Stay up to date with the latest news, announcements, and articles.

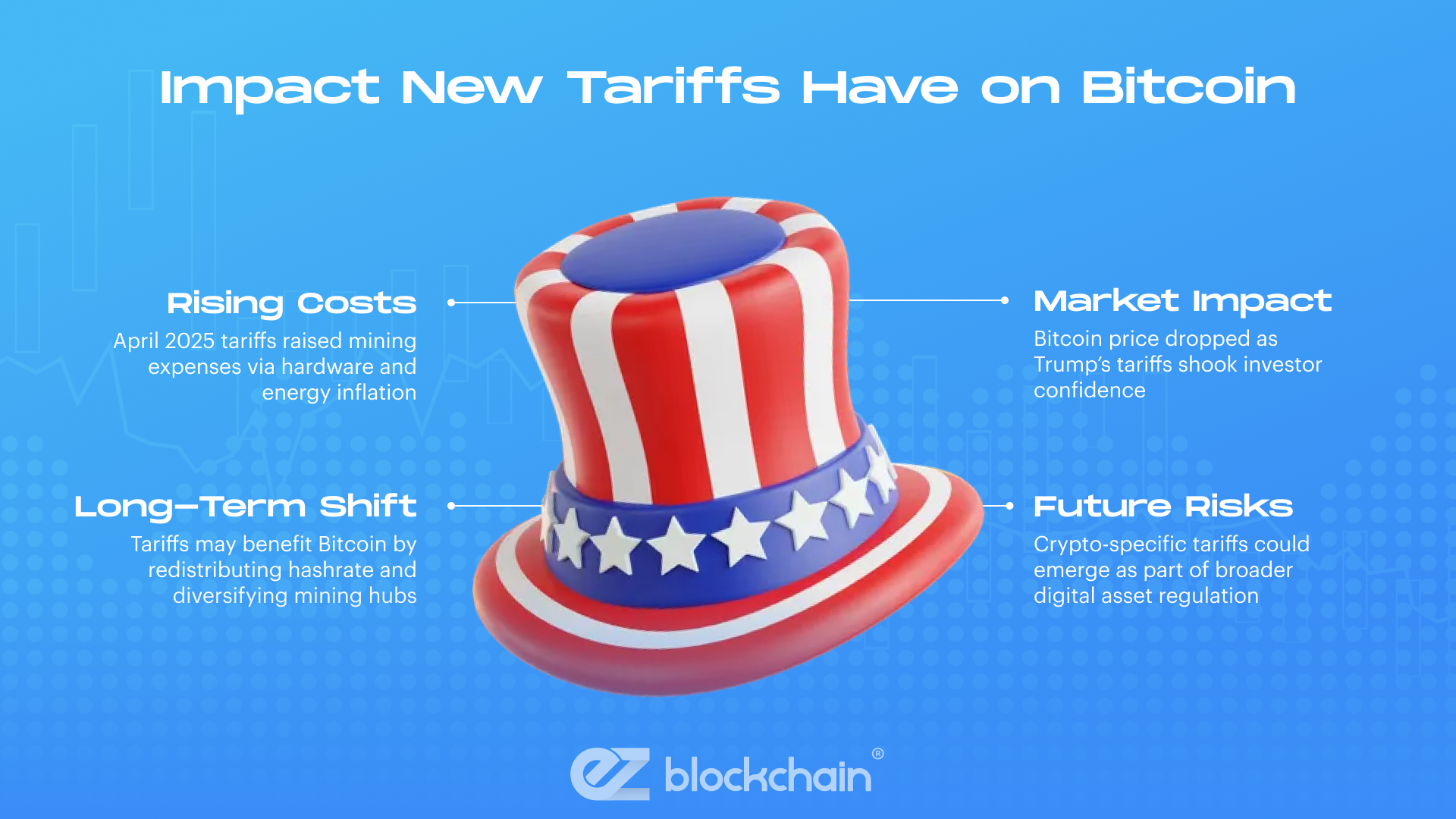

Before diving into details, here’s some heads-up for you: sweeping new tariffs announced in April 2025 have driven up costs for mining hardware and energy, squeezed margins for U.S.‑based miners, and injected fresh volatility into Bitcoin markets.

In fact, what we are witnessing right now is a real test of Bitcoin’s worth and reliability as a decentralized store of value — the true and promising non-fiat crypto currency.

More so than that, however, this is a test for miners across geographies and preferred types of hardware, who should be fast to diversify their mining operations in line with the times.

Takeaways:

- April 2025 tariffs have materially increased mining costs through hardware duties and energy price inflation.

- Bitcoin falls as Trump tariffs rattle markets, showing the direct effects of tariffs on crypto markets.

- The Bitcoin network may come out the winner in the long term, benefitting from redistributed hashrate and diversified mining geographies.

- Crypto enthusiasts should stay prepared for emerging risks, including potential crypto‑specific tariffs as governments look toward digital‑asset regulation.

Why Tariffs Are Back in the Global Spotlight in 2025

It’s difficult to pinpoint what exactly brought us to this point or swayed Mr. Trump to emphasize on global tariffs — America’s intensifying geopolitical tension? Post-pandemic effect on international supply chains? These and other major events had their effects, of course.

A lot of things piled onto each other, which reignited the trade tensions in early 2025 when governments all over the world were faced with nationalist economic policies that were a bit out of line, to say the least.

U.S. President Donald Trump’s decision was to impose broad‑based reciprocal tariffs — against China at 125% and a baseline 10% on most imports from other countries, including the EU locations.

On top of tons of immediate market turbulence, this stimulated new concerns about imported inflation and global supply disruptions. It’s important to note that, in the midst of all the commotion, major central banks warned that Trump’s extreme measures threatened to worsen inflationary pressures and slow the President’s own country’s economic growth.

Whether the new tariff situation is an elaborate part of Trump’s aggressive economic politics, a short-sighted decision of a desperate leader, or something else entirely — the best thing we all can do right now is to stay in the know.

Let’s now inspect what exactly you should know and expect, and, most importantly — how will tariffs affect Bitcoin?

What Are the Latest Tariffs and Who Do They Target?

Staying in tune with the tariff dynamics is the first thing we should prioritize. Among other things, this will help us welcome change in all arms and calculate the Trump tariffs’ impact on Bitcoin.

Here are summaries of the tariffs imposed by Trump and retaliatory measures of other countries.

New U.S. tariff measures

- Baseline tariff: A 10% levy on all imports effective April 5, 2025, under a national‑emergency declaration.

- Reciprocal tariffs on China: Escalated to 125% on select Chinese‑origin goods, including mining rigs and components, amid unresolved trade disputes.

- Electronics exemptions: Smartphones, computers, and certain semiconductor devices were carved out to mitigate consumer pain, though ASIC miners remain subject to tariffs.

EU measures

In response to U.S. actions, the EU faces a 20% U.S.-imposed tariff on its exports (notably impacting machinery and chemicals). As a major counter-measure, the EU is also looking to increase limits on U.S. exports of steel and aluminum.

While a forced measure in nature, the only immediate result we’re seeing from that are growing trade risks, especially in Atlantic-bound supply chains.

China measures

Beijing retaliated by maintaining and expanding duties on U.S. agricultural goods and energy products. China also enforced more restrictions and limits in their export controls on rare‑earth minerals, which are crucial for electronics manufacturing worldwide.

Again, while retaliatory, these moves and decisions put more pressure still on all niches that rely on chip manufacturing and mining‑hardware flows.

All of the above means that, yes, unfortunately Bitcoin isn’t safe from the effects, and we’re to see more of Trump tariffs’ impact on Bitcoin price. This stems mostly from the rehauled conditions in hardware markets.

Let’s take a look.

Sectors Impacted: Semiconductors, Energy, and Electronics

Due to President Trump’s sudden levy decisions, semiconductor companies like Nvidia and ASML saw industrial-grade losses in billions of dollars, due to the blockage on selling AI chips to China. All thanks to intimidating chip-specific levies and new export curbs that made semiconductor stocks drop in a major way.

Energy prices spiked as markets priced in slower global growth and supply‑chain constraints. Major hardware and software providers fed into electricity cost pressures, especially in energy‑intensive industries. It goes without saying that this has a direct effect on Bitcoin mining, which requires stable, powerful flows of energy to power operations.

“The last frontier” of niches affected by the tariffs, if we may say so, is electronics, where a bunch of exclusions were issued by the White House — the so-called “carve-outs” intended for the sake of global economic balance.

These carve-outs intend exemptions (under increased trade duties) for the following types of semiconductor electronics:

- Smartphones

- Flat-screen displays & TVs

- Laptop computers & parts

- Desktop PCs and workstations

- CPUs, motherboards, memory chips

- Hard disks & storage media

- Discrete chips & integrated circuits

Exemptions are temporary — U.S. Commerce Secretary Howard Lutnick confirmed that electronics will face separate Section 232 or national‑security tariffs in the near future.

Video game consoles remain classified outside the “electronics” carve‑out (treated as “toys”), and remain covered by all the duties.

How New Tariffs Affect Bitcoin Mining Costs

It all comes down to the main subject of discussion — the connection between the new tariffs and Bitcoin, direct effects on the main crypto network, and future predictions.

Rising Prices of ASIC Miners and GPUs due to Import Restrictions

With China, Malaysia, and Thailand facing 25–125% tariffs on mining equipment, the spot price of high‑end ASICs jumped by as much as 30% in the first week of April. This made miners rush shipments out of Asia before duties took effect.

Bloomberg reported that U.S. miners scrambled to be the first to pre‑position new Antminer S21 fleets ahead of the tariff deadline. This shows exactly how easily hardware delays can translate directly into lost revenue and other unwanted prospects.

Higher Energy Prices and Their Effect on Mining Profitability

Electricity, already the largest cost point for miners, became more expensive because tariffs on energy exports and industrial inputs drove up power‑plant fuel prices. Regions with low overnight tariffs (e.g., $0.03–$0.05/kWh) retained a relative stability, but many U.S. miners saw costs climb to $0.08–$0.10/kWh, which stifled their profiting margins in a major way.

Miners in the U.S. vs. Miners in Asia

U.S.-based facilities that locked in long‑term power contracts managed to bear through the price shock better than smaller Asian farms that deal with both rising local energy rates and equipment import duties. Still, Asia remains dominant in raw hashrate, inspiring some operators to shift rigs to more favorable jurisdictions before the reciprocal tariffs become even more stringent.

Supply Chain Disruptions and Equipment Shortages

Then, we also have supply chains. The tariffs basically induced new pipeline bottlenecks and left many small‑scale miners waiting weeks to receive replacement ASIC modules. This scarcity inflated secondary‑market prices. But, more importantly, it forced a number of owners to put their rigs on hold, with the resulting downtime not only spawning money losses, but also slowing down global hashrate growth and affecting network difficulty.

Bitcoin’s Price Reaction to April 2025 U.S. Tariffs

Bitcoin price reaction to Trump tariffs demonstrates the leading crypto’s sensitivity to macro trade policy shocks. Namely, following the April 2 tariff announcement, Bitcoin’s price dipped from $105,000 to a low of $92,000 — a 12% drop. It then partially recovered as the market priced in potential tariff suspensions on Canada and Mexico.

However, these volatility spikes reflected the broader risk‑off sentiment. In particular, market players and stakeholders repositioned their sales strategies and offers ahead of potential policy rollbacks. This made the trading volumes surge, and dangerously so, what in such unstable conditions.

Impact on Bitcoin Trading and Market Sentiment

The Bitcoin price reaction to US tariffs April 2025 have spawned tariff-driven uncertainty in digital‑asset markets, too: open interest in Bitcoin futures fell 18% in the week after the announcements. However, premium levels for Bitcoin in the U.S.-based exchanges widened. Ultimately, this signalled higher risk aversion and hedging costs.

Despite this turbulence, some long‑term investors perceived this pullback as a buying opportunity. In fact, retaining authority under such challenging macro conditions, Bitcoin plays a historical role of an inflation hedge, and can even become a mediator in this whole “tariff war” thing.

Could Tariffs Accelerate Bitcoin’s Global Decentralization?

High‑cost U.S. mining may motivate rig owners to shift geographically, toward regions with favorable energy prices and free‑trade agreements. Thus, we may see most of the world’s generated hashrate potentially move to Canada, Iceland, or parts of Scandinavia.

Over time, this redistribution could help further diversify the network’s power base away from any single jurisdiction. In turn, this will reinforce Bitcoin’s censorship resistance and global decentralization ethos, growing and stabilizing Bitcoin future price as well.

Regulatory Risks: Are Crypto Tariffs Next?

The big question on everybody’s mind right now is whether we’ll see new tariffs emerging dedicated especially to crypto regulations?

With policymakers already leveraging tariffs as an economic weapon, some analysts believe that specialized crypto duties could emerge next. These could be targeted at existing exchange platforms or mining equipment imports, creating another layer in an already complex economic stand.

There is no visible jurisdiction yet for digital‑asset‑specific tariffs and any tangible concept of “Bitcoin tariffs” is far from existence. But the influence of global economics shifts on the network creates the precedent that calls for regulatory fragmentation in the crypto space.

_________________________________________________________________________

When it comes to such major shifts in market economics, it’s crucial to stay informed and prepared. Contact specialists at EZ Blockchain to get help fending off new tariffs, consult your next crypto mining steps, and build a cost-effective rig!

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.