Stay up to date with the latest news, announcements, and articles.

But how long until all bitcoin is mined? This systematic reduction means the final Bitcoin is unlikely to be mined until approximately 2140. This scarcity not only reinforces Bitcoin’s role as “digital gold” but also presents unique future challenges for network security and mining economics as block rewards wane.

When mining subsidies eventually cease, miners will no longer receive new Bitcoin as income and will depend entirely on transaction fees to sustain operations and secure the network. As stated by River.com and others, this transition could lead to increased fee pressure and a recalibration of miner incentives . Research also points to potential risks regarding long-term network stability if fee revenues are insufficient—a concern highlighted in the literature on blockchain sustainability under a fee-only reward regime. In this article, we will explore how miners may adapt to these systemic changes and assess the broader economic, technological, and governance implications of reaching Bitcoin’s issuance cap.

Why Bitcoin’s Supply Is Limited to 21 Million

How much BTC has been mined? The Bitcoin protocol, designed by Satoshi Nakamoto, includes a hard cap of 21 million coins. This was intended to mimic the scarcity of precious metals like gold and to prevent inflation caused by unlimited currency issuance. In details:

- Scarcity Principle: Limited supply increases potential value over time.

- Predictability: Users can calculate the number of Bitcoins in circulation at any given time.

- Deflationary Nature: Unlike fiat currencies, Bitcoin’s supply cannot be arbitrarily increased.

“Bitcoin’s capped supply creates digital scarcity, reinforcing its role as a store of

Value“

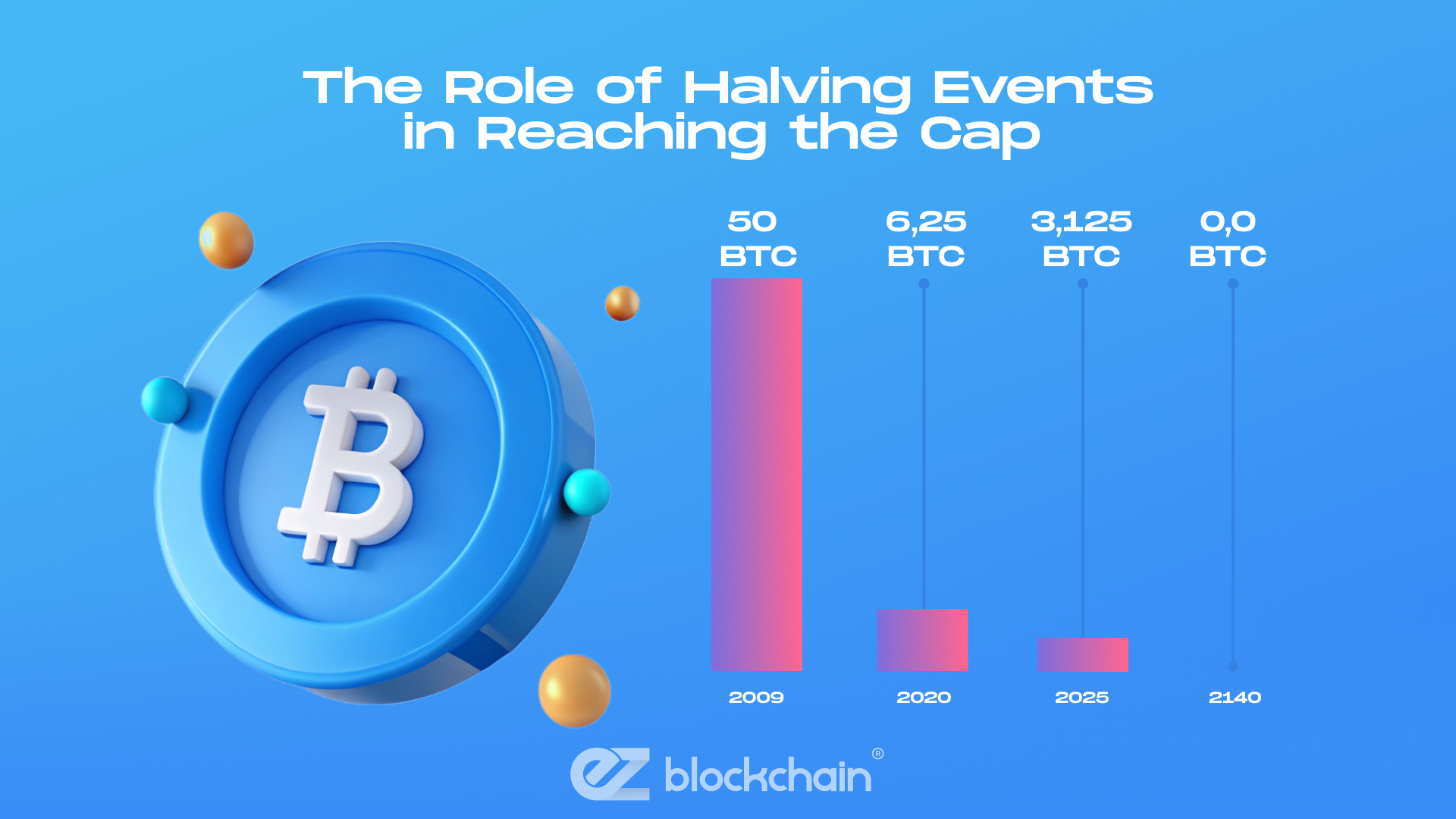

The Role of Halving Events in Reaching the Cap

Bitcoin halving events occur approximately every four years, reducing block rewards by 50%. These events slow the pace of new Bitcoin issuance until the cap is reached.

Key Points:

- Initial Reward: 50 BTC per block in 2009.

- Current Reward: 6.25 BTC per block (as of 2020 halving).

- Final Reward: Block rewards will reach zero around 2140.

Halvings contribute to scarcity while making mining profitability increasingly reliant on transaction fees.

What Happens When All Bitcoins Are Mined?

When will all bitcoins be mined? When the final Bitcoin is mined around the year 2140, the network will transition from a dual-reward system—comprising both block subsidies and transaction fees—to a fee-only model. This shift is a fundamental aspect of Bitcoin’s design, ensuring that the supply remains capped at 21 million coins, as intended by its pseudonymous creator, Satoshi Nakamoto. Currently, approximately 93.3% of all Bitcoin have been mined, with the remaining 6.7% to be mined over the coming decades [5].

In the post-mining era, miners will rely entirely on transaction fees for revenue. The sustainability of this model hinges on the continued demand for Bitcoin transactions. If transaction volumes remain high, fees could provide sufficient incentives for miners to maintain network security. However, if transaction activity declines, it may challenge the viability of the network’s security model. Therefore, the future of Bitcoin’s security and miner incentives will depend on its adoption as a medium of exchange and store of value [6].

No New Bitcoin Creation: The End of Mining Rewards

Once 21 million coins are mined, no new Bitcoin will be created. This eliminates block rewards as a source of miner income.

Transaction Fees as the Primary Incentive for Miners

Miners will rely solely on transaction fees to secure the network. As transaction volume increases, fees are expected to become a sustainable incentive.

How Bitcoin Miners Will Adapt

Miners must shift from reward-based incentives to fee-based income models. Adaptations may include:

- Efficiency Optimization: Investing in energy-efficient mining rigs.

- Fee Market Participation: Competing for higher transaction fees.

- Diversification: Some miners may move to other cryptocurrencies for profitability.

“Long-term miner sustainability depends on a robust fee market that incentivizes

continued network security“

Furthermore, an analysis by Bitfinex underscores the importance of a healthy fee market in sustaining Bitcoin’s security budget. The study notes that as the block subsidy diminishes, the network’s reliance on transaction fees intensifies. A robust fee market ensures that miners remain incentivized to secure the network, thereby preserving Bitcoin’s decentralized nature and resistance to attacks.

These findings emphasize the critical role of a dynamic and efficient fee market in Bitcoin’s long-term sustainability. Without adequate transaction fees, miners may lack the necessary incentives to continue securing the network, potentially compromising its integrity and resilience.

Impact on Bitcoin’s Value and Market Dynamics

- Supply and Demand: With no new supply, scarcity may drive value higher if demand persists.

- Investor Behavior: Increased long-term holding (HODLing) could reduce liquidity.

- Market Stability: Bitcoin may act more like digital gold.

Will Bitcoin Still Be Secure After 21 Million?

Network security will depend heavily on transaction fees and node participation. As long as users continue to transact and pay fees, miners have incentive to secure the blockchain.

Security Factors:

- Nodes: Independent nodes validate and enforce rules.

- Transaction Fees: Sustain miner participation.

- User Base: Growing adoption strengthens security through demand.

Economic Implications of a Fixed Supply

- Deflationary Pressure: Scarcity may cause Bitcoin’s purchasing power to rise over time.

- Comparison to Gold: Bitcoin could solidify its role as “digital gold.”

- Global Finance: Fixed supply challenges traditional inflation-based monetary systems.

Bitcoin’s Role in the Broader Financial System

As adoption grows, Bitcoin could serve as:

- A hedge against inflation.

- A global reserve asset for institutions.

- A decentralized alternative to fiat-based systems.

The Future of Bitcoin Mining

Even when will last bitcoin be mined, mining remains essential for processing transactions.

Miners will:

- Secure the blockchain through proof-of-work.

- Rely on transaction fees for profitability.

- Continue innovating in hardware and energy use.

| When will all BTC be mined? | ||

| Aspect | Current State | After 21M Cap |

| Block Rewards | 6.25 BTC per block | 0 BTC (fees only) |

| Miner Incentives | Block rewards + fees | Fees only |

| Supply Growth | New BTC mined every 10 minutes | Fixed at 21 million BTC |

| Value Dynamics | Inflationary + deflationary mix | Pure scarcity-driven |

| Security Model | PoW + block rewards | PoW + transaction fee sustainability |

In summary, the transition to a post-21 million Bitcoin world represents a fundamental shift in the network’s economic and security dynamics. Miners will no longer receive newly minted BTC as block rewards, relying entirely on transaction fees to maintain profitability. This change will make fee structures and market demand critical drivers of miner behavior, directly influencing the security and stability of the network.

At the same time, Bitcoin’s fixed supply will solidify its scarcity, potentially enhancing its value proposition as a store of wealth. However, the shift from an inflationary-deflationary mix to pure scarcity also means that network participants must carefully consider transaction fee models and incentives to ensure continued decentralization and robust security. Ultimately, the post-cap era will test the resilience of Bitcoin’s protocol and the adaptability of its economic model.

Conclusion

The question of what happens when all Bitcoins are mined is central to Bitcoin’s future. While when will Bitcoin hit 21 million is estimated around the year 2140, the transition from block rewards to fee-based incentives will redefine miner economics. The scarcity of a bitcoin cap limit ensures its long-term value proposition, while continued innovation in mining, nodes, and fee structures will safeguard its security.

For miners looking to adapt to this shift, platforms like EZ Blockchain provide real-time performance tracking, fee monitoring, and profit calculation tools that can help optimize operations in a world without new Bitcoin creation.

Ultimately, Bitcoin’s fixed supply may strengthen its role in the global economy as a store of value and a hedge against inflation, even as miners adapt to a world without new Bitcoin creation.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.