Stay up to date with the latest news, announcements, and articles.

If you have been looking to (re)locate operations for better crypto tax benefits, this list of the most crypto friendly countries will help you .

Criteria for Choosing Countries with Favorable Crypto Tax Laws

Keep in mind that the best country for crypto mining, trading, and any other market interactions is one that satisfies the following criteria.

Minimum or No Capital Gains Tax on Crypto

This is perhaps the most impactful criterion. There are countries with no capital gains tax, like Cayman Islands, Singapore, Switzerland, or with waived taxes based on certain conditions — taxes are waived for long-term holdings in Portugal and for crypto held over one year in Germany.

Low of Full Absence of Income Tax on Crypto Earnings

Crypto earnings include staking rewards, mining income, or trading profits which can be classified as business or self-employment. To mitigate this, look for jurisdictions in crypto friendly countries that exclude such activities from income tax, or tax them minimally for casual use.

Friendly Regulatory Environment or Clarity

Crypto operations are still very under-regulated in numerous jurisdictions, which can pose risks and cause market instability, harming your budget in unexpected ways. Whether you’re an individual or a business working with crypto, it is essential that you find a transparent, consistent legal framework to run operations safely.

Gentle Residency or Citizenship Requirements

Even in crypto tax-free countries there still can be residency rules, which determine who qualifies for which tax benefits. Many favorable jurisdictions require your minimum presence or investment in the country’s economy, so keep that in mind before relocating.

Top Crypto Tax Favorable Locations

Based on the deep dive into the latest figures and percentages, these are the best countries for crypto ventures right now.

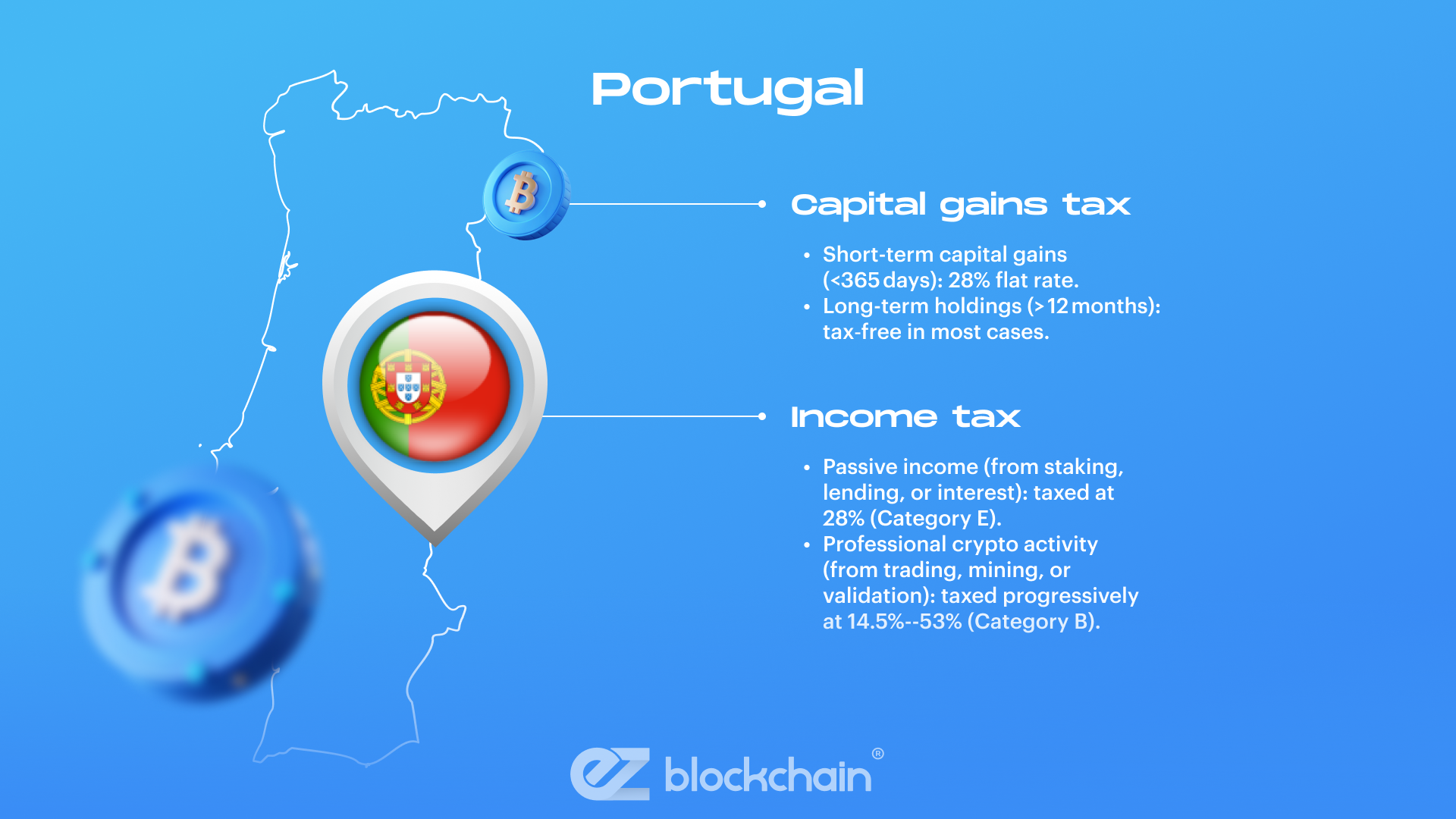

Portugal

Locating your mining or trading operations in Portugal, you can avoid any crypto taxes whatsoever as long as you hold your crypto gains for over twelve months. At the same time, any short-term gains that are withdrawn in less than a year are taxed at 28%. Staking or lending income may be taxable as income depending on circumstances. There are also certain residency program benefits for non-habitual residents, but they no longer work for applicants in 2025.

- Capital gains tax:

-

-

- Short-term capital gains (<365 days): 28% flat rate.

- Long-term holdings (> 12 months): tax‑free in most cases.

-

- Income tax:

-

-

- Passive income (from staking, lending, or interest): taxed at 28% (Category E).

- Professional crypto activity (from trading, mining, or validation): taxed progressively at 14.5%–53% (Category B).

-

- Regulatory environment:

-

-

- EU-wide MiCA compliance.

- Portugal’s tax authority issues detailed guidance on crypto classification and reporting (“Categories E, G, B”).

-

- Residency requirements:

-

- Tax residency triggered by ≥183 days/year or owning a habitual dwelling.

- Non-Habitual Resident benefits ended for new applicants in 2025 and only prior registrants may retain privileges.

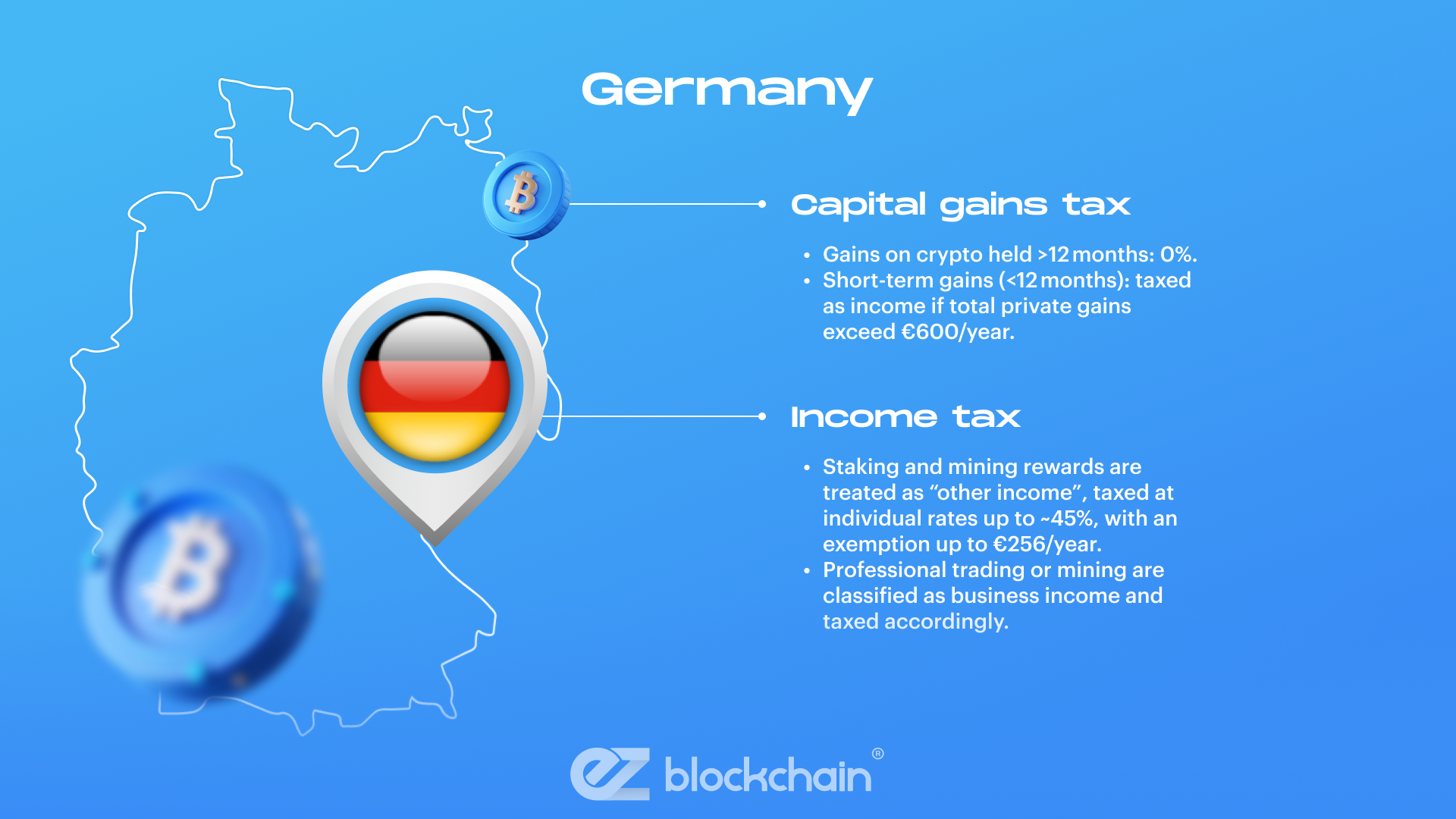

Germany

In Germany, crypto held over twelve months is also fully exempt from capital gains tax. Gains under €600–€1,000 within one year are also absolutely tax‑free. Only short-term sales above the set thresholds and professional crypto activity, including mining, staking, and trading, is taxed as income. But while Germany is certainly one of the best crypto friendly countries out there, the local authorities require you to backlog and mandate everything.

- Capital gains tax:

-

-

- Gains on crypto held >12 months: 0%.

- Short-term gains (<12 months): taxed as income if total private gains exceed €600/year.

-

- Income tax:

-

-

- Staking and mining rewards are treated as “other income”, taxed at individual rates up to ~45%, with an exemption up to €256/year.

- Professional trading or mining are classified as business income and taxed accordingly.

-

- Regulatory environment:

-

-

- Crypto assets are classified under § 23 EStG as “private assets”.

- New guidance in July 2025 clarifies reporting and record-keeping requirements.

-

- Residency requirements:

-

- Tax resident if domiciled or present ≥183 days/year.

- Worldwide crypto income must be declared and strict record-keeping mandated.

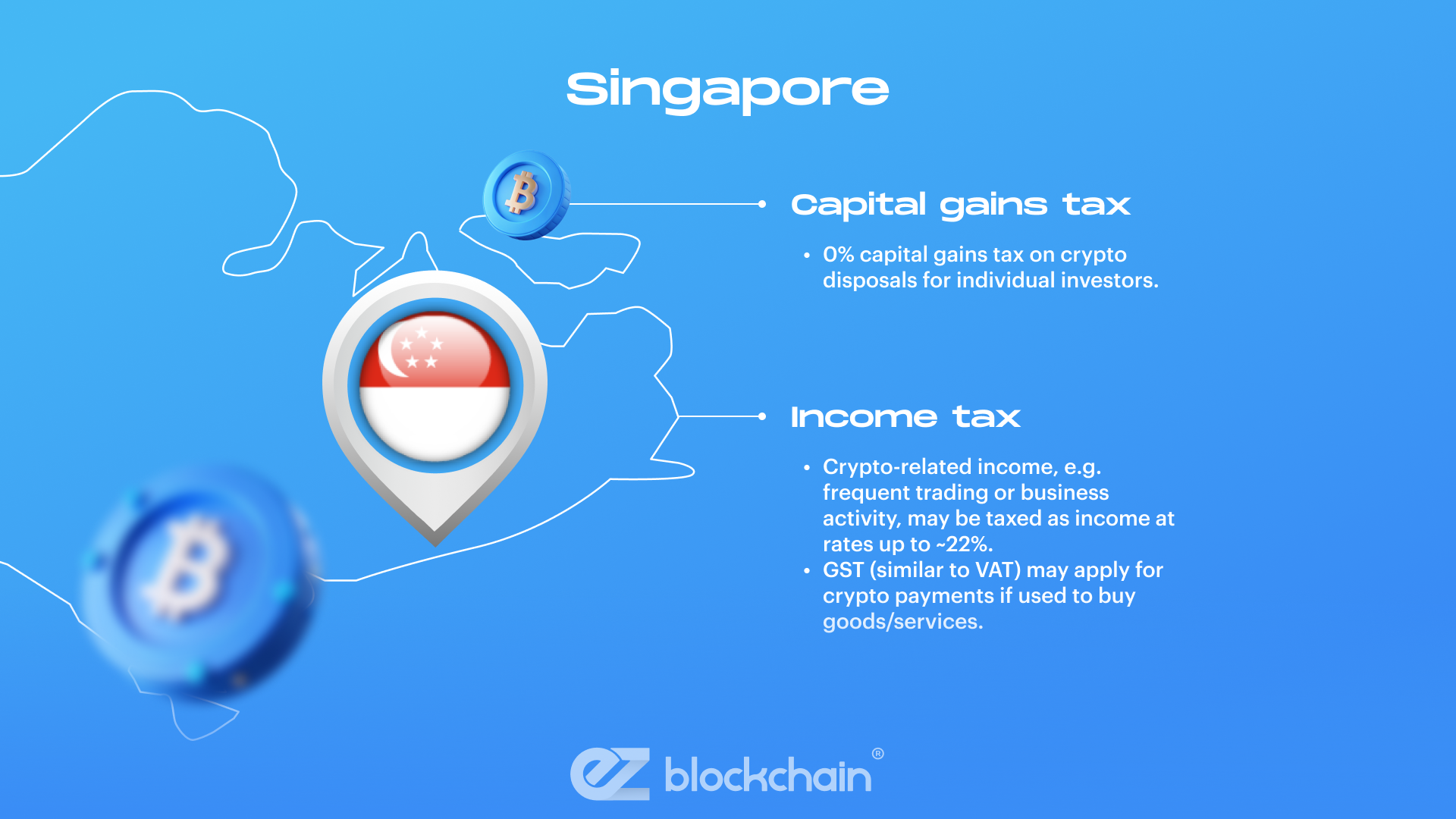

Singapore

In a very IT-concentrated Singapore, there are no capital gains or VAT taxes on crypto. Individual holders are exempt unless their trading activity can be categorized as a business, which is then taxed up to ~22%. Also, GST, Singapore’s somewhat different alternative to VAT, may apply when using crypto to purchase goods or pay for services.

- Capital gains tax: 0% capital gains tax on crypto disposals for individual investors.

- Income tax:

-

-

- Crypto-related income, e.g. frequent trading or business activity, may be taxed as income at rates up to ~22%.

- GST (similar to VAT) may apply for crypto payments if used to buy goods/services.

-

- Regulatory environment: Monetary Authority of Singapore (MAS) provides clear registration/licensing.

- Residency requirements:

-

- Tax residency usually requires ≥183 days in a calendar year.

- Investor and work visas are available for high-net-worth individuals seeking residency.

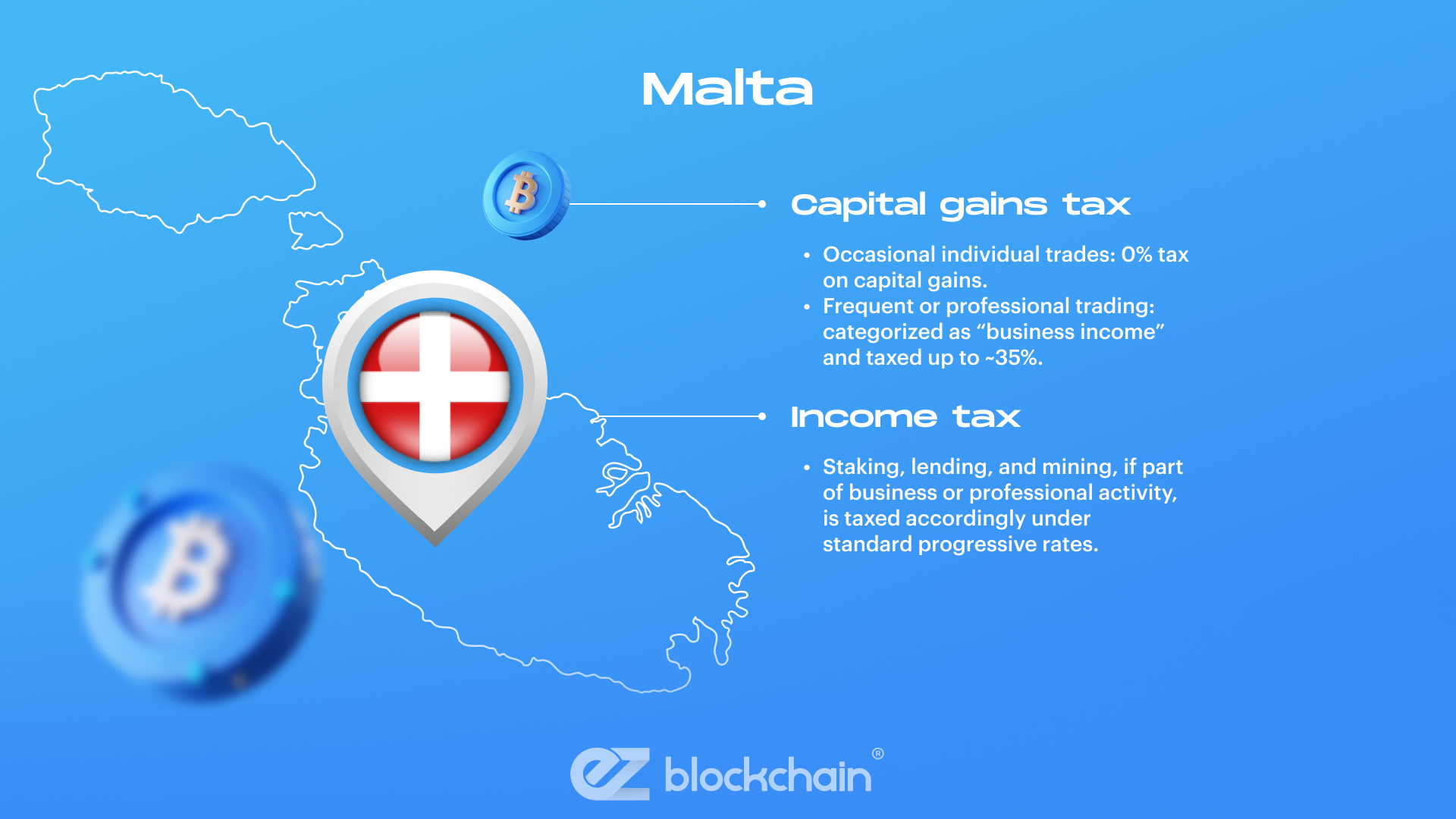

Malta

Known as the “Blockchain Island”, Malta stands out among the tax free crypto countries, treating even long-term crypto trades as non‑taxable for occasional investors. Of course, frequent or professional trading is taxed as business income (up to ~35%). The country’s Virtual Financial Assets Act provides sufficient legal clarity and even EU-based resident options via investment-based programs.

- Capital gains tax:

-

-

- Occasional individual trades: 0% tax on capital gains.

- Frequent or professional trading: categorized as “business income” and taxed up to ~35%.

-

- Income tax: Staking, lending, and mining, if part of business or professional activity, is taxed accordingly under standard progressive rates.

- Regulatory environment: Malta’s Virtual Financial Assets Act provides transparent licensing and clear legal framework, earning it the “Blockchain Island” reputation.

- Residency requirements:

-

- EU residency — possible via investment-based residency or citizenship programs.

- Standard residency is also achievable with long-term stay or localized professional activity.

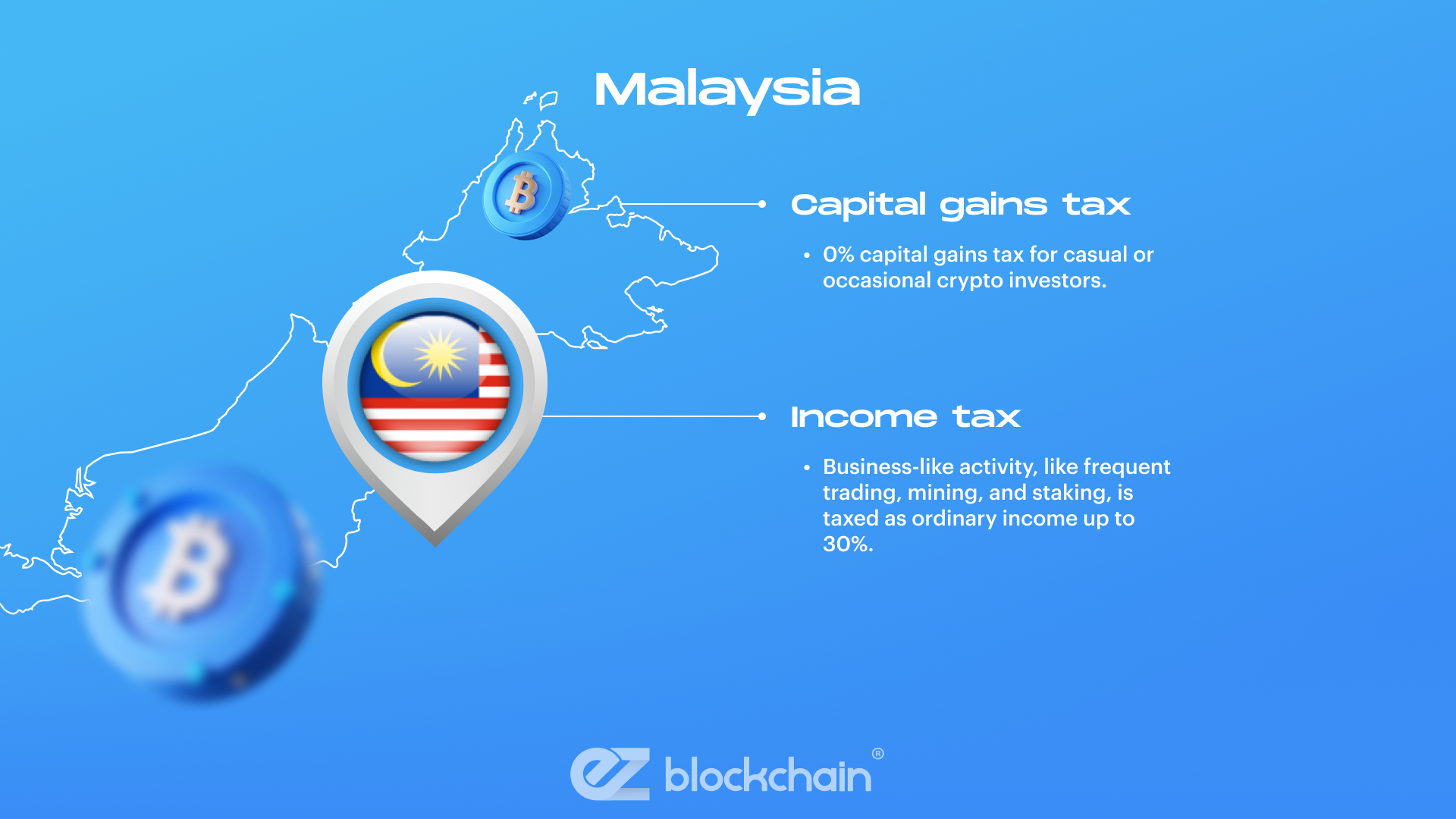

Malaysia

Malaysia is a great, profitable location for locating crypto mining or trading operations, which isn’t that overcrowded with businesses and entrepreneurs yet. There are no local capital gains or income tax on crypto for casual or occasional investors. However, profits from frequent trading or business-like activity may be taxed as ordinary income, up to 30%. And tax residency can be simply achieved if you manage to reach Malta.

- Capital gains tax: 0% capital gains tax for casual or occasional crypto investors.

- Income tax: Business-like activity, like frequent trading, mining, and staking, is taxed as ordinary income up to 30%.

- Regulatory environment: Growing regulatory framework; professional and enterprise crypto entities mostly face standard corporate and tax rules.

- Residency requirements:

-

- Tax residency usually requires ≥182 days/year.

- Standard work or business visas apply.

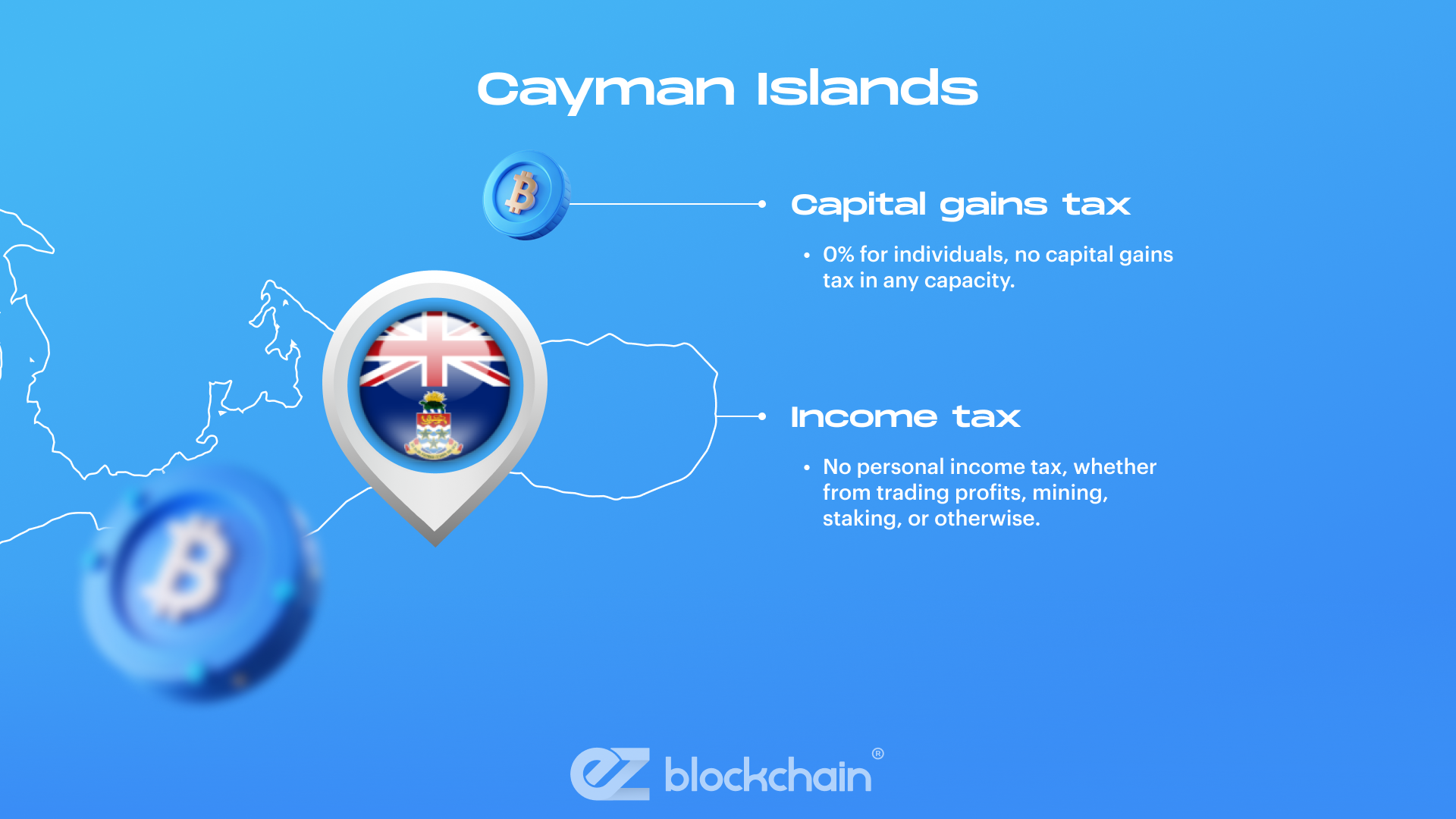

Cayman Islands

If the Cayman Islands have been missing from your map of crypto tax free countries, it’s high time to add it and pin it, as there’s no personal income tax, capital gains tax, or corporate tax on crypto. Yes, this may as well be the “winner” of our list, offering some of the friendliest conditions possible if you manage to locate operations there. The Cayman Islands’ crypto is regulated under the Virtual Asset Service Providers Act (effective April 2025).

- Capital gains tax: 0% for individuals, no capital gains tax in any capacity.

- Income tax: No personal income tax, whether from trading profits, mining, staking, or otherwise.

- Regulatory environment: Virtual Asset Service Providers Act establishes clear licensing and regulatory transparency for crypto service providers.

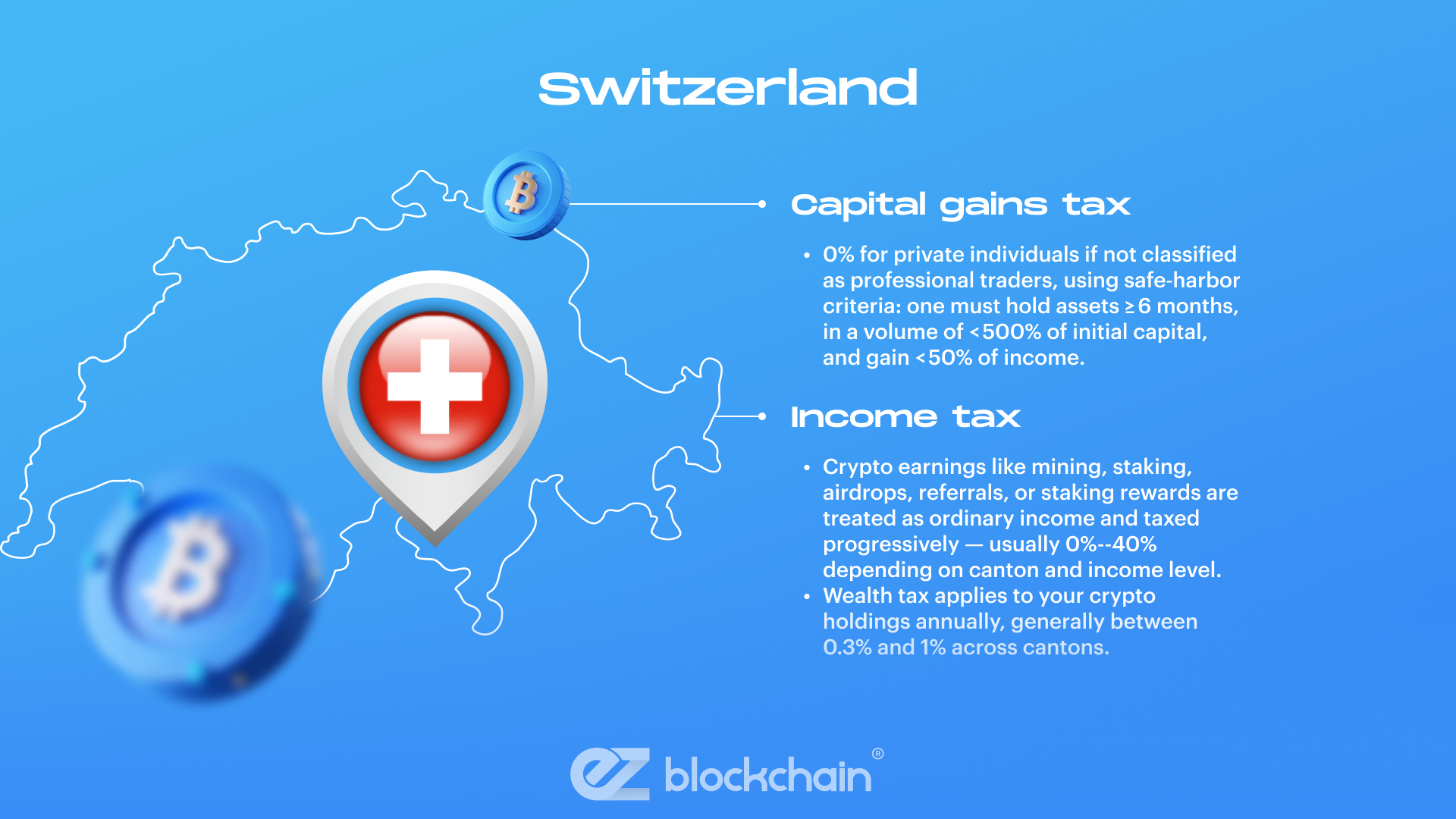

Switzerland

Another go-to location, Switzerland leaves individual capital gains on personal crypto holdings tax‑free. However, the local wealth tax of 0.5–0.8% may apply depending on the canton your operation is located in and your total assets. And income from mining, staking, or professional trading is taxed based on regional income tax rates.

- Capital gains tax:

-

-

- 0% for private individuals if not classified as professional traders, using safe‑harbor criteria: one must hold assets ≥ 6 months, in a volume of < 500% of initial capital, and gain < 50% of income.

- 0% for private individuals if not classified as professional traders, using safe‑harbor criteria: one must hold assets ≥ 6 months, in a volume of < 500% of initial capital, and gain < 50% of income.

-

- Income tax:

-

- Crypto earnings like mining, staking, airdrops, referrals, or staking rewards are treated as ordinary income and taxed progressively — usually 0%–40% depending on canton and income level.

- Wealth tax applies to your crypto holdings annually, generally between 0.3% and 1% across cantons.

- Regulatory environment:

-

- Governed under Switzerland’s DLT Act with clear licensing standards via FINMA, covering exchanges, custodians, and token issuers. Cantons like Zug (Switzerland’s Crypto Valley) even allow tax payments in BTC or ETH up to defined thresholds.

- Residency requirements:

-

- Tax residency requires ≥90 days of stay without gainful employment or ≥30 days while working in the country.

- High-net-worth individuals can opt for lump-sum (“forfait”) taxation, paying a negotiated flat rate based on living expenses in friendly cantons like Zug or Geneva.

Comparison Table

To sum up and make your choice of a crypto tax free location, here’s an elaborate table comparing the above criteria for each mentioned country.

| Country | Capital gains (for individuals) | Income/Mining/Staking tax | Residency traits |

| Cayman Islands | 0% | 0% | High cost of living, residency licensing required |

| Germany | 0% if >1 year; <€600–1,000 tax-free | Ordinary income tax rate | Tax resident ≥183 days/year |

| Portugal | 0% if >12 months | 28% for short-term profits; staking income — variable tax rates | NHR benefits closed to new applicants |

| Singapore | 0% | Income tax for regular crypto income or business | Accessible via investor visas |

| Switzerland | 0% for personal holdings | Wealth + income tax on professional activity | High cost of living, canton-dependent |

| Malta | 0% for occasional trades | Up to 35% on professional trading | Residency via investment possible |

| Malaysia | 0% for casual traders | Income tax on business-like crypto trading | Under review in 2026 |

Still got more questions or need assistance locating crypto operations? Talk to experts at EZ Blockchain — consult your next step with pros, purchase a mining rig, or order hosting services to save the budget.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.