Stay up to date with the latest news, announcements, and articles.

Myth 1: Bitcoin Is Anonymous

A common misconception regarding blockchain technology is that users are immediately anonymous. But the reality is more complex. Blockchain transactions are pseudonymous rather than completely anonymous. This point is often misunderstood in lists about cryptocurrency myths.

On the other hand, anonymity would imply that the transactions are completely unrelated to any identity, including a pseudonym, rendering the user unable to track them down. Since everyone with access to the blockchain may see each blockchain address’s transaction history, blockchain often does not offer this degree of anonymity. Discussions about anonymity start debates about ‘crypto mythology’ and misconceptions in the publicity.

Myth 2: Cryptocurrency Is Only Used for Illegal Activities

One crypto myths defender could argue that the absence of personal information needed to conduct cryptocurrency transactions encourages illegal activity. In reality, though, it produces a ton of evidence. The majority of cryptos are pseudonymous rather than completely anonymous. This implies that your name gets substituted with your crypto wallet address, which is 35 characters long, rather than completely hiding your identity.

However, a lot of stores and businesses now accept cryptocurrency as payment. Governments are trying to figure out how to control them, and people are accepting them in private transactions. You must learn about the workings of cryptocurrencies if you are going to be involved with them. This is part of the truth about crypto that often gets ignored.

Myth 3: You Can Get Rich Quickly with Crypto

The abrupt rise and fall of cryptocurrencies with no practical use to support their value, like the notorious Dogecoin, has led to the widespread belief that they are only speculative assets for short-term gain. However, a lot of cryptocurrencies do have practical uses, and the blockchain technology that powers them also has genuine value.

Blockchain technology, which provides unmatched transparency, security, and decentralization, is used in the construction of nearly all cryptocurrencies. Like gold, Bitcoin may not be backed by a tangible item, but then so are the US dollar and almost all other contemporary fiat currencies. Bitcoin is immune to inflation because it is hard-coded to be scarce. When fiat currencies are produced in vast amounts, the supply becomes diluted, and inflation may result. Many myths about cryptocurrency stem from ignoring these underlying fundamentals.

Myth 4: Mining Bitcoin Is No Longer Profitable

Although there has been a lot of price volatility for Bitcoin over the past ten years, that is to be expected for a new and developing industry. With a market valuation of more than $1300 billion, Bitcoin has gradually increased in value over time since its creation in 2010. Additionally, regulatory frameworks are growing in tandem with the usage of Bitcoin as it continues to mature.

Since their debut, cryptocurrencies like Bitcoin have undergone substantial change. When Bitcoin was first introduced in 2009, its value was quite small, but by 2021, it had risen to an all-time high of $69,000. Bitcoin is currently trading at about $115,995 as of September 2025, indicating a significant rise in value over time . Its increase in value shows that a society’s perception of an asset is crucial in determining its worth. A number of other comparable cryptocurrencies have shown promise, including Ethereum, Cardano, Litecoin, and others. For skeptics, the truth about Bitcoin lies in its long-term resilience.

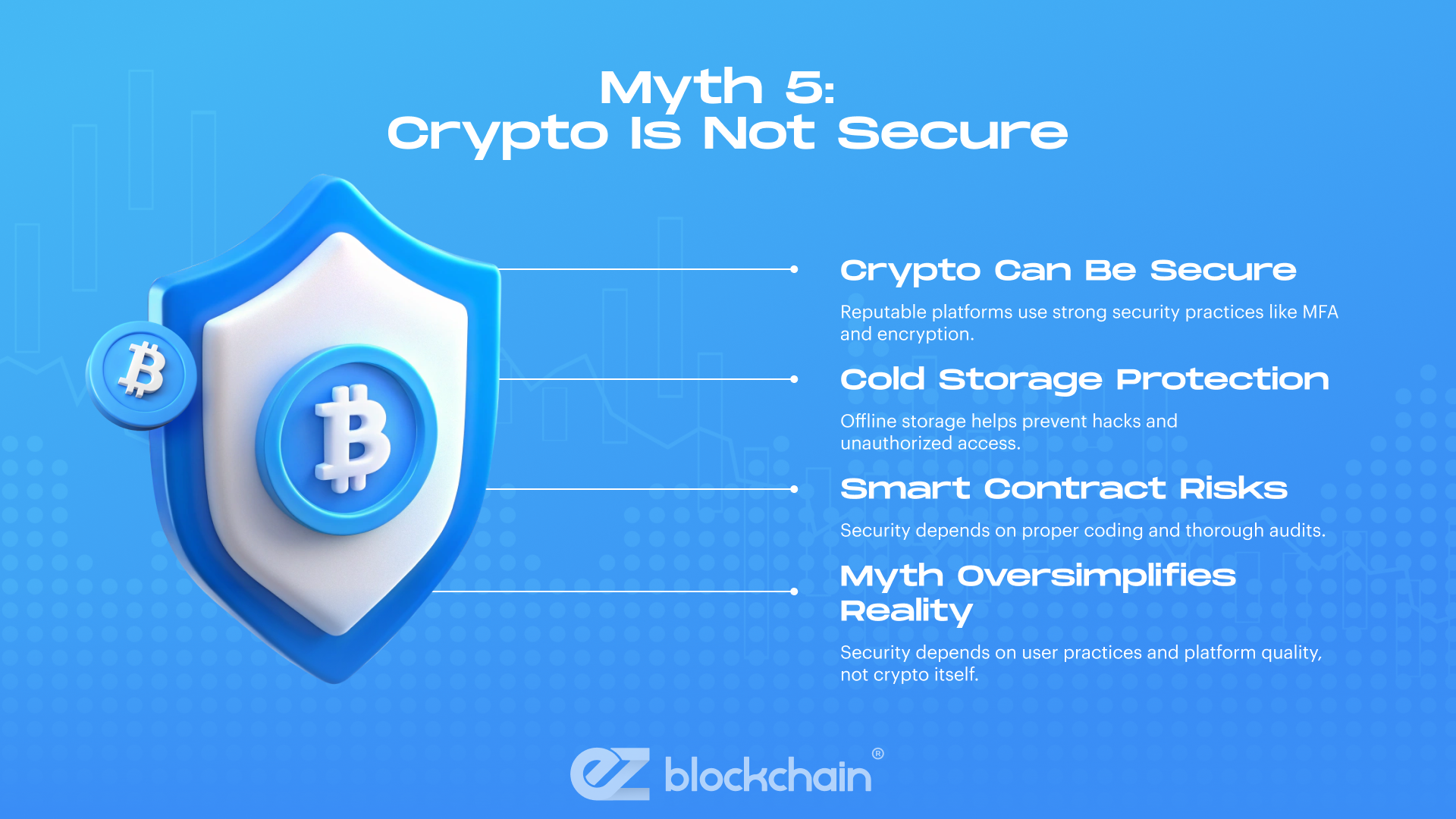

Myth 5: Crypto Is Not Secure

Transactions involving digital assets are equally safe when conducted on an exchange or platform that adheres to best practice security and privacy requirements as they are on any other platform that does the same. Although no ecosystem is impervious to security flaws or breaches, the majority of well-known cryptocurrency platforms employ strong security measures, like multi-factor authentication and digital wallet key encryption, to safeguard their users’ accounts. As an extra security precaution, digital assets can also be stored offline in “cold storage,” which helps thwart hack attempts.

Preventing scams brought on by flaws in the smart contract codebase is another crucial component of security. It takes a deep comprehension of the logic and functionality of smart contracts as well as a careful analysis of the codebase to find vulnerabilities in order to find these attacks. To lower the danger of exploits, it is always strongly advised to hire a qualified third party to evaluate and audit smart contracts before launch and on a regular basis following. Security is an important reminder against oversimplified myths about crypto.

Debunking the Myths: Facts You Should Know

Satoshi Nakamoto created the revolutionary technology known as blockchain. A distributed database or file is one that is kept on several computers spread out over several places, with database work being divided among them. The blockchain database is an ever-expanding collection of blocks containing records of trade contracts, bitcoin trades, financial transactions, and anything else of value between two parties. It was initially created to manage Bitcoin (BTC) transactions, but it quickly discovered uses in other fields.

Note: It’s a popular misperception that Bitcoin and blockchain are synonymous. The use of blockchain technology is not limited to bitcoins, though. The other digital currencies are as well. This mix-up fuels many cryptocurrency myths and realities debates.

A peer-to-peer (P2P) investment adds a transaction to a block when it has been verified by a large number of willingly participating nodes. After then, the block is added to a sizable blockchain data structure. Although each node joins the network voluntarily and serves as a blockchain administrator, they are all motivated to do so by the possibility of winning Bitcoins. Blockchain technology is used by a global computer network to collaboratively administer the transaction database. Once a record is added to a blockchain, it is difficult to change.

Blockchain Transparency

The term “blockchain transparency” describes the feature of the blockchain that guarantees that all network transactions and data are accessible to all users with system access. Anyone may view and verify the legitimacy of transactions and data on the network thanks to blockchain transparency. Many public blockchains, including Ethereum and Bitcoin, developed their various networks using this methodology. Important elements consist of:

- Public Ledger Access: Every transaction is documented on a decentralized ledger that is accessible to all network users, enabling verification without the need for middlemen.

- Immutable Records: Transaction data cannot be changed after validation, guaranteeing historical correctness and guarding against manipulation.

- Auditability: Each block has cryptographic evidence that connects it to earlier blocks, allowing participants and auditors to follow the movement of assets throughout the network.

- Smart Contract Verification: Participants can examine and validate executable code on the blockchain, fostering transparent and reliable automated processes.

Since transparency enables everyone to have faith in the data stored within the blockchain network, it is crucial. Members of the network can also use it to confirm that the transactions they are conducting are authentic. A blockchain network’s transparency is one of its main advantages. Fairness, trust, and dependability are some of the main characteristics that make blockchain technology superior to traditional data storage systems.

Security and Regulation

Governments and regulatory agencies throughout the world are attempting to establish rules for the cryptocurrency sector as the regulatory environment changes quickly. The new regulations are intended to give users in the cryptocurrency field legal clarity when they invest in the market.

The Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the Financial Crimes Enforcement Network (FinCEN) share primary regulatory oversight responsibilities. Certain tokens and cryptocurrencies are regarded by the SEC as securities, necessitating registration and adherence to federal securities regulations.

While FinCEN enforces know-your-customer (KYC) and anti-money laundering (AML) laws for exchanges and custodial services, the CFTC regulates cryptocurrency derivatives and futures markets, guaranteeing ethical trading activities. This all contributes to the truth about Bitcoin and its ecosystem, far from sensationalized fears.

Final Thoughts

The potential of blockchain technology is growing across industries, and it is still developing. Businesses and individuals will have a better grasp of blockchain’s actual potential as more blockchain myths are dispelled. This will probably result in more widespread use and creative applications in a number of industries.

By distinguishing fact from fiction and filtering out myths about cryptocurrency, we can better utilize blockchain’s potential for useful and significant applications, guaranteeing that it changes industries in significant ways.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.