Stay up to date with the latest news, announcements, and articles.

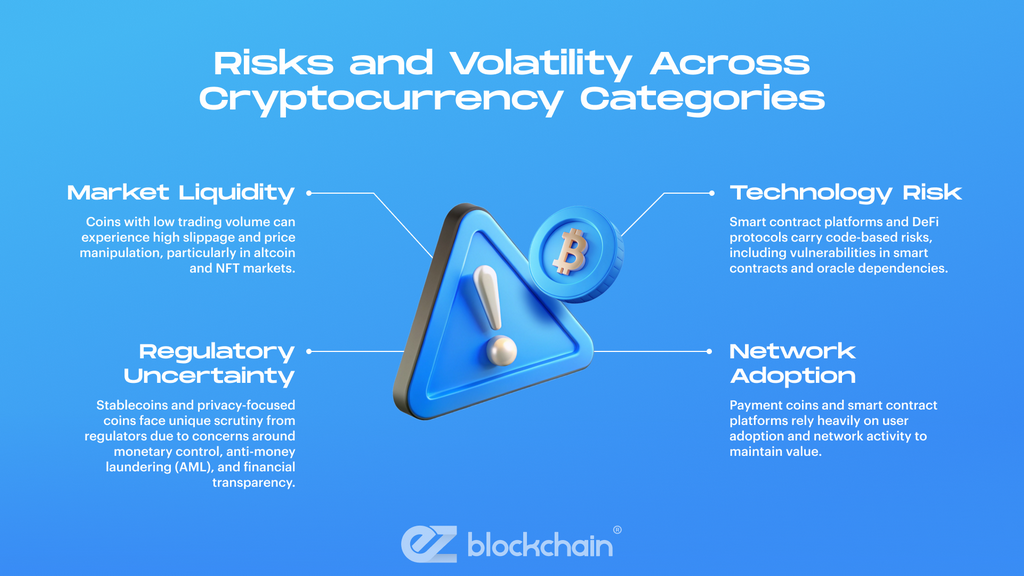

Risks and Volatility Across Cryptocurrency Categories

Cryptocurrencies are inherently volatile due to factors such as market sentiment, regulatory developments, technological changes, and macroeconomic conditions. However, volatility is not uniform across all crypto categories. Some assets, like payment coins, tend to follow broader market trends, whereas DeFi tokens and NFT-related tokens often experience extreme short-term price swings based on network activity and hype cycles.

The primary risk factors include:

- Market Liquidity: Coins with low trading volume can experience high slippage and price manipulation, particularly in altcoin and NFT markets.

- Regulatory Uncertainty: Stablecoins and privacy-focused coins face unique scrutiny from regulators due to concerns around monetary control, anti-money laundering (AML), and financial transparency.

- Technology Risk: Smart contract platforms and DeFi protocols carry code-based risks, including vulnerabilities in smart contracts and oracle dependencies.

- Network Adoption: Payment coins and smart contract platforms rely heavily on user adoption and network activity to maintain value.

Investors must evaluate each category’s volatility and underlying risk profile before allocating capital. Diversification across categories can mitigate exposure to extreme price fluctuations while providing opportunities for growth in high-risk, high-reward assets.

Categories of Cryptocurrencies

Cryptocurrencies can be broadly classified into several categories, each with distinct use cases, technological underpinnings, and market behavior.

1. Payment Coins

Examples: Bitcoin (BTC), Litecoin (LTC)

Payment coins are designed primarily as digital currencies for peer-to-peer value transfer. Bitcoin remains the most widely recognized and adopted cryptocurrency, often referred to as “digital gold” due to its fixed supply of 21 million coins and store-of-value characteristics. Litecoin, created as a faster and more lightweight alternative to Bitcoin, offers lower transaction fees and shorter block confirmation times.

Key characteristics:

- Focused on value transfer and settlement

- Network security through Proof-of-Work (PoW) consensus

- Moderate volatility relative to smaller altcoins

Payment coins are generally considered foundational assets for crypto portfolios, offering liquidity and widespread exchange support. However, their scalability and transaction throughput limitations remain a challenge, prompting development of layer-2 solutions like the Lightning Network for Bitcoin.

2. Smart Contract Platforms

Examples: Ethereum (ETH), Solana (SOL), Cardano (ADA)

Smart contract platforms enable programmable digital agreements that execute automatically when predetermined conditions are met. Ethereum pioneered this functionality and has catalyzed the growth of decentralized finance (DeFi), non-fungible tokens (NFTs), and decentralized applications (dApps). Solana and Cardano compete with Ethereum by offering higher throughput, lower transaction fees, and alternative consensus mechanisms such as Proof-of-Stake (PoS) or Proof-of-History (PoH).

Key characteristics:

- Support for decentralized applications and programmable logic

- Network upgrades and scalability solutions influence long-term value

- Higher technical and operational risk due to protocol complexity

Investors should consider smart contract platforms for growth potential but remain aware of technical and adoption-related risks. Market sentiment around network upgrades, such as Ethereum’s transition to ETH 2.0, can significantly impact token valuations.

3. Stablecoins

Examples: USD Coin (USDC), Tether (USDT)

Stablecoins are cryptocurrencies pegged to a fiat currency or other asset, designed to maintain a stable value. USDC and USDT are backed by reserves of U.S. dollars and operate primarily on Ethereum and other blockchain networks. Stablecoins serve as critical infrastructure for crypto trading, lending, and DeFi protocols by providing a reliable medium of exchange and store of value in volatile markets.

Key characteristics:

- Pegged to fiat or other stable assets

- Low volatility compared to other crypto categories

- Subject to regulatory oversight and reserve audits

While stablecoins reduce market volatility, investors should monitor issuer transparency, reserve adequacy, and regulatory developments. Central Bank Digital Currencies (CBDCs) may further influence stablecoin adoption and regulatory treatment in the coming years.

4. Privacy Coins

Examples: Monero (XMR), Zcash (ZEC)

Privacy coins prioritize transaction anonymity by obscuring sender, recipient, and transaction amounts. Monero employs ring signatures and stealth addresses, while Zcash leverages zero-knowledge proofs to enable shielded transactions. Privacy coins are particularly attractive for users seeking confidentiality but face regulatory scrutiny in several jurisdictions due to concerns over illicit activity.

Key characteristics:

- Focused on transaction privacy and anonymity

- Advanced cryptographic techniques (ring signatures, zk-SNARKs)

- Higher regulatory risk relative to mainstream coins

For investors, privacy coins offer portfolio diversification and hedging against privacy-sensitive use cases. However, liquidity can be limited, and market access may be restricted by exchanges complying with Know Your Customer (KYC) and anti-money laundering (AML) regulations.

5. DeFi Tokens and Protocols

Examples: Uniswap (UNI), Aave (AAVE), Compound (COMP)

Decentralized Finance (DeFi) tokens power protocols that provide financial services without intermediaries. DeFi applications include lending, borrowing, automated market making, and yield farming. Governance tokens allow holders to participate in protocol decision-making, incentivizing network participation and decentralization.

Key characteristics:

- Integrated within decentralized ecosystems

- High yield potential and extreme short-term volatility

- Smart contract risk is significant

DeFi token valuation depends on protocol usage, liquidity pool size, and governance engagement. Investors should evaluate risk-adjusted returns carefully, particularly as DeFi protocols remain susceptible to security vulnerabilities and market manipulation.

6. NFT and Gaming Tokens

Examples: Axie Infinity (AXS), Decentraland (MANA), Enjin Coin (ENJ)

NFT and gaming tokens represent digital collectibles, in-game assets, or metaverse land parcels. These assets derive value from community engagement, rarity, and adoption within virtual ecosystems. Blockchain-based gaming platforms often incorporate token economies that allow users to earn, trade, and monetize digital assets.

Key Characteristics:

- Highly speculative and community-driven

- Liquidity and market depth vary significantly

- Valuation heavily dependent on adoption, scarcity, and platform development

Investors should approach NFT and gaming tokens cautiously, recognizing the potential for rapid appreciation alongside significant downside risk. Strategic allocation may be appropriate for portfolios targeting high-growth exposure.

7. Utility and Governance Tokens

Examples: Chainlink (LINK), Polygon (MATIC), Maker (MKR)

Utility tokens provide access to products or services within a blockchain ecosystem, such as oracle services, transaction processing, or staking rewards. Governance tokens grant holders voting rights over protocol parameters, including fee structures, reward distribution, or strategic upgrades.

Key characteristics:

- Tied to network function and ecosystem utility

- May offer governance participation and protocol incentives

- Price influenced by adoption, utility demand, and community engagement

Utility and governance tokens require careful analysis of tokenomics, use case viability, and long-term ecosystem sustainability. They are particularly relevant for investors seeking exposure to decentralized networks’ operational success rather than speculative value alone.

Comparative Overview of Cryptocurrency Categories

| Category | Examples | Use Case | Risk Profile | Volatility | Key Considerations |

| Payment Coins | BTC, LTC | Peer-to-peer payments | Moderate | Medium | Adoption, scalability, network fees |

| Smart Contract Platforms | ETH, SOL, ADA | dApps, DeFi, NFTs | High | High | Network upgrades, adoption, technical risk |

| Stablecoins | USDC, USDT | Trading, DeFi collateral | Low | Low | Reserve transparency, regulatory risk |

| Privacy Coins | XMR, ZEC | Anonymity and confidentiality | High | Medium-High | Regulatory scrutiny, liquidity |

| DeFi Tokens | UNI, AAVE, COMP | Decentralized financial services | High | High | Smart contract risk, protocol usage |

| NFT & Gaming Tokens | AXS, MANA, ENJ | Digital collectibles, metaverse | Very High | Very High | Community engagement, liquidity |

| Utility & Governance | LINK, MATIC, MKR | Protocol access and governance | Medium-High | Medium-High | Tokenomics, adoption, ecosystem growth |

This table summarizes key characteristics and risk factors across major cryptocurrency categories, enabling investors to tailor strategies to their risk tolerance and investment horizon.

How Categories Influence Investment Strategy

Understanding cryptocurrency categories allows investors to implement nuanced allocation strategies. For instance:

- Core Holdings: Payment coins and stablecoins provide liquidity and stability.

- Growth Exposure: Smart contract platforms and DeFi tokens offer potential for outsized returns but carry higher volatility.

- Speculative Play: NFT, gaming, and privacy tokens are suitable for high-risk, high-reward portions of the portfolio.

- Ecosystem Participation: Utility and governance tokens allow strategic involvement in network governance and long-term operational success.

A diversified portfolio can reduce systemic risk while leveraging high-potential opportunities across various crypto sectors. Investors should continuously evaluate market trends, technological developments, and regulatory changes to recalibrate allocations.

Conclusion

The cryptocurrency landscape is both diverse and dynamic. Categorizing digital assets into payment coins, smart contract platforms, stablecoins, privacy coins, DeFi tokens, NFT/gaming tokens, and utility/governance tokens provides a framework for understanding risk, volatility, and investment potential. Each category carries unique characteristics that influence market behavior, adoption, and long-term sustainability.

Effective crypto investment strategy requires aligning asset allocation with risk tolerance, understanding network fundamentals, monitoring adoption trends, and accounting for regulatory developments. By leveraging this categorical framework, investors can navigate the crypto market with greater insight, diversify risk, and identify opportunities aligned with their financial objectives.

The evolution of blockchain technology and digital assets is ongoing, making continuous research, education, and portfolio reassessment critical. As the crypto ecosystem matures, informed investors who understand the distinctions among cryptocurrency types will be better positioned to capitalize on market opportunities while mitigating inherent risks.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.