Stay up to date with the latest news, announcements, and articles.

With deep cross-integrations of the blockchain architecture and AI, you can use autonomous agents, gain access to decentralized data markets, and leverage compute networks. But there’s more. This novel match may be among the main drivers of Web3 currencies.

But how does it work, what do we need AI coins for, and what are the best AI crypto coins to use? Let’s go through the ins and outs of AI cryptocurrency, see how exactly such coins can be leveraged today, and what you should expect in return for mining one.

What Are AI-Powered Cryptocurrencies?

AI-based cryptos were born out of an experiment — integration of certain artificial intelligence features with a blockchain infrastructure. However, this time around, AI was embedded directly into the blockchain protocol and application layer.

This has opened a new horizon of capabilities and automations. You can only use your regular crypto token to stake, govern, or pay for something with it. A token with AI at its core, in turn, can be employed for more operations, all of which can be made autonomous.

“While looking at some tangible advantages, the AI-crypto space also faces significant challenges and risks.”

An AI coin thus can power an independent agent or node, which would use machine learning and smart decision-making algorithms to complete custom tasks. Such agents/nodes can interact with each other and other systems daily, and you don’t need to supervise them.

But that’s only one method — there are more described below. To sum up, AI alt coins can easily expand the blockchain as we know it beyond its role as just a ledger. It has already proven to be a fruitful space for decentralized intelligence projects.

How AI Is Used in Blockchain Projects

Now, we went over some technology background, but to understand the specifics, let’s take a look under the hood, at the key mechanisms explained with real-world examples:

- Autonomous Economic Agents or AEAs

Projects like Fetch.ai use autonomous on-chain programs that represent users or devices — agents. They can make decisions, negotiate, and even transact costs. The agents operate via a communication layer (uAgents), while an AI Engine orchestrates their workflows.

- Machine Learning integrations

Agents learn from past interactions to improve performance thanks to ML. According to Fetch.ai, recurrent neural networks and deep learning enable AI to assess trust — e.g., how trustworthy a node is, how normal a transaction is, etc.

- AI marketplaces

A decentralized marketplace lets developers list custom AI services. E.g., at SingularityNET, users can pay AGIX tokens to order various services, the delivery and fulfillment of which are processed via smart contracts.

- Compute and GPU networks

With projects like Render Token, you can rent out your GPU resources and get compensated in tokens.

- Data sharing protocols

For instance, Ocean Protocol focuses on privacy-preserving data exchange, allowing data providers to monetize their data, while AI developers get high-quality assets for AI training.

- Consensus innovation

Research is emerging on combining consensus with AI tasks: for instance, Proof of Useful Intelligence, or PoUI, suggests that nodes perform AI-related tasks as part of consensus.

These are, by far, the most relevant and promising implementations of AI in crypto environments. This brings us to the next question — what is the best AI crypto to put at the core of such implementations?

Different types of AI coins can have diverse utilities. Here are the top 4 AI crypto coins that can help launch a new decentralized AI project today.

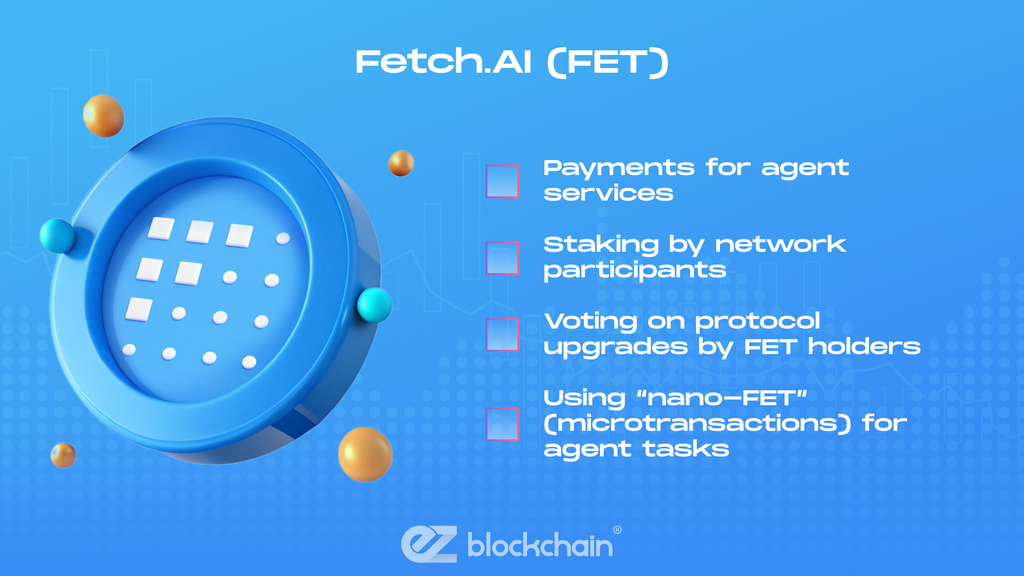

Fetch.AI (FET)

Fetch.AI is a complete network of autonomous economic agents, which facilitates the instant access to and use of AEAs for custom goals. The network houses ML-powered AEAs that can be managed via the AI Engine that translates your goals into multi-agent workflows.

The network’s dedicated token FET can be used for:

- Payments for agent services.

- Staking by network participants.

- Voting on protocol upgrades by FET holders.

- Using “nano-FET” (microtransactions) for agent tasks.

Fetch.AI runs on a uPoW — a useful Proof-of-Work consensus, which enables nodes to validate transactions while also contributing to AI workloads.

Best used for: Supply chain optimization, IoT, mobility, DeFi, and energy markets.

SingularityNET (AGIX)

SingularityNET is a vivid example of a decentralized marketplace for third-party AI services. Developers publish AI services, usually models and algorithms, users pay to use them. The project promotes the next level of contextual sensitive AI — Artificial General Intelligence.

The platform’s AGIX token’s utility includes:

- Payments for accessing AI services.

- Staking.

- Voting on platform proposals by AGIX holders.

SingularityNET is interoperable, which means it works cross-chain and can be used for Ethereum and Cardano projects. It’s also integrated with other projects, like Ocean Protocol for data sharing.

Best used for: Projects with long-term vision toward AGI.

Render Token (RNDR)

A decentralized GPU rendering network, Render Token is a novel platform that gathers GPU computing powers and provides them for external rendering tasks as well as AI training and inference.

The RNDR token allows users to pay for the GPU power they use. The providers of that power — the GPU owners — earn RNDR for contributing.

Best for: Digital content creation, metaverse, real-time graphics, and AI model training.

Ocean Protocol (OCEAN)

Ocean is a decentralized protocol for data exchange, which data providers can use to share or sell their datasets. AI developers, in turn, can access these datasets to start training AI models faster.

The OCEAN token’s utility includes:

- Payments for data access.

- Governance of protocol decisions by OCEAN holders.

Best used for: Privacy-preserving exchange and decentralized access to well-prepared data.

Potential Benefits of AI Integration

You get a lot of practical implementation with the above top AI coins to buy, but their ecosystems must still completely mature. For now, you can potentially benefit from:

- Decentralized intelligence

Developers may contribute AI assets globally and freely, and users pay for them in tokens, removing any centralized structures hindering the AI use. - Efficient resource usage

You can monetize idle devices or GPUs, while AEAs can help optimize logistics, energy consumption, or IoT processes more efficiently than centralized systems. - Trust

Blockchain provides immutability and smart contracts, ensuring transparent, trustless AI service payments, access, and governance. - Incentivized data sharing

With data marketplaces, individuals or organizations can monetize existing data assets, contributing to model training without giving up ownership. - Scalable AI infrastructure

Decentralized compute networks (like RNDR) can scale AI workloads without requiring centralized cloud providers.

Risks and Limitations

While looking at some tangible advantages, the AI-crypto space also faces significant challenges and risks, like:

- Technical complexity — building and deploying AEAs, composing AI services, and designing incentive models require in-depth expertise.

- Scalability constraints — running complex AI tasks on-chain is difficult, with many systems relying on off-chain computation.

- Regulatory uncertainty — AI and crypto are both under increasing regulatory scrutiny.

- Token and market risk — as with crypto, token prices are volatile, so it’s important to not run into vain AI-crypto projects.

- Adoption challenges — for AI marketplaces to work, both developers and users must join, which calls for more matured demand.

Investment Opportunities in AI Coins

If you’re already considering investing in AI-powered crypto, here are some angles and prospects — and what to watch out for:

- Early-stage potential vs. proven utility — projects like agent-based networks could explode if adoption picks up, offering instant profits. However, more mature cases, like data marketplaces and GPU compute networks, may gain more immediate real-world traction, making the profits more spread but also reliable.

- Token mergers — there’s the upcoming ASI merger of FET with AGIX with OCEAN, which could be a major event to capitalize on.

- Staking and utility — many AI crypto coins can be staked or used to pay for on-chain services that could drive long-term value.

- Partnerships — seek collaborations that focus on real AI-blockchain use cases to profit off the early demand when it kicks in.

- Risk diversification — AI coins will make another great non-fiat asset to allocate funds in your investment portfolio, diversifying it further.

Future Outlook

Last but not least, what should we expect from the emerging AI-crypto niche in the near future? We’d like to point out several fundamental trends to keep in sight:

- Consolidation and token merging: More consolidated AI ecosystems are expected to follow the example of the ASI merger (if it succeeds);

- Decentralized MLOps: More protocols are expected to integrate decentralized AI techniques, including federated learning and on-chain verification of AI outputs.

- Regulation and governance: As AI and crypto regulators catch up, token governance mechanisms will evolve with a focus on data privacy, ethical AI, and decentralized operations.

- Edge AI and compute networks: Projects that allow monetizing GPU or CPU power could scale dramatically, boosting the demand for edge AI — AI algorithms running from devices.

- More tech innovation: Lastly, we should expect better multi-agent architectures, improved LLM integrations, and efficient on-chain AI verification.

Still have questions or can’t decide what AI crypto to buy for your purposes? Contact EZ Blockchain experts for an individual consultation, guidance, and profitable ASIC miner purchase and hosting.

FAQ

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.