Stay up to date with the latest news, announcements, and articles.

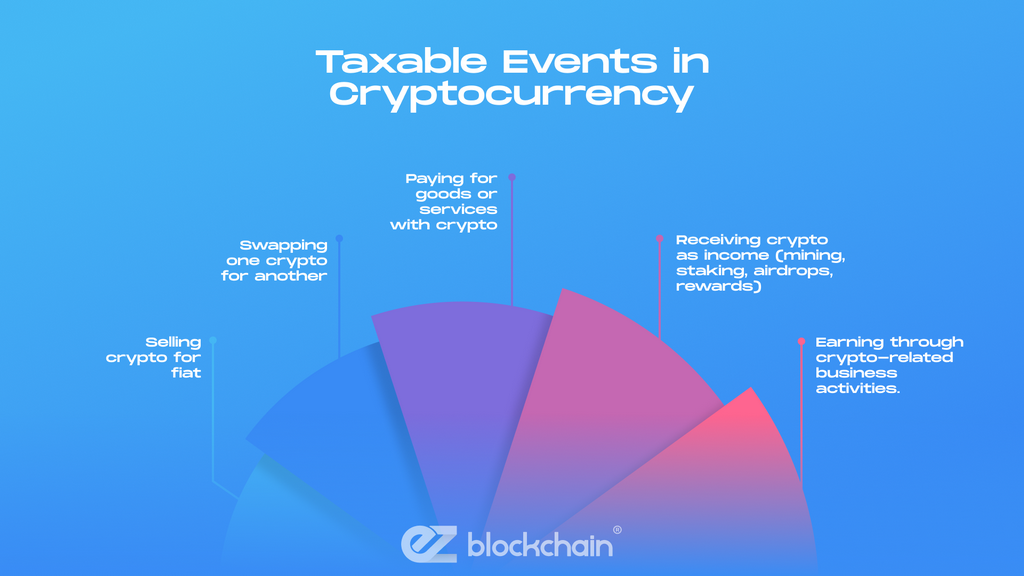

Taxable Events in Cryptocurrency

In the U.S., the Internal Revenue Service (IRS) treats cryptocurrencies as property, not currency. This classification drives the rules for when a taxable event occurs.

Here are common taxable events:

- Selling crypto for fiat (USD) or other government currency.

- Exchanging one cryptocurrency for another (e.g., ETH → BTC) – even if no fiat is involved.

- Using cryptocurrency to purchase goods or services.

- Receiving crypto as income: mining rewards, staking rewards, airdrops, referral bonuses, interest.

- Earning from crypto‑based business activity (e.g., mining as a business, providing crypto‑related services).

Because crypto is property, every sale, trade, exchange, or monetization triggers a gain or loss, unless you’re just holding. Gain or loss is calculated as the difference between your cost basis (original purchase price, including fees) and the fair‑market value (FMV) at the time of disposal or receipt (for income) .

For most participants, that means every trade, crypto-to-crypto swap, or reward payout is a potential tax event and accurate bookkeeping of cost basis, timestamps, and FMV is required to stay compliant with IRS rules.

Capital Gains Tax Rates for Short‑Term and Long‑Term

How much you pay depends primarily on two factors: holding period and your overall taxable income.

Short‑term vs long‑term gains:

- If you held crypto for 1 year or less before selling or trading, any profit is taxed as short-term capital gains, meaning the same rate as your ordinary income tax bracket (10%–37% in 2025–2026) .

- If you held crypto for more than 1 year, the profit is taxed as long-term capital gains, with favorable rates: 0%, 15%, or 20%, depending on taxable income and filing status.

2026 Capital‑Gains Rate Brackets

| Filing Status | 0% Rate Up to* | 15% Rate Up to* | 20% Rate Above* |

| Single | ≈ $49,450 | ≈ $545,500 | Above that |

| Married Filing Jointly | ≈ $98,900 | ≈ $613,700 | Above that |

| Head of Household | ≈ $66,200 | ≈ $579,600 | Above that |

* Thresholds reflect 2026 inflation‑adjusted values, as published by recent tax‑rate updates .

What This Means

- Realizing gains in a year where total income remains modest may result in a 0% tax on long-term crypto profits.

- Short-term trades, frequent flips, or high-income earners tend to pay higher tax rates due to ordinary income treatment.

- Matching your crypto sale timing (holding periods) with broader income planning can materially affect your tax liability.

For tax efficiency, long-term holding often offers substantial benefits, but only if you track acquisition dates accurately and avoid frequent short‑term disposals.

Income Tax on Mining and Staking Rewards

Cryptocurrency received via mining, staking, airdrops, referral bonuses, or as payment for services counts as ordinary income at the moment of receipt. The FMV on that date becomes both your taxable income and your cost basis for future capital‑gains calculations.

When you subsequently sell or exchange those coins, any additional gain or loss is subject to capital‑gains tax based on the holding period.

Implications:

- Mining or staking yields are taxed even if you don’t convert to fiat.

- If crypto is received regularly (e.g., mining rewards), the IRS may treat your activity as a business, which can create additional obligations (Schedule C, self‑employment tax).

- You need accurate timestamped records and FMV snapshots for each reward event.

Treat mining and staking analogously to wage income, taxable on receipt, and separate from future capital‑gains events when disposing of the asset.

Reporting Crypto Earnings to the IRS

Accurate reporting is critical. The IRS expects you to report crypto gains and income just like other income or investment gains (on Schedule D / Form 8949, plus Schedule 1 or Schedule C for income‑type events) .

Key reporting requirements:

- Track cost basis, acquisition date, disposition date, and proceeds for every taxable sale or exchange.

- Use FIFO (First-In, First-Out) or another consistent basis method (LIFO, Specific Identification) — but maintain documentation.

- Record FMV in USD at time of receipt for income events (mining, staking, airdrops).

- File on Form 8949 + Schedule D for capital gains/losses; and Schedule 1 or Schedule C (or 1099‑NEC/MISC if relevant) for income from crypto operations.

Failure to report, or poor record‑keeping, may trigger audits, penalties, and potential interest, especially as IRS scrutiny on crypto activity intensifies.

Treat every crypto transaction like a finance‑grade trade or income event, record it, timestamp it, log USD values, and integrate the data into your tax return exactly as with stocks or other investments.

Using Deductions and Tax Loss Harvesting

Crypto tax strategy can also use losses and deductions to improve net tax outcome. Two common mechanics:

- Tax‑Loss Harvesting: Sell underperforming or loss-making crypto positions to realize capital losses, then use those losses to offset capital gains or up to $3,000 of ordinary income per year; excess losses carry forward .

- Expense Deductions (in business context): If you run mining operations or provide mining/staking services as a business, you may deduct legitimate business expenses, electricity, hardware depreciation, hosting fees, etc. Proper structuring (self‑employment vs hobby) and documentation is essential.

Using a mix of realized losses and business deductions can substantially lower tax‑burden, but only if the underlying records are watertight and defensible in an audit.

Smart tax planning for crypto doesn’t stop at reporting, it includes strategic disposals, routine reconciliation, and careful accounting of expenses when eligible.

Common Mistakes to Avoid on Crypto Taxes

Many crypto taxpayers, even experienced ones, get tripped up by recurring pitfalls:

- Treat transfers between your own wallets as non-taxable (they’re not gains, but must still preserve basis and date stamps).

- Failing to record the cost basis accurately, especially when using multiple exchanges or wallets.

- Misclassifying mining/business income vs. hobby income – leading to under-reported self‑employment tax or deductions.

- Overlooking small, frequent trades (e.g., paying with crypto, in‑token fees) that create many micro‑events needing documentation.

- Ignoring tax‑loss harvesting potential or mis‑timing disposals – leading to suboptimal tax outcomes.

- Using poor record‑keeping tools, or none – making audits or reconciliations impractical.

The complexity of crypto taxation demands good data hygiene and disciplined accounting. Errors are not just costly, they multiply quickly when trades, rewards, and transfers pile up.

Tools and Software for Tax Compliance

Given crypto’s complexity, most individual taxpayers benefit from specialized tax‑tech tools. Key features to look for:

- Exchange & wallet integration (import trades via API or CSV)

- Automated cost‑basis tracking (FIFO, LIFO, Specific-ID)

- Support for DeFi, staking, mining, airdrops, NFT trades

- Audit-ready reporting (Form 8949, Schedule D, income/expense summaries)

- Loss-harvest tools, realized/unrealized gain tracking, carryforward management

Popular platforms in 2025–2026 include CoinTracker, Koinly, TokenTax and others, each with varying coverage depending on exchanges, tokens, and transaction types.

For anyone with more than a handful of trades or any staking/mining activity, tax‑software is virtually indispensable. Manual bookkeeping often fails once complexity grows beyond basic buy/sell transactions.

State-Level Tax Considerations

Federal taxation is only half the picture, state taxes (income tax, capital-gains tax, and state‑specific rules) can significantly change total liability. As of 2025–2026:

- Some states impose no state income tax (e.g., Florida, Wyoming, Texas, Nevada), which benefits crypto holders by eliminating state-level capital‑gains tax on crypto sales .

- Others (e.g., California, New York, Hawaii) maintain high marginal income or capital‑gains tax rates, crypto gains may be taxed up to ~13.3% in California.

- Tax treatment of mining or staking rewards may vary by state, treatment as business income, or other classification, examine state-level rules carefully.

Before selling or realizing gains, it’s wise to check your state’s crypto tax posture: it can materially impact net after-tax return.

While federal rates set the baseline, state taxes often determine your real “take‑home” yield from crypto sales or income, neglecting them results in inaccurate net‑after‑tax planning.

Planning Your Crypto Taxes for Maximum Efficiency

Here’s a rational, structured approach to planning crypto taxes in 2026:

- Segment holdings by intent and holding period – long-term HODL, trading, staking/mining, short-term flips.

- Maintain detailed records – wallet exports, exchange CSVs, timestamped FMV snapshots, cost-basis documentation.

- Leverage losses and deductions when possible – watch for tax‑loss harvesting windows and business‑expense eligibility.

- Use reliable tax‑software early and consistently – don’t wait until the end of the year.

- Model state and federal tax impacts before realizing large gains – simulate net after-tax proceeds.

- Align disposals with long-term holding rates where possible – maximize utilization of favorable 0% or 15% long-term brackets.

- Separate income and capital events – treat mining/staking income differently from gains, prepare to report both appropriately.

Crypto tax efficiency comes down to disciplined planning, real data capture, and strategic timing. Treat your crypto portfolio like a taxable investment portfolio, not a toy ledger.

Final Thoughts: What 2026 Means for Crypto Investors

As crypto adoption grows, U.S. tax authorities continue to clarify and enforce rules. Under current law, crypto remains property: taxable upon sale, exchange, or income realization. Long-term holdings, meticulous accounting, tax‑loss harvesting, and strategic timing are your tools to optimize after-tax returns.

The evolving landscape, including potential changes to reporting requirements, state laws, and enforcement, means diligent compliance and proactive planning are not optional. For serious investors, a robust tax‑reporting stack and forward-looking strategy should be considered as integral to portfolio design as custody and asset allocation.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.