Stay up to date with the latest news, announcements, and articles.

The mechanics described by the administration indicate that the dividend may not be a direct one‑time lump‑sum check but rather a composite of tax credits, rebates, or other relief financed by import‑duty surpluses. Treasury Secretary Scott Bessent acknowledged that the “dividend” might manifest via tax offsets (e.g., no tax on tips, Social Security relief) rather than a straight payment.

The policy seeks to link trade‑protection (tariffs) with direct fiscal redistribution, repositioning tariffs as not only revenue instruments but also as funding streams for citizen‑benefits. This is unusual in U.S. fiscal policy, where tariffs traditionally serve protectionist or revenue‑raising roles, not direct household transfers.

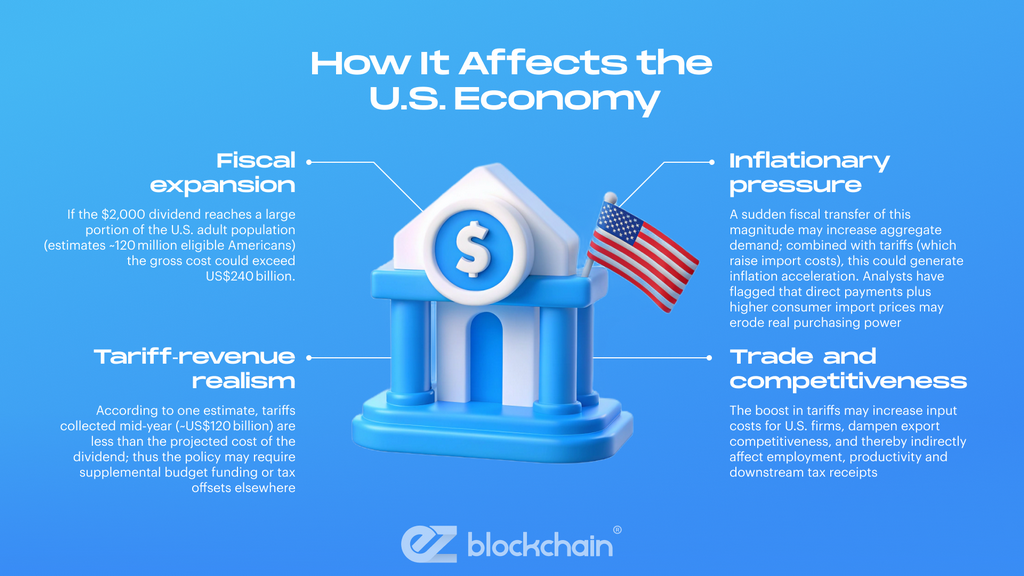

How It Affects the U.S. Economy

From a macro‑economic standpoint, this policy has several implications:

- Fiscal expansion: If the $2,000 dividend reaches a large portion of the U.S. adult population (estimates ~120 million eligible Americans) the gross cost could exceed US$240 billion.

- Inflationary pressure: A sudden fiscal transfer of this magnitude may increase aggregate demand; combined with tariffs (which raise import costs), this could generate inflation acceleration. Analysts have flagged that direct payments plus higher consumer import prices may erode real purchasing power.

- Tariff‑revenue realism: According to one estimate, tariffs collected mid‑year (~US$120 billion) are less than the projected cost of the dividend; thus the policy may require supplemental budget funding or tax offsets elsewhere.

- Trade and competitiveness: The boost in tariffs may increase input costs for U.S. firms, dampen export competitiveness, and thereby indirectly affect employment, productivity and downstream tax receipts.

Thus, while the direct household impact may appear stimulative, the net economic effect is ambiguous: higher import costs + large fiscal transfer = complex inflation/deficit dynamics.

Connection Between Fiscal Policy and Crypto Markets

Crypto markets are sensitive to macro‑fiscal policy shifts because they influence liquidity, risk‑appetite and inflation expectations—three variables that drive digital‑asset price behaviour.

- Liquidity dynamics: Direct household transfers (e.g., the $2,000 dividend) expand disposable income and may push incremental capital into risk‑assets (including crypto) if consumers or retail investors allocate a portion to digital‑assets.

- Inflation hedge narrative: Crypto assets such as Bitcoin (BTC) are regularly portrayed in media and investor‑forums as inflation hedges. A policy that increases inflation expectations may reinforce that narrative, leading to increased demand for crypto.

- Risk‑on sentiment: A large‑scale stimulus historically triggers “risk‑on” flows—investors shifting from safe‑assets to higher‑beta assets. Crypto tends to amplify these effects due to high leverage, derivatives, and retail participation. For example, an article in CoinDesk notes “the idea of direct household payments … revived the same risk‑on reflex that drove digital assets during the pandemic‑era stimulus rounds.”

- Dollar/debt interplay: Increased fiscal deficit and tariff‑financed transfers may weaken confidence in the U.S. dollar or increase sovereign‑credit risk, prompting some investors to seek non‑sovereign store‑of‑value assets, including crypto.

These linkages create a channel through which a tariff‑dividend policy can influence crypto‑asset prices—both positively (stimulus, risk‑on) and negatively (inflation, regulatory risk, economic drag).

Bitcoin’s Reaction to Economic Stimulus

Empirical data following the announcement illustrate immediate crypto market responses:

- According to CoinDesk, after the tariff‑dividend announcement, Bitcoin (BTC) rose approximately 4.6 % in 24 hours, while Ethereum (ETH) gained roughly 6.1 %.

- The total crypto‑market capitalisation increased to around US$3.5 trillion, with unusually high Sunday trading volumes (~US$113 billion) in part driven by this liquidity/anticipation event.

- TheStreet published a similar observation of “crypto market surged” post‑announcement.

These reactions suggest that markets are pre‑emptively pricing in the possibility of increased liquidity and stimulus‑driven risk‑asset flows. However, whether the effect is persistent depends on realisation of the policy and broader macro context.

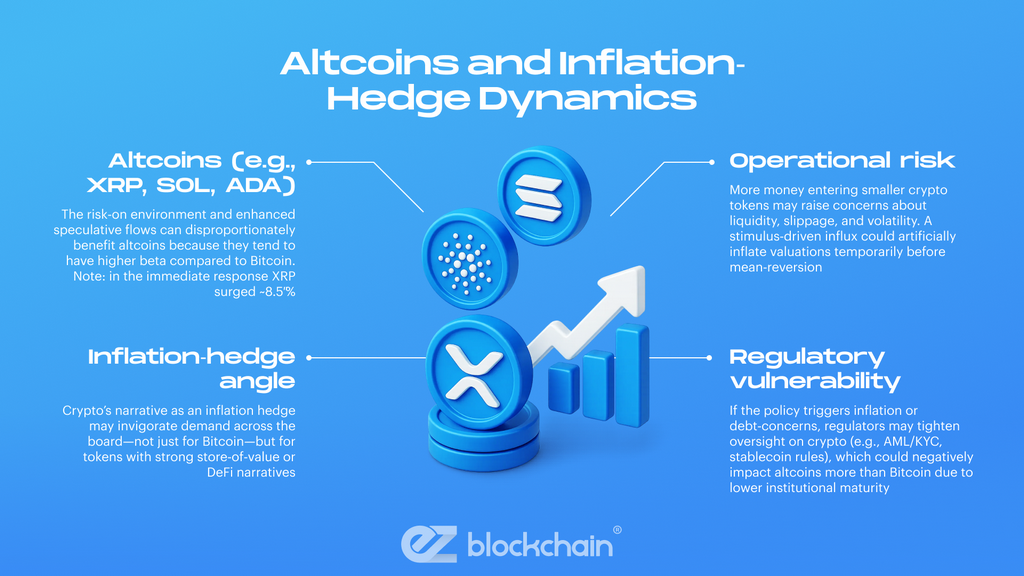

Altcoins and Inflation‑Hedge Dynamics

Beyond Bitcoin, altcoins and crypto sectors may also benefit or face distinct risks under this policy:

- Altcoins (e.g., XRP, SOL, ADA): The risk‑on environment and enhanced speculative flows can disproportionately benefit altcoins because they tend to have higher beta compared to Bitcoin. Note: in the immediate response XRP surged ~8.5 %.

- Inflation‑hedge angle: Crypto’s narrative as an inflation hedge may invigorate demand across the board—not just for Bitcoin—but for tokens with strong store‑of‑value or DeFi narratives.

- Operational risk: More money entering smaller crypto tokens may raise concerns about liquidity, slippage, and volatility. A stimulus‑driven influx could artificially inflate valuations temporarily before mean‑reversion.

- Regulatory vulnerability: If the policy triggers inflation or debt‑concerns, regulators may tighten oversight on crypto (e.g., AML/KYC, stablecoin rules), which could negatively impact altcoins more than Bitcoin due to lower institutional maturity.

Altcoins may capture amplified upside in a stimulus scenario, but carry disproportionate risks relative to Bitcoin when stimulus is reversed or inflation/kids‑wear‑off.

Investor Sentiment After the Announcement

Investor sentiment appears to have shifted, as captured by market behaviour and sentiment‑analysis metrics:

- The tariff‑dividend announcement triggered a “risk‑on” reflex in crypto markets—indicative of retail/institutional participants believing in renewed fiscal expansion.

- However, underlying scepticism remains: predictions markets put the probability of the Supreme Court approving the tariffs at ~21–23%.

- Some analysts caution that the announcement functions more as a liquidity‑signal than a confirmed policy implementation, meaning execution risk is high.

- Historical analogues (e.g., pandemic stimulus checks) show that markets front‑run policy announcements, but correction risk increases if actual roll‑out is delayed or weaker than marketed.

Sentiment is bullish in the short‑term, driven by hope of fiscal injection, but remains contingent on real policy delivery and macro stability.

Will Crypto Benefit from Tariff Measures?

Evaluating whether crypto will benefit from this tariff‑dividend policy requires weighing supportive and cautionary factors.

Supportive factors:

- Increased household liquidity → more capital flows into risk‑assets including crypto.

- Stimulus boosting risk appetite and leverage in crypto derivatives.

- Inflation expectations rising → crypto purchase as store‑of‑value.

- Perception of crypto as decoupled from traditional trade/earnings risk (since tariffs target goods, not digital assets) → relative appeal.

Cautionary factors:

- If tariffs raise import costs and suppress growth, the economy could slow, reducing retail risk‑appetite and hurting crypto.

- Execution risk: if the dividend fails to materialize or is delayed, markets may reverse gains.

- Potential regulatory backlash: large fiscal deficits or inflation may prompt regulatory tightening over crypto.

- Liquidity risk: rapid flows into crypto may cause overheating, and if stimulus ends markets may face reversal.

Analyst Predictions

A summary table of key analyst/market‑commentary reactions:

| Analyst/Source | Viewpoint on Tariff Dividend & Crypto |

| CoinDesk | Markets interpreted the dividend announcement as fresh liquidity injection → crypto rallied. |

| TradingView / Cointelegraph | Probability of policy enactment low (21–23%) → markets pricing optimism despite high execution risk. |

| Investopedia | Tariff revenue may be insufficient to cover the cost of dividend → potential fiscal strain. |

Analysts see momentum for a crypto boost from this policy, but emphasise the high contingency risk; much depends on implementation, macro environment and regulatory reaction.

Conclusion

In summary, the proposed $2,000 tariff dividend by President Trump represents a significant fiscal stimulus vector, with potential spill‑over into crypto markets via increased risk‑appetite, household liquidity, and inflation expectations. Crypto (particularly Bitcoin and major altcoins) has already shown a positive reaction to the announcement, but this is heavily premised on the dividend becoming real, on macro conditions remaining supportive, and on regulatory tailwinds rather than headwinds.

If you are monitoring crypto investment through the lens of this policy, the key take‑aways are: (1) understand the execution risk; (2) assess how much of the expected liquidity may reach the crypto sector; (3) consider how inflation, tariffs and trade‑policy interplay may impact crypto as a store‑of‑value alternative; and (4) remain aware of the regulatory dimension—stimulus may boost crypto, but inflation or debt‑concerns may trigger tightening.

Ultimately, the policy can be a catalyst for crypto-assets, but it is not a guarantee of sustained upside. Market participants should treat it as one of several macro drivers, not the sole foundation of investment strategy.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.