Stay up to date with the latest news, announcements, and articles.

Quantitatively, the USD-pegged layer dominates the market microstructure for on-chain liquidity: the two largest dollar-pegged issuers (USDT and USDC) represented a combined market capitalisation exceeding $215 billion as of June 2025, accounting for the vast majority of stablecoin transactional rails and cross-border flows. By contrast, tokenized gold markets remain niche relative to the dollar-backed layer; tokenized-gold initiatives have strong proof-of-concept traction (industry pilots and LBMA/LGC alignment) but not near the systemic liquidity footprint of USD stablecoins.

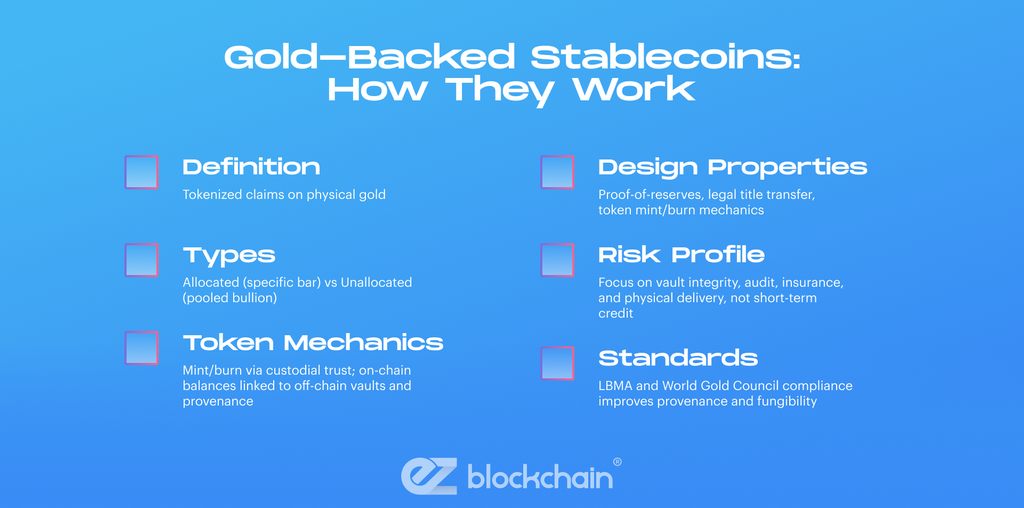

Gold-Backed Stablecoins: How They Work

Gold-backed stablecoins are tokenised claims on physical metal. Architecturally they either represent: (a) allocated gold — a fractional title to a specific Good Delivery bar held in audited vaults, or (b) unallocated claims — a fungible claim against pooled bullion. Token minting/redemption is governed by custodial trust contracts that map on-chain balances to off-chain vault inventories and provenance records (serial numbers, assay certificates, and vault location). Settlement involves atomic off-chain reconciliation (custody ledger → token mint/burn) with cryptographic receipts linking on-chain token IDs to bar attributes.

From a risk engineering perspective, gold-backed tokens shift counterparty exposure away from short-dated credit instruments to storage, audit, and settlement risks: proof of vault reserve integrity (chain of custody), insurance covering gross-loss scenarios, and mechanisms for physical delivery or conversion to fiat. Gold tokenisation programs that interoperate with LBMA and World Gold Council standards improve provenance and fungibility via bar-level registries (e.g., the SGU / Gold Bar Integrity Programme pilots) — a necessary foundation before scaled use as collateral in financial plumbing.

Typical design properties: allocated vs unallocated, token mint/burn mechanics, proof-of-reserves mapping, legal title transfer provisions.

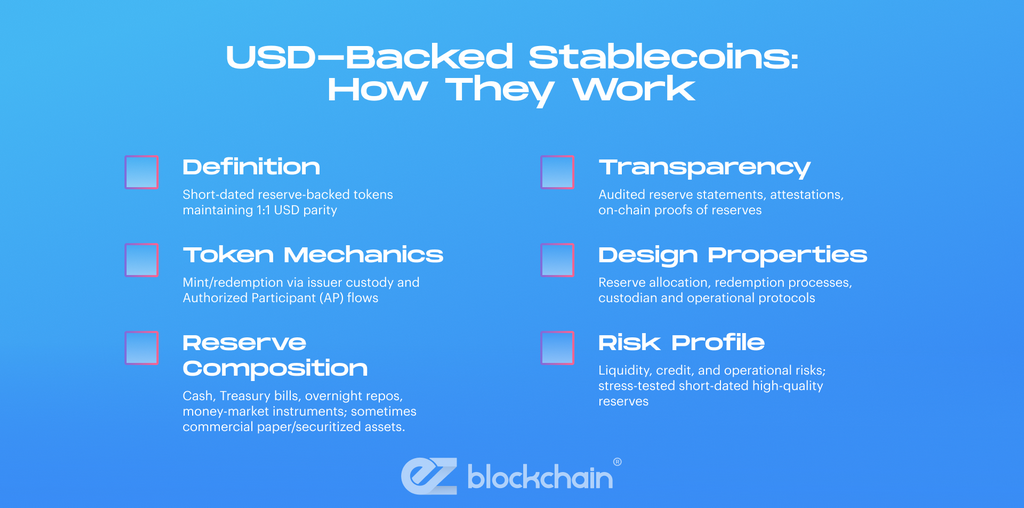

USD-Backed Stablecoins: How They Work

USD-backed stablecoins are engineered as short-dated reserve vehicles. The canonical architecture maintains 1:1 nominal parity by holding a portfolio of cash, overnight reverse repos, Treasury bills, and highly liquid money-market instruments; some issuers include commercial paper and securitized assets. Operationally, minting/redemption is coupled to issuer custody processes and authorized participant (AP) flows: AP submits USD → issuer acquires reserves → mint tokens; conversely, token redemption triggers sale of reserves and fiat settlement. Transparency is enforced (in regulatory frameworks) through attestations, audited reserve statements, and, increasingly, on-chain proofs of reserve mappings.

USD stablecoins therefore expose holders to liquidity risk (reserves must be liquid enough to absorb redemptions), credit risk (quality of reserve assets), and operational risk (custodian solvency, AP behaviour). Recent policy and supervisory work emphasises short-dated, high-quality reserve composition and stress-testing to reduce run-risk and systemic spillovers.

Typical design properties: reserve composition, redemption mechanics, custody & AP framework, attestation cadence.

Stability and Security Comparison

Stability and security are multi-factor tradeoffs across liquidity, counterparty exposure, settlement finality, and regulatory enforceability.

| Dimension | Gold-backed | USD-backed | Practical security implication |

| Price anchor | Commodity market (spot gold) | USD money market & Treasury yields | Gold resists fiat inflation but can decouple from USD volatility |

| Liquidity | Lower on-chain liquidity; off-chain physical settlement latency | High on-chain liquidity; fast fiat rails via APs | USD coins dominate trading and rails |

| Reserve risk | Vault custody, provenance, insurance | Credit & duration risk of cash/T-bills | Different failure modes (custodial vs market/credit risk) |

| Regulatory clarity | Fragmented; commodity custody regimes apply | Increasing regulatory frameworks (MiCA, US guidance) | USD model is being domestically regulated as payment instruments |

Reserve Transparency and Audits

Reserve transparency is the control plane that converts off-chain collateral into credible on-chain money. For USD-backed coins, best practice now codified in supervisory guidance requires frequent (monthly or better) independent attestations, reserve composition disclosure by asset class, and stress-test results showing redemption coverage under simulated runs. For gold-backed tokens, credible practice demands bar-level registries (serial numbers, assays), proof of allocated storage, insurance certificates, and independent vault audits. The World Gold Council and LBMA initiatives (Gold Bar Integrity Programme) are key to creating interoperable, machine-readable provenance for tokenized gold.

“Transparency is not only periodic attestation; it is the ability to cryptographically map an on-chain token to an auditable off-chain reserve record (bar ID, assay, vault) and a legal title transfer mechanism.”

Technical controls that matter: Merkle-anchored attestation feeds, auditability APIs, auditor SOC/SSAE reports, and legal trust frameworks that allow on-chain claims to be enforced in courts.

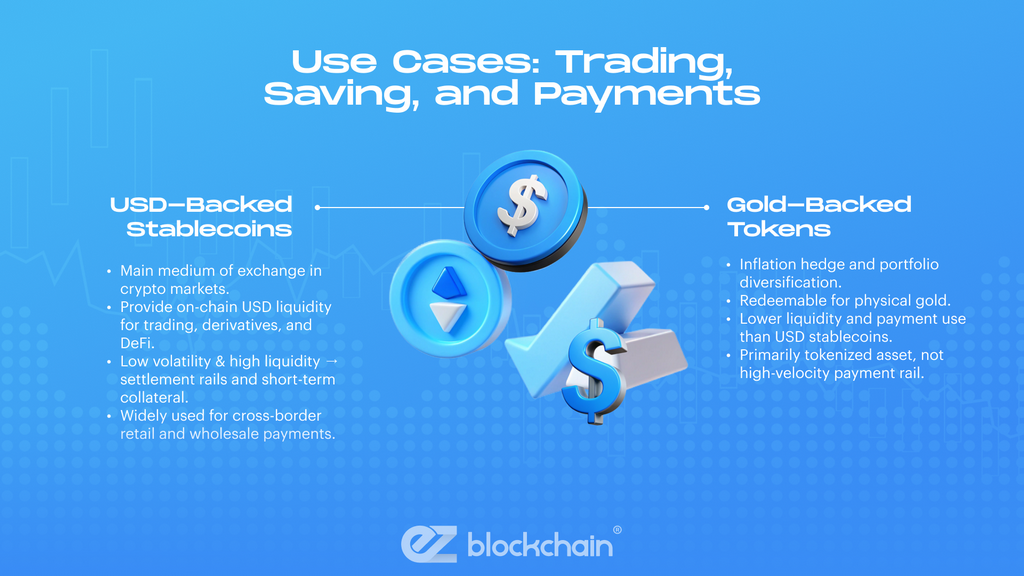

Use Cases: Trading, Saving, and Payments

USD-backed stablecoins are the dominant medium of exchange for crypto markets — they provide on-chain dollar liquidity for spot, derivatives, and DeFi (lending/borrowing, AMMs). Their low volatility and high liquidity make them usable as settlement rails and as collateral for short-term financing. The BIS and IMF note stablecoins’ extensive use in cross-border retail and wholesale settlement and that the USD-pegged layer accounted for most transactional flows in 2024–25.

Gold-backed tokens serve a different set of use cases: inflation hedge allocation, portfolio diversification, and composability for precious-metal-linked DeFi instruments. Because gold tokens can be redeemed for physical metal, they are appealing where investors want commodity exposure with token liquidity and settlement programmability. However, their on-chain liquidity and acceptance as payments are lower than USD stablecoins; they are used more as tokenized asset classes than as high-velocity rails.

A practical design decision: projects that need high-velocity transactional liquidity should use USD-pegged tokens; those requiring long-term store-of-value exposure may prefer gold-backed tokens if custody/payout mechanics match investor needs.

Adoption and Market Trends

Stablecoin market growth resumed after 2023–24 volatility and by mid-2025 the sector regained scale: IMF and BIS analyses show the two largest USD-pegged stablecoins (USDT + USDC) exceeded a combined $215 billion market cap (June 2025), and the stablecoin complex remained a major conduit for cross-border and DeFi flows. Central banks and supervisors are responding with bespoke frameworks (MiCA in the EU, SEC/US guidance) to address reserve quality, disclosures, and systemic risk.

Tokenized gold programs are moving from pilot to institutional proofs: World Gold Council pilot projects and LBMA interoperability work are addressing provenance and fungibility barriers, creating the technical preconditions for scaled institutional use. But tokenized-gold market depth is small relative to USD stablecoin rails, so adoption will likely be incremental and vertical (wealth management, commodity clearing) rather than wholesale replacement of dollar rails.

Macro policy bodies (BIS, IMF) flag that stablecoins could influence safe-asset pricing and Treasury yields; BIS quantifies that modest increases in stablecoin market cap already have measurable effects on short-term yields and market liquidity. This is propelling higher regulatory scrutiny.

Regulatory Considerations

Across jurisdictions, regulation is diverging along functional lines. The EU’s MiCA framework creates a comprehensive rulebook for issuers operating inside the Single Market (obligations on reserves, redemption, governance). U.S. regulators (SEC, FSOC inputs) emphasise reserve composition, redemption rights, and potential need for bank-like prudential safeguards. BIS and IMF work consistently recommend higher disclosure frequency, high-quality liquid reserve composition, and stress-testing to avoid systemic runs. For gold-backed tokens, commodity custody and property law create a different legal set of obligations — regulators will expect vault audits, title clarity, and anti-money-laundering controls aligned with precious-metals standards.

“Regulation will likely treat USD-pegged payment stablecoins as potential systemic retail payment instruments, while gold tokens will be supervised on custody/commodity rules — both demand stronger auditability and legal clarity.

Which Type Is Better for Investors

No single “best” design exists — it depends on investor objectives. Below is a quick decision table:

| Investor Goal | Preferred Type | Key tradeoffs | Operational checklist |

| High-frequency trading / DeFi collateral | USD-backed | High liquidity; counterparty & short-duration credit risk | Check reserve attestation cadence; AP liquidity |

| Inflation hedge / long-term store of value | Gold-backed | Lower on-chain liquidity; commodity price exposure | Verify allocated vault audit; redemption terms |

| Payments & remittances | USD-backed | Lower settlement friction; regulatory focus | Legal/regulatory status in corridor |

| Portfolio diversification | Gold-backed (plus USD) | Correlation benefits; custody complexity | Assess provenance registry & insurance |

Choosing the Right Stablecoin — Conclusion

From a systems-design vantage, USD-backed stablecoins are the plumbing of on-chain dollar liquidity; gold-backed tokens are tokenised commodity instruments that offer a distinct store-of-value profile. Institutional and retail participants must choose based on required liquidity, legal enforceability of claims, reserve transparency, and regulatory fit for intended use (payments vs portfolio exposure). Before adopt-in-production, require cryptographic attestation of reserves (or bar registry proofs), independent audits, and legal comfort around redemption and title transfer.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.