Stay up to date with the latest news, announcements, and articles.

- What Is Bitcoin Mining?

- How to Regulate a Gold Rush

- Governments Are Starting to Respond

- China vs. Kazakhstan: An Important Contrast

- China

- Kazakhstan

- See the trend?

- What are mining pools? Why does it matter?

- Taxes and Cryptocurrency Mining

- Bitcoin Earned Through Mining

- Taxes on The Sale of Mined Bitcoin

- Current U.S. Bitcoin Mining Regulations by State

- Bitcoin Mining Legality: It's All About Energy

- Is Crypto Mining Worth Your Investment?

- New Needs, New Regulations

- Next Steps

Some regulations will protect consumers, and others will protect government interests. Still others will protect the environment.

In the United States, cryptocurrency has become a focus of the SEC, the CFTC, the FTC, the IRS, the OCC, and the FinCEN. No end of the debate is insight. The conversation, however, has been focused almost entirely on buying and using cryptocurrency.

The regulations few are talking about are those around mining cryptocurrency.

Is cryptocurrency mining currently regulated? Is mining Bitcoin illegal in certain jurisdictions? What do Bitcoin miners need to know? Is Bitcoin mining legal?

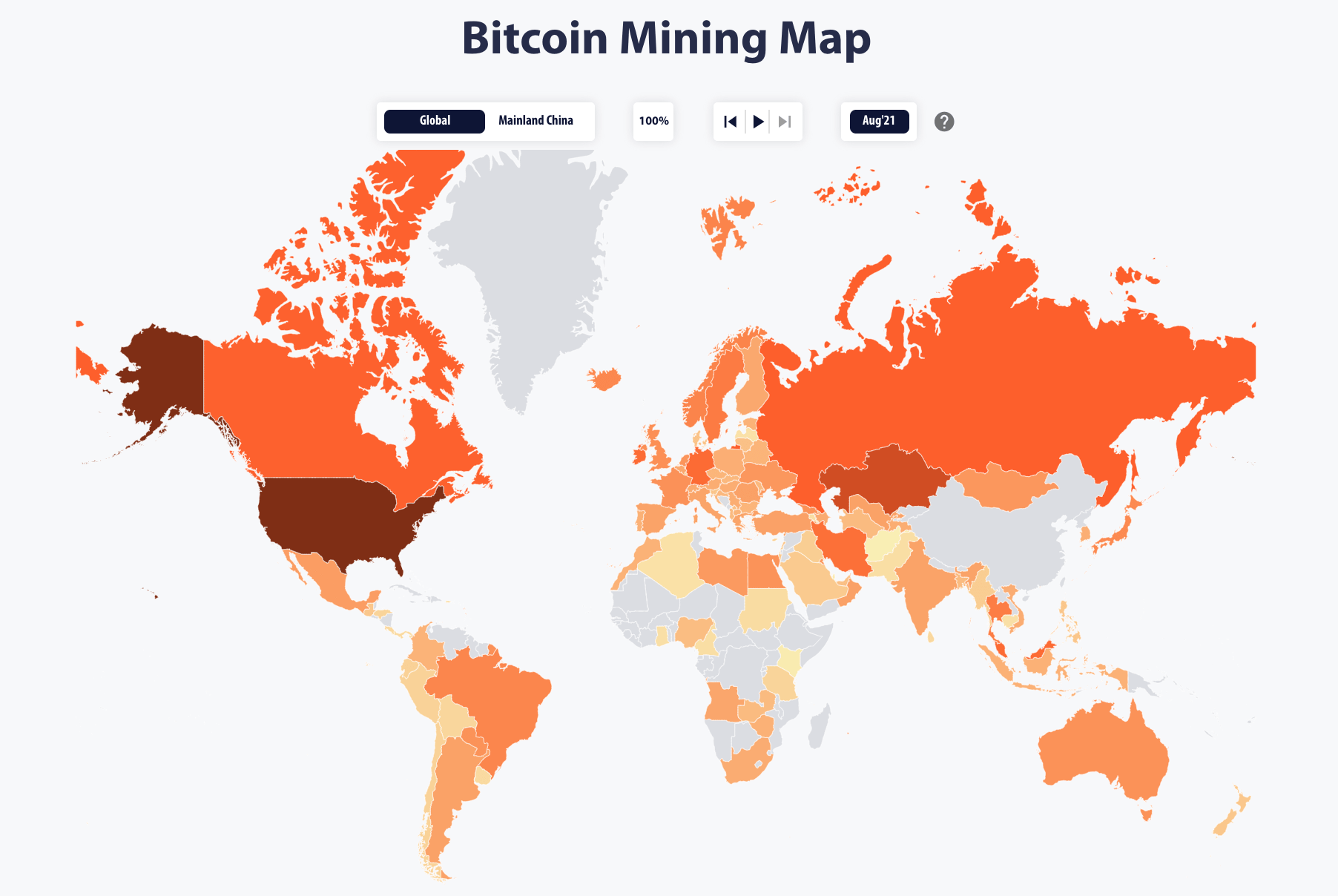

The Chinese government recently cracked down on Bitcoin mining within their borders. Miners were effectively sent abroad (most to Kazakhstan, Russia, and the U.S.) with their equipment and investments in tow.

What was China’s rationale for cracking down, though? What regulations are in place elsewhere? Is crypto mining legal in the US, and what does the future of Bitcoin and other cryptocurrency mining regulations look like?

What Is Bitcoin Mining?

“Mining” of cryptocurrency is how new coins enter circulation. The mining process is a complex sequence of equations solved by a decentralized computer network. Decentralized computers around the world maintain the blockchain ledger. New coins “mined” are the reward for their work each time they successfully solve a digital token equation.

Mining cryptocurrencies is demanding (and resource-intensive) because the encrypted transaction equations are so complex. Each high-performance mining rig (advanced computers) uses the latest processor technology and runs 24/7 because the miner who solves each equation is the one who earns the new coin.

That race to the finish line of each transaction has created a digital “gold rush” of crypto mining, particularly of Bitcoin.

The original Bitcoin Protocol by the founder Satoshi Nakamoto caps the total number of Bitcoin at 21 million. Bitcoin was easier to mine in the beginning so that more coins would enter circulation.

Today, however, solving one Bitcoin equation takes hundreds of times the energy and computing power than the original equations required.

Cryptocurrency mining has nonetheless attracted more miners and investments. Many miners fail because the process is costly and only sporadically rewarding.

The changing regulatory landscape could impact mining for better or worse.

How to Regulate a Gold Rush

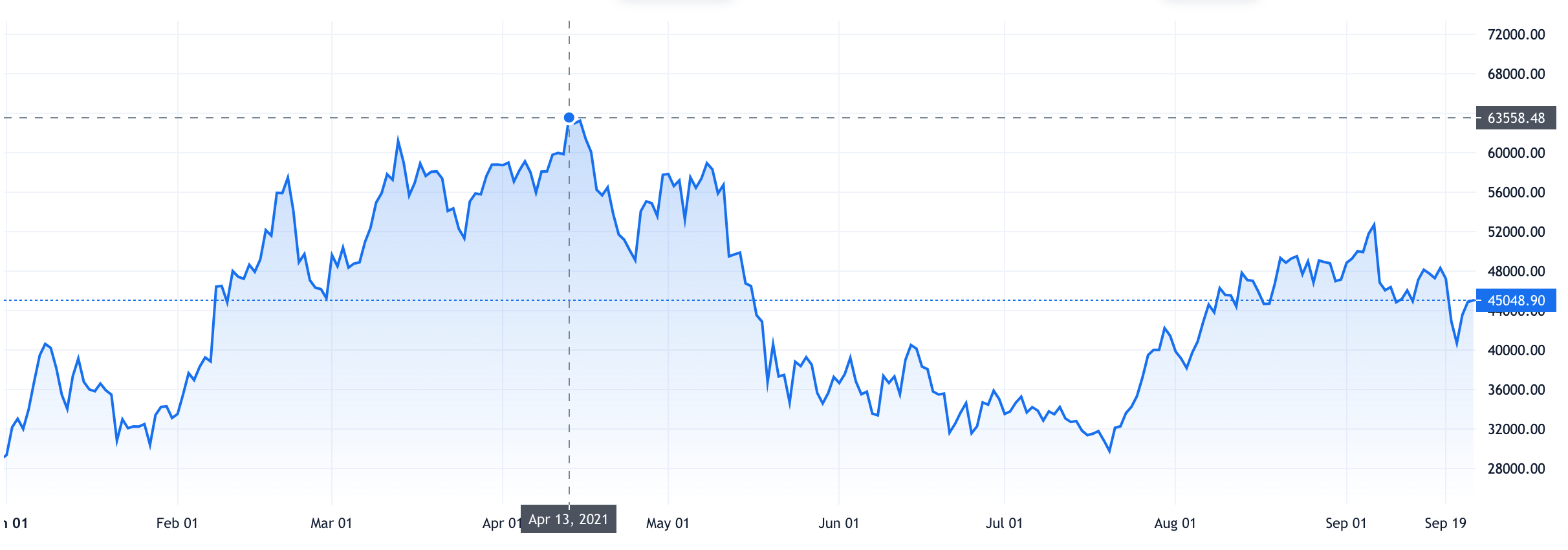

The biggest draw to crypto mining is the prospect of gaining newly minted crypto coins. With Bitcoin valued at almost $60,000 per coin in April 2021, Bitcoin mining has garnered special attention.

The governments of each country where mining takes place see the booming industry as an opportunity to tax gains, of course. New tax laws are also being used to support or pressure the crypto mining industry (for better or worse).

In countries like El Salvador and even states like Montana and Wyoming, new tax laws incentivize more mining. This differs from China’s own tax decisions that pushed mining operations out of the country.

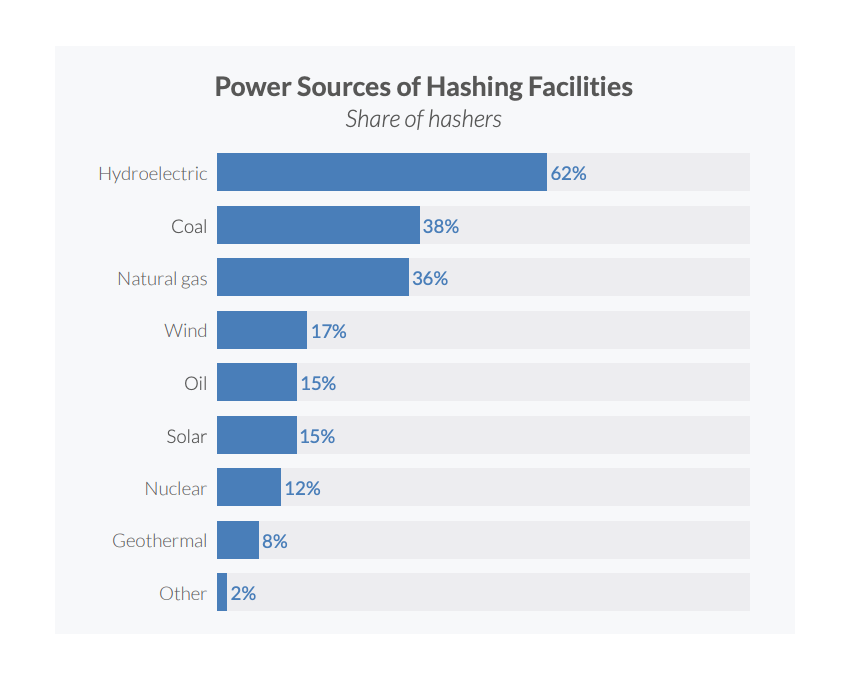

China also used another legislation on cryptomining to discourage Bitcoin mining: new laws around energy consumption. Because of the sophisticated computers needed to mine cryptocurrency, miners have become an unprecedented energy consumer.

Governments that oppose crypto mining cite the energy-hungry operations as a principal reason for rigidly regulating the industry.

As in El Salvador, another approach to regulating mining comes in the form of recognizing Bitcoin as legal currency—or forbidding it. The progressive Salvadoran president just lobbied successfully to recognize Bitcoin and the decision will have a huge impact on the Salvadoran economy. More foreign miners will come in droves.

Foreign bitcoin miners will also bring tremendous amounts of money into alternative energy development in El Salvador, bringing us right back to the issue of energy and computing power. The regulatory questions around crypto mining and energy consumption are clearly interrelated: bitcoin mining depends on cheap energy to support more computing power, and today’s miners compete for that energy aggressively.

Here, we’ll take a closer look at each of the factors in play in the bitcoin system, starting with a general look at how governments are beginning to respond.

Governments Are Starting to Respond

The debate has increased significantly since the early days. Recent years have seen whole governments and bands of lawmakers step into the arena of bitcoin use and mining and whether it should be legal, regulated, or taxed.

The more the crypto mining market heats up, the more of these kinds of regulations come down.

Prospective miners must realize that the increasing growth in mining competition does mean that more regulation will follow. Countries and regional jurisdictions will choose to do anything from outright banning bitcoin use and mining to actively legalizing it.

The best solution for miners in most cases will be to keep their mining operations as mobile as possible. Then, not only will they follow the best opportunities for the upfront cost of energy, but the most favorable laws and cryptocurrency mining regulation, too.

China vs. Kazakhstan: An Important Contrast

Look at two global cases—China and Kazakhstan—to bring the shifting regulatory landscape into focus.

China

China was once home to more than half of global Bitcoin mining operations. More recently, the government has cracked down on the mining industry due to energy consumption and infrastructure concerns.

Specifically, the China State Council spoke to the need to “mitigate financial risk,” however the decision came after a newsworthy blackout in one of the most active mining regions. It was assumed that crypto mining energy consumption was to blame.

Other local authorities in China did speak to the “misuse of electricity,” “shortage of electricity” and “highly polluted source [of electricity]” in talking about the decision, too.

The end result was a mass exodus of bitcoin miners from China to other bitcoin-friendly nations.

Kazakhstan

Kazakhstan is considered one of the world’s most “mining-friendly” countries today. Indeed, many miners who fled from China made a home in the central Asian nation instead.

The Kazakhstan government sees mining bitcoin and other digital currency as a business opportunity and economical boon. They have encouraged private mining investments at an opportune time as the price of bitcoin has soared.

Today, the country has the second-largest bitcoin mining community (thanks largely to the recent arrivals from the China market).

In 2020, Kazakhstan formally legalized mining bitcoin and bitcoin transactions. It wasn’t expressly illegal before, so this wasn’t a huge change, however, it made a clear statement on government saw the digital token.

There were tax purposes to the decision, too. The tax code was simultaneously amended to allow for the taxation of digital currency mining. The taxable amount would be based on each miner’s energy consumption.

Since then, this revenue for the government has opened doors for the citizens of Kazakhstan, and miners have considered it a fair shake to set up shop within their borders.

The recent influx of miners coming from China has, however, pushed the demand for energy in Kazakhstan to its limit. Proponents of the new cryptocurrency mining business have suggested investing some of the energy tax in new, greener sources of energy—for the new industrial demand and for the general public.

It is possible that Kazakhstan could arrive at the same all-out-ban conclusion that China did if this new energy demand is not managed as the opportunity for investment that it is.

See the trend?

There is a trend in the countries where crypto mining businesses are set up in droves.

Originally, China offered an attractive regulatory landscape. One their energy demands were too much for existing infrastructure, however, the government took a very different spin on crypto mining.

Recently in Iran, summer blackouts forced the government to come up with their own solution, too. The Irani government issued a four-month ban on all mining operations. Once they were back up and running, miners are now subject to new regulations. A licensing regime is now in place to limit what energy can be consumed by the industry.

The same could happen in Kazakhstan if the energy sector isn’t given more room to breathe now that demand from new miners is so high.

Intensive energy consumption from digital currency mining tends to be what forces governments otherwise friendly to cryptocurrency into a corner. From that vantage point, the only way out is to essentially “break up” with Bitcoin.

Other countries have taken a more productive and long-term look, however. For instance, the current government of El Salvador has pushed its own crypto mining taxes right back into green energy development. The energy needs of mining will be more easily met and the people of the country will be better served with more sustainable energy as a result.

Cryptocurrency miners congregate in geographic areas where energy is cheap. The more miners congregate, the more likely it is that the local energy system will groan under the weight.

If more countries took a long-term approach like that of El Salvador, perhaps crypto miners could better spread out, reducing, even more, the likelihood that any country or region would strain to keep up.

Meanwhile, there are other regulatory considerations to keep in mind.

What are mining pools? Why does it matter?

The natural structure of a crypto mining business is another thing to consider when looking at local, national, and international regulations. There are, for instance, “mining pools” where individual miners pool their hardware resources. This is a different model than a sole miner’s operations.

A mining pool allows individual miners (usually on a smaller scale) to combine their hardware and computational resources to increase their hash rate. The reward of any mined block is split between the parties.

Most of the time, these mining pools are representative of crypto enthusiast miners coming together online to create their own shared projects.

Mining pool resources are rarely physically pooled (but instead operate on a shared network from unique locations around the world). This tends to make regulatory concerns a little murky.

Since most of the cryptocurrency mining debate is about energy consumption, these mining pools sometimes slip through the cracks. It’s unlikely there will be new regulations looking at these operations anytime soon.

Miners not only side-step many electricity costs headaches with their global networks, but they also are considered more reliable by some. Many of these are formed on online communities (which, for the time being, are totally legal in every company), including CryptoCompare and others.

Taxes and Cryptocurrency Mining

Tax law is the easiest way for governments to wield their interests over Bitcoin mining.

In cases like the Bitcoin Law in El Salvador, tax laws come in the form of exemptions that favor Bitcoin adoption and mining. The Bitcoin Law acts as a magnet to more industry investments on a local level, too.

Bitcoin tax laws in other countries with more conservative outlooks have come in the form of taxing capital gains and reporting trading losses. Those laws, however, still haven’t addressed Bitcoin mining, specifically.

Even in China where the recent crackdown on Bitcoin took place, the new restrictions didn’t touch the current tax structure around Bitcoin mining. Instead, the Chinese government actively shut several Bitcoin exchanges down, forcing many miners to transfer operations across borders.

As new tax laws unfold, the legislation will affect how appealing (or not) the current digital gold rush will be country to country.

In the United States, reporting capital gains and losses from trading or investing in cryptocurrency has been relatively straightforward. In the early 2010s, the SEC came out with their first assessment of crypto that required declaring gains and losses.

Bitcoin mining, however, has still-undefined tax implications. For now, Bitcoin mining is considered a sticky business that requires multiple tax forms to report the same information. Evolving state regulations add to the dubiety.

The following outlines the current process for taxing and reporting Bitcoin mining in the United States.

Bitcoin Earned Through Mining

Bitcoin earned through mining is reported as gains, which are taxed at regular income tax rates. The value of each Bitcoin is determined by the day it was received (mined).

If Bitcoin is mined by a business entity, there are standard tax deductions that can lower the company’s tax liability. The costly nature of mining can be deducted as “ordinary and necessary expenses paid or incurred…in carrying on any trade or business.” That’s good for miners with the huge investments they make in energy and equipment.

Taxes on The Sale of Mined Bitcoin

When Bitcoin is mined, that creates a taxable event. Then, if those Bitcoin are sold, that creates a second taxable event. The “gain” of Bitcoin is taxed by its value at the time it was mined, then the sale is taxed at the value it’s sold for.

The value received for Bitcoin is reported as a profit or loss against the original cost basis (the value of the Bitcoin when it was mined minus the cost of mining).

Current U.S. Bitcoin Mining Regulations by State

State tax law lends another view of how Bitcoin mining is taxed. Some states encourage mining operations within their borders. Others are driving them out.

At the time of this article, no federal law in the U.S. explicitly prohibits Bitcoin mining. No laws confirm its legality, either. Instead, the federal government has left these decisions to the states.

The U.S. Treasury views Bitcoin as a currency but not as a legal tender. This allows the organization to classify those working in the blockchain as “money transmitters” but not financial institutions.

In practical terms, though, what does that mean?

Crypto miners are subject to the supervision of the U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN). This includes requirements to make suspicious activity reports and take anti-money laundering security measures.

A bitcoin miner wouldn’t usually be privy to data that appears to be “suspicious,” however, because transactions are validated individually and with total anonymity. The miner doesn’t get access to the detailed money movement of the bitcoin owner—and that’s kind of the point.

The Commodity Futures Trading Commission has had its say, too. Bitcoin was determined to be a “commodity,” meaning it falls under the Commission’s jurisdiction. That has not, however, amounted to much in the way of regulation in the last few years.

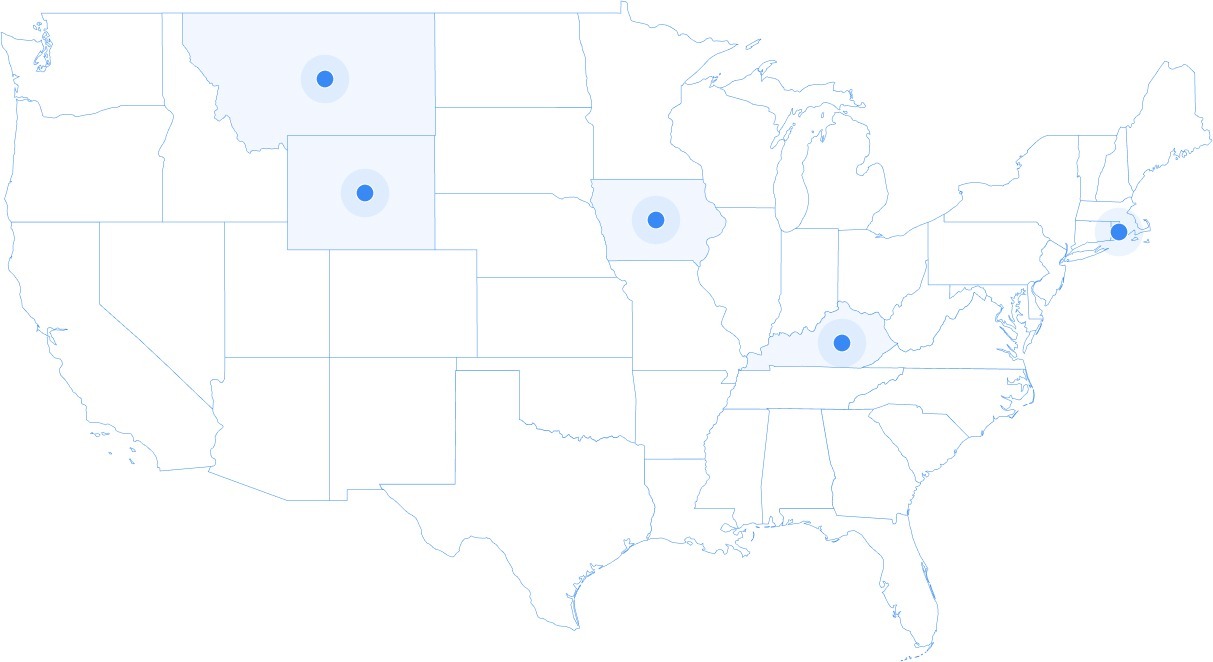

Lax though the federal position has generally been, several states have passed legislation to encourage Bitcoin mining through tax breaks and regulatory “sandboxes,” namely:

- Rhode Island

- Kentucky

- Iowa

- Montana

- Wyoming

The motivations these states have to encourage mining is no secret, either. Mining operations gain states more tax revenue, boost employment, and create more public utility revenue, especially in energy consumption.

Montana is leading the development of Bitcoin legislation related to mining and transactions. In 2017, governor Bullock used grant money to fund a large Bitcoin mining project. In 2019 the legislature passed a bill exempting cryptocurrencies from security laws.

In a similar move, legislators in Wyoming passed a law the same year providing cryptocurrency developers, sellers, and exchanges certain exemptions from securities and money transmission laws.

Other states like Pennsylvania have passed laws that encourage Bitcoin mining through another route: energy consumption.

Bitcoin Mining Legality: It’s All About Energy

Cryptocurrency mining requires a great deal of energy. The sophisticated computers running the distributed ledger include hundreds of thousands of mining operations around the world.

In the Xinjiang region of China where a recent power outage was sourced to the Bitcoin mining operations there, energy consumption concerns manifested in an increased pressure on miners to spread out. This helps avoid similar infrastructural crashes in the future.

No matter the geographical spread, however, miners have other pressures to become energy-conscious. And with the development of better hardware and new energy solutions, they’re doing exactly that.

In the 10 years since the crypto mining industry boomed, the computer processors used to mine coins have become thousands of times more efficient. This hyper-capable equipment became the new status quo because anyone mining with older equipment will have unsustainably high energy costs. The competition drives energy consciousness.

Cryptocurrency miners are a unique energy consumer and their place in the market has inspired regulatory responses around energy, too.

Bitcoin mining is illegal, for instance, in nations like Bolivia, Ecuador, Egypt, and Algeria.

Countries like El Salvador, on the other hand, are encouraging Bitcoin mining and adoption. The invitation includes the proviso that investors come prepared to develop the country’s untapped renewable energy sources. It’s a win-win for miners and for the host country.

Renewable and cleaner energy is a “must” for cryptocurrency miners today for several reasons:

- The energy on the grid is now too expensive to make mining profitable

- The energy on the grid results in too many carbon emissions, and Bitcoin’s footprint is unsustainable

- The energy on the grid does not have the infrastructure to support the energy demands of cryptocurrency mining

- The energy requirements of the blockchain will only grow, and renewable energy sources are the only long-term solution

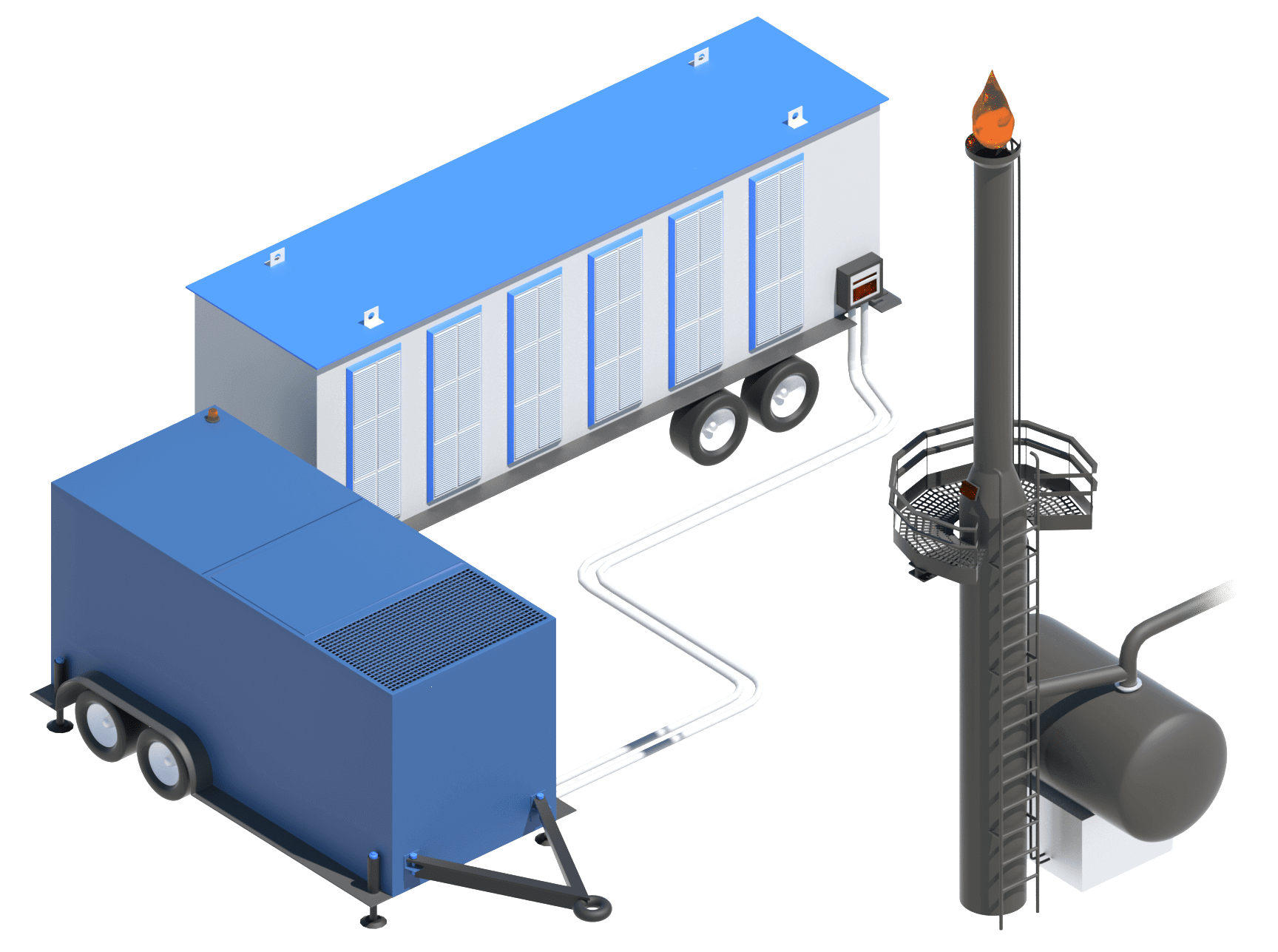

Self-sustaining energy initiatives have pushed some cryptocurrency miners to the front of the pack. For example, the EZ Blockchain initiative using natural gas cryptocurrency mining has been revolutionary for two industries: crypto mining and the oil and gas industry.

The oil and gas industry has recently been up against its own regulatory challenges:

- Consumption of fuels was down in 2020 during rolling lockdowns where the world pressed a hard “pause” on travel;

- And practices like fracking and natural gas flaring have come under fire.

New regulations require oil and gas producers to meet new standards or eliminate practices like flaring altogether.

By 2020, these requirements made oil and gas producers more receptive to the idea that EZ Blockchain’s own Sergii Gerasymovych had been pitching for more than a year. The industry lacked the infrastructure for oil and gas producers to sell natural gas to market. Instead of forcing that investment with anti-flaring laws, EZ Blockchain wanted to use that natural gas on-site.

Flaring could be eliminated by turning natural gas into productive energy right on the oil pad.

With the power-hungry Bitcoin mining industry looking for smarter energy sources, taking stranded and flared natural gas off producers’ hands to use it for crypto mining posed a win-win for both industries.

EZ Blockchain has installed “Smartgrid” systems across North America. These systems include specially-engineered mobile crypto mining centers powered by natural gas generators. Those generators take in all the natural gas that the oil and gas producers would have otherwise wasted.

Is Crypto Mining Worth Your Investment?

With all these regulations coming down, even in countries where governments showed great interest in cryptocurrency before it’s hard to navigate the legal waters today.

When any mining project comes up against the question of regulations, the answer is usually another question: if the linchpin to success is affordable and safe energy, where in the world will that be a steady constant?

It’s not what anyone wants to hear, but there are multiple factors that miners have to take into account on a regular basis to keep mining. The industry requires a constant soccer match of substitutions and strategy, so if a miner isn’t prepared for that, it’s time to get out of the business.

To get more strategic, first, a miner chooses a location. Say that country has crypto mining laws that are acceptable or even favorable. The right energy source is identified, and the miner sets up shop.

Other questions the miner will be asking at that time is what hash rate will be acceptable at the cost of local electricity.

For example, the average ASIC mining rig will use approximately 72 terawatts of power to create on Bitcoin in around ten minutes.

Right?

Not so fast. Calculating the cost of energy and equipment is done early and then cross-checked against the current hash rates required to mine coins. Due to the way Bitcoin was designed, fewer coins are introduced into circulation every year. With so many people and companies mining now, the mining difficulty of the equations on the blockchain is constantly climbing. This means each block takes more time and electricity to mine.

Whether crypto mining is worth it for a particular case comes down to these three factors:

- Energy source

- Local legal statutes around crypto mining

- Current hash rate requirements

With these three things weighed fairly, miners can determine whether a mining operation is worth it.

New Needs, New Regulations

The symbiosis of cryptocurrency and oil and gas is one of many examples of crypto miners moving toward a sustainable future. Thought leaders in the crypto industry have also created new international agreements to promote conscientious standards in the mining process and energy consumption.

With this development, the decentralized nature of crypto has proven to flourish with self-regulation.

In 2021 there was nonetheless a hearing before the U.S. Senate Committee on Banking, Housing, and Urban Affairs that zeroed in on cryptocurrency miners. The loudest voices called for tighter regulation.

Opponents of the decentralized network referred to transaction ordering and incentives that miners earn as “bribes.” They also called for “greater scrutiny” on miners’ activities.

These perspectives, however, hinged on the view of cryptocurrency miners as intermediaries, like gatekeepers to consumer buyers and their cash. This perspective is erroneous.

Given the investment that miners make as businesses, others at the hearing corrected this characterization to explain that miners’ role is actually one of a service provider.

Several states like New York have already set precedents that miners are not considered “financial intermediaries.” This standard remains in place for now.

Next Steps

The shift in cryptocurrency attitudes around the world has split in two. Some countries and other governments are seeing the opportunity. Some are even defining the requirements around that opportunity to funnel behaviors into a very specific idea they have of the future.

There are additional steps to consider when weighing the pros and cons of these regulations. These are essential to determine what mining operations are worth it, and where.

- Step one, review the requirements around Bitcoin and around the conventional financial system in the country or countries you’re considering your operations.

- Step two is to research the energy market in the country or countries you’re considering. Is it reliable? How much does it cost? How are changes in cost determined?

- Be prepared to report on numbers—if only for yourself. Even if you set up mining operations in a country where regulation is null, record your capital gains and losses as well as any Bitcoin value over a certain threshold (usually USD$10,000). These numbers will be important if regulation comes down without giving you time to prepare.

- Finally, set a business framework that includes many “if, then” statements describing your steps in certain cases. What would happen to your mining operation if you could no longer mine in a given country, for instance?

With more miners moving to the U.S. after the crackdown in China, there will be more scrutiny on the crypto mining industry coming soon. The only way to keep the Bitcoin network working as it was designed to be to keep educating thought leaders and consumers.

Stay ahead of cryptocurrency mining regulations by following EZ Blockchain articles. Look for news on sustainable energy and its role in the crypto mining of the future, too. Also we offer to explore bitcoin mining hosting solution.

Contact us to learn more.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.