Stay up to date with the latest news, announcements, and articles.

Ever since the coin’s introduction to crypto communities and then public markets, Bitcoin’s maximum supply has remained the core rule in the functional logic of the BTC network. The limited supply, along with halvings and mining competition, help make the Bitcoin go round.

Still, with so many recent shifts in how entire governments perceive crypto (e.g., the US Senate launching its own crypto capital), there is a possibility to get more coins “minted” in the future.

This article explores the mechanisms behind BTC’s fixed supply, the possibility of it scaling, and arguments in favor and against. Let’s take a look.

What Is Bitcoin’s Hard Cap and How Was It Established?

The hard cap of 21 million Bitcoins is one of the holding pillars of BTC’s monetary policy. But the limit isn’t simply set in stone — it is based on the formula for block rewards and maintained by the schedule of halvings that is coded into Bitcoin’s consensus rules. The limit is baked into each aspect, helping to regulate Bitcoin mining.

Here’s how it works: The foremost owners of BTC coins are crypto miners. The miners gain BTC rewards for putting in their hardware’s hashrate and validating transactions on the chain. But those rewards are cut (halved) roughly every 210,000 blocks (about every four or five years).

Over the successive halvings, block rewards become smaller, requiring miners to invest higher levels of hashrate. Thanks to that, the network can generate fewer new bitcoins and the mining remains competitive.

Why Did Satoshi Nakamoto Set the 21 Million Supply Limit?

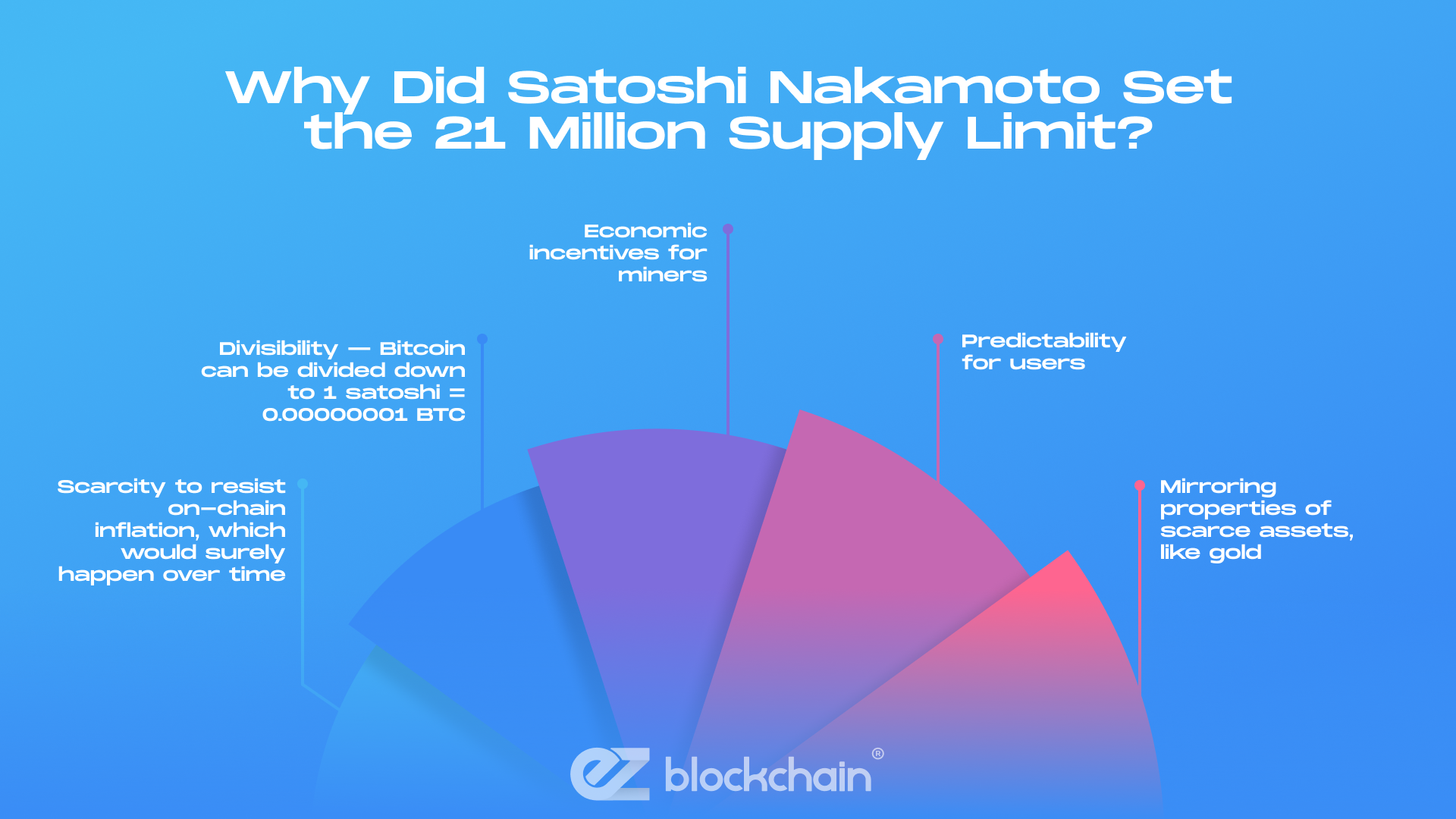

Talking about the hard cap, the main question that you instantly get — why 21 million Bitcoin exactly? What’s the reasoning behind this number? In fact, it was a technical decision made by Satoshi Nakamoto himself. The creator of the BTC network, Satoshi chose twenty-one mil through what has been described as an “educated guess,” influenced by several fundamentals.

Namely, Satoshi knew that in order to stay operational, effective, and demanded, his cryptocurrency network needed:

- Scarcity to resist on-chain inflation, which would surely happen over time

- Divisibility — Bitcoin can be divided down to 1 satoshi = 0.00000001 BTC

- Economic incentives for miners

- Predictability for users

- And mirroring properties of scarce assets, like gold

He also wanted a number that worked with the reward schedule, which is 50 BTC per block originally, with the halving taking place every ~210,000 blocks. That way, the supply curve would gradually flatten out. The result of that schedule yields 21 million in total.

How Bitcoin’s Monetary Policy Works

There are many complexities to the BTC network’s underlying mechanisms, but in short, the monetary policy depends on two things.

Halving events

Thanks to halvings, the reward given to miners for creating a block is cut in half. That reduces the rate at which new BTC enters circulation. Over many halvings, this gradual reduction causes the BTC issuance to approach zero. Thus, Bitcoin’s monetization is kept dynamic and competitive.

Mining rewards and decreasing supply

Essentially, mining rewards are how new bitcoins are distributed. Initially, miners got 50 BTC per block. After the first halving, it went down to 25. Then 12.5, and so on. With each halving, the incremental supply of BTC shrinks. Over time, most of the 21 million will have been issued, leaving only a small portion to come.

What happens once the rewards are nearly zero? To continue gaining income, miners are expected to start relying solely on transaction fees or other alternative ways to profit with BTC.

Can the Bitcoin Hardcap Be Changed Technically?

Once you’ve found out the underlying reasons for the maximum Bitcoin supply, the second big question on the agenda is can more Bitcoin be created even technically? The answer is yes — technically it can be changed, because Bitcoin is software with an open source code.

In theory, someone could modify the Bitcoin Core code to adjust the issuance schedule, or alter the halving rules, or change the cap. But doing so would require consensus between many stakeholders, including node operators, miners, developers, and the adjacent wider community.

Without overwhelming agreement, any change would likely lead to a split (i.e., hard fork), resulting in two separate chains. And while such a scenario is also technically possible, it would pose many critical security risks to the whole chain.

What Would It Take to Change the Limit?

There are certain obstacles that will require mitigation in order for the Bitcoin max supply limit to change in any way. And these aren’t just some bureaucracy issues that can be solved individually. The entire Bitcoin community must participate in the decision making.

Namely, we would require:

- A Bitcoin Improvement Proposal or similar change must be documented, reviewed, and accepted by the chain’s developers.

- A majority of full nodes must upgrade to the new version. If many nodes refuse, they’d continue validating the old rules, rejecting blocks that violate the 21 million cap.

- Miners need to support it (or at least enough of them). Many miners’ incentives are tied to scarcity, so increasing supply might devalue BTC in fiat terms, especially for those holding large amounts.

- Broad community support is required because Bitcoin isn’t centrally governed. Many people — users, exchanges, and institutional holders — agree on scarcity as a core part of Bitcoin’s identity. Changing it risks trust, value, and adoption.

Because of all these obstacles, while code can be changed, realistically such a change is extremely unlikely. It may just spawn too many risks underlying the Bitcoin community’s trust, value, and adoption trends.

Arguments for Changing the Hard Cap

Why only 21 million Bitcoin when the technology could theoretically be scaled and we can get more of that precious crypto coin?

There are many people in favor of either increasing or removing the cap altogether, raising arguments like the following:

- As block rewards close toward zero, miners may become less incentivized. This may require boosting transaction fees dramatically. If revenue doesn’t cover operational costs, miner decentralization could suffer.

- Some enthusiasts speculate that a larger supply might help ease friction in using BTC for smaller transactions if price gets very high.

- There are also concerns about lost coins: a significant number of bitcoins are permanently lost (due to lost keys, etc.), meaning the real circulating supply is less than the stated. Some argue that raising the cap could partially compensate.

Keep in mind, however, that these points are quite controversial, with nothing but pure speculation baking them up (for now).

Arguments Against Changing the Hard Cap

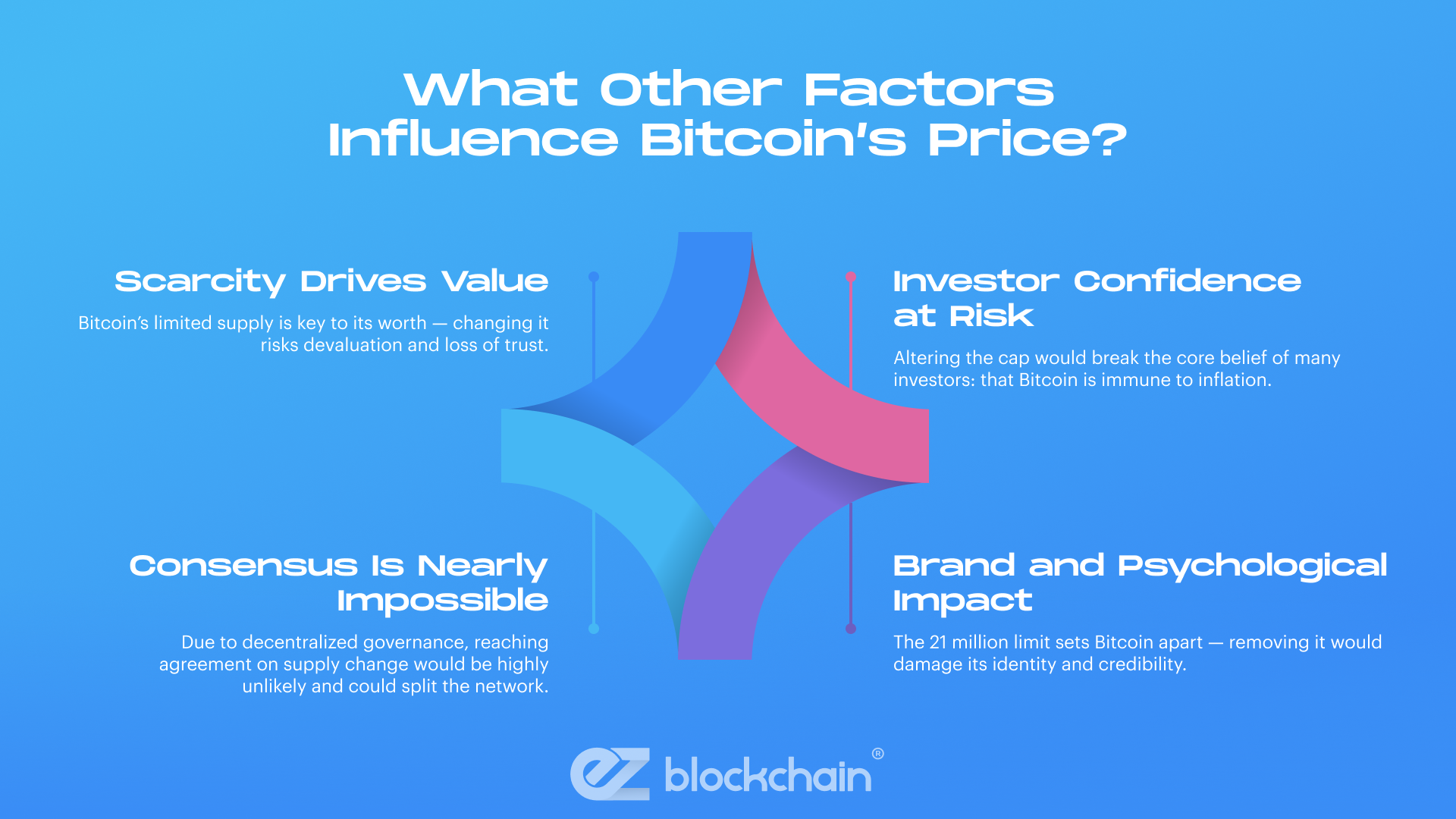

On the flip side, most community members, BTC owners, and just enthusiasts oppose any change in the max Bitcoin supply, prioritizing its crucial role.

This prevailing side of the camp believes that:

- Scarcity is core to Bitcoin’s value proposition — changing the supply will undermine the overwhelming trust, which could cause devaluation.

- Due to decentralized governance, achieving a controversial consensus will be extremely difficult. Furthermore, a major change may fracture the network into competing chains.

- Many investors bought Bitcoin because they believe the supply will never be inflated. Altering that would damage the market confidence and BTC’s overall credibility.

- Lastly, there’s psychological and brand value — the twenty-one million cap is part of what puts Bitcoin apart from fiat currencies.

These reasons are why many consider the hard cap one of Bitcoin’s most immutable principles.

What Happens When All 21 Million Bitcoins Are Mined?

As you can see, there is only a tiny, theoretical, and very hypothetical chance for the Bitcoin limited supply to expand in any way. However, even with all of that knowledge out of the way, we can’t help but wonder — what to do once the fixed supply runs out?

At a calculated approximation, the last bitcoin is expected to be mined in the year 2140. After that happens, no new BTC will come into existence through mining rewards. The transaction fees will remain, however, which is what the miners will have to rely on.

In this scenario, the issuance schedule would become irrelevant. Any new BTC issuance would cease. Interestingly, because some coins are lost forever, the effective circulating supply of Bitcoin might never truly reach twenty-one million.

To sum up, while it is technically possible to modify the hard cap, be it via code changes, hard forks, or consensus among stakeholders, such a change is extremely unlikely. The cap is deeply woven into Bitcoin’s identity, economic incentives, and community norms.

For many, changing it would mean changing what Bitcoin is. As 2025 goes on, more discussion may arise (especially as mining rewards dwindle), but for now, the twenty-one million supply limit remains one of Bitcoin’s unwavering principles.Do you have more questions or need assistance with your own Bitcoin journey? Contact EZ Blockchain if you want to start mining via ASICs at high levels of profit, with reliable hardware in place.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.