Stay up to date with the latest news, announcements, and articles.

Energy

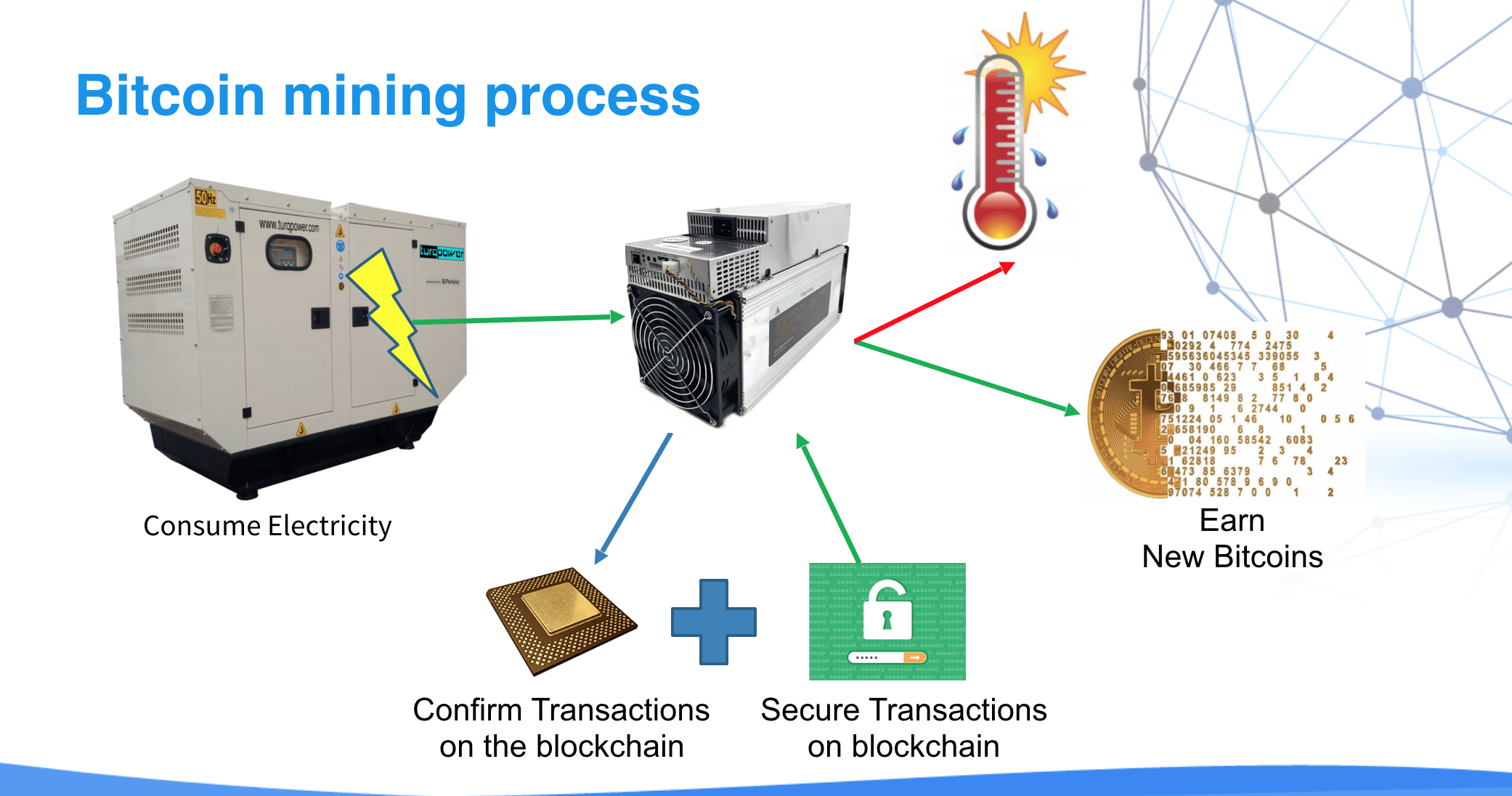

According to estimates from the Cambridge Bitcoin Electricity composition index, Bitcoin mining, on average, consumes about 11 GW consistently. That seems like a lot of energy for Bitcoin mining, but it may be different. Taking the Electricity Reliability Council Of Texas (ERCOT), for instance, the council had the highest recorded demand this summer of 75 GW. To put this into perspective, the Bitcoin network’s total usage is about 15% of ERCOT’s highest demand.

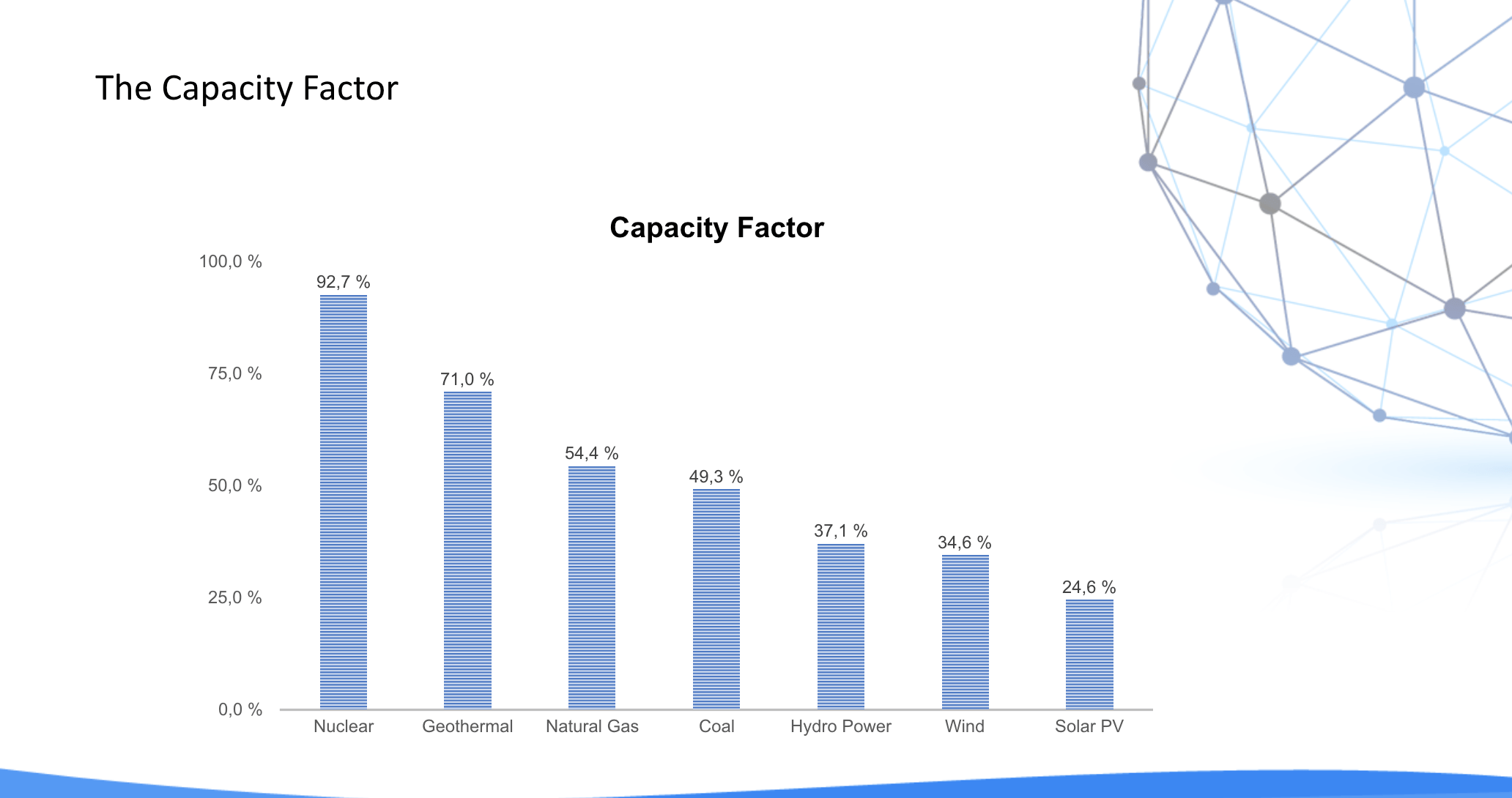

It may be acceptable to sound a lot, but the energy industry is also quite massive. For example, the United States produces and consumes many different types of energy from different sources. Energy sources fall into diverse categories, including primary and secondary sources, renewable and nonrenewable sources, and fossil fuels.

Primary energy sources take many forms, like fossil energy, nuclear energy, petroleum, natural gas, coal, and renewable sources like wind, geothermal, hydropower, and solar energy. All these primary energy sources are converted into electricity, a secondary power source.

In the US, the Energy Information Administration statistics indicate that renewable energies account for only 12% of all energy sources. Fossil fuels assume the largest proportion, with petroleum at 36%, natural gas at 32%, and coal at 11%. Nuclear and electric energy account for 8%.

The energy from these sources is distributed across the transportation, industrial, residential, and commercial sectors. However, it’s noteworthy that there is a portion of energy in both the sources and the end-use sectors dedicated to retail electricity sales. At the same time, the total electrical energy system suffers energy losses of up to 65%.

With such problems in the electrical energy system, Bitcoin mining has something to do with each energy type.

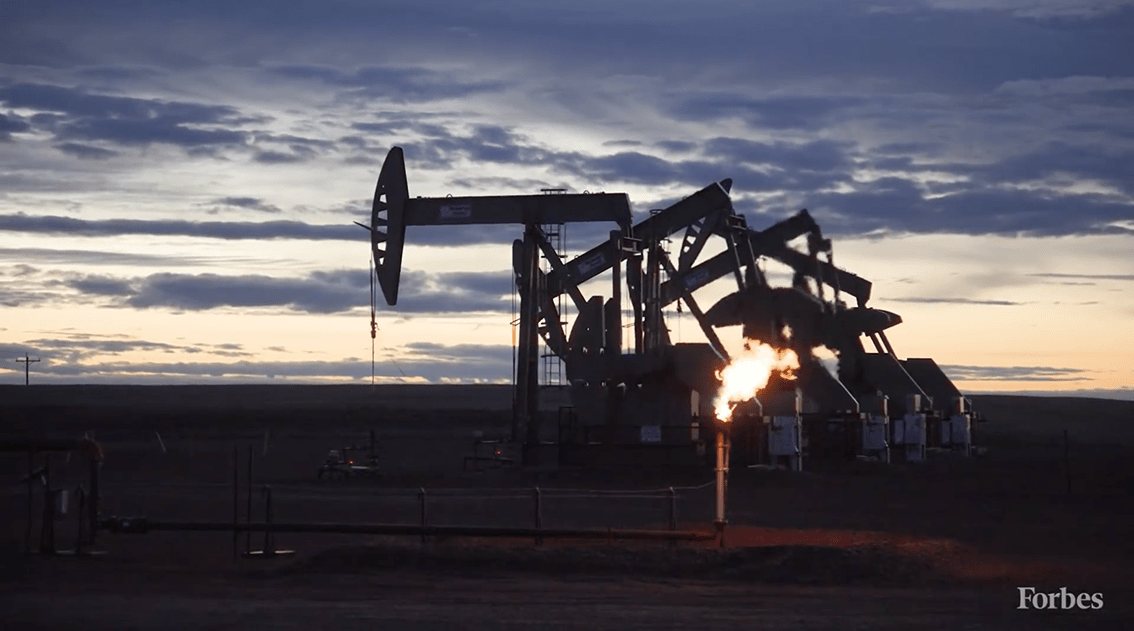

Flared Gas

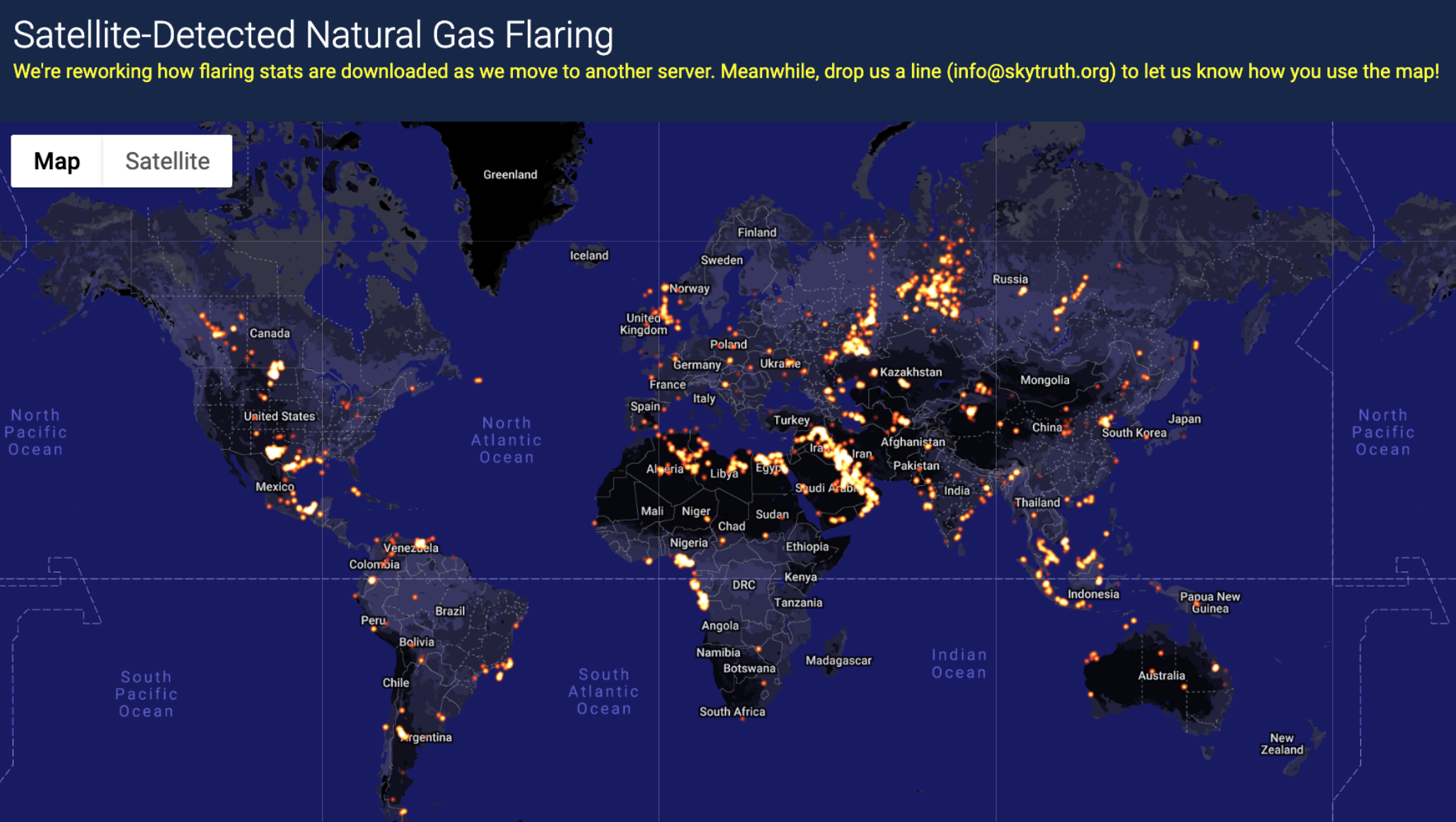

The World Bank is on a global initiative to reduce gas flaring to zero by 2030. According to the report on gas flaring, oil production fields worldwide burn about 140 billion cubic meters of natural gas annually. The tradition releases over 300 million tons of Carbon IV Oxide into the atmosphere.

In 2020, the World Bank estimated that about 5.3 trillion cubic feet of natural gas were flared annually, equivalent to 25% of US energy consumption. To date, gas flaring and venting is a normal practice where local markets and gas transportation infrastructure are unavailable. At the moment, Russia, Nigeria, the US, and the Middle East are the leading gas-flaring countries.

When energy investors produce oil in the fields, the associated gas leaves the reservoir along with the oil. A considerable proportion of the gas is captured using oil companies and government facilities, but some of it gets flared due to economic, regulatory, and technical constraints.

Flaring emits black carbon and other pollutants and is thus an environmental hazard. It also means that natural gas goes to waste despite being a valuable energy resource that can help advance sustainable development. The global flared natural gas can generate about 750 billion kWh of electricity.

The Solution?

Bitcoin mining provides the solution for flared and vented gas by tapping these wasted energy sources for Bitcoin mining. Energy investors and mining companies can use gas generators to convert associated gas in oil fields into electricity and use it for Bitcoin mining on-site. We can turn around the traditional proof of work mining from the grid to off-grid and solve the global waste energy problem using Bitcoin mining.

Flared gas is captured and transformed on-site with the help gas electric generators. Ideally, the technology has been around for quite a long time. However, there was the problem of what to do with the electricity in the remote oil fields. Bitcoin mining solves that problem, eliminates the flared gas emissions and pollutants from the ecosystem, and creates a new revenue stream.

It’s now possible to utilize natural flared gas on a scale at remote facilities instead of burning it. Oil and gas investors can mitigate their flaring numbers, continue drilling, optimize their operations, and create a new revenue stream. The flaring mitigation also means the oil producer drilling permit is renewed, minimum footprint, 2.5 MW of usage, 500 MCFd of flared gas utilized, and a reduction in CO2 and Volatile Organic Compounds (VOC) emissions.

Stranded Natural Gas

Stranded gas refers to natural gas that is unutilized or wasted due to its remote locations. It is similar to flared gas, but since there are no oil production activities in the fields, it remains stranded underground. According to the Department of Energy, around 270 trillion cubic feet (TCF) of gas are stranded in the US due to the distance between oil fields and the market. Usually, the cost of production and delivery of the stranded natural gas to the market is much higher than the possible returns from selling it.

Stranded natural gas is also available in areas where the natural gas pipeline was not built due to regulatory or economic reasons or remote locations like Alaska North Slope. The demand for natural gas is quite low, and the market is far away. The amount of gas stranded in the US alone would be enough to power Bitcoin mining 10-fold without denting the demand for the existing electrical infrastructure.

Without Bitcoin mining, utilizing stranded gas would be a tedious and costly activity involving:

- Building infrastructure at the gas field

- Developing a gas production facility

- Developing a gas conversion facility

- Transporting the gas from the source to customers

- Building receiving facilities

- Creating distribution channels for users to deliver value

Bringing Bitcoin mining into the equation, delivering value from stranded gas becomes easier, less costly, and more profitable. It involves:

- Clearing the gas field

- Building gas production facilities

- Building gas to electricity conversion facility

- Bitcoin mining

EZ Blockchain Flaring Mitigation Solution

The Problem

According to the World Bank, $30.6 billion is the approximate cost of flared natural gas. The most popular gas flaring solutions are NGI recovery, stripping natural gas liquids from natural gas, and liquefying natural gas (LNG) to deliver to the market. Both of these solutions are quite expensive on CAPEX and may not prove to be economically feasible. Dealing with liquids is pretty expensive in terms of transportation, stability, and price. Because of inconsistent gas volume and pressure, it is also hardly possible to predict the project’s economic side. Power generation does not prove to work by itself because of the regulatory difficulties in selling power to the grid and the lack of powerline infrastructure.

Further, there is the problem of slow infrastructure development. It may take a few years to develop and build all the needed infrastructure to solve the problem of flaring on the scale, such as gathering lines, pipelines, power lines, and gas processing facilities, among others. Usually, when it is built, the problem still exists because of the higher production volume and, therefore, the higher number of flaring emissions.

Finally, there is also the environmental problem because some of the solutions do not solve the problem completely. For instance, NGL recovery only strips rich BTU liquids from flared gas, but lean gas flaring still occurs. The type of flaring reduces Carbon IV Oxide emissions by a considerable amount. Flaring releases significant gas emissions into the atmosphere and doesn’t produce any useful energy.

The Smartgrid Flaring Mitigation Solution

EZ Blockchain introduced a unique flaring mitigation solution called the EZ Smartgrid Flaring Mitigation System. It is a unique solution for the existing wasted energy problem in oil fields. It features a mobile gas engine generator that converts wasted flared gas into electrical energy, which is immediately utilized on-site to power a mobile data center, the EZ Blockchain Smartbox.

The green Bitcoin mining company developed a mobile flaring mitigation system available to be deployed right on oil well pads to reduce flaring. The unique system does not require a connection to the grid; all electricity produced is used on-site.

Instead of flaring, wasted associated gas can be harnessed by a gas engine generator to produce electricity, then the electricity is used to power the mobile data center on the well pad without distributing energy to the grid.

The smartgrid mitigation system benefits investors with a complete flaring elimination at locations with a minimum of 350 MCF flared a day. No CO2 emissions are caused by flaring where the EZ Blockchain Smartgrid System is deployed.

Further, oil investors can meet the rapidly growing regulations and tightening environmental guidelines without interruptions of the operation by reducing harmful emissions.

Finally, there is zero upfront cost for producers and additional royalties to landowners by bringing flared gas to market on-site without building physical pipeline infrastructure.

Power Plant Application

Power plants can generate power more efficiently by utilizing a Bitcoin mining farm as a battery to balance the load. Some power plants also use resistors to reduce the power that they cannot dispatch to the market. Such plants can install a mobile data center in the backyard within a few days and mine bitcoin using the spare capacity of the power plant. The power plants can then utilize their electrical infrastructure with higher capacity, increasing the consistent supply to the grid.

Summing It Up

There are tons of use cases that can be applied to Bitcoin mining. It helps reduce gas flaring, utilizes stranded gas, and is a base load for power plants. With all this apparent, Bitcoin mining can be said to be inseparable from the energy industry. Without energy, Bitcoin mining proof of work cannot exist, although there is a mutual relationship since consistent Bitcoin mining is a tool for solving energy problems rather than creating more.

EZ Blockchain is on a mission to use Bitcoin mining as a tool to solve wasted energy problems. The company implemented a flaring mitigation project in North Dakota by installing the 40 ft EZ Blockchain mobile data center.

The project’s aim was to lower the carbon footprint of the oil producer by using the excess gas to run generators that, in turn, power the smartboxes. Due to the carbon footprint associated with gas flaring, oil producers are often capped at how much they can pump per day.

EZ Blockchain used multiple generators to generate 2.5 MW of power which they needed to power their data center. That way, the oil producer was able to lower their carbon footprint and emissions after three days of installation.

The company also implemented a project for eliminating stranded gas in Alberta, Canada, where an oil services company needed a solution to offer clients a better way to monetize their stranded natural gas. EZ Blockchain deployed two mobile data center solutions, the EZ Tank 300 and EZ Tank 600. Both data centers were fitted with frequency drive regulators to lower fan speeds during cold times.

A total of 28,000 MCF of gas were flared, equivalent to 4 MW of power. The company managed to lower its operational cost and eliminated the problem of stranded gas, which needed to be flared or vented. It allowed for asset monetization of stranded gas and revenue diversification through bitcoin.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.