Stay up to date with the latest news, announcements, and articles.

This Bitcoin adoption will certainly send new waves of pro-crypto sentiment, which will touch every other major country. Following the example, big nations like China and the United Kingdom are expected to launch new crypto initiatives and regulate their crypto reserves. But how much crypto must each of those countries manage?

More interestingly, which country has the most Bitcoin? We’ll try to answer this by exploring how those holdings were accumulated, and what they reveal about the priorities and vulnerabilities of those nations. But first:

How Bitcoin Holdings Are Tracked

Tracking which country owns the most Bitcoin is pretty difficult in our case, since we are dealing with the scale of sovereign holdings. But we’ll try — first, we need to trace the available sources of BTC holdings statistics or reports of any sort.

For now, the only available sources include:

- Public records and disclosures

Governments sometimes report the crypto that they either seized, purchased, or held and acquired via official channels. Such reports can include court documents or parliamentary disclosures. E.g., post-court reports on forfeited assets can provide some numbers.

- Blockchain analysis

The addresses of certain government and institutional blockchain wallets can be traced and analyzed to gain some statistics. For this, you can use specialized chain-analysis tools, reposts of crypto seizures or scams, or forensic work. For example, when funds are seized, the addresses may become public and hence traceable.

- Third‐party aggregators and research firms

There are readily available services and platforms that can be used to track Bitcoin treasuries or government holdings based on publicly visible addresses and events. To name a few: Bitbo (BitcoinTreasuries.com), Visual Capitalist, CoinGecko, Arkham Intelligence..

- Mining disclosures or national investment strategies

In a few cases, governments either mine Bitcoin directly or have state-owned companies that mine it. Thanks to investment disclosures and contractor reports, their mining output and/or purchase policies should be public or semi-public, offering useful statistics for research.

Limitations of Public Data

One of the main challenges in researching Bitcoin holdings by country (and trying to count crypto in general) is that we don’t get much public-access information or statistics. Due to the decentralized, consensus-based mechanism of the BTC blockchain, publicizing any internal data can be problematic.

But even when you know where to dig, there are more difficulties that you can encounter trying to find out what country has the most Bitcoin, including:

- Ambiguity of crypto ownership

We are seeking “government” status BTC wallet addresses for research, but the addresses don’t always map cleanly to the “government” ownership. Some wallets may be held by state‐owned enterprises, local agencies, or may have mixed ownership. - Lack of disclosure

Many governments do not publicly disclose their crypto assets in full capacity, or any at all. Some of what is reported comes after seizures; some comes via leaks or investigative journalism. In any case, there is a severe lack of disclosure when researching the countries buying Bitcoin. - Timing and price fluctuations

Due to Bitcoin’s high price volatility, once you convert BTC holdings into USD (or other currencies), you can get absolutely different value figures based on the date of the BTC purchase and conversion. Also, holdings may be moved, sold, or lost and not updated in trackers. All of this adds to the difficulty of our research. - Seized vs. strategic vs. operational holdings

Some holdings come through law enforcement seizure (when the crypto is seized from the fraud schemes, darknet, or scams). Others are strategic reserves or investments. Varying categories of holdings further complicate our research. - Hidden or cold storage

Some government wallets are in “cold” storage, which makes them less visible. So neither hackers nor analysts can always trace and attribute them correctly. - Lost coins

Some holdings are permanently lost, e.g., because the private keys were simply lost and forgotten. Such keys, however, still count on the chain, even if they’ll never be moved. The apparent governmental crypto holdings may thus look inflated as compared to the reality.

Top Countries by Bitcoin Holdings

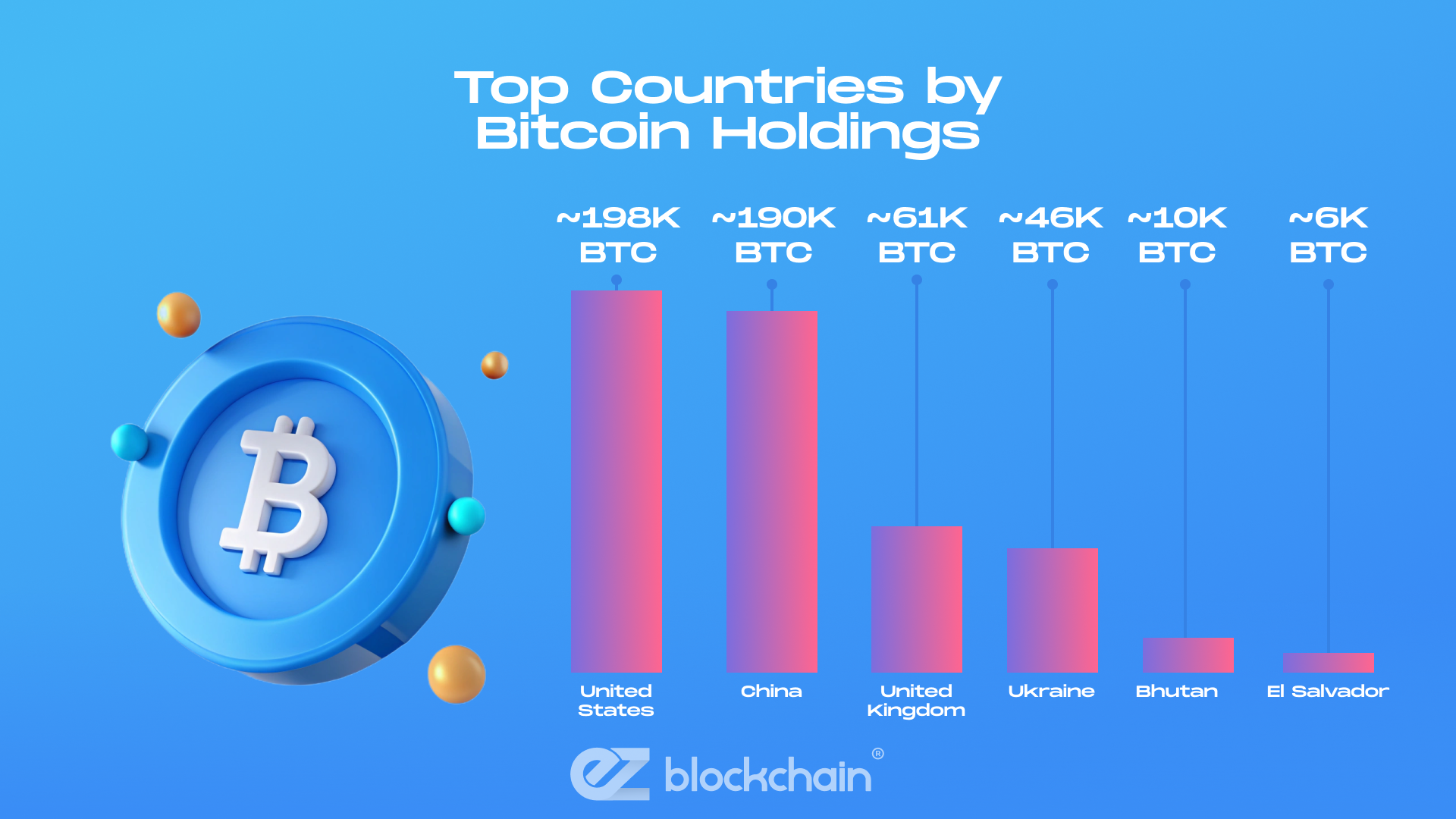

While it can definitely be difficult to trace which government owns the most Bitcoin, we’ll still try to give you some approximate figures. Here are the leading governments by known Bitcoin holdings as of mid-2025.

| Country | BTC held (approx.) | Estimated value |

| United States | ~198,000 BTC | USD ~$20–25 billion, depending on BTC price |

| China | ~190,000–194,000 BTC | Similar magnitude in dollars to the US, depending on BTC price |

| United Kingdom | ~61,000+ BTC | ~6–7 billion |

| Ukraine | ~46,300 BTC | ~5 billion+ |

| Bhutan | ~10,000–13,000 BTC | Over US$1 billion at current prices, depending on exact amount and BTC price used |

| El Salvador | ~6,200–6,300 BTC | Several hundred million USD, depending on BTC price (~US$700–$750 million in some reports) |

| Finland, Georgia, etc. | Much smaller amounts (tens to low hundreds of BTC) | Minimal in comparison to top hodlers |

Now, let’s take a look at each location individually.

United States

The US leads the government-status crypto race, with approximately 198,000 BTC in government-controlled or government-seized holdings. Many of these bitcoins come from law enforcement seizures (silk-road, fraud cases, darknet markets, etc.). There is ongoing discussion about making these holdings more formally part of national reserves rather than letting them sit idle or liquidating them. For this, the US government announced a “Digital Fort Knox” style reserve, which may help consolidate the country’s accumulated crypto.

China

How much Bitcoin does China own exactly? We probably don’t know, but it is near the top by volume. Much of China’s known BTC holdings stem from criminal scheme seizures, especially the PlusToken Ponzi scam. However, the country’s official stance on owning or publicly regulating any crypto remains contradictory: while private crypto ownership or trading has been banned, not much is known about what China may be doing with its holdings.

European countries

The United Kingdom is among the top European Bitcoin countries for the crypto acquired via seizures. Finland, Georgia, etc., hold much smaller amounts. For example, Finland, reportedly, holds around 90 BTC, and Georgia holds around 66 BTC. All in all, there’s less evidence of European governments treating Bitcoin as part of central bank reserves or strategic reserves (at least publicly).

Other notable locations

Bhutan is very notable because it used its hydropower capacity to mine Bitcoin, acquiring over US$1B in BTC holdings as a result. In Ukraine, national crypto holdings are boosted by now-traditional nationwide donations, plus possibly some strategic accumulation. Given unstable circumstances, these holdings are more volatile in how and when they’re used.

Factors Influencing Bitcoin Ownership

Trying to figure out what country owns the most Bitcoin, it’s hard not to wonder — Why do some countries end up holding more BTC than others? In fact, several underlying factors shape this, including:

Economic and political stability

Countries that are facing currency inflation, economic uncertainty, or capital flight incentives are more likely to consider Bitcoin or other cryptos. They could perceive it either as a preservation tool or hedge asset that can save them from inflation through the expansion and diversification of assets.

Regulatory environment

If a country officially allows Bitcoin ownership, trade, mining, or even accepts it legally, some of the existing crypto friction will be slowed down. The demand may drop as the crypto becomes more widely available. On the other hand, bans or heavy restrictions (as in parts of China, for retail trading) make crypto accumulation more difficult (except via seizures or illicit pools).

Technological adoption and infrastructure

A country can accumulate more crypto funds if the local electricity is cheaper, there is a stable power supply, the climate is cooler, and mining hardware is accessible. How much the country regulates, audited, and invests in crypto initiatives also shapes how much crypto can be owned locally..

Strategic reserve policy or national finance strategy

There are also countries that openly consider Bitcoin as part of their reserve diversification. Does the US government own Bitcoin exactly for that? You guessed right. Other countries accumulate it for ideological, financial, or geopolitical reasons.

Impact of Large Holdings on the Global Market

Last but not least, it is important to know that any large sovereign or quasi-sovereign holdings of Bitcoin make for more than just statistics or country-wide crypto sentiments. The biggest BTC holders influence the entire global market in major ways. Here’s how:

- Supply exposure

When a government holds a substantial amount of BTC, any further decisions, either to sell it or hold it, affect the big market’s sentiment. People that know that a formidable portion of supply is “locked up” can have different scarcity perceptions.

- Regulatory signaling

Governments that are eager to hold Bitcoin are often a step away from shifting policies or nationwide currency acceptance. This can result in more regulation, more institutional trust, and boosted BTC distribution.

- Geopolitical implications

Holding large amounts of Bitcoin may become part of financial sovereignty narratives. It could be used (or threatened to be used) as leverage, or as part of a hedging strategy against sanctions, currency devaluation, or foreign exchange risks.

- Impact on adoption

Government holdings can legitimize cryptocurrency to a wider population, boosting trust, infrastructure investments, and possibly overall usage.

Got more questions? Contact EZ Blockchain to consult your next step in setting up passive crypto mining profits via hosted miners.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.