Stay up to date with the latest news, announcements, and articles.

The Evolution of ASIC Mining

The trajectory of bitcoin mining hardware has followed a predictable but relentless curve: from CPUs to GPUs to FPGAs and finally to ASICs built specifically for SHA-256. Early ASICs in 2013 delivered only modest advantages over FPGAs, but constant miniaturization and voltage scaling pushed them into dominance. As an example, early ASICs operated at ~68 J/TH; by the mid-2020s, top miners were reaching into the 10–20 J/TH range.

With each generation, improvements came in three dimensions: (1) more efficient fabrication nodes (e.g. 5 nm, 3 nm) enabling lower voltage and leakage; (2) architectural optimizations in the hash core pipeline, memory routing, and voltage domains; (3) auxiliary enhancements in cooling, binning, redundancy, and control logic. The cumulative effect is that each successive ASIC model must deliver a nontrivial leap in hash-per-watt just to justify the investment, as network difficulty and competition also escalate.

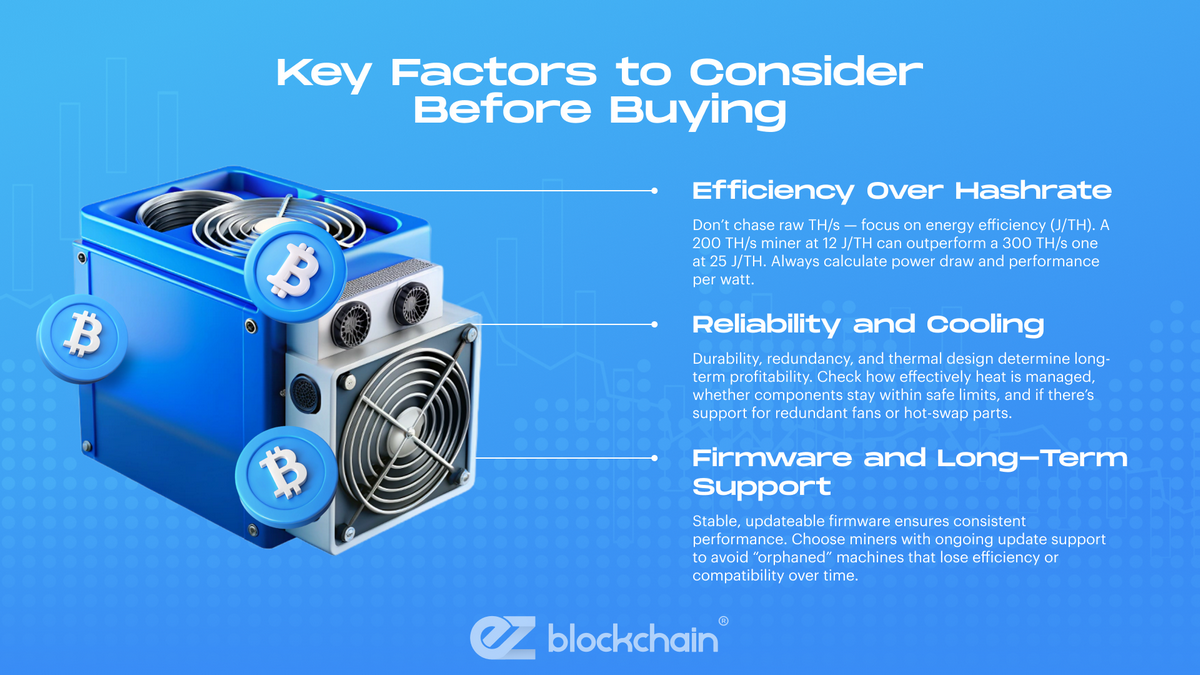

Key Factors to Consider Before Buying

Prior to selecting or purchasing an ASIC mining rig, it’s critical to vet the hardware across multiple technical vectors. A failure in any of these dimensions can undermine profitability or stability.

First, efficiency (J/TH) often matters more than raw hashrate. A miner with 300 TH/s but 25 J/TH will frequently be outperformed by a 200 TH/s unit at 12 J/TH under realistic electricity pricing. Always calculate expected kWh draw and compare throughput per watt.

Second, durability, redundancy, and cooling architecture are paramount when running 24/7 in harsh conditions. A rig that fails or requires frequent servicing is a profit leak. Evaluate how heat is removed, whether boards operate at safe temperature margins, and whether the design supports redundant fans or hot-swap hash boards.

Third, firmware, control logic, and update support can define usability over time. Many miners run for years, with firmware patches addressing stability, error correction, and frequency tuning. Machines that become “orphaned” without updates tend to degrade or lose compatibility with newer mining ecosystems.

Top ASIC Models to Watch in 2025

In 2025, the competition is concentrated in a few high-end models from Bitmain, MicroBT (WhatsMiner), and new entrants. Below is a quick overview followed by a comparative table of the top machines to watch:

Recent launches show Bitmain pushing the S21 series aggressively—the Antminer S21 XP and S21 Pro aim to capture high-end farm deployment, while variants like S21+ and base S21 offer balanced performance. On the alternative side, MicroBT’s WhatsMiner M50S++ and M60S+ are appearing in spec leaks and profitability indices as contenders. Additional models like Antminer L9 (for Scrypt coins) and ElphaPex DG1+ (a newcomer in the ASIC space) round out the top picks.

Of these, machines like Antminer S21 XP already push the ceiling of farm-grade performance, while S21 Pro and S21+ strike a practical balance for operators deploying at scale. The WhatsMiner models remain credible alternatives, especially in scenarios with optimized firmware and good board availability. Check out the recent mining hardware.

Antminer S21 XP

The Antminer S21 XP is Bitmain’s flagship next-generation SHA-256 ASIC that (in its hydro-cooled variant) delivers up to ~473 TH/s with a power draw of ~5,676 W, achieving ~12 J/TH efficiency.

Antminer S21 Pro

The Antminer S21 Pro is tuned for high throughput with solid energy trade-off: ~234 TH/s at ~3,510 W, resulting in ~15 J/TH efficiency.

Antminer S21+

Bitmain’s Antminer S21+ model offers ~216 TH/s with ~3,564 W consumption (≈ 16.5 J/TH) according to recent leaks.

Antminer S21

The base Antminer S21 remains a solid workhorse: ~200 TH/s at ~3,500–3,551 W, giving ~17–18 J/TH in real world operation.

Antminer L9

Although not for SHA-256, the Antminer L9 remains relevant for Scrypt-based coins (Litecoin, Dogecoin). It delivers ~16 TH/s at ~3,360 W, making it highly inefficient when viewed in SHA-256 terms—but in its niche it can still yield ROI where LTC/DOGE pricing is favorable.

ElphaPex DG1+

ElphaPex DG1+ is an emerging ASIC contender whose specs are not fully public yet, but it’s positioning itself toward ultra-dense hashboard modularity and competitive efficiency. Consider it for speculative orders or pre-shipping deals if their design meets advertised metrics.

WhatsMiner M50S++

The WhatsMiner M50S++, while not fully documented in public leaks, is expected to push above previous MicroBT thresholds. Observers expect optimized board design and firmware to drive it toward double-digit J/TH performance if hardware yield allows.

WhatsMiner M60S+

The WhatsMiner M60S+ spec, as captured by HashrateIndex, lists a hashrate range of ~170–186 TH/s, at ~3,441 W consumption, around ~18.5 J/TH efficiency.

Performance and Efficiency Comparison

When comparing ASIC miners, two metrics dominate: throughput per watt (i.e., J/TH or W/TH) and density of deployment in a given footprint (i.e., how many units you can stack or rack). The more efficient a miner is, the longer it remains competitive as network difficulty rises and electricity costs become the marginal limiter.

Machines like S21 XP (hydro) currently lead in efficiency at ~12 J/TH, making them ideal for large-scale operations chasing maximal returns per watt. Lower-tier air-cooled rigs (S21, S21+, S21 Pro) tend to land in the 15–18 J/TH window, which still remains in the range of viable profitability in regions with favorable electricity or subsidized rates.

Below is a simplified comparison of key models (some values approximate or inferred from leaks):

| Model | Efficiency (J/TH) | Hash Density & Footprint Notes | Ideal Deployment Use Case |

| S21 XP (hydro) | ~12 | High packaging density, liquid loop integration | Large-scale farms with infrastructure |

| S21 Pro | ~15 | Standard rack spacing, moderate cooling overhead | Mid-tier cluster nodes |

| S21+ | ~16.5 | Compact, lower heat load | Edge or localized farms |

| S21 | ~17–18 | Baseline air-cooled option | Entry or balancing role in fleet |

| M60S+ | ~18.5 | Known MicroBT rack density | Reliable mid-class alternative |

| L9 | Very high (for Scrypt) | Low density, high power draw | Specialty Scrypt deployments |

Even though absolute hash rate matters, the operating margin (hashrate minus power cost) is what ultimately drives ROI. Efficiency gaps of just 2–3 J/TH can translate into tens of USD difference per unit per month in high-power datasets.

Profitability and ROI Expectations

In 2025, miners must accept that profitability is a function of not just hardware but electricity cost, network difficulty trajectory, and BTC price volatility. Under those assumptions, the best units (e.g. S21 XP) can recover capital in 12–18 months in favorable jurisdictions; lesser units might stretch to 24 months or become unprofitable.

“Modern ASICs are efficient enough that, with electricity prices between $0.05–$0.08/kWh, they can generate solid daily returns.” Sazmining [2]

As an example: at $0.07/kWh, an Antminer S21 Pro may generate $35–$40 per day (gross) before difficulty rises — though this number is speculative and dependent on BTC price. Meanwhile, less efficient legacy hardware (e.g. older S19 series) may still be nominally profitable (~$10–$12/day) but lack the margin to contend with difficulty escalations.

Where to Buy Reliable ASIC Miners

When sourcing ASIC mining hardware, reliability, warranty, and legitimacy matter at least as much as specs. That is where EZ Blockchain can be a trusted resource. As a specialized distributor built on servicing mining operations, EZ Blockchain offers verified inventory, serial-number validation, warranty support, and advisory services for deployment.

Buying directly from manufacturers often requires bulk orders, long lead times, and restricted regional distribution. Meanwhile, some retail marketplaces carry counterfeit or “used/burned-out” units. A partner like EZ Blockchain adds assurance (e.g. tested units, return policies, repackaging, and shipping tracking).

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.