Stay up to date with the latest news, announcements, and articles.

What Is Token Burning?

Token burning is a supply-management mechanism that permanently removes a set number of tokens from circulation. Technically, a burn is implemented either (1) by transferring tokens to a provably unspendable address (commonly called a “burn address” or “eater address”) whose private key is not known, or (2) by calling a smart-contract function that irrevocably reduces totalSupply (typically via a burn() or destroy() opcode that updates ledger state and emits an event). The former is common for UTXO-style chains (or ERC-20 tokens where controlled addresses are used), while the latter is the canonical approach on smart-contract platforms where the contract maintains token accounting. Empirical studies of burn usage examine both on-chain traces and the economic signaling that burns create.

From a protocol economics viewpoint, burns serve three distinct technical roles: (a) permanent supply reduction (deflationary lever), (b) fee-sink for protocol security or priority allocation (e.g., EIP-1559’s fee burn), and (c) governance or reward mechanics (e.g., burning LP tokens to withdraw liquidity, or burning in exchange for on-chain receipts). The effectiveness of a burn in changing market outcomes depends on execution transparency, the scale of supply removal relative to circulating supply, and whether the burn is perceived as a mechanical scarcity shock or merely a marketing/PR signal.

“A burn’s economic effect is not automatic: it is the intersection of provable supply deletion and market participants’ expectations about future issuance, demand, and protocol policy ”

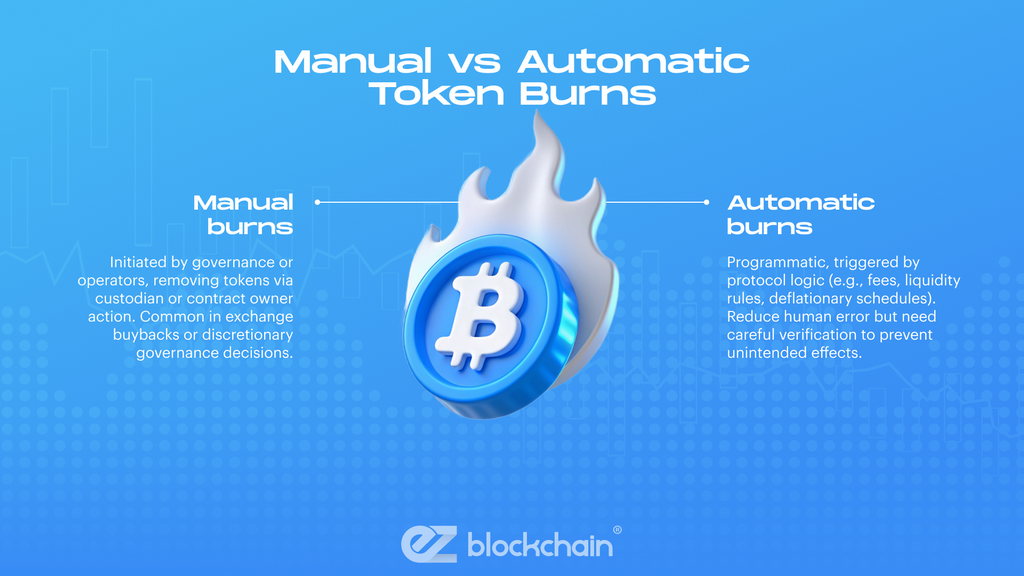

Manual vs Automatic Token Burns

Two engineering patterns dominate burn implementations.

Manual burns are governance or operator-initiated transfers that remove tokens when a custodian or contract owner triggers a burn. These are common for exchange buyback programs (where an operator executes buys on market and then sends the purchased tokens to a burn address) and for discretionary governance decisions. Automatic burns are programmatic — embedded in protocol logic so that burns occur as a deterministic consequence of blockchain events (e.g., a transaction fee algorithm, a liquidity-pool rule, or a schedulable deflationary mechanism). Automatic burns eliminate human action risk but require careful formal verification to avoid unintended state changes.

| Mode | Mechanism | Example Implementation | Pros / Cons |

| Manual Burn | Off-chain purchase or governance vote → on-chain transfer to burn address | Exchange buyback & burn (operator sends tokens to eater address) | + Flexible; − Requires trust/verification of operator |

| Contract-Triggered Burn | Smart-contract burn() called as part of function execution | Token contract burns portion on each transfer | + Transparent & deterministic; − Bugs can be catastrophic |

| Protocol Fee Burn | Base or priority fee algorithm sends fee to contract that destroys value | EIP-1559 base fee burn (Ethereum) | + Aligns economic incentives; − changes supply dynamics permanently |

| LP / Redemption Burn | LP receipts or redeemable tokens are destroyed when liquidity redeemed | LP token burn() to withdraw underlying assets | + Enforces accounting; − can be exploited if logic flawed |

Manual burns require audit trails and deterministic logging to be credible; automatic burns require formal verification and careful simulation of long-term monetary effects.

Why Projects Burn Tokens

Projects burn tokens for a mix of monetary-policy, incentive, and signaling objectives. Practically, burns are used to counteract inflation from token issuance schedules, to create scarcity that supports value capture for remaining holders, or to reconcile supply after certain operational activities (e.g., refunding, fee settlement). From a governance perspective, burns can be a mechanism to return economic value to token holders without issuing dividends — a “buyback-and-burn” mimics corporate share repurchases in traffic albeit with materially different legal treatment.

Strategically, teams sometimes use burns to signal commitment or to bootstrap deflationary expectations: a one-time large burn can change short-term supply flows, while protocol-level burns (like recurring fee burns) can create persistent supply leakage that compounds over time, altering effective inflation. But signal and substance must align: credible burns are provable on-chain and accompanied by transparent accounting to avoid accusations of market manipulation.

“Burns that are provable and regularly reported integrate into market expectations; ad-hoc or opaque burns risk being perceived as cosmetic ”

Impact on Supply and Price

Token burns alter the numerator in simple scarcity models (supply), but they affect price only via the interaction of supply change with demand elasticity and market microstructure. A token removal that is marginal relative to circulating supply will have negligible price impact, whereas a material one-time reduction or a persistent burn rate that exceeds new issuance can create measurable price pressure. For example, Ethereum’s EIP-1559 introduced a base-fee burn that, during periods of high network demand, burned significant ETH daily — this protocol-level burn converted a previously inflationary or neutral supply dynamic into one with deflationary episodes. Total ETH burned since EIP-1559 has been tracked and runs into the multiple millions of ETH ― a non-trivial change to supply accounting.

Empirical event-study literature shows mixed outcomes: some buyback-and-burn events are followed by short-term abnormal returns (consistent with a signaling or temporary demand surge), while rigorous analyses caution that buyback burns can be indistinguishable from market timing or liquidity effects once transaction costs and information asymmetries are considered. Macro-scale protocol burns (like EIP-1559) are more likely to affect price trajectories because their operation is persistent and predictable; ad hoc burns are less powerful.

Famous Token Burns and Case Studies

Ethereum — EIP-1559 (protocol burn): EIP-1559 replaced the first-price auction model with a base fee that is burned. Since activation, the cumulative ETH burn has been tracked in real time and totals into the millions of ETH, producing episodic deflation when network demand is high. This is the archetypal example of a programmatic, protocol-level burn with observable macroeconomic effects.

Exchange buyback burns (industry practice): Several exchange tokens historically employed quarterly or periodic buyback-and-burns funded by exchange revenue. Academic reviews of such mechanisms question whether the burns produce long-term value or simply reallocate near-term liquidity; rigorous event studies reach cautious conclusions and urge careful disclosure standards. NBER and related working-papers analyze how buyback-style burns interact with token utility and platform growth.

Bitcoin / UTXO “burn addresses”: While Bitcoin lacks a native burn() opcode, coins sent to provably unspendable addresses (e.g., OP_RETURN sinks or addresses with no known private key) have been documented. Research into such burn addresses analyzes their motives and consequences; because BTC’s supply cap is fixed, these burns are often symbolic or accidental, yet they remain provable in the ledger.

Statistical case work shows the strongest, most persistent supply effects come from protocol-level burns (where the burn is constant and tied to usage), whereas ad-hoc burns produce transient signals that markets arbitrage quickly absent concurrent demand growth.

Risks and Misconceptions

Token burning is not a panacea; it carries both technical and economic risks:

- Burns can be cosmetic if the project simultaneously mints or re-issues supply elsewhere.

- Manual burns require trusted operators — without auditability they are opaque.

- Smart contract burn() functions can contain bugs that unintentionally destroy value.

- Burns do not create demand — without demand, reduced supply alone may not raise market price.

- Market participants may front-run announced burns, neutralizing intended effects.

- Legal and tax regimes may treat burns differently, creating regulatory exposure.

- Liquidity reductions from burns can increase price volatility and slippage risks.

Practically, conflating burns with guaranteed price appreciation is a fallacy: valuation remains driven by utility, adoption, and real economic activity, with burns functioning as a monetary-policy instrument that must be analyzed in context.

How Token Burning Affects Investors

For investors, burns can change risk/return profiles in three ways. First, they can reduce circulating supply, which — all else equal — increases scarcity. Second, burns can alter volatility and liquidity; fewer tokens on exchanges may mean higher realized spreads for traders. Third, burns tied to platform usage (e.g., fee burns) directly connect network activity to holder economics, aligning investor returns with protocol adoption.

Key investor takeaways:

- Re-parameterize liquidity models to account for burn-induced float reduction.

- For long-term holders, protocol burns that are persistent (linked to fees or usage) can have compounding effects.

- For traders, burns may increase execution costs and event-driven volatility and should be priced into strategies.

Token Burn Transparency and Audits

Verification is essential. The strongest burns are provable on-chain and accompanied by third-party attestations: on-chain transaction hashes showing transfer to known eater addresses, smart-contract source code with verifiable burn() implementations, and independent audits confirming no hidden minting pathways. For exchange or operator burns, audit trails and off-chain proof (e.g., independent attestations of market buys and subsequent on-chain destruction) are necessary to prevent manipulation. Academic literature emphasizes formal audits and public accounting to distinguish credible monetary policy from marketing.

Token Burning in Practice — Conclusion

Burn mechanisms can be powerful monetary instruments when designed as part of a coherent tokenomics framework: protocol burns create predictable supply leakage tied to usage, while buyback/burn programs can return economic value if funded by sustainable platform revenue. However, burns must be transparent, verifiable, and economically justified — absent that, they risk being cosmetic or even manipulative.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.