Stay up to date with the latest news, announcements, and articles.

Most miners are taking advantage of the low prices as they gear up for the upcoming Bitcoin halving event.

So, how do you go about choosing your crypto-mining equipment in 2025?

Read on for more insights.

Types of Miners

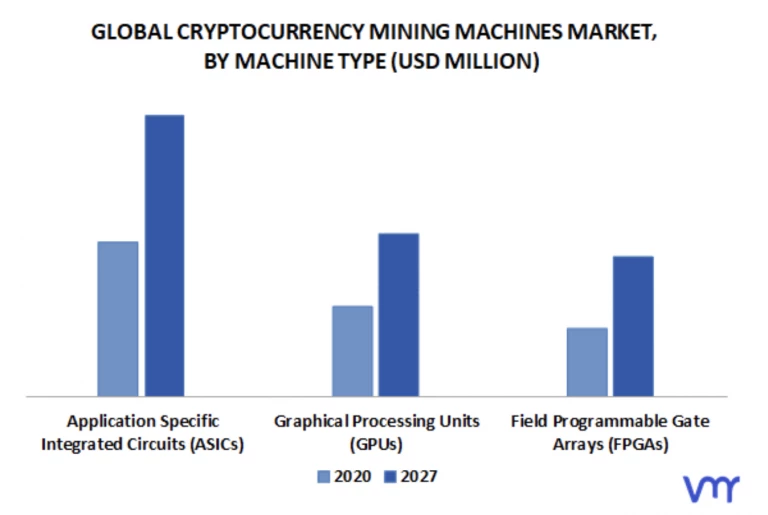

Crypto mining equipment comes in different types. However, the equipment’s hashing power, energy consumption, and mining rewards are what matters for mining profitability. Investors strive to balance miner cost, hash rate, power consumption, durability, and overall cost-effectiveness. Typically, a miner can be a CPU, GPU, ASIC, or FPGA.

CPU Mining in 2025

CPU mining was the first method used to mine Bitcoin. With around 10 megahashes per second hash rate, Satoshi used a computer’s basic central processing unit to verify the genesis block. However, due to the increasing mining difficulty on the Bitcoin network, the computing power provided by CPU miners could no longer keep up. Miners had to shift to GPU miners for profitable bitcoin mining. Though you can still mine some crypto using CPU miners, mining BTC with a CPU is unprofitable.

GPU Mining in 2025

Graphics Processing Units (GPUs) came to ease the increasing complexity of crypto mining. The first bitcoin mining with GPU happened in October 2010 to leverage GPU’s parallel processing power, enabling them to compute the cryptographic puzzles faster and more efficiently. Their primary advantage is their ability to run multiple operations in parallel, and miners can even use multi-GPU miners to run concurrently. With most modern GPUs, you have up to 2000 times the hashing power delivered by a 20 kilohashes CPU miner.

FPGA Mining in 2025

With the continuous volatility of the crypto industry in terms of crypto prices, mining complexity, and mining costs, there’s a constant need to mine more efficiently. Consequently, the field-programmable gate array miners were introduced to make mining more lucrative. The FPGA miner is an electric circuit that can be programmed and reconfigured to perform different tasks. They offer up to five times the cost and energy efficiency of GPU miners, and you can use the same equipment to mine different cryptocurrencies with different algorithms.

ASIC Mining in 2025

Despite the convenience of FPGA miners, investors still wanted more improved mining machines that provide efficiency in energy consumption and initial cost. In addition, crypto mining was growing to a large-scale billion-dollar industry, even as competition among nodes and mining difficulty increased.

Application Specific Integrated Circuits (ASICs) provided a workable solution due to their high computing power. Ideally, ASIC miners are much more powerful than popular GPU mining rigs. Unlike GPU miners, whose power is measured in megahashes per second, ASIC’s power is computed in terahashes per second. The first ASICs were also 200 times more powerful than the standard GPU miner.

While crypto mining remains an ever-evolving industry, ASIC miners remain the linchpin of bitcoin mining. They are uniquely tailored to validate transactions on blockchain networks more efficiently, and above all, their prices have come to an all-time low in the last couple of months.

Top ASIC Mining Rigs

The ASICs are the basis for the next generation that most investors prioritize. They have mining rig models released in November 2023 that top 300 Th/s. For instance, MicroBT WhatsMiner M63S has a hash rate of 390 Th/s and a power consumption rate of 7215 watts, while MicroBT WhatsMiner M63 has a hash rate of 334 Th/s and a power consumption of 6646 watts. Other ASIC miners set for release in February 2025 include:

| Miner | Hashrate | Power Consumption |

| Bitmain Antminer S21 Hyd | 335 Th/s | 5360 watts |

| Bitmain Antminer S21 | 200 Th/s | 3550 watts |

| MicroBT WhatsMiner M60S | 186 Th/s | 3441 watts |

| Bitmain Antminer T21 | 190 Th/s | 3610 watts |

| MicroBT WhatsMiner M60 | 172 Th/s | 3422 watts |

Miner Prices

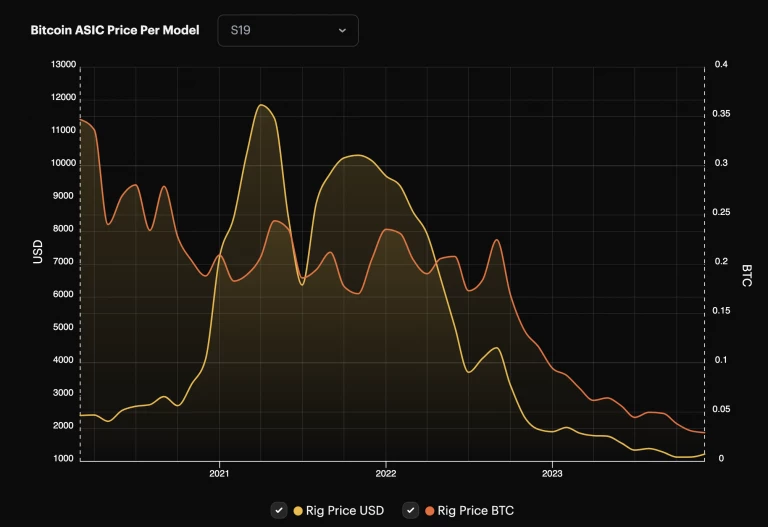

After a long crypto winter that nearly became an ice age, the crypto industry is fast rebounding. Bitcoin dipped to lows of $16,000 in 2022 amid the second crypto winter but has regained traction, topping $42,000 in December 2023. However, the effects of the crypto winter can still be felt in crypto mining equipment prices.

As crypto prices generally declined, investors were less interested in mining activities. The crypto winter came when global energy prices rose, so Bitcoin mining was largely unprofitable. Many mining companies declared bankrupt, and mining entry costs came to a record low. However, as crypto prices continue to rebound, more people may be interested in acquiring new and more efficient mining equipment, more so in readiness for Bitcoin halving in April 2025. Others who invested in old equipment and have not yet used it will also need to update their equipment, and this could mean more demand for miners, hence a rise in their prices in 2025.

Investors looking to invest in updated miners like the MicroBT WhatsMiner M63S will have to pay between $9,000 and $11,000, depending on where they acquire the miner. However, older miners like the Bitmain Antminer S19 Pro with 110 Th/s are available for as low as $1,600.

How Will Halving Affect Miners?

After bitcoin halving, many miners will become unprofitable, but not all will be unprofitable to turn off immediately. Usually, there is a period when miners will accumulate enough Bitcoin and hold with the hope the price goes up so they can sell those Bitcoins to power their costs. However, that strategy doesn’t work because you usually have no idea how long the price stays where it is, and maybe it never goes up.

The market participants who have updated their equipment for a new one would be in a good spot. But it depends on which cost they update that equipment because, at the end of the day, bitcoin mining is a business like everything else. If you spend $1,000 to make $300 and then spend another thousand dollars to keep making $300, that doesn’t do anything for you.

Therefore, what’s important is to ensure that if you have all the equipment you need, it runs as long as possible at a low power cost until it actually fails.

“I think that those market participants who do not have equipment higher than a hundred tera hash per second will not make money within the 6 months after halving, unless, of course, Bitcoin price goes up.”

But if the Bitcoin price goes up, there will be more demand and fewer rewards to share. So, if you are a new miner, the only mining equipment that you should buy is with an efficiency of less than 21 Joules per tera hash. That equipment will be very competitive, and you will stay in a game for quite some time.

Will Older Miners Still Be Effective in 2025?

According to Sergii Gerasymovych, the CEO of EZ Blockchain, older mining equipment will not likely be effective in 2025 or any time in the future. During his webinar on Bitcoin Halving 2025, Sergii was candid about the fate of older mining equipment and how the bitcoin halving will affect them.

“Unfortunately, the Bull Run of 2021 to 2022 drove the cost of crypto mining equipment to insanity. Many people did buy the cryptocurrency mining equipment on the top, so that means that those players are still sitting with that equipment. They have not sold it because that equipment has not made any money yet and is far from making any money, and that’s a big issue. They will not survive the halving if they don’t throw more capital, small or big.”

Cooling

Crypto mining is a highly energy-intensive process, and as a result, it generates a lot of heat. The mining rigs emit a substantial amount of heat that can damage their components and must, therefore, be effectively managed. Primarily, miners choose between the cooling technologies of air and immersion cooling.

Air Cooling Technology

Air cooling is the most commonly used and most affordable cooling technology in crypto mining. Here, miners use strategically placed high-velocity fans to circulate air around their miners. The fans ensure that the hot air dissipated from the mining hardware is blown away while drawing in cold air to cool the miners. These cooling systems are cheap to install and maintain, although they are inefficient with large-scale mining operations with many mining rigs.

Immersion Cooling Technology

Immersion cooling provides the efficiency every investor needs for large-scale crypto mining. This cooling method completely submerges the mining equipment in a thermally conductive but electrically non-conductive fluid. Although the initial cost of the immersion cooling infrastructure is high compared to air cooling, it provides unmatched efficiency in cooling and additional benefits.

- Increased miner hash rate

- 100% noise reduction because there are no rotating miner fans

- Protects mining equipment from dust and debris

- Extended equipment lifespan

- Saves the energy used in running fans

Self Mining vs Hosted Mining

Self Mining

In its simplest form, self-mining is the process of assembling own miners in a private space for bitcoin mining. You’re responsible for developing all the necessary infrastructure, including the floor space, sourcing the miners, power, cooling infrastructure, and handling all mining operations.

However, due to the complexity of bitcoin mining, self-mining comes with drawbacks.

- High power rates – solo miners lack the advantage of economies of scale and are thus unable to negotiate favorable power rates with energy companies.

- Limited infrastructure – self-miners lack the resources to build the infrastructure required in crypto mining.

- Dealing with mining complexities – solo miners are responsible for their mining setup. They must handle all the complexities, including equipment breakdown, dealing with noise, and maintaining the appropriate uptime and internet bandwidth.

Hosted Mining

Hosted mining, on the other hand, refers to mining cryptocurrency from a rented space. Miners contract a hosting service company to handle all their mining operations for a fee. The hosting service will provide power, cabinets, racks, internet, cooling, and all operational aspects.

With a hosting service, miners are guaranteed of:

- Competitive power prices – mining hosting companies can negotiate better energy rates with utility companies. As a result, they provide affordable hosting packages to their clients.

- Cooling infrastructure – most hosting services like EZ Blockchain provide clients with different cooling infrastructure. You can choose between air and immersion cooling for your miners.

- Professional team – with a hosting service, mining rigs are left in the hands of professional teams, including experienced engineers and technical staff. They assemble the miners for you and handle all technical issues.

- No heat and noise pollution – mining hosting companies situate their data centers away from residential areas. As such, you don’t have to worry about your mining operations being a nuisance in your neighborhood.

So, What Should You Mine, Bitcoin or Altcoins?

Bitcoin remains the most popular and valuable cryptocurrency. It has the highest market capitalization and a relatively high trading volume compared to most altcoins. However, the crypto giant has received massive criticism in the past over its mining process. Bitcoin uses the proof of work algorithm, which is quite energy intensive, making bitcoin mining have a large carbon footprint.

Regardless, Bitcoin is still among the best crypto coins to mine when you have the right setup. Besides, it has a massive influence on the crypto industry, and with its reward reduction design embedded in its codebase, the crypto has vast potential.

Additionally, thought leaders like EZ Blockchain are quickly changing the narrative and turning Bitcoin mining’s high power consumption into a solution for wasted energy and a grid-balancing solution.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.