Stay up to date with the latest news, announcements, and articles.

While there are many available cyber protection methods out there, for crypto asset security, a more traditional, even basic approach can be best. Routinely overlooked due to the abundance of technology, a cold wallet can safeguard digital assets immutably.

But let’s figure it out in more detail. What’s a cold wallet? Do you need to get one? And how does a cold wallet work to boost the safety of crypto in particular?

What is a Cold Cryptocurrency Wallet?

Crypto wallets are no novelty these days. Even a person who doesn’t necessarily own one probably manages finances digitally in some way or another. With both fiat and crypto finances stored, managed, and traded online being a total norm, hackers and digital thieves of all sorts gain more ways to potentially put their malicious hands on your assets. And they get this opportunity simply by going online.

You use a cold wallet when you store cryptocurrency in a place that’s completely offline — no connection to the web whatsoever. This isolation of valuable assets helps to fully avoid the risk of hacking or unauthorized access. Ultimately, this is where the old but true way is probably the best way, what with all the volatility of the crypto market and a range of threats lurking online.

Core concept

As opposed to hot wallets (online crypto wallet solutions), cold wallets have two basic advantages that make them so relevant for today’s crypto holding practices — offline storage of assets and the solid security of holdings stemming from that.

Cold wallets store your private keys — essential for accessing and transferring crypto — on devices or paper, which aren’t online or digitized at all. Without an online connection, the wallet is immune to common online threats like phishing, malware, or remote hacking. But there’s more.

Why cold wallets are considered the safest option

Despite a huge progress of the latest crypto protection mechanisms, traditional, cold crypto wallets remain the most foolproof storage method, for a bunch of reasons. By minimizing the exposure of your wallet to any third parties, you get to completely avoid cyber attacks, cutting down malicious intentions of hackers and scammers at the root.

Storing all your data secrets and keys offline is a sure way to get past all the common vulnerabilities of digital and online environments. And even if your connected device or online account is compromised in any way, a cold wallet will remain untouched.

How Does a Cold Wallet Work?

A “cold wallet” is more of a format than a definition of a certain type of storage as is. You can turn any offline device, ledger, or even a piece of paper into a cold wallet. The main principle is that only you can access it, and none other than physically, by hand.

Crypto assets are defined by secret keys, and by storing these keys outside of web-connected systems, you isolate this highly sensitive, confidential information used to authorize the cryptocurrency for access and transactions.

The tricky part

The tricky part of managing cold wallets is keeping the keys untouched by the Internet on all ends. But what is cold wallet’s use when transfers must still happen online, you may ask? If you need to conduct a transaction, you’ll have to put some extra effort into keeping the keys fully offline.

But it’s more than doable. Namely, you need to:

- turn off the web connection completely

- sign the transaction offline

- once signed, re-connect and go online

- finish the transaction online

This way, your private keys will stay outside of the web’s reach and won’t be processed by any online intermediaries.

Types of Cold Wallets Explained

Cold wallets can vary in format, shape, and function as far as the imagination goes. From specialized offline apps to classic notebooks and ledgers to more intricate yet effort-intensive ways, crypto keys can be preserved via a bunch of practical solutions.

With the cold wallet meaning out of the way, let’s take a look at the essential options we get.

Hardware wallets

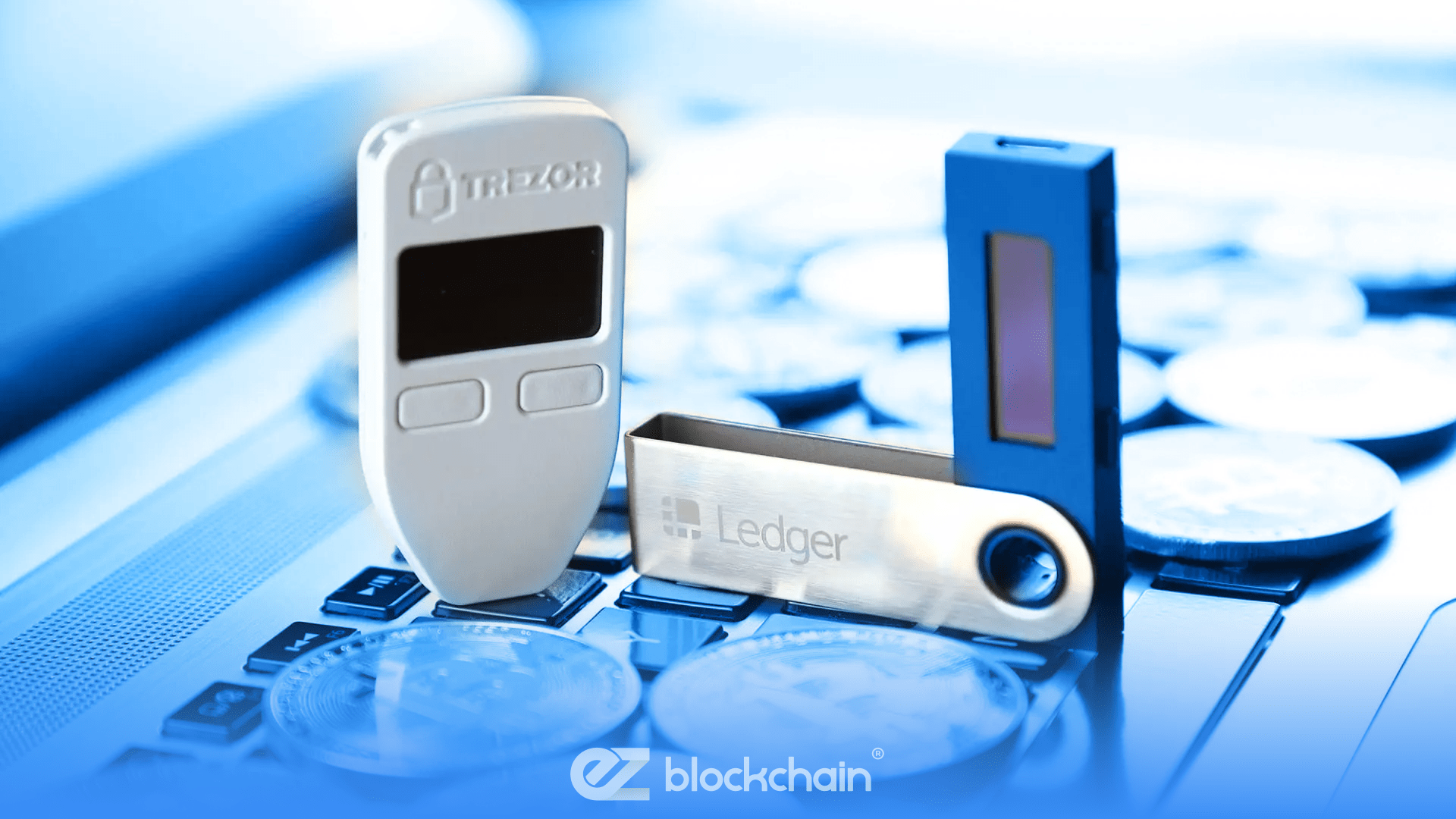

First off, you can use any physical device with space available to hold data and store your private keys beyond the network’s reach. The most basic and widely-used example is a simple USB stick. You can also use spare hardware, like old flesh drives, mobile phones and devices, and external HDDs or SSDs, throwing a text file on it and letting it rest securely offline.

There are also specialized apps that help automate the offline-based transaction process while keeping it fairly manual. For instance, you can automate transfers with the help of Ledger or Trezor, making sure that once connected to a computer or smartphone, the USB stick signs the transaction internally without exposing the keys.

Paper wallets

Yes, keeping records purely on paper is still one of the best, most reliable backups, especially when it comes to crypto. So take an extra mile and make physical printouts or handwritten copies of your public and private keys.

The keys themselves can be generated offline and written on paper or printed out. In this way, to transfer a crypto, you simply have to manually specify the keys in a software crypto wallet.

The only downside here is that you have to be extra careful with all your sheet records because paper can be easily lost, damaged, or destroyed. You need to make sure to maintain careful handling and storage.

Air-gapped computers

Last but not least, you may have an old, unused computer laying around, or you can invest and get a separate cheap machine dedicated to holding key data, for that matter. Just make sure to keep this PC, Mac, or laptop air-gapped.

An air-gapped computer is a type of machine that has never gone online. Not even once, which ensures there is no possible way to access the data and any other stuff it stores.

Thus, you get to store and manage private keys completely offline. Just launch an air-gapped PC or laptop when you need to sign a transaction, then finish the transfer by other means. For extra security, you can:

- Sign the transaction offline

- Transfer it via a QR code

This is a go-to method for high-net-worth crypto holders looking for some extra firm crypto protection.

Pros and Cons of Cold Wallets

However inherently safe and non-accessible by third parties they may be, cold wallets still have both beneficial and weak points to them. It’s important to know all aspects to weigh out your options and boost your crypto key storage security knowingly.

Pros

- Reinforced security

Since you generate and store crypto keys purely offline, you get to dramatically lower or fully avoid the risk of online hacks and malware attacks. - Long-term storage

If you are holding large amounts of cryptocurrency and you don’t plan to transact it any time soon, a cold wallet is a perfect solution to just let it rest safely. - Control over keys

With a cold wallet used to conduct end-to-end offline transactions, you retain full ownership and control of your private keys, avoiding third-party custodians.

Cons

- Convenience sacrifices

You may have to put a bunch of manual effort into managing keys entirely offline, which can make transactions a bit more longer and cumbersome. - Risk of physical loss

Devices or paper can be lost, stolen, or damaged, and you won’t get your keys back unless you’ve taken care of sufficient backups. - Added complexity

Installing the wallet software, taking care of copies and devices, and managing an air-gapped computer may require you to go an extra mile or two.

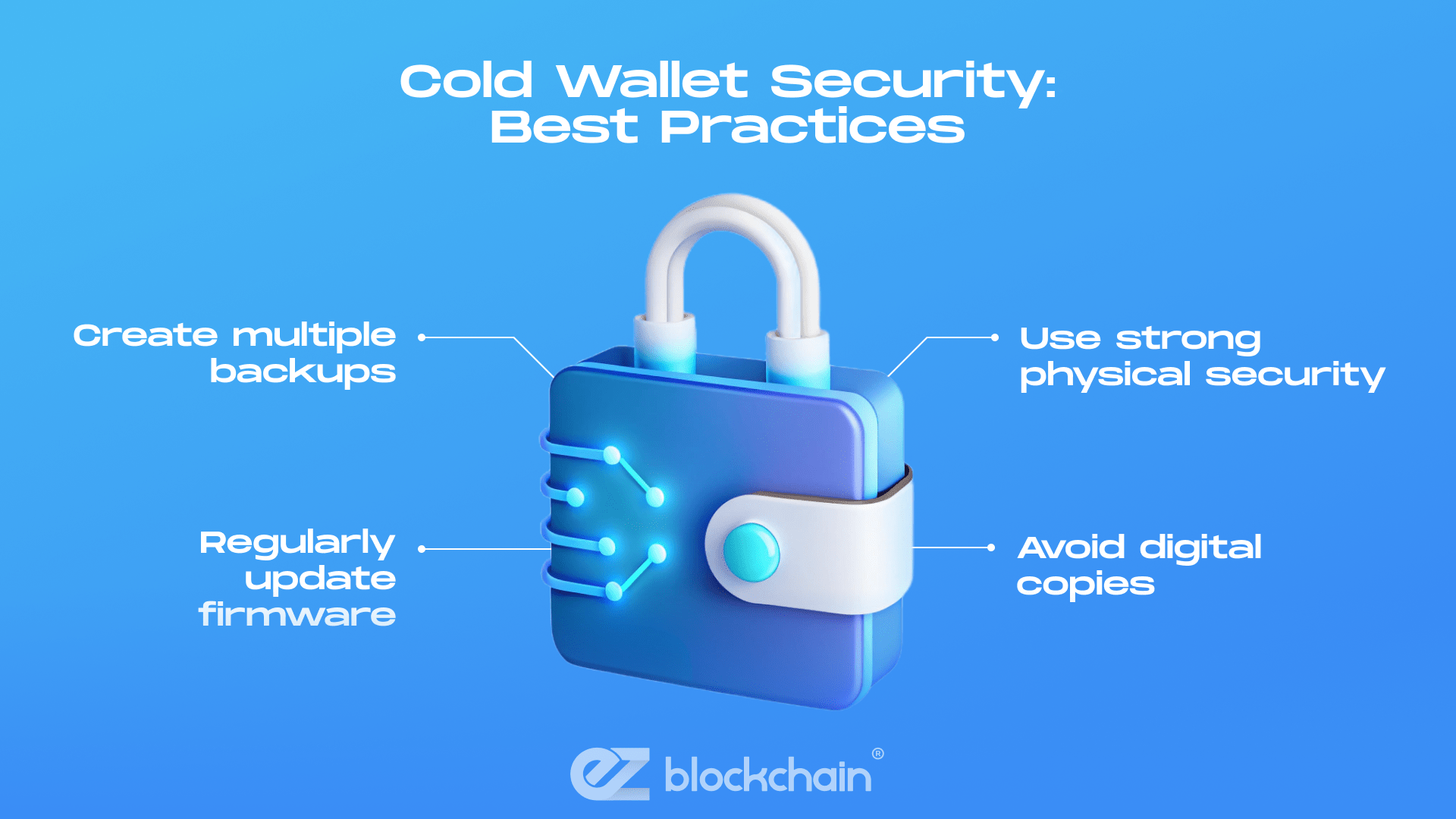

Cold Wallet Security: Best Practices

As you can see, there are still possible dangers and flaws to the cold wallet and offline key storing approach. But you can boost the safety of your cold wallet by tapping into these best practices:

Create multiple backups

Make sure to always have extra backups of your private keys kept in different locations, preferably offline ones.

Use strong physical security

Store hardware wallets and paper records in a safe or bank vault, especially if your assets are formidable.

Regularly update firmware

For hardware wallets, make sure to keep the device’s firmware updated, to benefit from the latest security patches.

Avoid digital copies

Forget about digital files or cloud storage services when it comes to storing crypto keys — any of those can easily leak or get hacked.

Who Should Use Cold Wallets?

A cold wallet method is something you should consider if you’re into crypto at all. Whether you trade, mine, or simply hold cryptocurrency assets, cold wallets will help safeguard them in an immutable fashion.

Of course, such wallets can also serve as perfect backups or additions to hot wallets, existing storage systems, and various other software solutions related to crypto.

As for the core audience of users, cold wallets come in best for anyone looking to store major amounts of cryptocurrency, particularly for long-term investment. This may include:

- High net-worth holders

Cold wallets are a necessity for anybody holding large crypto portfolios that require a respective level of protection. - Institutions and enterprises

Companies that require secure storage for reserves and internal digital assets should certainly dedicate to cold wallets. - Investors not requiring frequent transactions

If you’re holding crypto as a long-term investment rather than for daily trading, a cold wallet is a must. - Security-conscious enthusiasts

Anyone prioritizing security and not shying away from some extra steps to boost it should consider cold wallets.

Still need clarifications on what is a cold cryptocurrency wallet or how does cold wallet work? Contact EZ Blockchain to get a personal consultation and full assistance in launching and managing crypto solutions of any size and purpose!

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.