Stay up to date with the latest news, announcements, and articles.

The Us News owes the crisis to seven risk factors, including the Russia-Ukraine war, rising inflation, and China’s economic drag. But for the crypto community, it’s all about the ‘crypto winter’ and whether it’s on the way or is already here.

Crypto Winter Explained

Cryptocurrency assets are notoriously volatile. They have routinely suffered massive drops of up to 50%, although this doesn’t scare away diehard investors. It is this volatility that makes them worthwhile investments. Even so, it doesn’t mean that Bitcoin and other crypto coins’ volatility augurs well with everyone in the space. The players keep track of the industry’s gyrations and know what to make of the previous phenomena like crypto winters.

Crypto winter is a common term describing a poorly performing crypto market in the cryptocurrency community. It is characterized by a nosedive in cryptocurrency prices, followed by a sharp slump in trading and months of depressed prices and trading activity. The last crypto winter occurred in June 2021, but people have been speculating about one over the last few months.

Why the Crypto Community Seems Worried

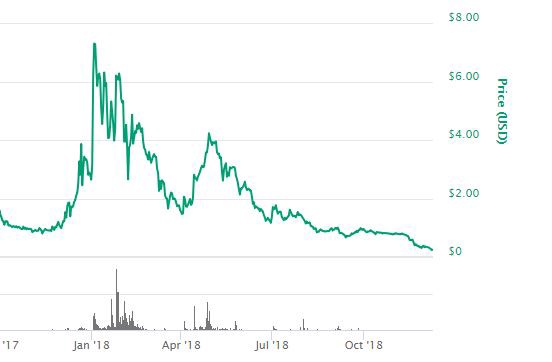

While the cryptocurrency space could be in the middle of crypto winter, it’s notably not the first time. There have been a few crypto winters in the past, and the 2018-2019 bear market is probably the most memorable. The prices dropped sharply and hovered far below their all-time highs for nearly 18 months. Bitcoin’s price came down 83%, spreading panic across the industry. Much of the innovation around cryptocurrencies stalled as most altcoins plummeted in unison.

The crash came along with layoffs as companies like ConsenSys lay off 13% of their workforce. Blockchain startup Steemit also laid off about 70% of its staff over the prolonged bear market. In a video posted on YouTube, Steem it’s CEO noted that they had been relying on projections of a higher bottom for the market. However, such projections were unachievable amid the crypto winter, so they had to lay off more than 70% of their team and begin restructuring.

The situation was no different in the stocks market, further confirming the correlation between cryptocurrency and stock markets. According to a report by the CNBC, 2018 was the worst year for the US stocks in a decade. The Nasdaq dropped 40%, while Dow Jones plunged 33.8%. Notably, it was the first time in three years for Dow Jones and S&P 500 to drop.

A Repeat Trend in 2022

There are no generally accepted guidelines on when a crypto winter should be declared. However, industry experts tend to agree when one has begun. CNBC reports that businesses are preparing for a recession, but in the crypto space, there are all the indicators of crypto winter.

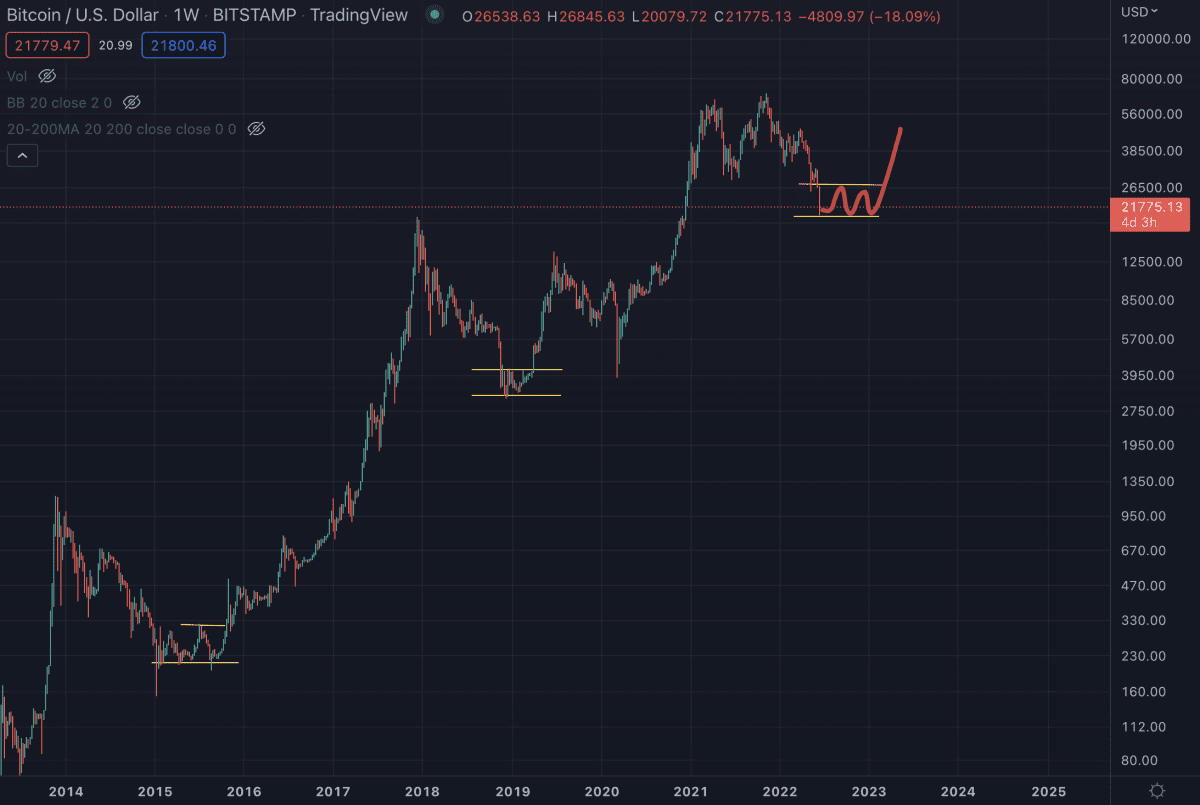

Like in the 2018 crash, Bitcoin and most altcoin prices have hit extreme lows. Bitcoin has fallen below the $22,000 mark, a 70% drop from its all-time high of $69,000 in November 2021.

The second most prominent and most popular cryptocurrency, Ethereum, has also plunged to its lowest level in more than a year. The global cryptocurrency industry is bearish and has fallen by more than 2 trillion since it hit 3 trillion in November 2021.

Cryptocurrency companies are also bearing the brunt. Coinbase, for instance, is laying off 18% of its staff as the management prepares for a crypto winter and a recession. Brian Armstrong, the cryptocurrency exchange CEO, highlighted a need to manage costs and ‘growing quickly’ during a bull market. Armstrong acknowledges that it is difficult to predict the market but notes that the crypto space looks at a recession. Usually, the exchange has about 5,000 workers, meaning it cuts off about 1,100 employees.

Gemini also announced its plans to fire some employees on June 2. The company revealed it would be cutting about 10% of its workforce, citing turbulent market conditions. Other crypto companies laying off significant proportions of their workforce include Buenbit and Banxa, reducing their staff by 45% and 30%, respectively.

Possible Worst-Case Scenario

While the cryptocurrency industry has been through several bearish trends, the 2022 crypto winter could be the worst-case scenario. Stocks are already in the bear market, and the crypto space is known to track the stock markets.

Armstrong notes that we are headed for a recession after an over 10-year economic boom, which could continue for an extended period.

Ideally, volatility is normal in the short term and is often an excellent opportunity for investors to buy the dip. However, in 2022, the bearish trend comes amid a macroeconomic crisis, so investors are concerned about a possible continued downward movement. There is a wide range of macroeconomic aspects straining the global economy, and there may be more to the worldwide crypto crash than the usual speculation, hype, and network effects.

Inflation

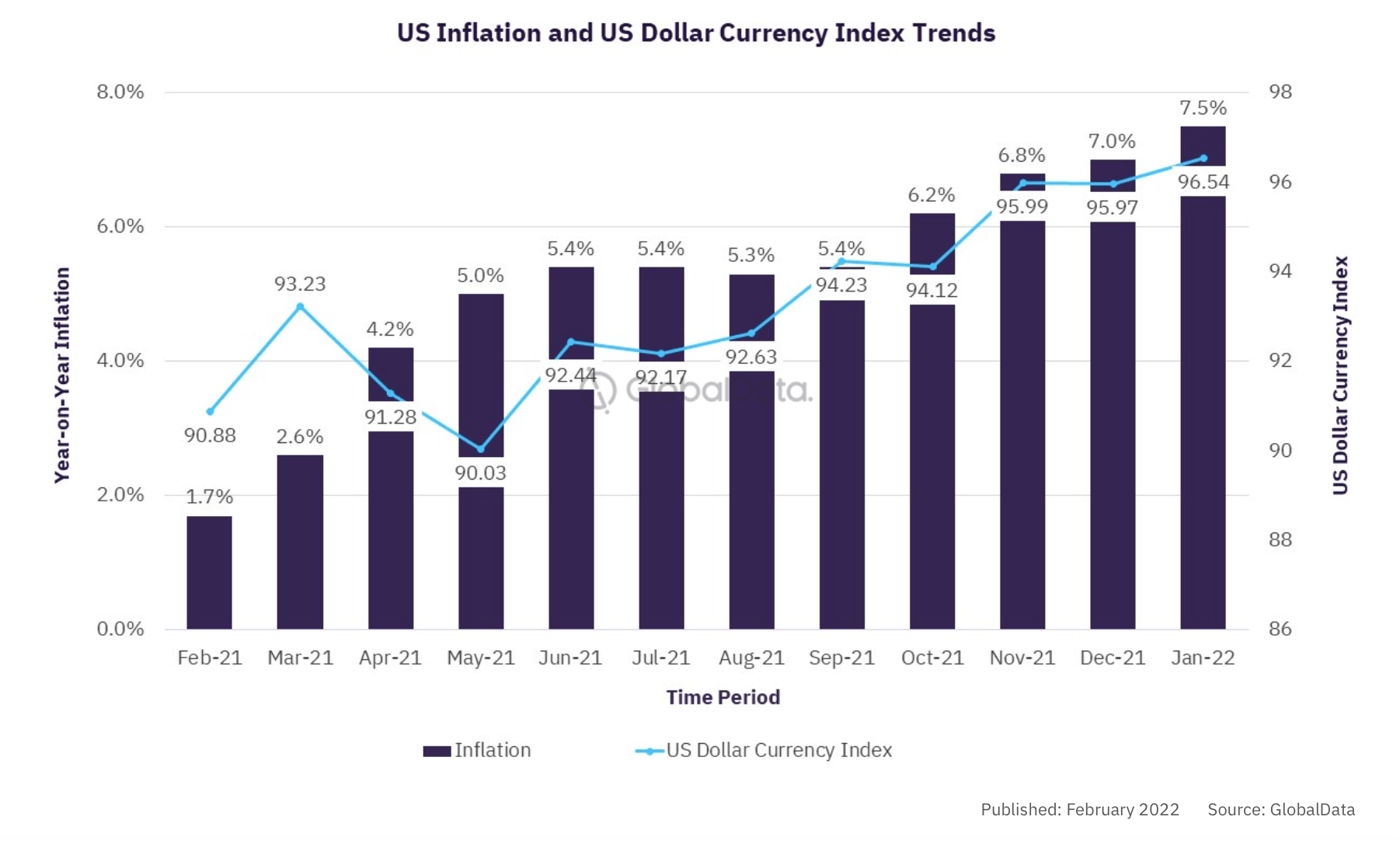

For a long time, cryptocurrencies have been viewed as safe havens during high inflation. However, the recent trends prove otherwise, and the crypto world could be heavily intertwined with the traditional financial market. The US economy, for instance, is facing high levels of inflation as prices of commodities continuously rise. The consumer price index shot up 8.3% on an annual basis, the highest level the country has seen in four decades.

The inflation levels have contributed to the volatility of the stock market. If the situation persists, it could be a significant burden to consumers, especially if there are no rising wages. The ongoing crypto sell-off could thus be much related to the increasing inflation, a possible reason for a prolonged crypto winter.

Rising Interest Rates

The Federal Reserve is trying to tighten the monetary policy to curb the inflation tide. Part of its effort includes hiking interest rates in 2022. Typically, high-interest rates will see companies cut down on spending and could slow the economy. However, interest rates alone may not solve the situation if other factors like supply chain bottlenecks are in play.

Additionally, experts believe that high Fed rates will bearishly impact the crypto space. Investors will keep pulling out from all high-risk assets, cryptocurrencies included. As the Federal Reserve continues to hike its rates, the situation only gets worse for crypto prices.

The Russia-Ukraine War

The Russia-Ukraine war has affected several aspects of the traditional financial market. It has contributed to the stock market volatility in the US and energy costs. Russia produces about 10% of the world’s oil, and the war has heavily disrupted the country’s exports. The US banned imports of Russian oil and gas, which has burdened businesses with inflated oil prices.

The war affects both the traditional and cryptocurrency markets. Bitcoin dropped more than 7% right after the start of the Ukrainian invasion.

As the war continues, cryptocurrencies and stock markets may continue to bear the brunt.

What’s Next?

The year 2021 was a breakthrough for the cryptocurrency industry. We all saw Bitcoin reach new all-time highs, and like in the years before, the rise was followed by a significant drop. All this while, the interest in cryptocurrencies keeps skyrocketing. Institutional investors and businesses still view it as a haven from the rising inflation and a new way to fund projects using NFTs and DAOs. With the much-anticipated metaverse world and a growing interest in NFTs, it’s right to say the crypto industry is still in its infancy. The crypto winter could be just a part of the usual highs followed by a massive drop, but at least not for the short term this time.

The ongoing trends point to the usual pattern for crypto winters, but with the surrounding macroeconomic uncertainties and the Russia-Ukraine war, it’s difficult to predict where things are headed. For now, it only sounds great to keep track of the progress of the macroeconomic risk factors, government regulations on cryptocurrencies, and institutional adoption to try and get a better sense of the future of crypto.

Read more about Bitcoin mining hosting services.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.