Stay up to date with the latest news, announcements, and articles.

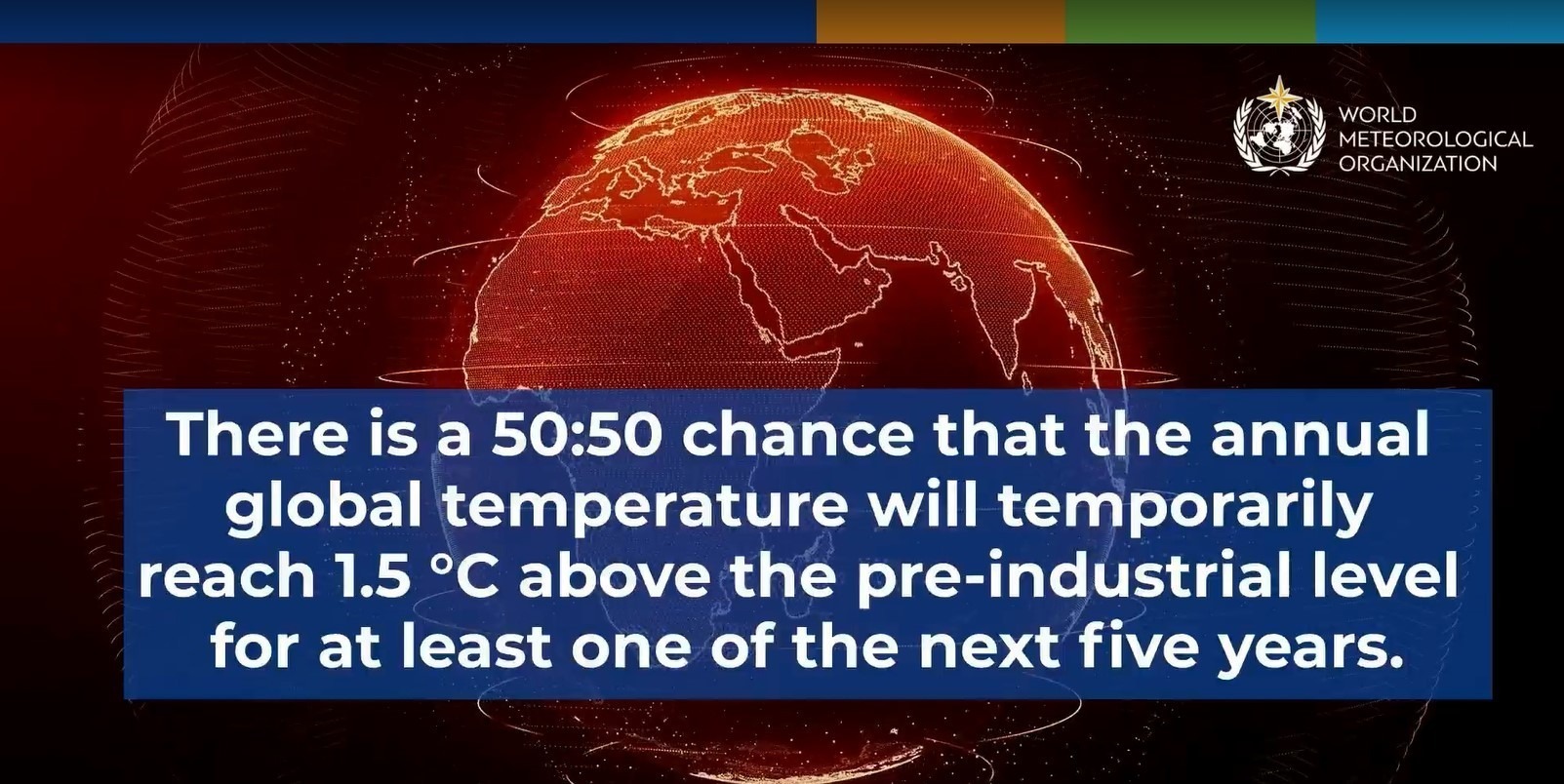

In light of these hazardous climate change effects, the time is ripe for an energy revolution, and energy investors should take the lead. Energy-intensive sectors like Bitcoin mining are shifting to crypto mining with solar energy, among other green mining solutions. Crypto mining with wind energy and other green energy options will help miners redeem their acts after facing heavy criticism over their vast energy consumption.

Energy investors are part of the revolution which presents new revenue streams for the sector. In addition to operating more efficiently and environmentally conscious, energy investors can sell their wasted energy. It is a new flaring mitigation solution that will help build a sustainable future for sectors with high energy requirements like cryptocurrency mining. Read on for a deeper insight into energy waste solutions and how you can monetize your wasted energy through crypto mining.

Understanding Wasted Energy

Wasted energy refers to the energy that is not transformed or transferred usefully. Typically, energy cannot be created or destroyed. Companies can only change it from one form to another, and part of it is lost. For instance, electrical energy gets converted to light energy to provide lighting. However, part of it is lost as heat energy in the process. This energy that is not usefully utilized is known as wasted energy.

Burning fossil fuels, an essential energy source, is both a financial and environmental hazard. The Environmental Defense Fund (EDF) notes that in America, $350 billion is spent on electricity production every year, with about three-quarters of the energy produced going to waste.

The EDF further notes that oil and gas companies waste methane gas worth hundreds of millions of dollars every year through flaring and venting. This occurs despite increasing pressure for the oil and gas industry to clarify its position and the implications of energy transitions to their operating models. They also need to explain their contributions to mitigating the effects of climate change and achieving the Paris Agreement and the sustainable development goals.

However, by June 2021, the IHS Markit report showed that no oil and gas company was entirely aligned with the Paris Agreement goals. The sector has failed to limit its greenhouse gas emissions despite being the most significant contributor to scope three emissions in 2019. According to the International Energy Agency’s (IEA) global energy review, the global CO2 released from energy combustion reached the highest level in 2021 after a 6% increase from 2020.

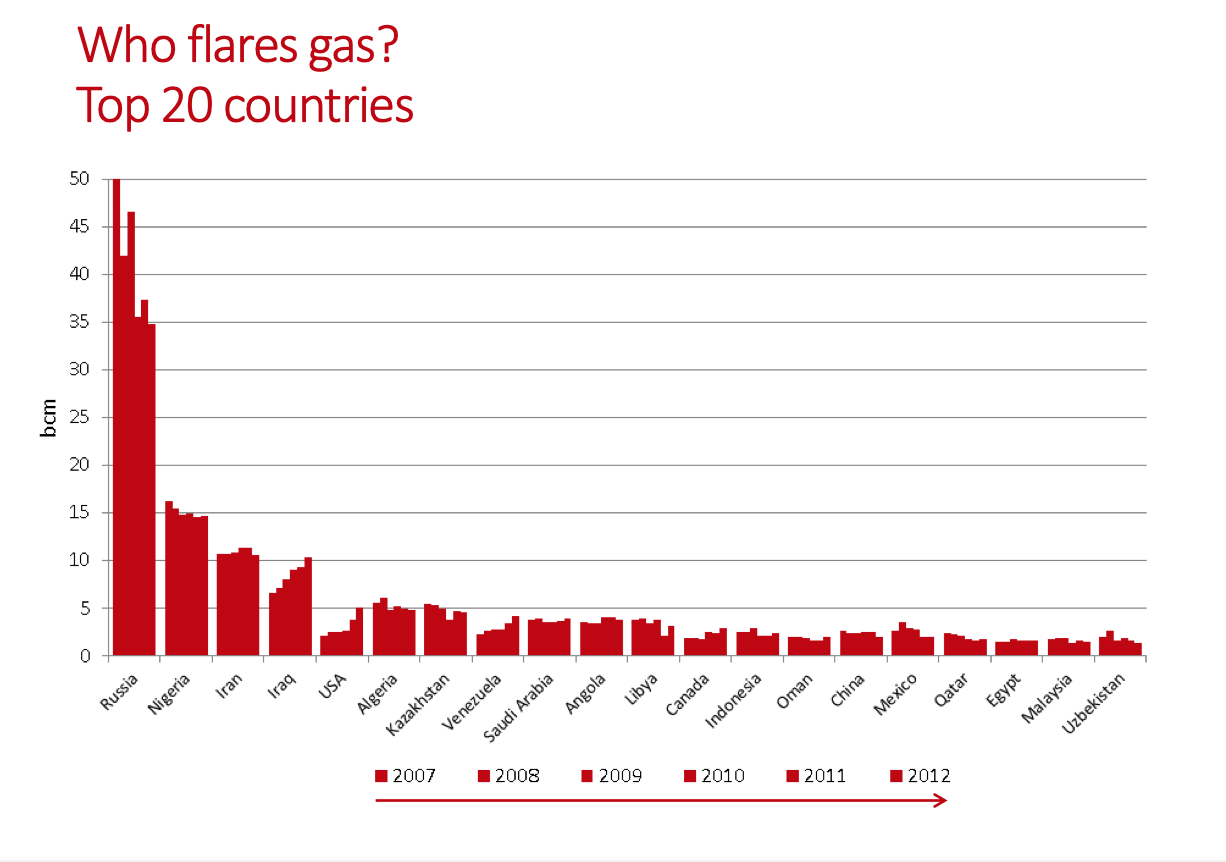

Much of the CO2 is released from oil production via the combustion of methane, the main component of natural gas as the intentional flared gas. At least 144 billion cubic meters of gas were flared in 2021 alone. According to the World Bank report, the United States was among the largest flaring countries, with Russia, China, and Mexico following closely. Russia, Iran, Iraq, the United States, Nigeria, Venezuela, and Algeria were the top seven flaring countries and remained at the top for ten years. There is an apparent waste of global energy resources in oil production and a significant environmental implication.

The Future of Oil and Gas Companies and Flared Gas

At the height of the environmental sustainability goals, the future of oil and gas companies is at stake. The cryptocurrency mining sector is equally threatened by its evident energy-intensive nature. Environmental enthusiasts accuse the industry of thriving at the expense of the environment, and miners now have to look for alternatives such as crypto mining with nuclear power.

The World Bank launched the ‘Zero Routine Flaring By 2030’ initiative, lobbying stakeholders to end flaring by 2030. The initiative requires oil and gas companies to report their flared gas annually and progress towards the goal. However, against the rising temperatures and millions of lives at stake, the core question should be whether oil and gas companies and crypto miners are the problem or could they be a critical part of the solution.

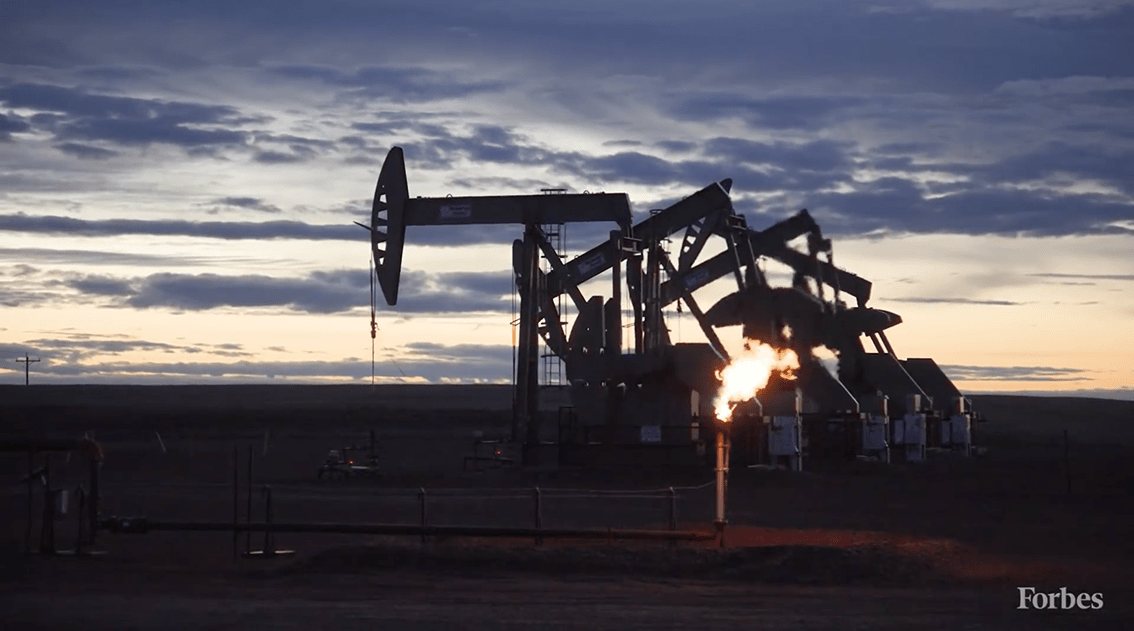

BP, the British oil and gas major, reportedly plans to stop flaring at its onshore assets in the US by 2025. The company intends to build a network of pipes that will enable it to collect the natural gas that is otherwise flared. While this could solve the problem for oil and gas companies, it is quite costly to build the infrastructure for collecting natural gases in oil fields, especially considering the remote location of the oil fields.

Monetizing Wasted Energy with EZ Blockchain

With all these pertinent issues surrounding non-renewable energy sources, green energy will take over the industry. Oil and gas companies will have to reinvent what they offer to survive the changing industry. Notably, flared gas forms a significant part of energy investors’ wasted energy and could become economically valuable for sectors like cryptocurrency mining. Blockchain companies are already looking into this flaring mitigation solution, and EZ Blockchain has made much progress in helping energy investors implement the solution.

EZ Blockchain helps oil and gas companies monetize the natural gas generated by using it as the power source for Bitcoin mining. EZ Blockchain helped Silver Energy Services end its stranded gas problem in Alberta, Canada, and turn it into a revenue stream. The oil services company needed a solution to offer clients a better way to monetize their stranded natural gas. They targeted the oil and gas fields in North America, specifically Alberta, although temperature extremes were a concern.

EZ Blockchain deployed two mobile data center solutions. One fully loaded EZ Tank 600 and an EZ Tank 300. Both tanks were fitted with frequency drive regulators to lower the fan speed during the cold hours. Other than eliminating the stranded gas problem, the company decreased its operational costs, diversified its revenue, and created jobs for local technicians. It boasts of a 28,000 MCF of gas equivalent to about 4 MWs of power capacity.

In Uinta Basin, EZ Blockchain helped their client with their flaring mitigation solution at their gas processing plant. The client can now monetize the fared gas in an alternative by doing crypto mining on site. The company doesn’t have to worry about flaring permit expiry date or applying for renewal or exemption.

The innovative solutions at EZ Blockchain are new in the industry. However, they are already helping clients attain global sustainability goals at lower costs and a guaranteed return on investment. Cryptocurrency mining is a lucrative venture, so investing in wasted energy-powered mining containers provides low risks and high returns. With a reliable energy source on site, oil and gas companies only have to partner with EZ Blockchain and tap into their wasted energy. The installation process is fast, taking only one to two weeks.

The crypto mining equipment is highly liquid, and energy investors can sell it to crypto miners. Additionally, they can sell their excess energy to crypto miners who are constantly looking for alternative energy sources. At the moment, 7-8 cents per kilowatt-hour is an average price among crypto miners. If the cost of energy provided by energy investors is less, they have an opportunity to profit from their wasted energy. With EZ Blockchain smartboxes, they can quickly break even as they have an affordable energy source and an efficient crypto mining solution.

In Summary

One of the most significant drawbacks of cryptocurrency mining is the high energy requirements. The process is so energy-intensive that some institutional investors that previously acknowledged Bitcoin for payments began to change their minds about the crypto coin. Recent reports show that Bitcoin mining in the US creates about 40 million pounds of carbon emissions, yet the industry seeks to reduce its carbon footprints by 100% by 2030.

Conventionally, the process is highly inefficient, with much of the energy consumed lost as heat. When used to solve the complex mathematical computations in crypto mining, the mining rigs are naturally prone to heating, and cooling them means using more energy. Some miners are shifting to green energy, such as crypto mining with wind energy, but EZ Blockchain provides solutions for energy investors and crypto miners.

About EZ Blockchain

EZ Blockchain is an innovative blockchain company that seeks to provide innovative solutions to the energy and cryptocurrency industries. With EZ Blockchain, energy investors can tap and monetize their wasted energy. EZ Blockchain helps oil and gas companies set up mining containers on-site, allowing them to mine using the wasted energy that is otherwise flared. They can also sell their new power to crypto miners looking for alternative sustainable energy sources.

By helping companies tap into their waste energy, EZ Blockchain ensures that energy investors operate efficiently and are environmentally conscious. They have a practical solution to the zero routine gas flaring goal and significantly reduce their carbon footprints.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.