Stay up to date with the latest news, announcements, and articles.

For one thing, you need to separate legitimate operations from scams, and understand what it takes to mine profitably and in a legit fashion. Now, this may take practice and experience, but the baseline knowledge of the arena you are about to enter is more than crucial.

Let’s break down everything you need to know — from picking hardware and genuine mining opportunities to choosing strategies and avoiding common risks.

Is Bitcoin Mining a Legitimate Way to Earn?

First things first, let’s cover the most pressing question on every non- or soon-to-be crypto enthusiast’s mind. But to answer this question, we need a recap of how crypto mining functions in general.

Cryptocurrency mining is the process of validating transactions on the Bitcoin (or other crypto) network. Miners must dedicate cost-demanding hardware resources, as well as organizational efforts, time, and skills, for which they are rewarded with, e.g., newly minted bitcoins.

Initially, mining was mostly done by die-hard enthusiasts modifying regular PCs into miners. Today, however, mining has evolved into a highly competitive arena that has specialized hardware and a slew of communities dedicated to specific coins.

All this makes it quite a legit and viable arena. But one thing is for sure — with ever-expanding technologies and crypto mining competition growing by the day, there is no safe and legit way to start mining unless you plan things thoroughly.

What Do You Need to Start Bitcoin Mining?

That leads us to the next question — where do you start to take on a new mining venture reliably, free from common pitfalls, and unwanted expenses?

Right off the bat, to kick off a bitcoin mining journey, you must invest in the right tools and resources. The essentials include:

- An ASIC miner

- A load-resistant power supply

- Good cooling

- A mining wallet

- Mining software

- Stable web connection

Setting up a proper mining operation requires initial capital and some extent of technical know-how, but with thorough research and a good tech partner by your side, you can build an operation that’s both legitimate and highly profitable in the long run.

Legitimate vs Fraudulent Mining Opportunities

The world of bitcoin mining offers a mix of genuine operations and fraudulent schemes. Questions like “is bitcoin mining legit?” or “is my crypto miner legit?” are often raised by starting-out miners.

Legitimate mining operations are transparent about their costs, provide clear data on performance, and have verifiable track records.

In contrast, fraudulent opportunities, often labeled as bitcoin mining scams or Ponzi schemes, promise outsized returns with little effort or upfront investment.

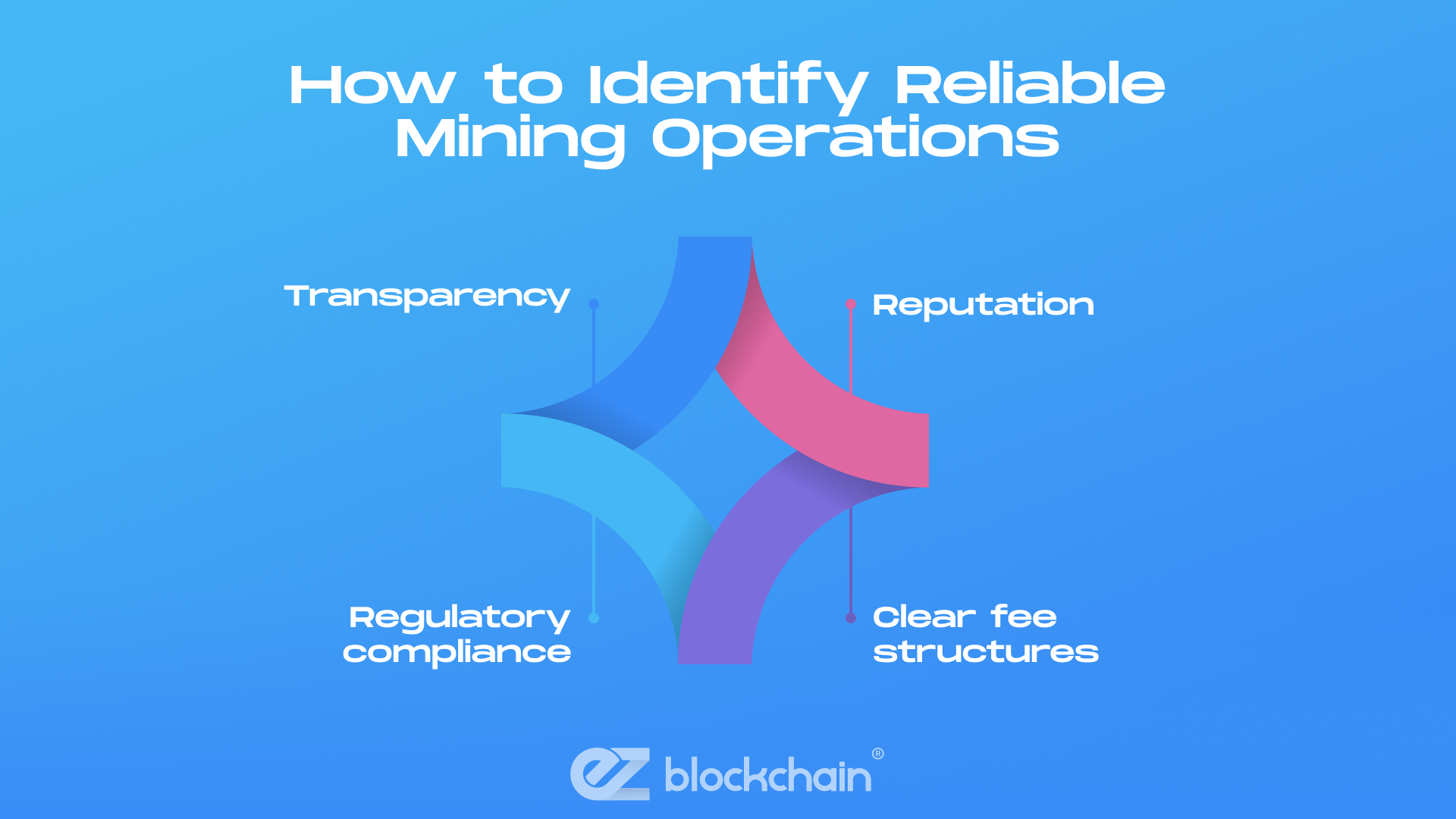

How to Identify Reliable Mining Operations

To identify reliable mining opportunities, research is key. Look for the following indicators:

- Transparency:

- Genuine operations publish their mining statistics, hardware specifications, and payout structures.

- Scammers promise unusually high yields

- Reputation:

- Reputable companies often have positive feedback and reputation backed by online forums, reviews, and third-party ratings.

- A scammer will most probably lack all of those.

- Clear fee structures:

- Reliable miners clearly outline costs and fees.

- Scams tend to hide fees or make vague promises.

- Regulatory compliance:

- Trustworthy mining companies follow local regulations and maintain proper business registrations.

- Scammers miss out on all of those, posing huge risks.

Red Flags: Mining Scams and Ponzi Schemes

To reinforce your confidence when choosing reliable mining opportunities, you can also refer to these red flags:

- Unrealistic returns: If an offer guarantees extremely high returns with minimal investment or effort, it’s likely too good to be true.

- Lack of transparency: Scammers often provide limited details about their operations, hiding information about their hardware, energy costs, or mining location.

- Aggressive recruitment: Ponzi schemes may focus more on recruiting new investors rather than actual mining, using funds from new users to pay earlier investors.

- Shady fee structures: Hidden or unclear fees can be a warning sign, as legitimate operations detail their costs openly.

- Pressure tactics: Be wary of urgent calls to invest immediately. High-pressure sales tactics are common in fraudulent schemes.

When encountering these red flags, it’s best to steer clear and opt for well-reviewed, transparent operations.

Cloud Mining: Is It a Viable Option?

Today’s readily available cloud platforms can power mining operations as an alternative to physical hardware management. Clouds allow you to pass on buying an ASIC altogether, instead renting the capacity for mining, as well as managerial assistance if needed, from a cloud platform provider. Is cloud mining legit? It is as much as the ASIC-powered mining, but, it certainly isn’t a fit-for-all alternative.

Cloud-based mining can be riddled with its own kind of challenges, like:

- Long-term contracts: Many cloud mining providers tend to bind their services provision with deals and agreements, limiting your flexibility in case of market changes or freedom of choosing and switching coins to mine.

- Lower profit margins: Surely, each provider has its own set profit margin, plus the fees that you must cover continuously. While this investment can be profitable eventually, it will be more difficult to maintain this profitable operation.

- Risk of fraud: The cloud mining sector certainly has its share of risks and scams. What you can do to battle it is make sure you research and select only proven providers.

All in all, cloud mining may fit certain operational goals, mainly at the kick-off stage or at a lack of investment, but how you balance convenience with the potential for lower control and ongoing profitability is on you.

Challenges and Risks of Bitcoin Mining

While a well-tested and legit in nature mining network, it’s important to understand that mining Bitcoin can be risky and challenging in its own way:

- Ever-growing difficulty: More miners in the network means higher mining difficulty rises.

- Costly investments: ASIC and its maintenance can be cost-intense.

- Energy: High energy prices pose a felt obstacle, adding up to the investment.

- Coin volatility: Bitcoin’s price can be notoriously fluctuating.

Having a clear understanding of these risks is the first step to actually avoiding them. One other thing you will need, apart from a reliable tech partner, is a good plan of action.

Strategies to Maximize Bitcoin Mining Earnings

To not only preserve costs and return investments but to maximize your bitcoin mining earnings, consider these pro tips:

- Pick top-end hardware: Check the latest bitcoin miner reviews to see their profitability rates and use mining calculators to estimate the ROI potential.

- Minimize energy use: Not a lot can be done here if a miner is based in a region with expensive utilities, but we’re already seeing the first fruits of renewable energy sources (more on that below).

- Join mining pools: A mining pool is a sort of a community of miners who share their resources, allocating hardware powers in one centralized environment, and reaping shared, yet guaranteed and consistent payouts.

- Monitor performance: Mining stat visualizers and management solutions, like EZ Blockchain Dashboard, help the uptime, hash rate, and overall efficiency ratio of a mining rig.

Of course, you must not forget about keeping your software and hardware updated and upgraded. However, you will have to bother much with that for the longest time if you make a smart miner choice initially.

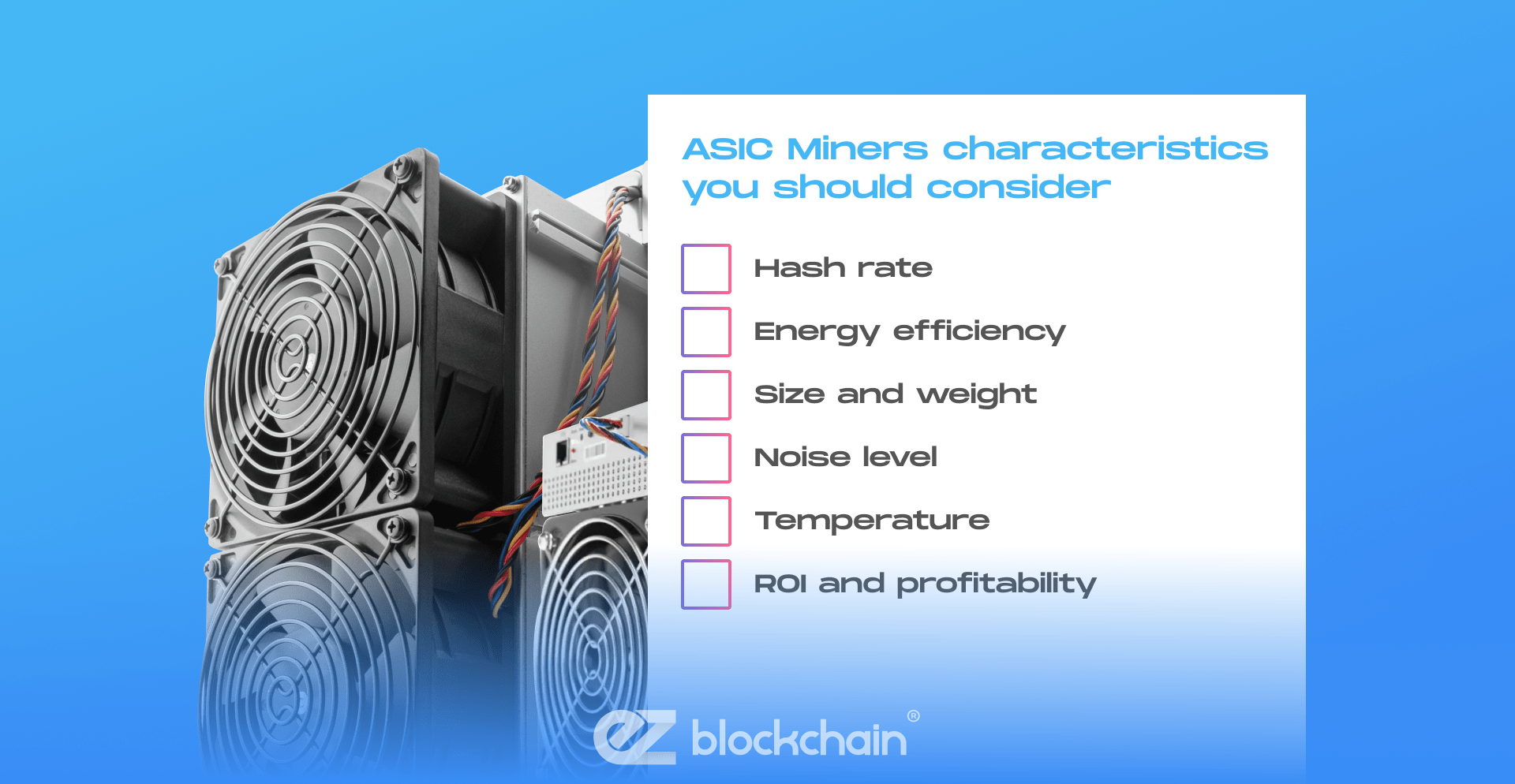

Selecting the Most Efficient ASIC Miners

Your ASIC miner of choice will define most if not all outcomes of your mining venture. It’s in your interest to invest in a long-term efficient device. Hash rate is the foremost characteristic to consider — the higher the hash rate, the more calculations a miner can perform per second.

Other characteristics you should also consider include:

-

- Energy efficiency (Usually indicated in watts per gigahash (W/GH), lower values mean less power consumption per unit of work)

- Size and weight

- Noise level

- Temperature

- ROI and profitability (Use online tools and bitcoin miner reviews to compare expected returns over the device’s lifespan)

Reducing Electricity Costs with Renewable Energy

Electricity is often THE largest operational cost in bitcoin mining. One promising way to reduce these expenses is by switching to renewable energy sources. Solar panels, wind turbines, or even geothermal energy allow for felt cuts in energy bills. Going green also minimizes your carbon footprint.

Some mining operations have already begun to integrate renewables, finding that the long-term savings and stability in energy prices make a huge difference in overall profitability.

If you’re exploring ways to cut costs, consider the long-term benefits of investing in renewable energy solutions, as they can provide a more sustainable and cost-effective power source over time.

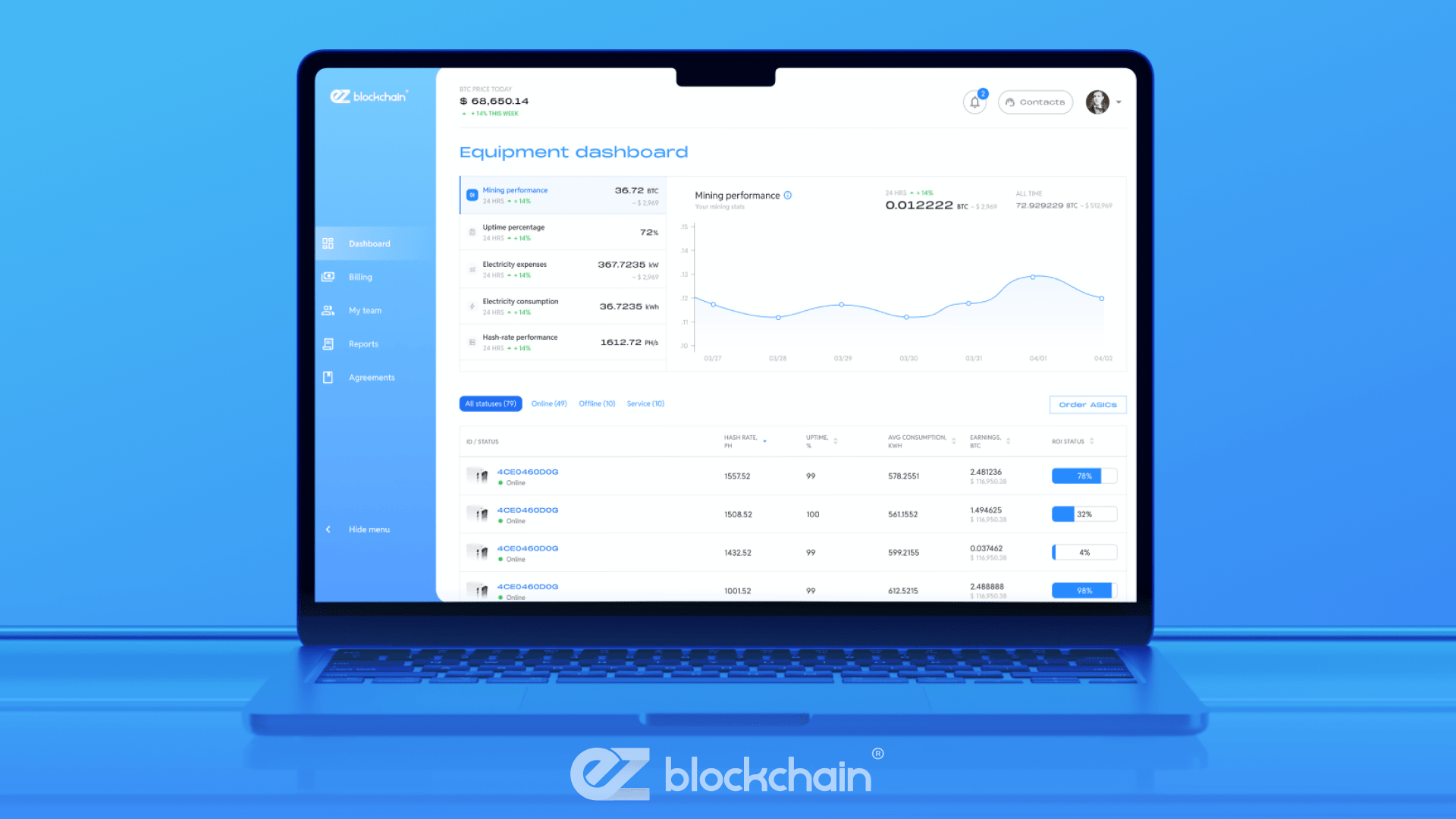

Using EZ Blockchain Dashboard for Performance Monitoring

One other crucial thing in kicking off, optimizing, or efficiently maintaining mining operations, is the choice of software that will help:

- Centralize and manage miner performance

- Get invaluable stats and readings

- Maximize mining profits by easily switching coins

With EZ Blockchain Dashboard, you can do all that and more in one handy app. It can help you boost productivity and cut tons of extra costs by giving a simple outlook on all processes and tasks.

Is Bitcoin Mining a Legitimate and Sustainable Income Source?

So, is bitcoin mining legit?

Yes, when approached the right way, bitcoin mining is an absolutely legitimate way to earn income. However, the rate of your miner setup’s profitability is shaped by points such as mining difficulty, hardware efficiency-to-energy consumption ratio, underlying costs, and market conditions.

A reliable specialized technological provider will help you achieve all that without going far or goin broke.

Start Optimizing Your Mining Operations with EZ Blockchain

EZ Blockchain is a seasoned provider of crypto mining services to consult, guide the implementation and launch, and optimize your mining operations, no matter their scale.

We will show you the best individual way to start your crypto journey, with mining farms located across the US and Canada available for rent and a full range of auxiliary services.

Contact us to discuss your crypto ambitions and start maximizing them ASAP!

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.