Stay up to date with the latest news, announcements, and articles.

Let’s get the answers about the Bitcoin mining future in this overview.

Cryptocurrency Price Crash

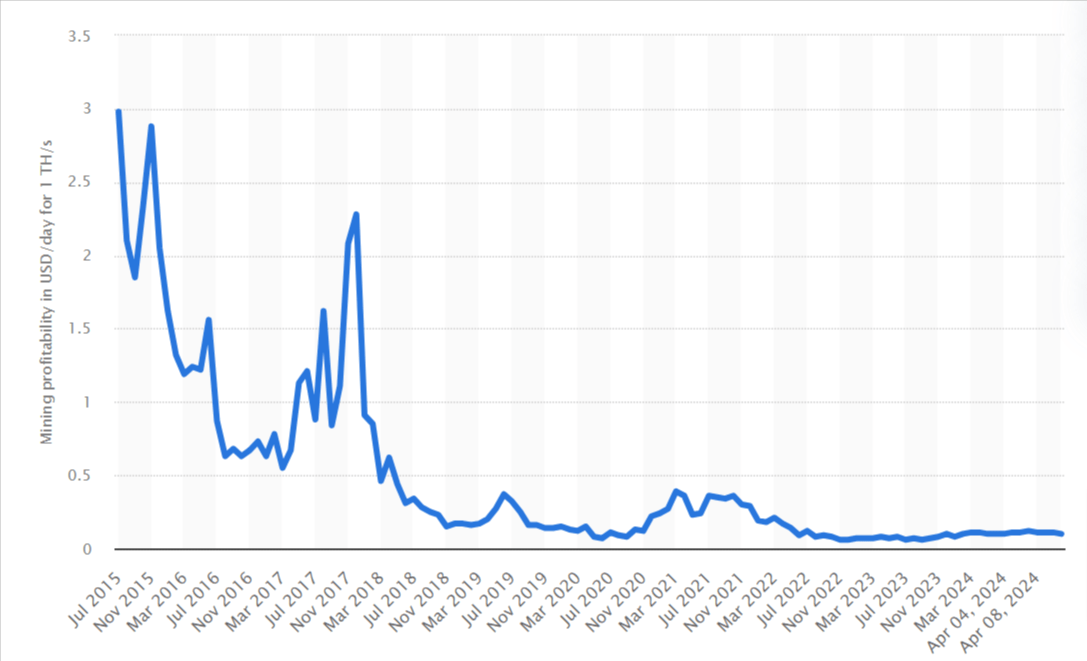

The crypto market is generally highly volatile, and instances, when Bitcoin and altcoins’ values came tumbling down, are still vivid. When will Bitcoin stop mining? This question arises as miners face increasing operational Bitcoin mining price and diminishing rewards. When Bitcoin’s price decreases, miners’ revenues are also significantly affected.

Ordinarily, miners receive rewards for mining a block successfully in Bitcoin. The amount of reward decreases periodically, with the most recent reduction happening on April 20, 2024. Will Bitcoin mining be profitable after halving? Bitcoin mining cost after halving now about 3.125 BTC per block, a reduction from the former 6.25.

With this reduction, miners are now raking in about $196K per block of Bitcoin mined, down from $390K before halving, with Bitcoin’s price of $63K. Consequently, miners are at a higher risk of running at losses from 2024 should Bitcoin’s price start dropping. In 2022, the crypto market encountered its worst crypto winter, sending Bitcoin’s value down more than 60%.

The market trend was blamed on the prevailing economic crisis and the downfall of the FTX. The economic crisis’s effects included skyrocketing energy prices, which rendered Bitcoin mining unprofitable. Many Bitcoin miners closed operations, while others filed for bankruptcy. Notably, this was not the first instance, as the crypto market is generally volatile. However, a repeat of an economic crisis would definitely have more lethal impacts on the future of Bitcoin mining, especially with the reduced mining rewards.

For miners, it’s a question of whether the amount earned from the rewards meets their operational costs. According to some of the most recent reports, the average cost of mining 1 BTC now stands at $53,000. Therefore, for miners, their mining operations will no longer be profitable if Bitcoin falls below the $53K mark, unless they adopt more innovative and efficient solutions.

High Energy Costs

Bitcoin mining is a highly energy-intensive process. Besides investing in costly equipment for their mining setup, miners have to meet energy expenses, which form the greatest part of Bitcoin mining’s operational costs. Because of the mining process’s power-hungry nature and varying power costs, miners’ profitability remains threatened.

Generally, electricity prices range between $0.1 and $0.2 per kilowatt hour in most states in the US. However, with the rapid shift to renewable energy for Bitcoin mining and the rise of crypto mining hosting solutions, miners enjoy pretty much lower energy costs falling between $0.06 and $0.09 per kWh. But still, these power rates do not guarantee profitable mining.

For instance, if you were to mine at an average cost of $0.08 per kilowatt hour, it means Bitcoin’s price must remain above a certain range for your mining operations to be profitable. Assuming you have 10 S19 Pro miners with 110 Terahashes total and a power consumption of 3250 watts. With this setup, Bitcoin mining will only be profitable after halving if Bitcoin’s value remains above $35K, according to our profitability calculator (which is in testing mode). The daily profit will, however, be low at $5.57, according to the Nicehash profitability calculator. However, for a miner enjoying better energy rates of $0.06 per kWh, the mining setup will only become unprofitable if Bitcoin’s value falls below $25K.

Mining Difficulty

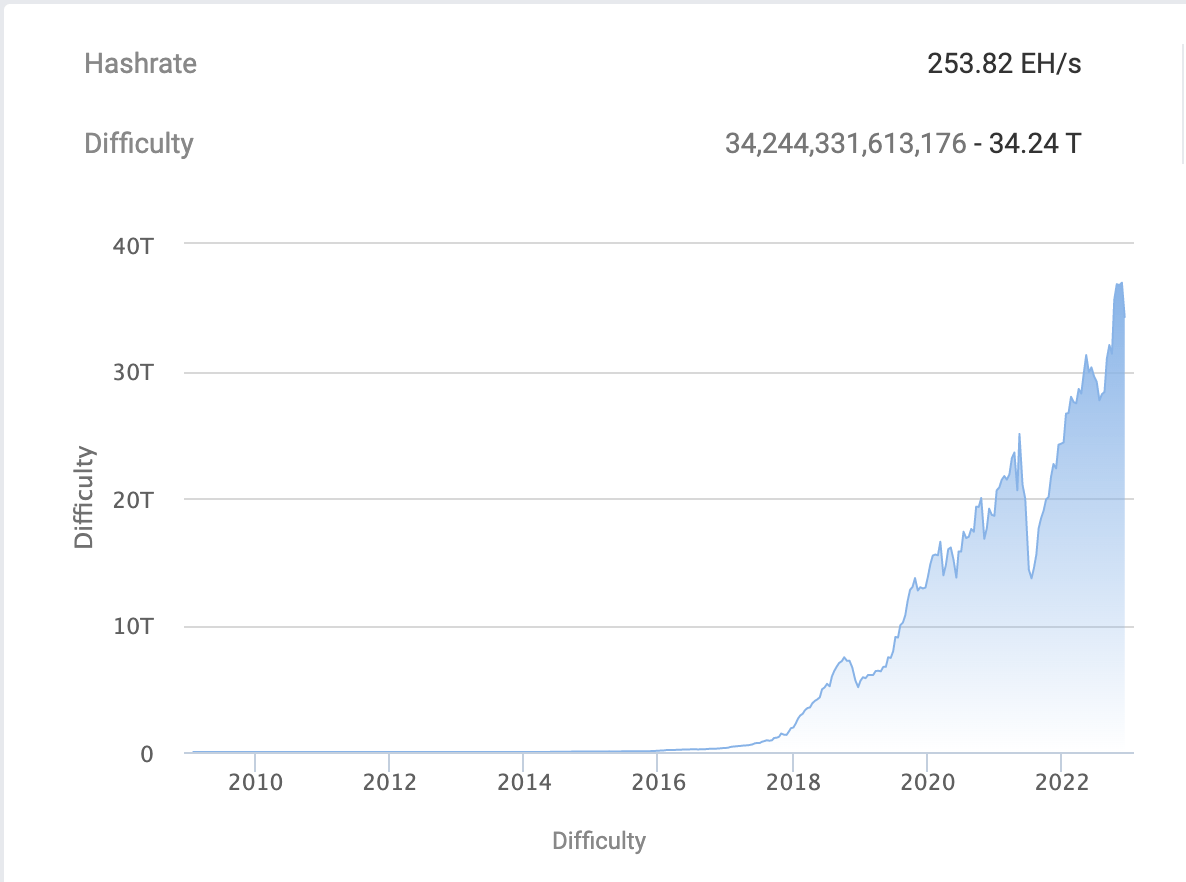

Bitcoin’s clever design includes a self-adjusting mining difficulty. The dynamic of this mechanism facilitates the creation of new blocks roughly every 10 minutes. Regardless of the constant changes in the technological power dedicated to mining, new blocks emerge at an expected pace. The rewards associated with mining encourage more people to join the industry daily. The more people join the higher the rise in the computational power a miner requires. This surge is triggered by an automatic difficulty increase, which results in the machines requiring even more processing power to solve the intricate cryptographic puzzles that confirm transactions.

Source:

As the difficulty increases and block rewards decrease, when will Bitcoin stop mining? Some speculate that mining will become unfeasible long before the last Bitcoin is mined in 2140. The future of cryptocurrency mining depends on technological advancements, lower energy costs, and innovations in mining hardware. Until then, miners must constantly adapt to changing market conditions to remain profitable.

While this rising difficulty reinforces the security of the Bitcoin network and shows its increasing adoption, it also presents quite a challenge for individual miners. With fewer Bitcoins awarded as block rewards, miners find it challenging to maintain good profits. This harsh reality incentivizes a continuous arms race for the most powerful and efficient mining hardware, further inflating operational costs.

The issue particularly affects smaller miners. They struggle to compete with larger players wielding the latest technological advancements. This trend could lead to an important alliance within the mining industry. Soaring energy costs and increasing mining difficulty could eventually lead to smaller miners dropping out of the mining game.

Regulatory Changes

Cryptocurrencies are all about decentralization, which means governments cannot control them as easily as regular banks and other financial institutions. This causes a strain between old rules and new ones, leaving miners stuck in the middle. Governments can use multiple approaches to regulating cryptocurrencies. In a worst-case scenario, they might implement a ban on mining activities in their country, shutting down the entire industry. They could also create very strict rules and regulations that make it hard for miners to make a profit.

The problem is, that these rules can be changed at a moment’s notice, which makes it risky for investors to put money into mining operations. They cannot predict the future of their operations because they don’t know what the rules will be tomorrow. For example, The European Union in 2023, came up with its own set of regulations on Bitcoin mining operations. Advocates argued that these rules were intended to protect consumers and prevent criminals from exploiting cryptocurrencies for illegal activities.

However, opponents pointed out that the same rules would further complicate matters for miners, imposing additional costs and bureaucratic obstacles. This would make it more expensive to mine Bitcoin to a point where the business would not attract any profits.

Countering Challenges and Embracing Innovation in Bitcoin Mining

So far, the Bitcoin mining business is facing difficulty in its operations. However, some methods are being applied to combat these challenges. These include:

Technological Advancements

Advancements in technology are resulting in significant improvements in mining operations. Better hardware and software could make mining more efficient and even change the way it’s done altogether.

- ASIC Miners: According to a recent report, the ASIC S19 Pro miner provides the quickest returns on investment for miners who invest in wind power plants for Bitcoin mining. ASIC miners are known for their excellent hash rate (around 110 TH/s for the S19 Pro) and relatively low power consumption (around 30 J/TH). These miners are much faster than older mining rigs and use less energy to get the job done. They are the best options for miners seeking high levels of operational efficiency to increase their profits and remain profitable during bearish markets.

- Hardware Optimization: Even with ASIC miners, there’s always room for improvement. Manufacturers are constantly making advancements to chip designs and coming up with new ways to keep things cool. For example, some miners are dipped in special liquids to help them get rid of heat more effectively. Hence, they use less energy overall.

- Second-Layer Solutions: The Bitcoin network can sometimes get overloaded, so the Lightning Network was created to help. It takes care of smaller transactions, letting miners focus on bigger ones that make them more money. Other new technologies, like Taproot and Schnorr signatures, could also make mining more efficient and secure.

By using better hardware and these new technologies, Bitcoin mining can become eco-friendlier and more profitable. In the future, these advances could even reduce the total amount of energy needed to run the Bitcoin network.

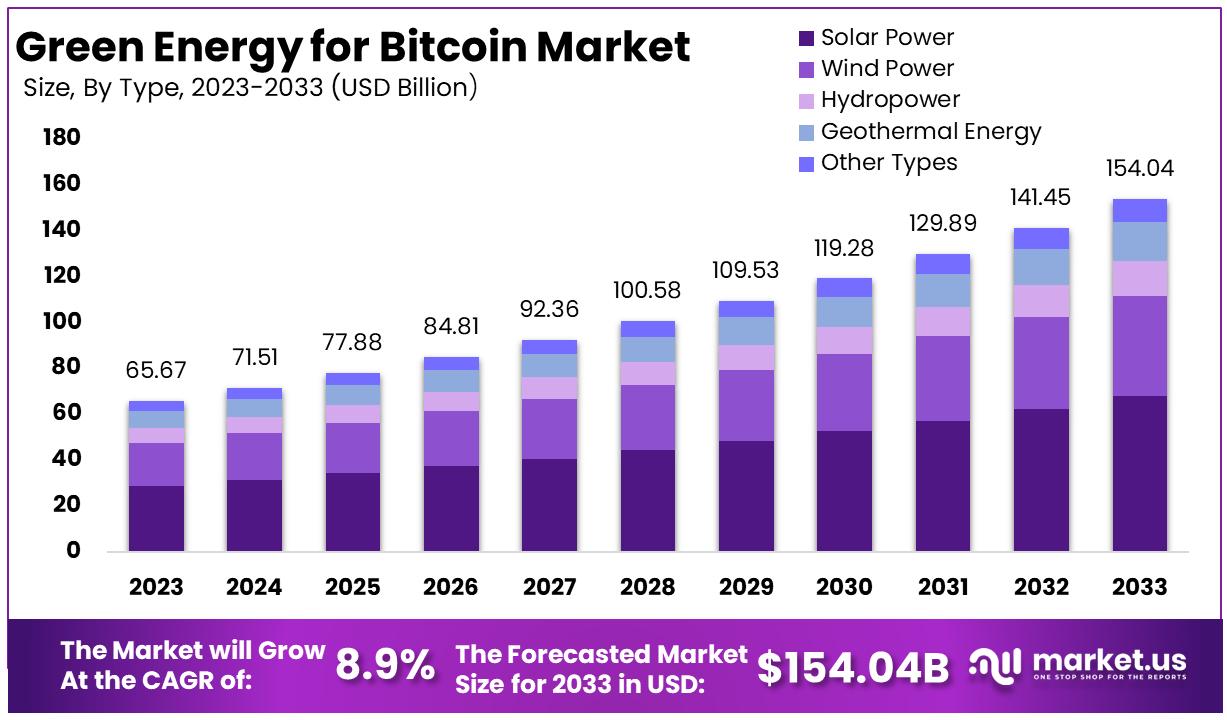

Renewable Energy Integration

One of the biggest complaints about Bitcoin mining has been how much it hurts the environment. All the energy needed to run mining machines has people worried about climate change. To be more eco-friendly and reduce their carbon footprint, miners are increasingly using renewable energy sources. These include solar panels, hydropower, and wind turbines are becoming common sights at mining facilities.

This shift towards renewable energy helps the environment by reducing the impact of Bitcoin mining. It also protects miners from the ups and downs of traditional energy prices. When the cost of fossil fuels goes up and down, it can make a big difference in how profitable mining is. By using renewable sources, miners can stabilize their operating expenses and have a better idea of how much they will spend.

Regulatory Clarity

Clear rules from lawmakers and miners working together are key to creating a friendly environment for mining businesses. By talking to policymakers in advance and following the best ways of doing things, miners can avoid problems with regulations more easily. This teamwork can not only protect their profits over time but also help make Bitcoin mining more sustainable overall.

Summing Up

Bitcoin mining profitability is a subject of many variables. From the energy costs, deployed hash rate, and mining difficulty, miners have to factor them in when determining the viability of their business. However, with energy being the most crucial concern, it’s easy to overlook some of these other factors. But looking at the power demands, miners still have to assess their individual needs depending on the number of mining rigs they have, their power ratings, and their miner uptime.

So, what is the answer to the question of “Will Bitcoin mining become less profitable?” For now, it’s hard to tell when exactly Bitcoin mining will become unprofitable. Miners only have to watch the signs and note when the revenues fall close to the expenses. Besides, some miners operate more efficiently than others, so even when the price of Bitcoin falls below $53K, miners with innovative and highly efficient mining setups and access to cheap alternative energy may still be in business.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.