Stay up to date with the latest news, announcements, and articles.

With the 4th halving, Bitcoin’s supply issuance dropped from 6.25 BTC to 3.125 per block, reducing daily production from 900 to 450 coins a day. We are a couple of weeks into the new halving epoch. What kind of effects have we seen in the aftermath of the event? These are the 7 trends EZ Blockchain has identified:

- Record Streak of ETF Outflow

- Transaction Fees Drop

- Bitcoin Rune Hype Faded

- Hashprice Marking Historic Lows

- ASIC Bitcoin Miner Efficiency Matter

- Price of Used Bitcoin ASIC Miners Tumbles

- Network Hashrate Starting to Show First Signs of Capitulation

Let’s delve into the details of these trends and learn how they affect miners.

-

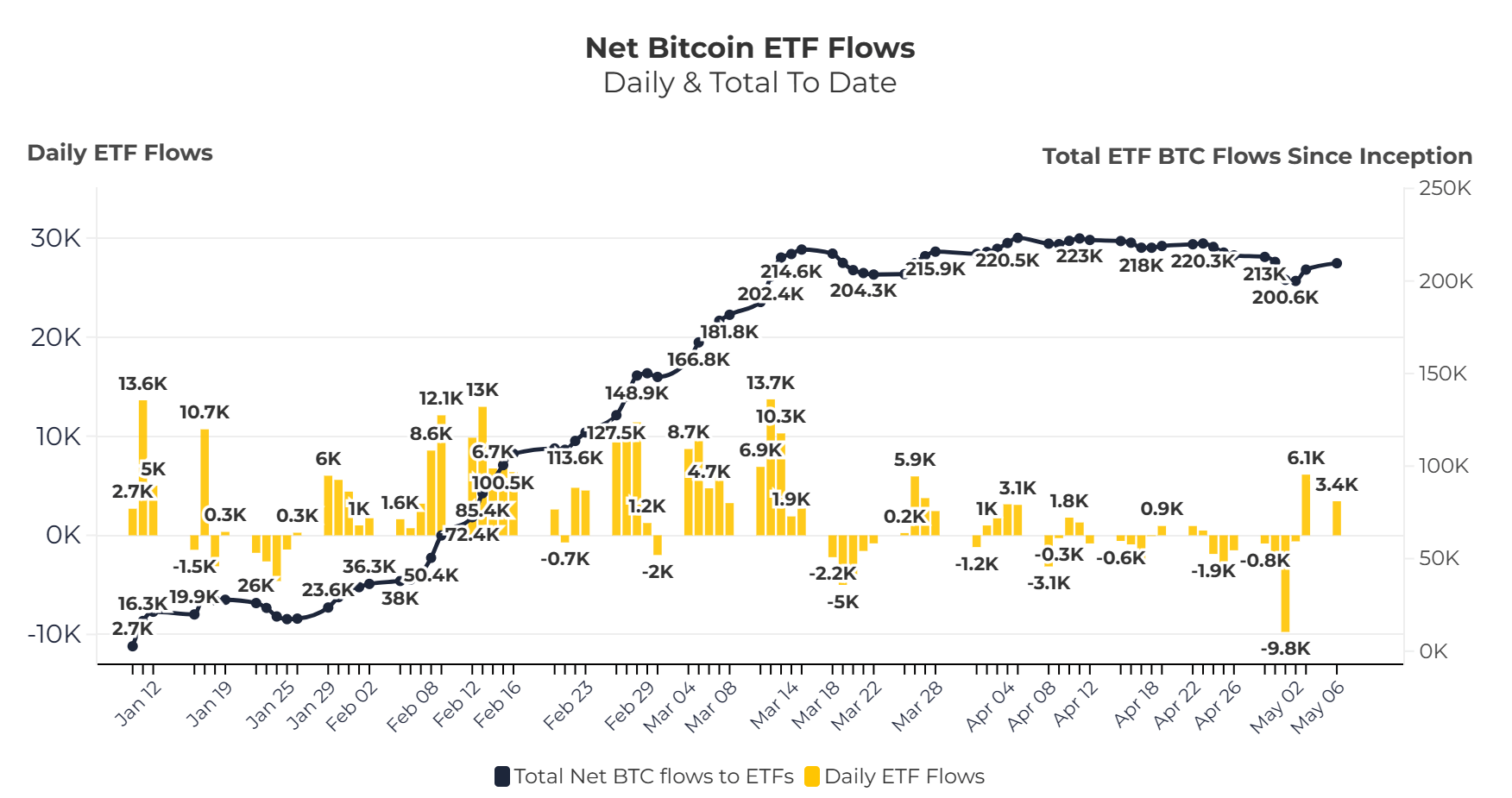

Record Streak of ETF Outflow

The strong demand for spot ETFs after their launch was an important driver behind the price move from $40k to $75k. However, in the week after the Halving event, ETF holders began selling, leading to a record streak of seven days with net outflows. According to James Butterfill, head of research at CoinShares, the recent price correction has led to hesitancy from investors, resulting in much lower inflows into new ETF issuers in the US. The recovery of BTC price on March 2, resulted in a net inflow the next day putting an end to the record streak of outflows.

The six new crypto ETFs that started trading in Hong Kong provided some hope. The first spot Bitcoin and spot Ether ETFs launched in the region, but the trading volumes were quite lackluster. Total trading volume for the Hong Kong ETFs was slightly over $100 million. In comparison, the US debut for the Bitcoin ETFs saw more than $4.5 billion in trading volume on day one.

-

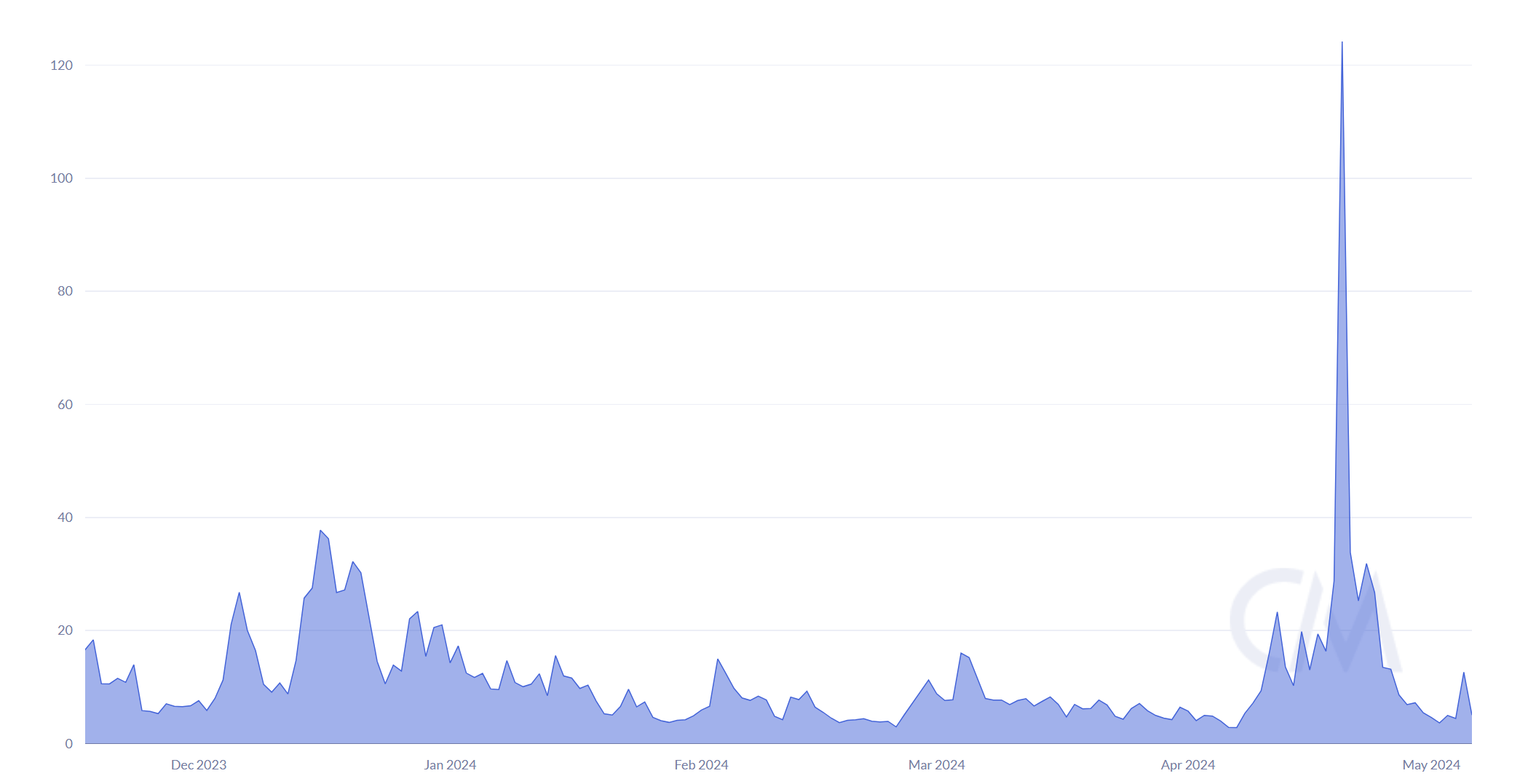

Transaction Fees Drop

ViaBTC hit the halving block at 840,000 with a whopping 37.626 BTC in transaction fees, resulting in over 40 BTC in total block rewards. This halving block recorded the highest fees seen since May 2021. Although block 840,000 was impressive, it wasn’t the only one with high fees. In fact, within the first 100 blocks of the new halving cycle, there was an average of 11.19 BTC in fees, with seven blocks having over 20 BTC and 52 blocks with over 10 BTC in fees.

The average transaction fees in USD dropped in the days after the halving, going from $124 at the peak to less than $4 in the following weeks. This is great news for those who want to send transactions on the base layer but has a huge impact on the profitability for miners.

Source: CoinMetrics

-

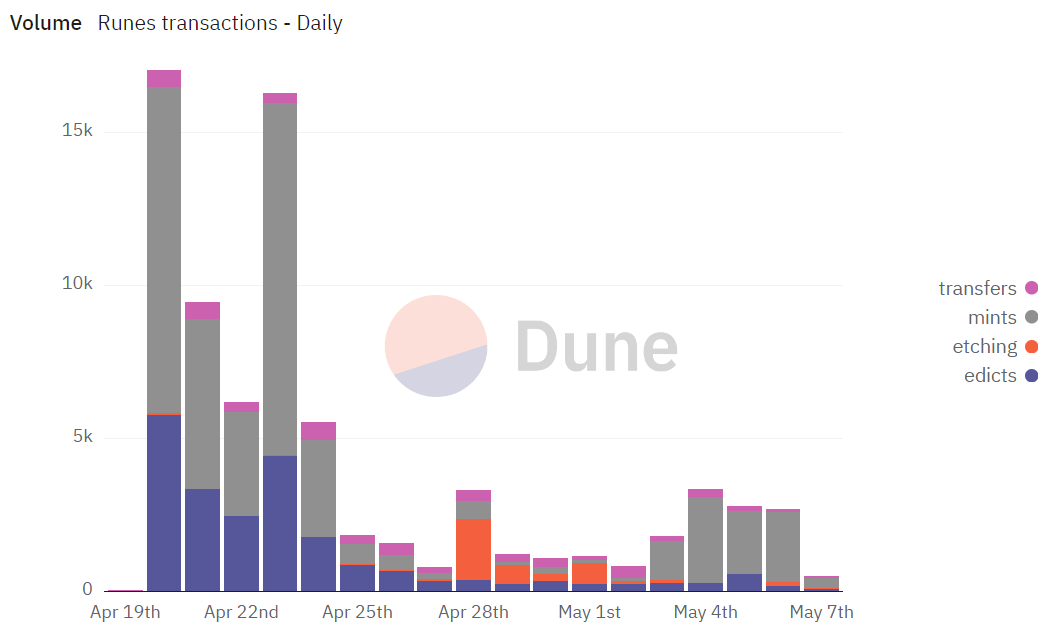

Bitcoin Rune Hype Faded

The spike in transaction fees around the halving was driven by the hype surrounding the Runes protocol, which was launched at block 840,000. The protocol collected $62.4 million in revenue fees on the day of the halving. However, in the following days, Rune transactions underwent a notable reduction compared to other transactions. This indicates how quickly its hype fizzled out.

-

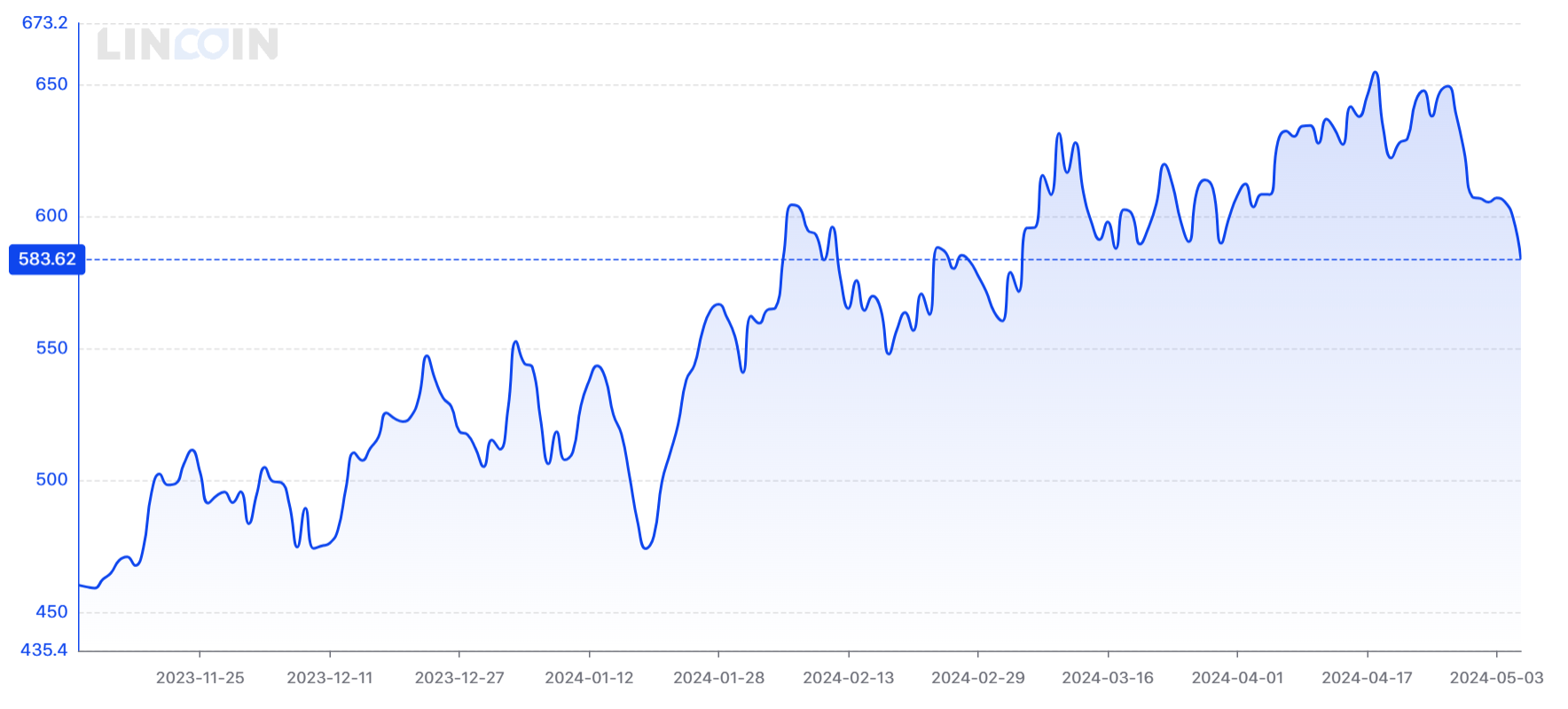

Hashprice Marking Historic Lows

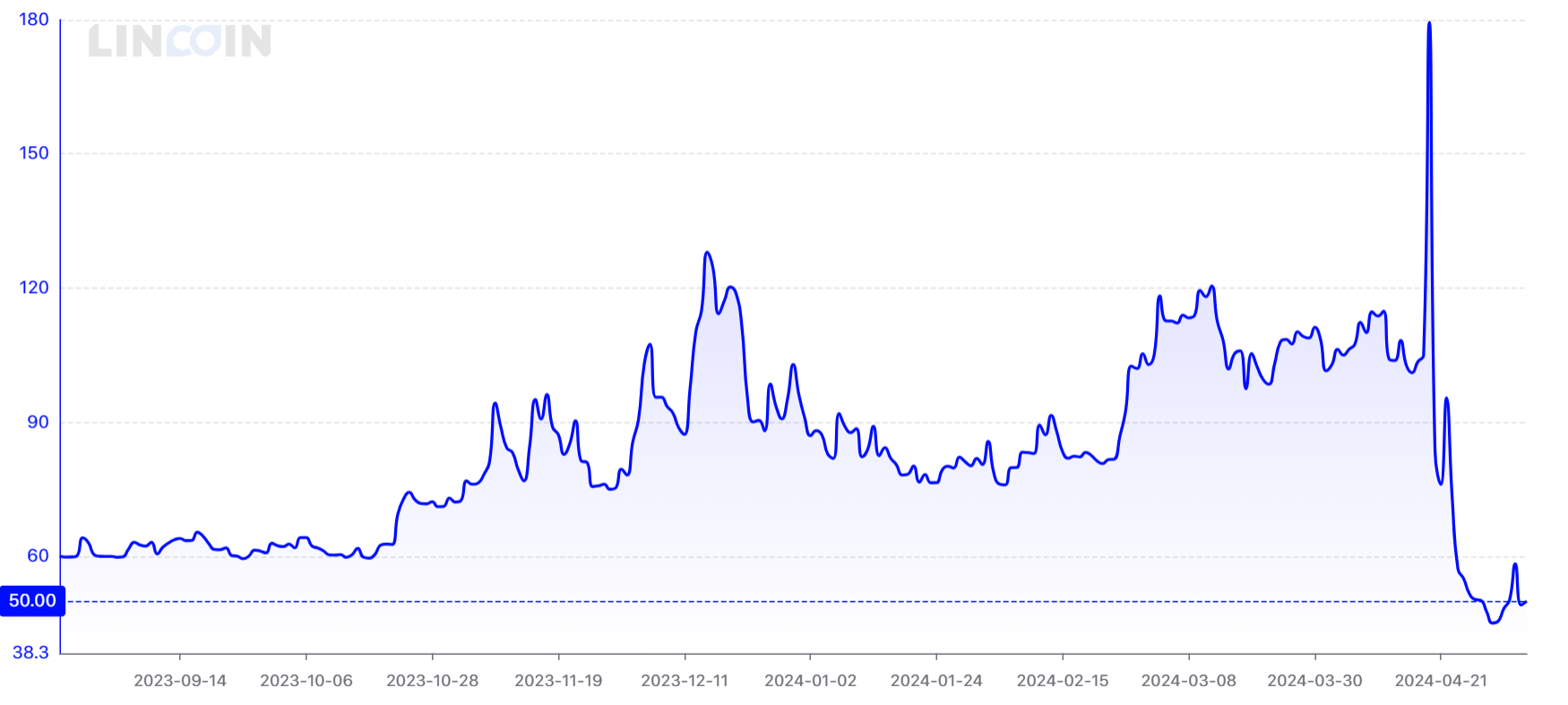

Hashprice serves as a crucial metric for miners, indicating the expected earnings in USD ($) per Petahash (PH/s) of computing power per day. It’s influenced by Bitcoin price, network difficulty, block subsidy, and transaction fees. After the halving, the surge in fees caused hashprice to skyrocket by 71%, reaching levels last observed in April 2022. However, shortly after peaking at $179/PH/Day, hashprice experienced a sharp decline. It even fell below $55/PH/Day, the record low level of November 2022. Currently, it’s recovering slightly from the record lows of $47/PH/Day, which was a 74% decline from the yearly high on April 19th.

-

ASIC Bitcoin Miner Efficiency Matters

Efficiency is how much power an ASIC Bitcoin miner or mining fleet is using to produce a certain amount of hashrate. It’s measured using J/TH and calculated by dividing power (W) by the amount of computational power (TH). The lower the amount of J/TH, the better the efficiency.

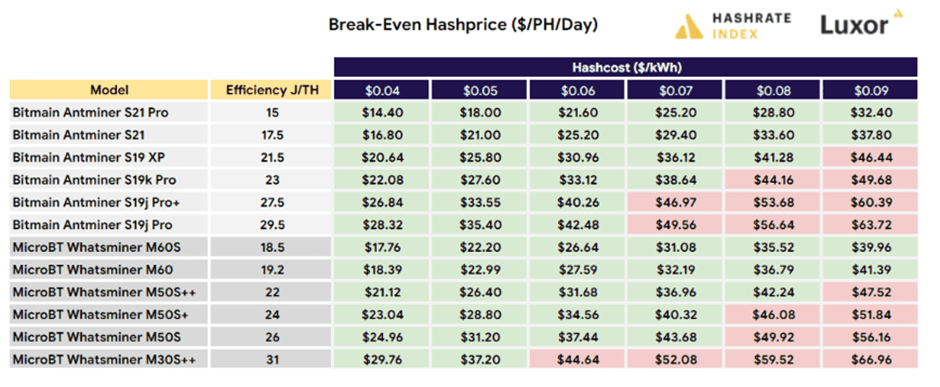

With Hashprice at $47/PH/Day, it becomes very apparent that ASIC miner efficiency matters. In current market conditions, miners operating machines with an efficiency of >30 J/TH are struggling if they have a hashcost (or hosting fee) of >$0.07/kWh.

The S19k Pro and M50S+ are unprofitable at >$0.08/kWh, and the more efficient S19 XP and M50S++ are projected to operate at a loss if hashcosts rise above $0.09/kWh. The latest, most efficient machines with an efficiency below 20 J/TH are still in the green, even if they operate at an elevated hashcost.

Source: Luxor Technologies

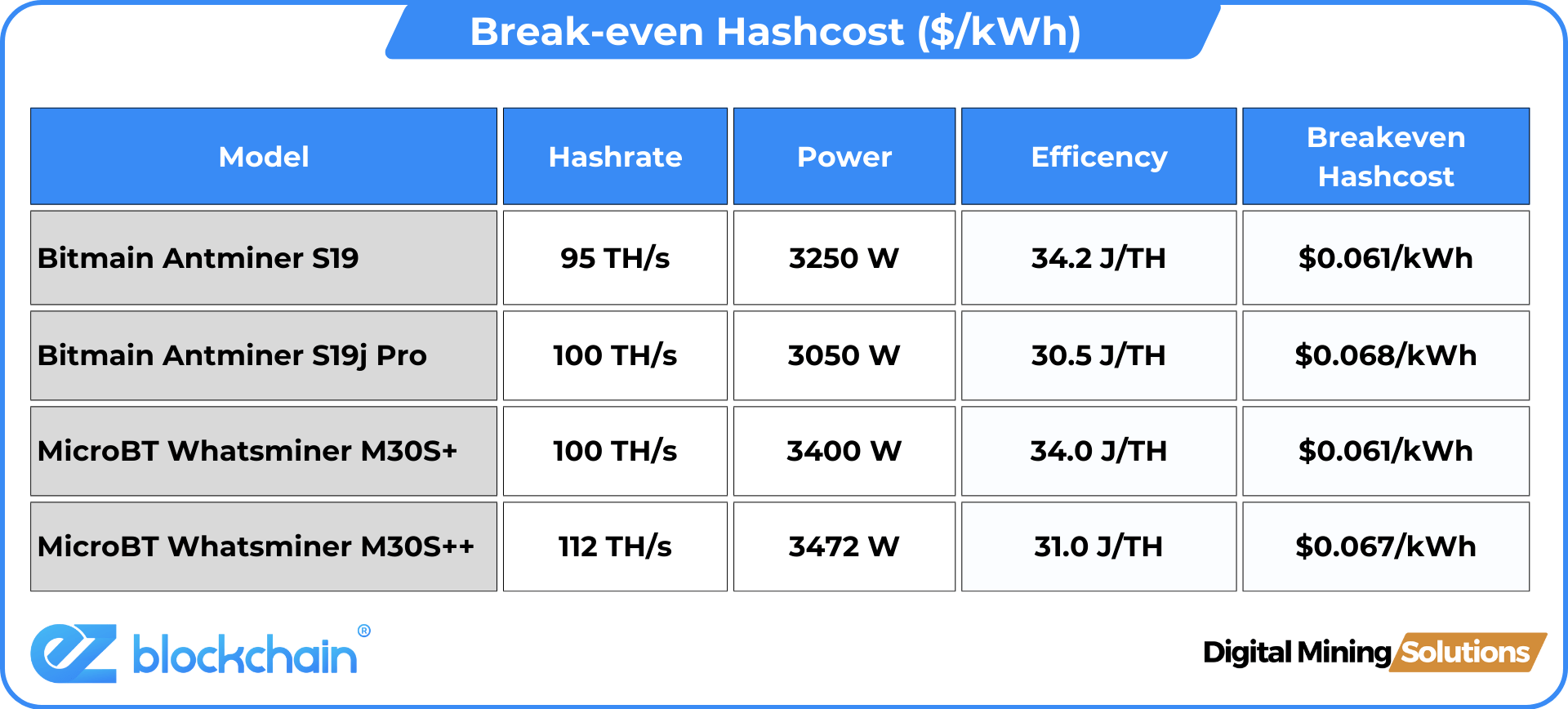

With hashprice dropping to historically low levels, not only are many old- and mid-gen ASIC miners mining at a loss, but some miners with new-gen machines are also in the red right now. At current hashprice of $50/PH/Day, the most popular machine on the network, the Antminer S19j Pro, is breaking even at a hashcost of $0.068 per kWh. While self-miners might still be running at a profit, many of these machines at hosting facilities in North America will not be.

Source: Digital Mining Solutions

-

Price of Used Bitcoin ASIC Miners

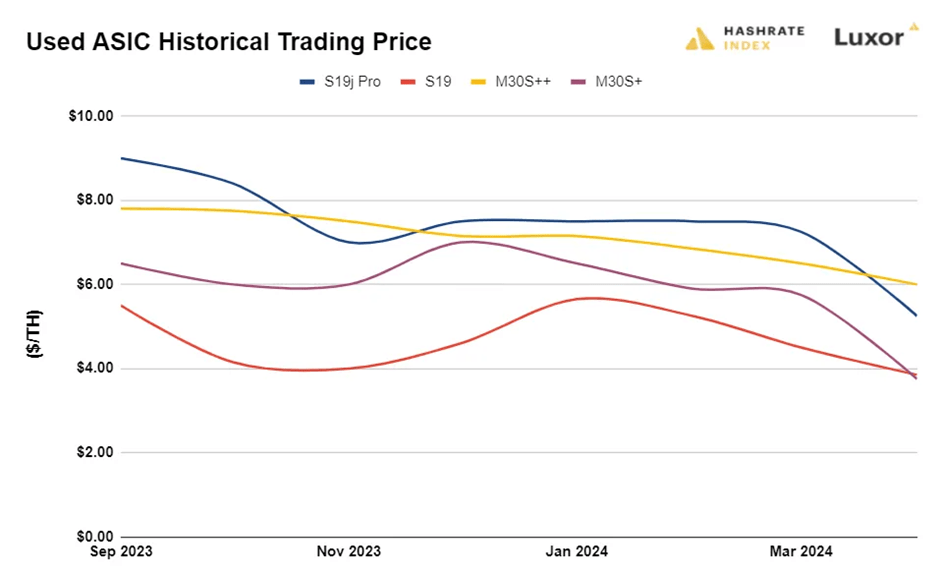

As a consequence, new-gen machines with an efficiency of >30 J/TH are falling in price. Significant price adjustments were observed at the Luxor ASIC miner marketplace for popular used ASICs. The most notable adjustment was seen in the S19j Pro, which experienced a 28% decrease in its average clearing price from $7.25/TH in March to $5.25/TH in April. The M30S+ saw a 35% drop from $5.75/TH to $3.75/TH.

Source: Luxor Technologies

As Bitcoin margins tumble, the demand for the latest generation ASIC models will increase over their predecessors. But for now, most miners are still sitting tight, and prices for ASIC models with sub-25 J/TH efficiency have remained virtually unchanged, suggesting that mining equipment is bottoming out. Currently, machines with an efficiency under 25 J/TH are priced at $12.21 per terahash.

-

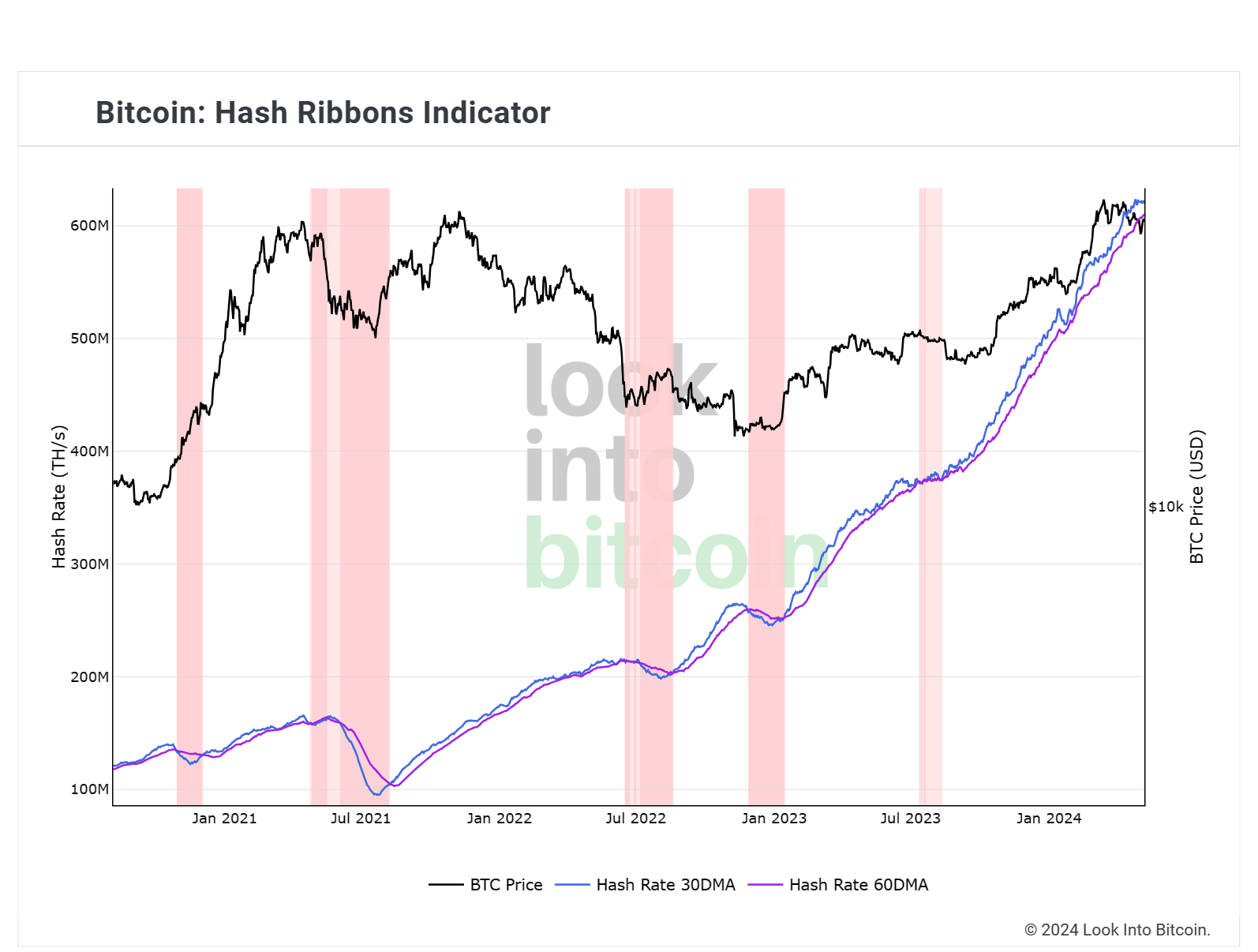

Network Hashrate Starting to Show First Signs of Capitulation

The network hashrate reached an all-time high of 654 EH/s on the 7-Day Moving Average (DMA) just a day before the halving event. The network hashrate 7 Daily Moving Average (DMA) declined almost 71 EH/s (10.9%) in the weeks after the halving.

This might sound like a lot, but such a decline is not out of the ordinary. Miner capitulation, in technical terms, is defined as the hashrate 30 DMA crossing below the 60 DMA. As shown by the Hash Ribbon Indicator, network hashrate still has a long way to go.

As mining margins take a hit over the last week, we start to see the first signs of a major drawdown in hashrate. Some miners that are mining at a loss might still keep machines online to observe how the market will play out. It was just a couple of weeks ago when mining was still highly profitable. Before an actual miner capitulation event happens, hashprice needs to go even lower or stay at suppressed levels for a prolonged time.

Conclusion: 7 Tips to Survive Current Market Conditions

- Ensure that your operation maintains a solid uptime. In the event of another spike in transaction fees, it’s crucial that your miners are operational to capitalize on these shorter but highly profitable periods.

- If you possess machines with an efficiency greater than 30J/TH, switch them to low-power mode. Decreasing power consumption enhances efficiency. This approach could sustain profitability even at lower margins.

- If you’re barely breaking even or operating at a loss, and your power or hosting agreement permits, consider temporarily taking your ASICs offline. This allows you to observe the market from the sidelines. If Bitcoin’s value rises and margins improve, you can bring the miners back online.

- If you’re mining at or near break-even levels, contemplate upgrading your miner fleet with more efficient machines.

- When retiring your ASICs and not in immediate need of capital, consider retaining the machines and selling them in a few months. The market is likely to be inundated with used machines, potentially fetching a higher price if you wait for the market to absorb the surplus.

- If your miner is nearing break-even and malfunctions, evaluate whether repairing the machine is worthwhile. Given the current low-margin environment, recouping the costs of an expensive repair might prove challenging.

- In the event of an ASIC breakdown, consider consolidating miners. Salvaging broken ASICs for parts may enable a quick fix of another miner in your fleet. Saving on parts costs could justify the repair effort.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.