Stay up to date with the latest news, announcements, and articles.

In this guide, we walk you through the full process, from understanding blockchain explorers and wallets, to exporting clean CSVs for tax or bookkeeping, to spotting common pitfalls and automating long-term monitoring.

Understanding Blockchain Explorers and Wallets

At the core of transaction tracking is the concept of the public ledger: every blockchain, Bitcoin, Ethereum, and many others, maintains an immutable, publicly accessible record of all transactions. A blockchain explorer is simply a user interface for querying that ledger. It lets you enter a wallet address, transaction hash (TxID), or block number, and view all associated activity, transfers, timestamps, fees, confirmations, contract calls, and more .

Wallet software (desktop, mobile, or hardware) often displays a subset of your transaction history, usually transfers to/from that wallet, but may omit internal or contract‑level operations. Therefore, for a comprehensive audit trail, explorers (or full node data) are indispensable.

Using explorers and wallets in tandem gives a full picture: wallets for convenience and balance overview, explorers for verification, history, contract‑level insight, and exportable records.

Step 1: Accessing Your Wallet Transaction History

Start with your wallet:

- Open your wallet app (software/hardware/desktop/mobile)

- Navigate to the “Transactions,” “History,” or “Activity” tab

- Review entries for deposits, withdrawals, token swaps, contract interactions, and staking/mining payouts

- Note the transaction ID (TxID or hash), timestamp, amounts, and network fees

If your wallet supports export, some wallets let you export a .csv or .json of transactions, that’s a good first step. For example, some wallets export only native‑coin transfers; token transfers or internal transactions may require separate export .

Important caveat: wallet‑level history can be incomplete. Internal transactions, contract-to-contract calls, token swaps, yield/staking distributions, may not appear. That’s why explorers are often mandatory for full accounting.

Wallet‑provided transaction lists give a convenient snapshot, but you shouldn’t rely on them as the sole record, particularly when you’ve engaged in DeFi, staking, contract interactions, or cross‑chain transfers.

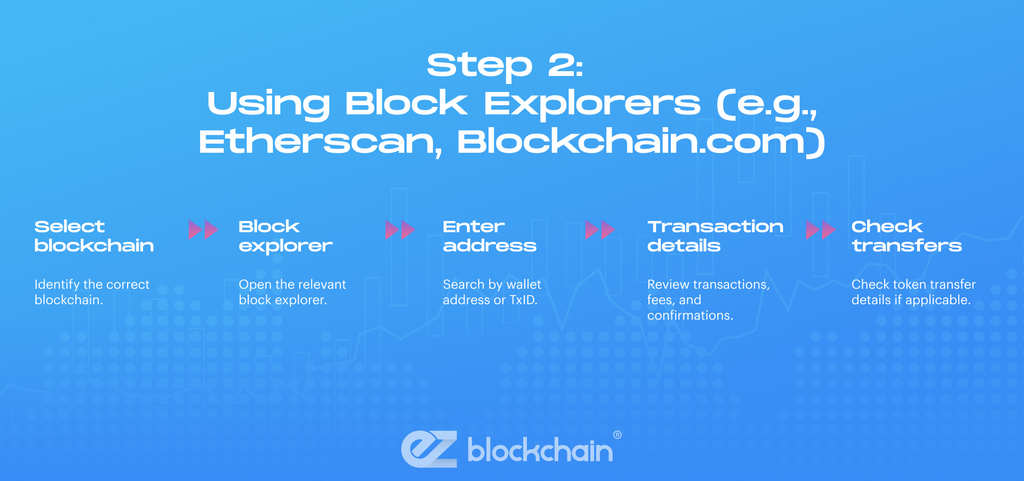

Step 2: Using Block Explorers (e.g., Etherscan, Blockchain.com)

To thoroughly trace on‑chain activity:

- Identify the correct blockchain for your asset (e.g., Bitcoin, Ethereum, BNB Chain, Solana).

- Open the corresponding explorer: e.g., Etherscan for Ethereum-based assets, Blockchain.com or a Bitcoin‑specific explorer for BTC .

- In the explorer’s search bar, paste either your wallet address, a TxID (transaction hash), or a block number .

- Review the result: you will see all on‑chain transactions associated with that address, incoming, outgoing, internal transfers, token transfers (ERC‑20 / ERC‑721 / etc.), gas/fee information, block confirmations, and timestamps .

- For token activity on networks like Ethereum, ensure you check the “Token Transfers” tab (or equivalent), standard coin‑only views might omit token transfers.

Block explorers effectively give you a public audit trail of all blockchain‑recorded events for any address, making them ideal for verification, forensic review, or tax‑compliance tasks.

A blockchain explorer is the foundational tool for full transparency, it reveals everything on‑chain, even events your wallet may hide; mastering it is essential for accurate crypto bookkeeping and audit readiness.

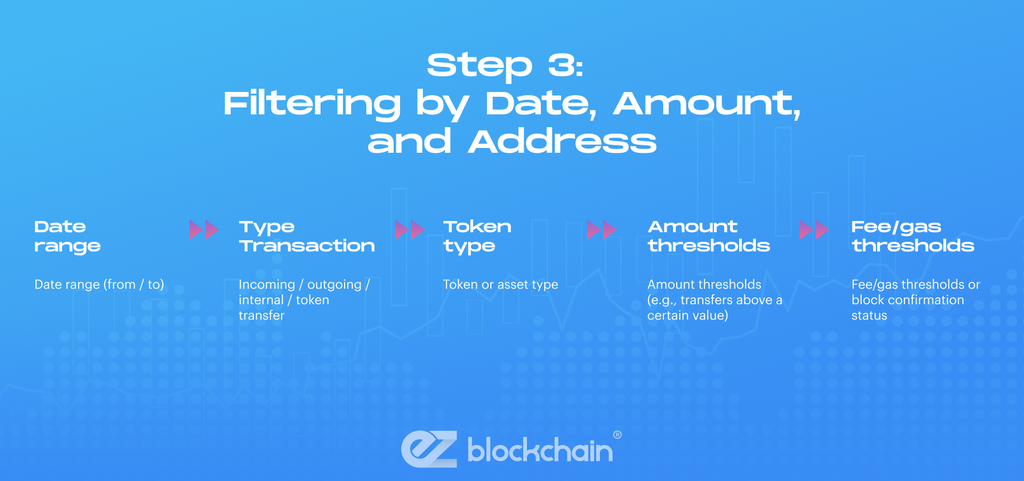

Step 3: Filtering by Date, Amount, and Address

As your history grows, manually scrolling becomes impractical. Most explorers provide filtering and sorting by criteria such as:

- Date range (from / to)

- Transaction type (incoming / outgoing / internal / token transfer)

- Token or asset type

- Amount thresholds (e.g., transfers above a certain value)

- Fee/gas thresholds or block confirmation status

Using these filters helps isolate relevant transactions, for example, to compute all incoming staking rewards for 2025, or all outgoing transfers to exchanges .

More advanced users may export transaction history (see next section) and import into spreadsheets or tax software for further filtering, pivot‑table analyses, or integration with price and fiat‑currency data.

Step 4: Exporting Transactions for Tax and Accounting

Once you’ve identified the relevant transactions, the next step is export, to CSV, JSON, or other formats, for long‑term record‑keeping, tax filing, or accounting workflows.

Typical procedure (for, e.g., Ethereum network using Etherscan):

- On wallet‑address page → download CSV of basic transactions (native coins)

- Then go to “Token Transfers” tab → download CSV for all token transfers (ERC‑20/ERC‑721)

- Also check “Internal Transactions” tab, export those to capture contract‑to‑contract calls or internal transfers not visible in standard lists

- Repeat for each network you use (e.g., Polygon, BNB, Solana) via corresponding explorers

For platforms or wallets that don’t support export, manual reconstruction may be necessary, though potentially tedious and error‑prone. For example, some users of non‑custodial wallets report that export tools miss certain transactions or metadata.

Exporting transaction data ensures you keep a durable, independent record, essential for taxes, audits, compliance, or bite‑sized accounting workflows across multiple wallets and networks.

How Mining and Staking Rewards Are Recorded

Mining payouts, staking rewards, airdrops, and other blockchain‑native revenue often appear as incoming transactions in your wallet. On‑chain, they are indistinguishable from standard transfers: a sender address (the network or staking contract), a recipient (your wallet), an amount, fees (if any), and a timestamp.

Using explorers or wallet history, you should see:

- The reward transaction with sender hash (network or contract),

- Time and block number,

- Coin or token type and amount received,

- Fee (gas) paid (if relevant), though often zero if the protocol subsidizes fee.

For accounting or tax purposes, treat these as income events, record the timestamp, coin/token type, and USD equivalent at the moment of receipt. Exporting these reward records via CSV (wallet + explorer) ensures you have audit‑ready records.

Mining and staking rewards are on‑chain events like any other, properly recorded; they integrate into your transaction ledger seamlessly, allowing transparent accounting and compliance when combined with accurate fiat‑value data.

Best Practices for Secure Record‑Keeping

Given the long-term implications, tax audits, compliance, financial transparency, adopting a solid record‑keeping best practices is essential. Recommended practices include:

- Maintain a master address log: map wallet names → addresses → network identifiers.

- Regularly export transaction history (native, token, internal) from explorers once per quarter – store chronological, dated CSV backups.

- Combine blockchain data with off‑chain fiat price history – log USD (or relevant fiat) value at each transaction time for tax or accounting reconciliation.

- Use cold‑storage and hardware wallets for long-term holdings; avoid burying key data in volatile hot wallets or exchange accounts.

- Segment operational vs. long‑term wallets, e.g., trading wallet vs. savings wallet vs. staking wallet, to maintain clarity.

- Use multi‑network accounting tools if you interact across several chains, ensure consistency and reduce manual workload.

Treat crypto transaction tracking like financial accounting, consistent address mapping, periodic exports, and backup procedures transform blockchain data into audit‑ready records.

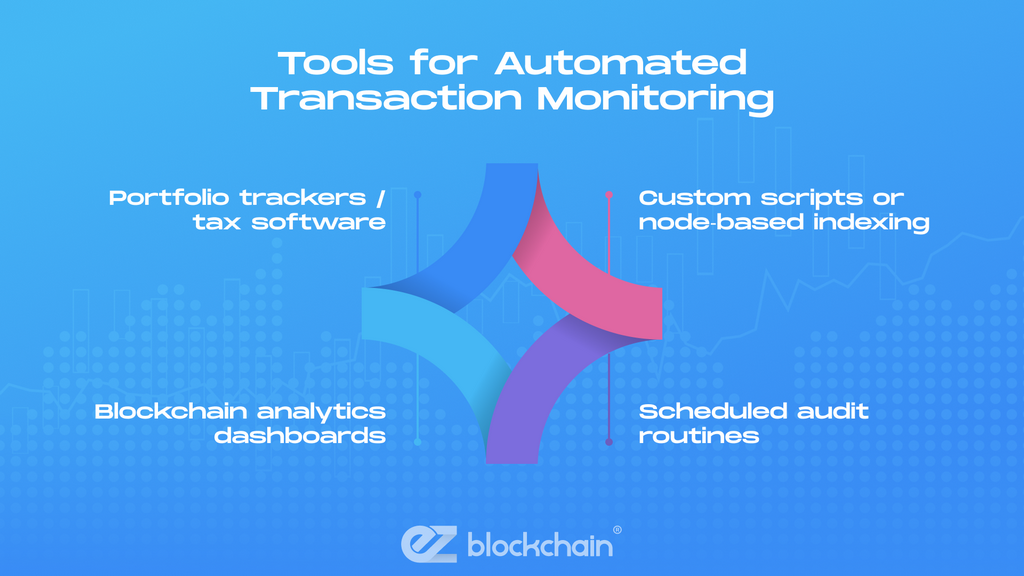

Tools for Automated Transaction Monitoring

Manual tracking works when transaction volume is low, but in active trading, mining, or DeFi use, automation becomes necessary. Several strategies and types of tools can help:

- Portfolio trackers / tax software: Many support automated sync with exchanges and wallets – importing CSVs or via APIs to build unified transaction ledgers.

- Blockchain analytics dashboards: Platforms that monitor wallet flow, alert on large transfers or outflows, and produce watch‑lists (useful for funds, institutional holders, or compliance teams).

- Custom scripts or node‑based indexing: For power users, running a full node or using open‑source analyzers to build a private transaction database, enabling advanced querying or internal audits. (Emerging research such as open‑source transaction‑trace analyzers illustrates this approach ).

- Scheduled audit routines: Quarter‑end or year‑end routines to export all history, reconcile with fiat conversions, and archive data for tax season or internal audit.

Automation reduces human error, ensures completeness, and scales with your activity, a must for traders, miners, fund managers, or heavy DeFi users.

Example Export Workflow for an Ethereum User

| Step | Tool / Source | Action | Output / Result |

| 1 | Wallet app (e.g., MetaMask) | Copy wallet address / public key | Address ready for explorer |

| 2 | Explorer (e.g., Etherscan) | Paste address → view full tx history | Full list of ETH and token transfers, internal txns |

| 3 | Explorer → “Transactions” tab | Download CSV (native ETH transfers) | ETH_Transactions_XXXX.csv |

| 4 | Explorer → “Token Transfers” tab | Download CSV (ERC-20/721 transfers) | TOKEN_Transfers_XXXX.csv |

| 5 | Explorer → “Internal Txns” tab | Download CSV (contract calls, internal transfers) | ETH_InternalTxns_XXXX.csv |

| 6 | Repeat for each network (Polygon, BSC, etc.) | Consolidate CSVs | Unified multi‑chain ledger for accounting |

| 7 | (Optional) Import into tax software / spreadsheet | Reconcile fiat value, mark incomes, gains/losses | Audit‑ready transaction ledger |

This workflow ensures you capture all on‑chain activity (native transfers, token swaps, contract interactions), archive it in durable format, and build a comprehensive ledger, essential for taxes, audits, or large‑scale account management.

Final Thoughts: Transparency, Accountability, and Long‑Term Crypto Hygiene

In the decentralized world of blockchain, transparency is built-in, every transfer, contract call, and token swap is immutably recorded on‑chain. The real challenge lies not in finding transactions, but in organizing, exporting, reconciling, and documenting them for the long term. Especially as crypto adoption becomes widespread, with tax obligations, regulatory audits, institutional scrutiny, or business compliance, the importance of robust transaction tracking cannot be overstated.

By combining wallet history, blockchain explorers, systematic exports, and automation, you can turn the raw public ledger into a disciplined accounting system. This level of rigor protects you in tax seasons, audits, or in the face of lost keys, and forms the backbone of responsible crypto investing.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.