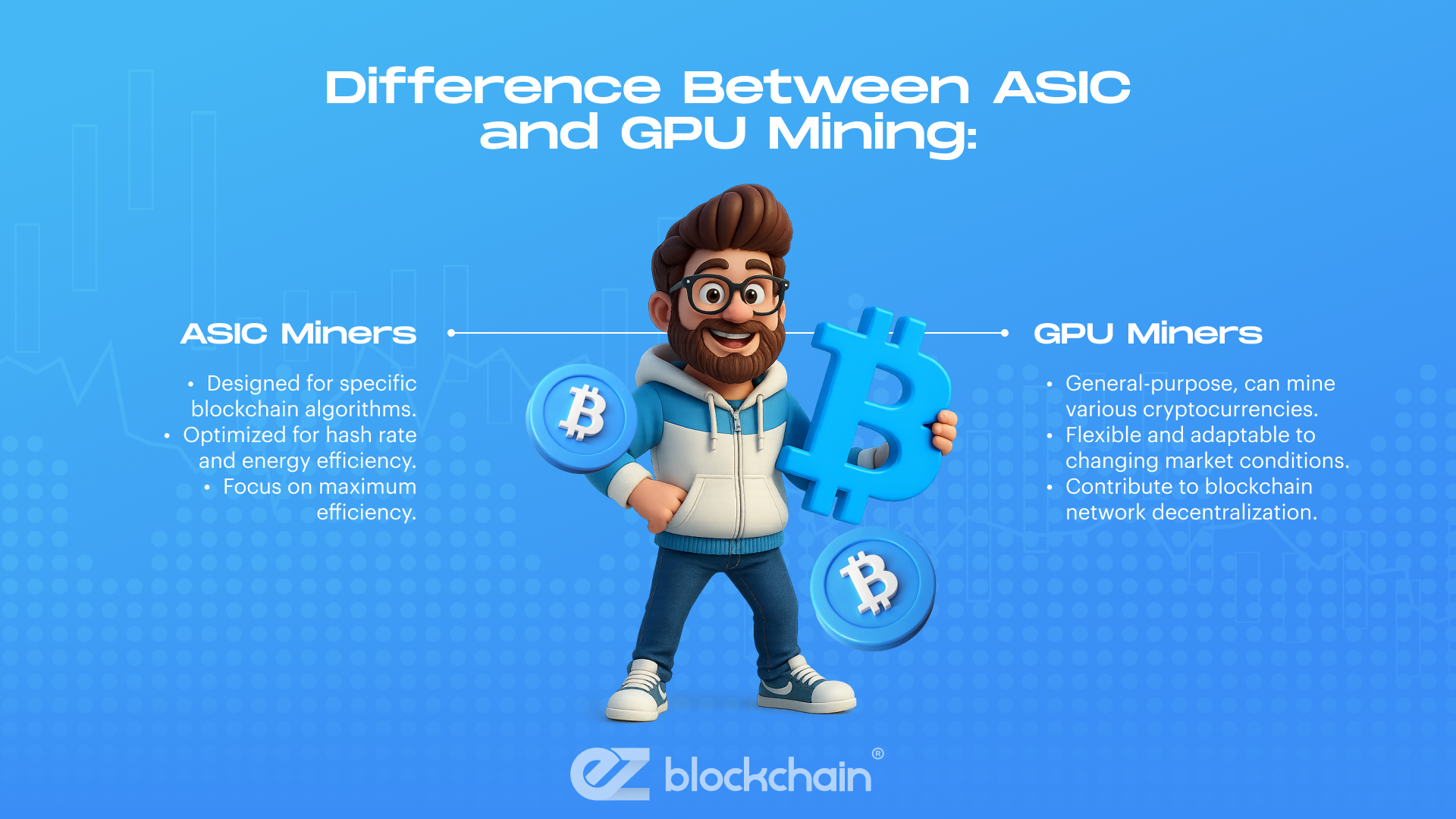

Difference Between ASIC and GPU Mining

Application-Specific Integrated Circuit (ASIC) miners are carefully designed devices created with a single goal in mind: to solve the cryptographic algorithms of a particular blockchain. These devices optimize every part of the mining process, from hash rate output to energy consumption, in contrast to general-purpose CPUs.

Because GPUs can do a wide range of calculations, unlike ASICs, which are single-purpose, miners may diversify across various cryptocurrencies and adjust to changing market conditions. To put it another way, GPU cards are readily moved to mine for several blockchain networks. It is thought that GPUs contribute to a blockchain network’s decentralization, while crypto mining ASIC hardware focuses on maximum efficiency.

How ASIC Miners Work

Its development in the context of cryptocurrencies aims to solve the challenging mathematical problems that come up during blockchain transaction security and validation. This process is identified as hashing. An ASIC miner BTC consists of a motherboard, a power supply unit (PSU), a cooling system, application-specific integrated circuit (ASIC) chips, and communication interfaces. Together, these components enable the quick and effective hashing operations required for Bitcoin mining.

Choosing Your First ASIC Miner

There are a number of crucial aspects to take into account when choosing an ASIC miner. Selecting a miner who not only complies with the cryptocurrency’s unique algorithm but also meets other essential requirements is essential for streamlining your mining process. Below is a list of the most important things to remember:

Hashrate, Power, and Efficiency

There are several important factors to take into account while assessing a mining rig:

- Hashrate: The rig’s speed in problem-solving. Better possibilities of prizes are associated with more hashes per second.

- Energy efficiency: The amount of electricity required by the device to produce such hashes. Lower electricity prices are the result of improved efficiency.

- Most individual miners join mining pools: Groups that boost their chances of consistently earning Bitcoin by combining hash power and splitting rewards.

While many miners may be able to purchase less expensive versions like the S19, specialized units like the KS5L are designed for people who are prepared to spend on top-tier performance and are targeting particular coins.

Budget Considerations

Although a less expensive ASIC miner could seem appealing at first, you should consider the long-term profitability. More costly models may require a larger initial investment, but over time, their improved performance and reduced energy costs typically make up for it.

An ASIC rig’s lifespan is influenced by its use, upkeep, and operational circumstances. An ASIC miner should have a lifespan of seven to five years. Its longevity can be increased by routine maintenance, sufficient cooling, dust protection, and avoiding voltage surges. However, since technology is constantly advancing, your current ASIC may become antiquated and reduce your earnings if a large number of new miners emerge in the future.

Setting Up Your Mining Rig

There are multiple steps involved in building a mining rig. Attaching the motherboard to the miner frame is the first step. The CPU, RAM, and GPUs should then be installed on the motherboard.

Next, attach the power supply unit to the GPUs and motherboard. Lastly, set up your cryptocurrency wallet and install the operating system and ASIC mining software on your storage device. Patience and perseverance are essential since developing a mining rig can be a trial-and-error process that calls for a lot of tinkering and adjusting. Many enthusiasts even research how to build an ASIC miner from scratch, but most prefer to buy assembled systems.

Joining a Mining Pool vs Solo Mining

Mining pools reduce revenue volatility and enable smaller miners to provide consistent returns by combining the hash power of several members and allocating rewards proportionately depending on contributed labor. In addition to your own hardware efficiency, energy costs, and risk tolerance, other important considerations are pool fees, payout methods, latency, and reliability.

| Factor | Mining Pool | Solo Mining | Notes |

| Reward Frequency | Frequent, smaller payouts | Rare, full block reward | Pool smooths income; solo requires high hash rate |

| Variance/Risk | Low variance | High variance | Pools reduce payout uncertainty; solo has higher risk of zero reward |

| Required Hash Power | Low to moderate | High | Solo mining needs sufficient network share to find blocks |

| Fees/Overhead | Pool fees (1–3%) | None | Consider fee impact on net profitability; solo avoids fees but higher variance |

Calculating Profitability

What does mining profitability actually mean? The profits that miners make from their cryptocurrency mining operations are known as mining profitability. The returns can be transaction fees that miners receive after subtracting all of the expenses they incurred throughout the mining process, or they can be mining rewards in the form of newly created cryptocurrency.

Profitability in mining is complicated because it depends on a number of variables, including market circumstances, hash rate, electricity costs, transaction fees, and pool rewards. In a nutshell, mining profitability is dynamic and constantly changes based on a variety of factors. Therefore, when determining mining profitability, miners should carefully take into account all relevant factors.

Electricity Costs

Verify the energy prices in your area twice because ASIC mining uses a lot of energy. In order to reduce their excessive electricity costs and increase their cryptocurrency mining profitability, a lot of big mining companies actually relocate their operations to isolated areas with lower electricity costs. Increased electricity costs have the potential to reduce your mining earnings.

During the crypto mining process, ASIC miners produce a lot of heat. In order to keep the machine from overheating and improve performance, miners frequently install extra cooling systems like fans and air conditioners. Profitability will be impacted as operating costs rise once more, especially in larger operations such as a Bitcoin mining rig warehouse.

Mining Rewards

To compensate the miners, a number of mining pools employ various payout plans. For instance, Pay-Per-Last-N-Shares (PPLNS) finds the last blocks you contributed after the new successful blocks were discovered, whereas Pay-Per-Share (PPS) pays the miner a set sum for each share. As a result, confirm the payout plans with your mining pool.

Regarding rewards, transaction fees, resource usage, etc., different mining pools adhere to different laws and regulations. Make sure to talk about them in advance to prevent unneeded disruptions during mining.

Final Thoughts

ASIC mining necessitates careful hardware selection, effective setup, and continuous maintenance to optimize return on investment. For certain blockchain algorithms, ASICs offer high-efficiency performance, whereas GPUs offer flexibility but have worse energy efficiency.

With high-performance ASICs, monitoring tools, and maintenance services, EZ Blockchain helps miners maximize profits and keep safe, dependable, and scalable mining operations.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.