Stay up to date with the latest news, announcements, and articles.

- Early Bitcoin Mining in a Nutshell

- Different Bitcoin Mining Equipment

- Bitcoin Mining Equipment Price Movements

- Reasons for Declining Crypto Mining Equipment Prices

- Is it a Good Time to Invest in Crypto Mining Equipment?

- Bitcoin Halving Event

- Expected Increase in Mining Difficulty

- Crypto Prices Are Rebounding in 2023

- Summing it Up

With the industry having had a year-long crypto winter, getting into Bitcoin mining has become unprecedentedly cheap. The bear market crashed Bitcoin and altcoin prices, and the mining technology and equipment also lost value. The result was less competition in mining, and now you can even acquire an ASIC for $1,500 on the Bitcoin mining hardware market. With record low entry costs, it could be an opportune time to start mining.

Early Bitcoin Mining in a Nutshell

Ideally, when Bitcoin first came into existence, miners could mine Bitcoin using the standard home computer, and mining Bitcoin at home was viable. However, for many reasons, home crypto mining is no longer feasible. First, the difficulty in mining Bitcoin has been increasing periodically as the network is programmed to do so. As more people join the bandwagon, the difficulty level increases, making verifying transactions and earning rewards more challenging.

In response, specialized Bitcoin mining equipment like the ASIC became the core of every Bitcoin miner. ASIC miners are much more powerful than the typical home computer and thus ideal for miners amid increasing difficulty. They can mine Bitcoin much faster, and the more ASICs a miner has, the higher the chances they have for verifying a block. As a result, there has been a high demand for ASIC miners, resulting in a hike in miner prices.

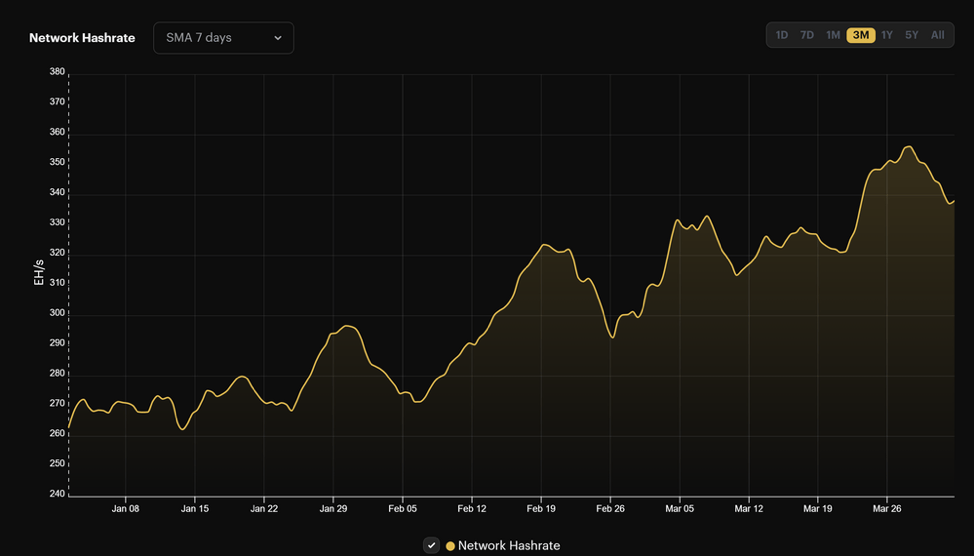

Hash rate and mining difficulty were constantly increasing, and at the same time, the cryptocurrency market was generally bearish. Many companies incurred debts to acquire more miners to remain profitable, but their balance sheets were growing weaker as the crypto prices dropped. According to hash rate index statistics, Bitcoin’s hash rate alone rose more than 30% in the first quarter of 2023.

Source: Hashrate Index

Different Bitcoin Mining Equipment

There are several types of crypto mining equipment, but notably, not all cryptocurrencies can be mined using the same type of mining rigs. Remember, each crypto coin has its own unique network and mining algorithm, although the proof-of-work algorithm tends to be more common. The algorithm used by a network determines the type of crypto mining equipment that is used to mine. Regardless of the type of mining equipment used, mining profitability may vary based on other factors, such as the cost of electricity, so it’s not always about the equipment used.

Central Processing Units (CPUs): These are the most basic and the first to be used to mine Bitcoin by Satoshi Nakamoto in 2009. Although they no longer work for cryptocurrencies like Bitcoin, traditional processors can still mine cryptocurrencies like Monero.

Application-Specific Integrated Circuits (ASICs): They are fondly known as ASICs and are the most commonly used miner types. Typically, they are computerized devices that use ASIC to mine digital currency. They are usually specialized mining equipment designed specifically for mining a particular crypto coin. Therefore, an ASIC designed for Bitcoin will not mine any other cryptocurrency. They are more powerful and efficient compared to GPUs but also come at a higher price. However, you can find used crypto mining equipment and save money.

Field Programmable Gate Arrays (FPGAs): Like ASIC miners, FPGAs are usually programmed to mine a particular crypto coin. The only difference is that FPGAs can later be programmed and used to mine another different cryptocurrency that uses a different algorithm. They are also more efficient when compared to GPUs, but again, they come at a higher cost.

Graphics Processing Units (GPUs): They are one of the most common mining equipment used to mine cryptocurrencies like Ethereum and Ravencoin. They are essentially graphics cards used to perform complex cryptographic puzzles to verify transactions on a blockchain network and receive mining rewards.

Hard Drives: Some cryptocurrencies, like Chia, are mined using hard drives instead of the traditional CPU or other mining equipment. The hard drives store volumes of data and can perform the computations involved in crypto mining.

Bitcoin Mining Equipment Price Movements

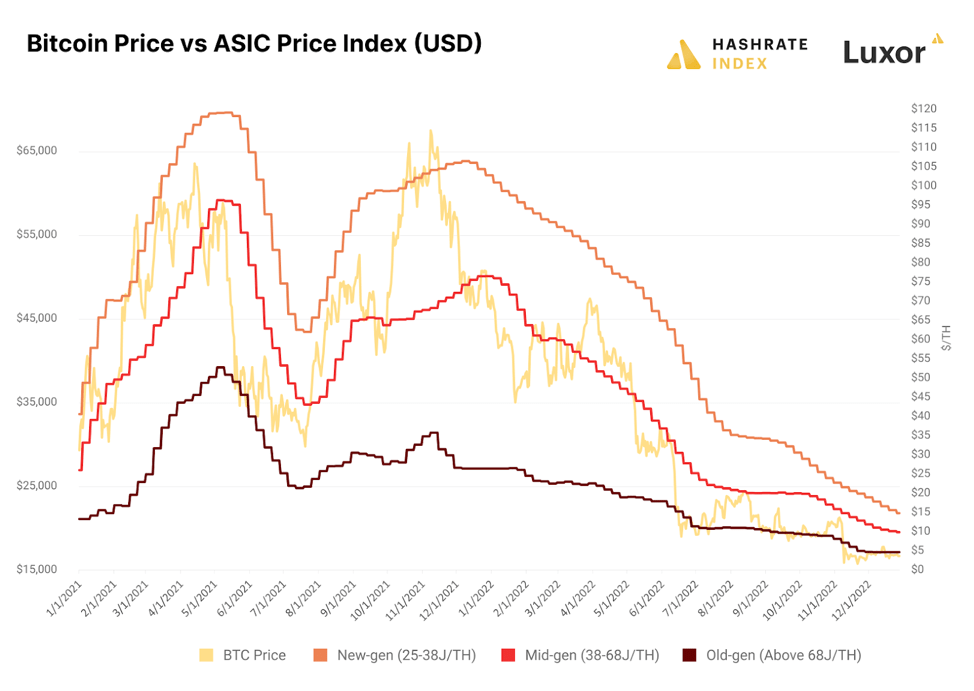

Over the recent years, the cryptocurrency mining hardware market has seen several major changes over short spans. For instance, between 2017 and 2018, mining equipment costs shot as the industry experienced a sharp surge in general cryptocurrency prices. However, as the market continued to become saturated and the growing competition, profits from mining activities began to diminish, resulting in a decline in the prices of mining rigs. In 2022, the situation was no different. Most miner prices were down significantly.

Since then, the prices of mining equipment have continued to fluctuate. However, in the last few months, there has been a notable trend of declining prices. In particular, ASIC miners, some of the most used in Bitcoin mining, have been experiencing sharp declines in prices.

Reasons for Declining Crypto Mining Equipment Prices

There are several factors contributing to the decline in crypto mining equipment prices. First, the cryptocurrency market has experienced a significant correction since its peak in early 2021. The prices of most cryptocurrencies, including Bitcoin and Ethereum, have dropped by more than half since the beginning of the 2022 crypto winter. The crypto winter, coupled with the general global economic crisis, resulted in a significant decline in profits for Bitcoin mining companies. A significant proportion even declared bankruptcy.

Secondly, the increased competition in the mining industry has led to a decrease in demand for mining equipment. As more people join the mining industry, the demand for equipment increases, leading to higher prices. However, as competition increases, the demand for mining equipment decreases, leading to lower prices.

Lastly, advancements in technology have also contributed to the decline in mining equipment prices. As newer and more efficient equipment is developed, older equipment becomes obsolete, leading to a decrease in demand and lower prices.

Is it a Good Time to Invest in Crypto Mining Equipment?

The answer to this question depends on several factors. However, based on past trends, real crypto enthusiasts believe it is the best time to invest now. But in any case, it’s always necessary to remember that crypto mining and the entire crypto market are generally highly volatile and, thus, a high-risk investment. The prices of cryptocurrencies can be unpredictable and fluctuate rapidly by huge margins. As a result, they could significantly affect the profitability of your mining operations. Additionally, many factors can impact the price of mining equipment, including technology changes, competition, and developments in the cryptocurrency regulatory framework.

Rob Chang, Gryphon Digital CEO, acknowledges the price drop in mining equipment. According to Chang, the prices of miners have continued to fall to their lowest since January 2021, but this still doesn’t mean the miners are cheap. Without considering their power demands, they will still cost you hundreds or thousands of dollars upfront.

NovaMining Labs CEO Mattia Pintus, on the other hand, agrees that the mining machines are among the primary things to think about for anyone interested in mining. However, they should theoretically check each miner’s potential profits while factoring in the energy costs.

Now is the best time to invest in crypto mining equipment based on past trends in the crypto industry.

Bitcoin Halving Event

Bitcoin halving is one of the most pivotal events that support the Bitcoin network. It’s typically a pre-organized event where the Bitcoin mining reward is cut in half. The original block reward was 50 BTC, but after three halving events, the Bitcoin block reward stands at 6.25 BTC. Halving occurs after every 210,000 blocks have been mined, and the next event is expected to take place in 2024.

With only a couple of months remaining until the next halving, many people anticipate that the price of Bitcoin will skyrocket and potentially hit over $100k. Why? Bitcoin has shown similar trends in the past halving events. Ideally, Bitcoin halving reduces the rate at which new BTC is mined and released into the market. As a result, it activates the law of diminishing returns which in theory should increase demand, hence a price pump.

Expected Increase in Mining Difficulty

Mining difficulty is the measure of how difficult it is to crack the hash on the Bitcoin network. The mining difficulty has constantly been increasing over the past year, with a few temporary decreases. In essence, it is designed to increase over time to make Bitcoin scarce and resistant to inflation.

The more difficult it gets, the more challenging it will be for miners to verify blocks. They will need more hashing power. This could result in the consolidation of miners as small miners join forces or become absorbed by large-scale miners.

If you are considering investing in Bitcoin mining equipment, you should do your research and carefully evaluate the potential risks and rewards. It’s also important to have a comprehensive understanding of the technology and underlying fundamentals of crypto and mining.

Crypto Prices Are Rebounding in 2023

After the year-long crypto winter, the cryptocurrency market has begun to show signs of rebounding. Bitcoin traded at unexpected lows of $16,000 for some time toward the end of 2022. For many, even the year 2023 has brought little hope as mining companies continue to struggle to remain afloat. However, just a little into the first quarter of the year, the market began to show some good trends. Fast forward to April, Bitcoin has a nearly 20% monthly gain finishing the first quarter above $28,000.

Summing it Up

The recent decline in crypto mining equipment prices is attributable to several factors, including normal market corrections in the crypto space, growing competition, and technological advancements. For those who believe in Bitcoin, it may be a good time to invest, but the decision ultimately depends on your individual financial situation, your risk appetite level, and future investment goals.

In any case, it’s necessary to understand the risks involved in the crypto mining sector and make informed decisions before committing any amount of money. Remember, you need the right hash rate to mine Bitcoin profitably, so even if the equipment prices are currently low, it’s still a significant investment involving some thousands of dollars.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.