Stay up to date with the latest news, announcements, and articles.

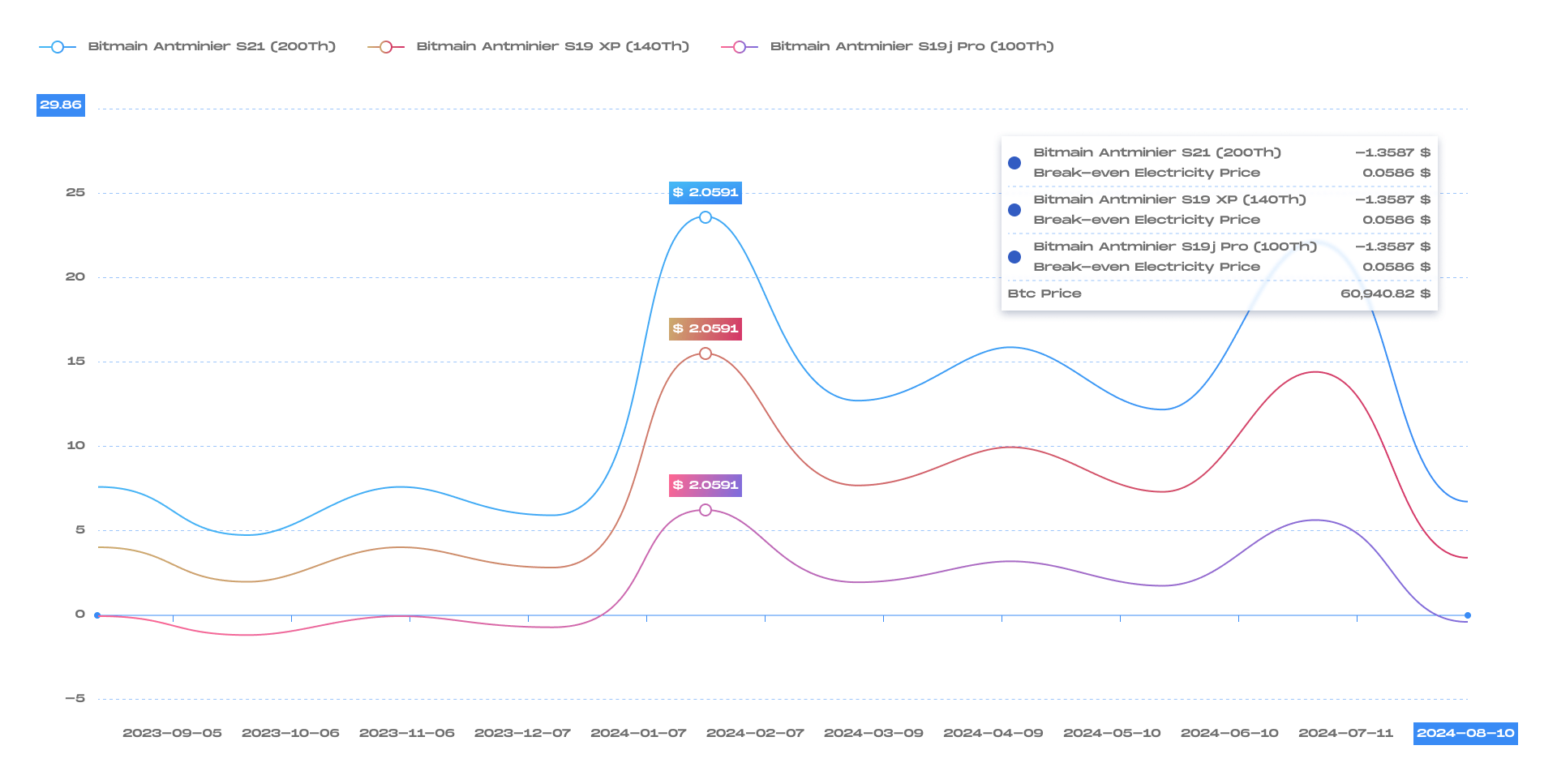

At $0.075/kWh the Popular Bitmain S19j Pro is mining at a significant loss (source: Lincoin Lens)

To assess whether mining is a viable option for you, it’s crucial to evaluate profitability. Profitability is influenced by both revenue and costs. In mining, revenue is affected by several key factors: the price of the coin, the network’s hashrate, block rewards (which include both the block subsidy and transaction fees), and the efficiency of your mining equipment.

Costs can be divided into two categories. The first is the initial investment, or capital expenditure (CapEx). If you are using hosting services, this typically includes the cost of the ASIC miner along with any additional expenses like shipping and setup fees. The second category is operational expenses (OpEx), which encompass ongoing costs such as electricity, maintenance, repairs, and security. For those utilizing hosting services, these operational costs are often bundled into a single hosting service fee.

In essence, profitability is determined by subtracting costs from revenue. However, in the world of crypto mining, this calculation is not straightforward due to factors beyond miners’ control, such as the price of coins and block rewards. Let’s delve into the calculations and answer the question: “Is crypto mining still profitable?”

Calculating Profitability in Crypto Mining

Finding the most profitable crypto to mine and, in general, profitability in crypto mining involves comparing your revenue with your expenses. Here’s how to calculate the revenue and expenses:

Calculate Revenue

Determine how much crypto you expect to mine over a given period. This depends on your the algorithm you mine, mining hardware’s hashrate, the network’s total hashrate, and in the case of Bitcoin the network difficulty. Estimate the revenue by multiplying the amount of Bitcoin mined by the current or projected Bitcoin price.

The hash rate measures the processing power of your mining equipment, expressed in hashes per second (H/s). Depending on your equipment, it can range from kilo hashes per second (KH/s) to exa hashes per second (EH/s).

Originally, GPUs were introduced to tackle the growing complexity of crypto mining. The first instance of Bitcoin mining with a GPU occurred in October 2010, leveraging the parallel processing capabilities of GPUs to solve cryptographic puzzles faster and more efficiently. The main advantage of GPUs lies in their ability to handle multiple operations simultaneously, and miners can even use multi-GPU rigs to increase performance. Modern GPUs can deliver up to 2,000 times the hashing power of a 20-kilohash CPU miner. However, as mining competition in Bitcoin has grown, GPU miners are not able to compete with ASIC Bitcoin miners. ASIC stands for Application-Specific Integrated Circuit, meaning that the device is built with a single purpose: to solve Bitcoin’s Proof of Work (PoW) algorithm, known as SHA-256, as efficiently as possible. An ASIC miner is a specialized piece of hardware designed specifically for mining Bitcoin.

A simplified way to calculate revenue for Bitcoin is to use an indicator called hashprice. Hashprice shows how much a miner can expect to earn in USD ($) per Petahash (PH/s) of computing power per day. This is a function of network difficulty, block subsidy, transaction fees, and Bitcoin price. Hashprice is measured in $/PH/Day.

Calculate Expenses

The operational expenditure will depend on the type of mining business you run – actually, this will give you valuable insights related to the question: “Is mining Bitcoin still profitable?” If your mining hardware is running at a hosting facility, the OpEx can be as straightforward as the hosting fee and repair costs.

When you operate your own data center infrastructure, the expenses consist of different types:

- Operating Expenses (OpEx): Day-to-day costs of running a business (e.g., rent, energy bills, salaries, office supplies).

- Non-operating Expenses: Costs not related to core business operations (e.g., interest expenses, losses on asset sales).

- Depreciation and Amortization: Allocation of the cost of tangible and intangible assets over their useful lives.

Power consumption, the electricity each mining rig uses, has the biggest impact on operational expenses. If a rate is not fixed, GPU mining profitability can vary due to fluctuating energy prices. Measured in watts (W), power consumption is a key factor in determining the efficiency of a mining setup. While the power usage for a single miner might seem negligible, it quickly adds up with tens or hundreds of units running simultaneously. More miners lead to higher hashing power and a better chance of mining more Bitcoin. However, this poses a challenge for GPUs. Although GPUs generally have lower power requirements than ASICs, achieving competitive computing power requires deploying many units, which can result in even higher energy consumption overall.

Electricity costs are a critical factor for miners, as mining is energy-intensive and power bills often represent the largest expense. The cost per kilowatt-hour (kWh) directly impacts profitability, which is why many Bitcoin mining colocation services use power rates as their primary pricing model. Although GPU miners typically consume less power than ASIC miners, the need to run more GPUs—and the associated cooling systems—drives up energy costs, reducing the overall efficiency and profitability of GPU-based setups.

Payback Period or ROI in Days

To calculate the Return on Investment (ROI) in days, you need to determine the time it takes for your investment to generate a return equivalent to the initial investment. This is often referred to as the “payback period.” Here’s how you can calculate it:

- Determine Initial Investment (CapEx): This is the total amount spent upfront to start the mining operation (e.g., cost of mining hardware, setup fees).

- Calculate Daily Net Profit: Daily Revenue – Daily Expenses.

- Calculate Payback Period (ROI in Days): ROI in Days = Initial Investment / Daily Net Profit.

Is GPU Mining Still Profitable?

Most crypto investors now prefer highly efficient ASIC miners, which raises an important question: Are GPUs becoming obsolete in crypto mining? Is GPU mining still profitable?

In GPU mining, miners use specialized computer hardware known as graphics cards or graphics processing units (GPUs). These devices enable them to verify transactions on blockchain networks like Bitcoin’s, earning rewards when they successfully solve complex mathematical computations.

By utilizing multiple GPUs, miners can significantly increase the computing power of their setup, improving their chances of being the first to verify a block. However, this approach also comes with downsides: it consumes large amounts of electricity and generates considerable heat, requiring substantial investment in specialized cooling infrastructure.

Unlike ASICs, which are purpose-built for mining specific cryptocurrencies like Bitcoin, GPUs are more versatile and can mine a variety of coins. This flexibility has traditionally appealed to miners who want to diversify across different cryptocurrencies, especially during the early days of altcoins. However, several factors have impacted the profitability of GPU mining over time, including rising competition and technological advancements. Additionally, cloud mining has emerged as a budget-friendly alternative, allowing miners to purchase hashing power from established mining farms without the need to own and maintain physical equipment. So, let’s delve into the question: “Is mining crypto still profitable?” a little bit deeper.

GPU Miners Only Option is Alt Coins

Now let’s try to answer the question: “Is crypto mining profitable?” in the context of the GPU. One of the aspects that made GPU miners attractive to miners is their ability to adjust and mine more than one crypto coin. Since the introduction of the ASIC miners, GPUs cannot mine bitcoin competitively anymore. As a result, investors shift to other coins they can still mine profitable. Joining mining pools can help GPU miners maximize their earnings when mining altcoins by sharing rewards and reducing risks.

However, Bitcoin remains the most valuable cryptocurrency, so most investors will always choose Bitcoin over altcoins. It has the highest market capitalization and a relatively high trading volume compared to most altcoins and is still the best crypto coin to mine when you have the right setup.

Determine Goal

Before clarifying the answer to the question: “Is Bitcoin mining still profitable?”, it is crucial to determining your goal when investing in Bitcoin mining. It helps you tailor your strategy, manage risks, allocate resources effectively, and measure your success. Different goals lead to different approaches, time horizons, and expectations, influencing decisions on hardware, energy costs, and operational scale. Here are some potential goals:

- Fiat profit maximization.

- Acquire coins below market price.

- Diversification of an investment portfolio.

- Contribute to the security and decentralization of the Prrof of Work coins.

- Learn about mining and blockchain technology through hands-on experience.

Different goals require different levels of investment in hardware, software, and infrastructure. Clear goals help in assessing and managing risks, such as market volatility, regulatory changes, and operational challenges. Your objective influences operational decisions, such as whether to reinvest profits into new equipment or hold mined coins. It also affects your approach to cost management, including electricity costs and maintenance.

To summarize all the above related to the answer to the question: “Is mining still profitable?”, it is important to understand that while mining rewards are paid-out in crypto, it’s a world apart from simply buying coins. Buying crypto offers straightforward exposure to price movements with minimal operational fuss, while mining requires investment in infrastructure to earn rewards through transaction validation, demanding more in terms of operations and maintenance. Both paths boast profit potential and risks, but the choice depends on individual investment objectives, risk appetite, and resources. EZ Blockchain explored the nuances between these investment opportunities in detail, click here to learn more.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.