Stay up to date with the latest news, announcements, and articles.

- Natural Gas Flaring Systems

- $20 BILLION OF POTENTIAL REVENUE LOST THROUGH FLARED GAS

- The Unspoken Dangers of Gas Flaring

- Effects of Natural Gas Flaring

- Natural Gas Flaring Alternative Solutions

- Alternatives to Reduce Gas Flaring

- Dated Solutions That Just Don’t Cut It

- The Future of Productive Natural Gas

- A Recent Case Study

Usually, natural gas producers collect natural gas to sell it to the market for use as energy.

Other oil and gas producers (OAGs), in contrast, only bring natural gas to the surface as a byproduct of drilling practices when reaching oil.

The intention of OAGs drilling for oil is not to sell the natural gas they find. Instead, that gas is either stored on-site, left in “stranded” pockets beneath the earth’s surface, or flared (i.e., burned) away in towering smokestacks.

The practice of flaring away natural gas sounds unproductive, and it is. OAG’s drilling for oil would gladly sell the natural gas they uncover. However, of the 9,000 OAG producers in the U.S. alone, few have access to the required infrastructure to sell the natural gas to market.

Gas flaring alternatives have become a key focus of governments and industry thought leaders alike. First, to solve the problem, it’s important to understand it.

Natural Gas Flaring Systems

Natural gas flaring has been a seeming “solution” for natural gas released during the course of oil extraction. The gas can’t be put to productive use, so it’s burned away instead.

This is a “solution” because it’s actually better for the environment than simply releasing methane-heavy gas into the atmosphere.

Of course, natural gas flaring is still a serious environmental problem. Yet, as new drilling technologies and techniques like fracking have become wider spread, more natural gas is being released.

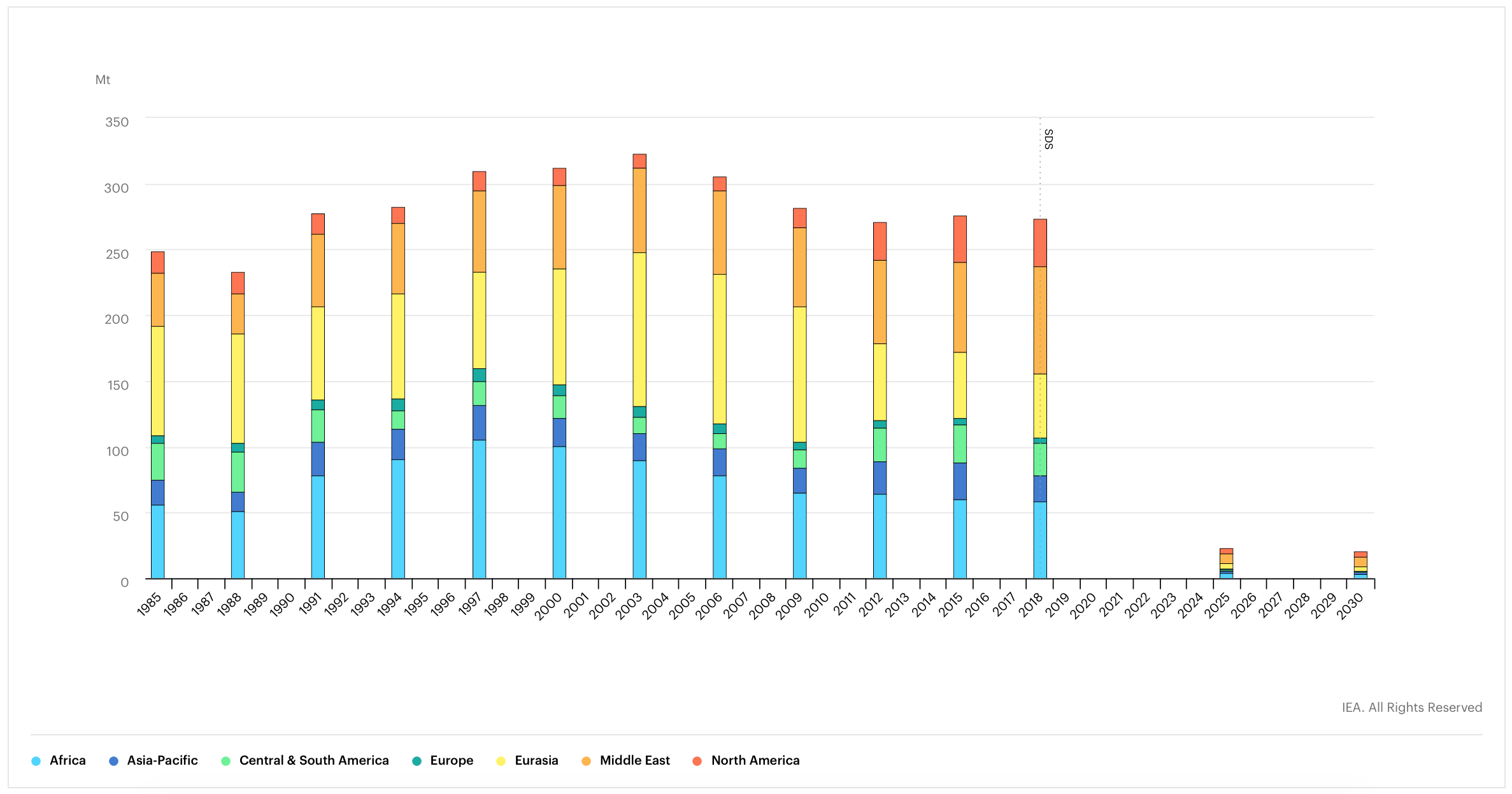

Today, the CO2 from natural gas flaring accounts for more than 5 billion MMBtu a year. If the infrastructure existed for OAG producers to sell this natural gas to the market, it could represent more than $20 billion of value each year.

$20 BILLION OF POTENTIAL REVENUE LOST THROUGH FLARED GAS

This is a lost opportunity for the OAG companies, for consumers, and carries heavy costs for producers and the world.

The typical natural gas flare used by the OAG industry utilizes a stack that collects the gases to be flared. At its tip, an air-assist mechanism combines free air with the gasses. Some of the gasses require oxidation, and the free air improves combustion efficiency for each unique mix.

Specific components of a natural gas flaring system include:

- Flashback seal drum

- Liquid knockout drum

- Flashback prevention unit

In other words, these are sophisticated stacks. They cost money to install and maintain. Not only is OAG losing the income they could have earned selling the natural gas, but they’re also having to pay considerable costs to flare it away.

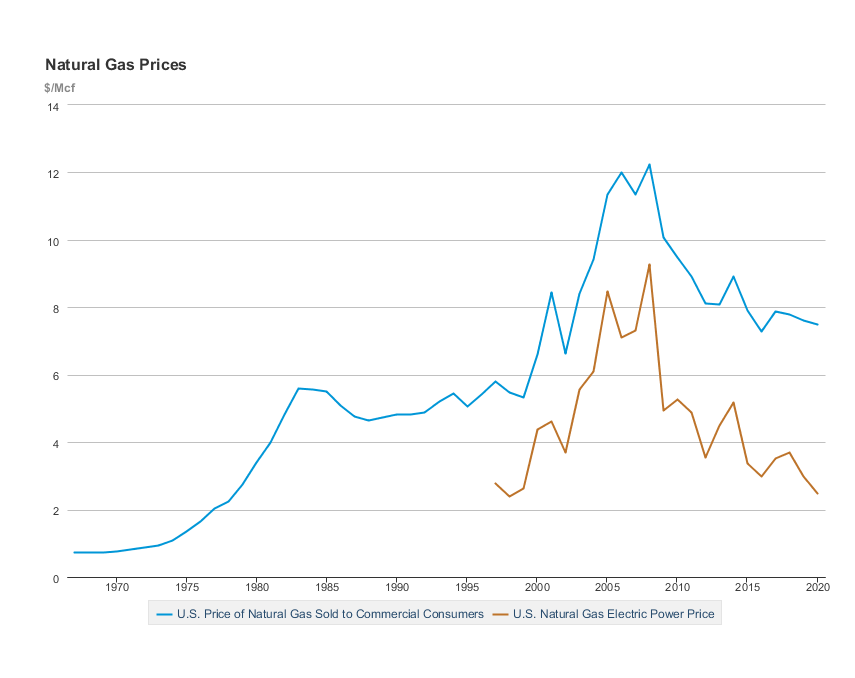

EZ Blockchain research found that it costs about $1 per MCF to flare gas. With billions of MCFs flared each year, the dangers of natural gas flaring are as economically important as they are environmental.

The Unspoken Dangers of Gas Flaring

There are unspoken dangers of natural gas flaring that the industry’s stakeholders are aware of but aren’t talking about.

Natural gas flaring data has pointed to serious consequences in both climate and economic concerns.

Climate concerns have been the recent focus of governments and international organizations, however, the general dialog has focused on broad terms and generalized statistics that make for good soundbites but don’t dig into the complex nature of environmental harm from gas flaring.

The natural gas that is allowed to be burned in most parts of the U.S., for example, is rich in carbohydrates. It’s not just methane; there are other gasses like octane, too, and the emissions from different mixes will have different environmental impacts.

Methane actually burns “cleaner” than other gasses. However, the mix of natural gas somewhere like Pennsylvania will be different than the mix of gas in North Dakota. Flaring one million cubic feet of gas in one state could result in emissions 50% higher than the same volume of gas flared elsewhere.

Local regulations come into play, too. In the Bakken region in North Dakota, OAG producers are required to “clean” natural gas before they flare it.

Why?

The BTU (i.e., or how hot the gas burns) can go up to thousands of degrees with the natural gas found in one area versus another. “Cleaning” is a treatment that reduces the required temperature to flare the gas, thereby reducing the emissions.

Effects of Natural Gas Flaring

The environmental harm from flaring brings us to the OAG financial challenges, too, comprising new dangers of gas flaring that aren’t talked about outside the industry.

Ultimately, these financial dangers impact the whole market.

Imagine you’re an OAG company in the Bakken Region. First, the natural gas released in oil production can’t be sold because of the lack of infrastructure, implicating an opportunity loss. Second, you have to pay to treat it through a complex chemical process to be allowed to flare it. Third, you have to install and maintain a stack flare system.

Even if the infrastructure were in place to sell the natural gas, treating and moving it would be cost-prohibitive. And market gas prices don’t pay enough for these OAG producers to build out more infrastructure on their dime, either.

The only real solution to natural gas flaring is to use the natural gas productively instead of flaring it away. Productive natural gas is gas turned into electricity using a natural gas generator. Many OAGs already do this to produce energy for their operational needs on-site.

This energy consumption still doesn’t use all the natural gas they deal with, however, which is why natural gas flaring is still the common norm.

That norm, however, is finally changing.

Now, OAG companies are being forced to ask what side of that equation they’ll be on—the failing one or the productive natural gas model of the future.

Natural Gas Flaring Alternative Solutions

Black carbon is second only to CO2 emissions in its impact on global warming. It’s the primary culprit in warming the atmosphere and reducing the reflection of light off ice and snow. It’s also a component of “fine particulate matter,” which is what negatively impacts human health.

Over seven million deaths have been attributed to air pollution each year.

These sobering statistics make the efforts to reduce natural gas flaring self-explanatory. Governments, non-profits, and the OAG industry itself have all been working to find solutions to gas flaring.

In a perfect world, OAG companies would be able to sell natural gas to the market. No one has the money to commit to building out the infrastructure, however, and natural gas prices on the market still render a ROI impossible.

Other natural gas flaring alternative solutions have popped up instead. Some of them work to change the chemical composition of natural gas, but these processes result in even more money spent by OAG companies. If they can’t recoup an ROI with the current requirements, there’s no hope to do so with additional processes thrown in the mix.

More modern gas flaring solutions point instead to making productive use of that natural gas.

The best gas flaring solution that’s recently come to sweep the OAG industry off its feet is the idea of installing a cryptocurrency mining data center.

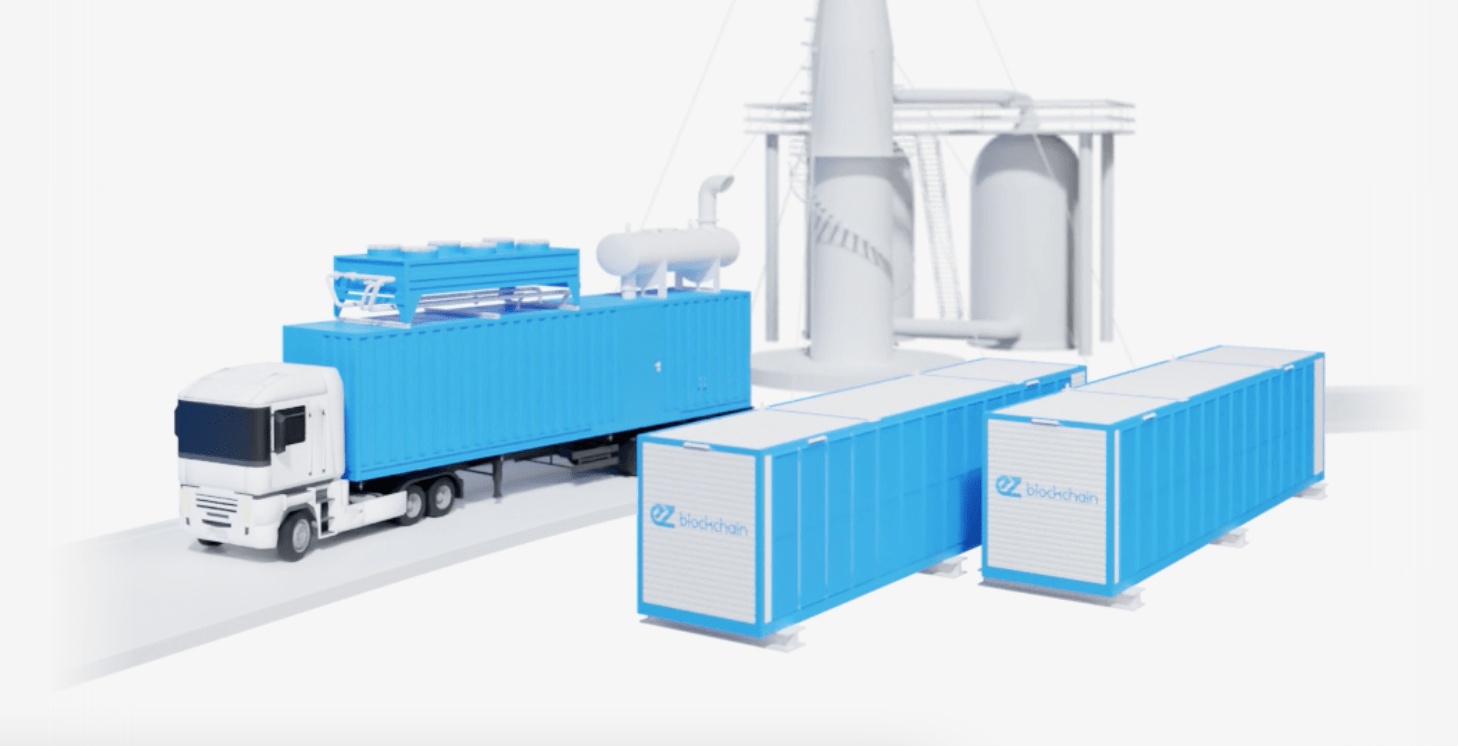

Cryptocurrency mining data centers are energy-hungry containers that use the same natural gas generators OAGs have seen on-site for years. But with these containers, every last trickle of energy is used productively to mine Bitcoin.

Alternatives to Reduce Gas Flaring

To reduce OAG producers’ costs and losses, oil and gas flaring mitigation must-see natural gas as a revenue source. Flaring it away at even a minimalized cost is unsustainable.

Putting natural gas to productive and highly lucrative use, on the other hand, results in an instant revenue stream that was previously a troublesome loss.

This new system enables OAG companies to comply with environmental requirements, too. EZ Blockchain clients who have installed the EZ Smartgrid (a system utilizing a natural gas generator and a mobile data center) at their pads have reduced natural gas flaring by as much as 100% and CO2 emissions by up to 70%.

True oil and gas flaring mitigation has been made possible by recent technological shifts. Namely:

- Reducing carbon emissions with Bitcoin was finally looked at seriously by the OAG industry as a result of the drop in fuel consumption in 2020 during lockdowns, and due to the soaring prices of Bitcoin in the same period.

- Stranded natural gas, too (where reserves of natural gas are left underground, more so today due to rising fracking practices) can be accessed and used productively in mobile Bitcoin data centers.

Billions of cubic meters of natural gas are flared each year, stunting economic growth and progress in the OAG industry. When pandemic-driven stagnation and even backward movement hit the industry hard last year, OAG companies finally looked past their operational status quo.

Ultimately, all energy needs to go somewhere. The industry standard should be to send it somewhere that it’s used productively.

Dated Solutions That Just Don’t Cut It

The biggest challenge for OAG companies looking to mobile mining cryptocurrency as a solution to gas flaring is shifting their way of thinking.

There have been other gas flaring solutions pedaled to the OAG industry for years, however, without the productive use of that gas, they just don’t stack up next to Bitcoin mining.

Other solutions the OAG industry tried in the past include:

- Liquifying natural gas (LNG) – this process cools the natural gas until it can be transported.

- NGl recovery – this process strips natural gas of specific chemicals to make it safer to use.

- Power generation – without a local grid in place to use all the energy, this option refers only to the limited power generation that some OAG producers do to turn a portion of natural gas into electricity used during drilling operations.

Natural gas flaring alternatives brought the industry to a “do or die” moment in 2020 when OAG producers looked to solutions as a possible source of revenue when all other income was down.

Fortunately, cryptocurrency mining containers were ready at the perfect time to change the landscape of natural gas forever.

The Future of Productive Natural Gas

Cryptocurrency mining farms provide an unexpected solution for some OAG producers. Many never would have thought of Bitcoin as having anything to do with OAG.

The cost-benefit analysis, however, makes the decision easy. This has become even truer in the current political environment with a growing number of governments and agencies pushing the OAG industry for major reform.

On an individual basis, though, what does implementing a mobile data center look like for an OAG company?

The installation of an EZ Smartgrid system is extraordinarily easy and straightforward. The biggest shift a company must be prepared to make is in their thinking.

No producer needs years to implement this system—just a few months.

These mobile data containers are simple to install onto a drill site. None of the components used are all that “new” for OAGs, either. For those who have already been using natural gas electric generators, this is simply a shift in using some of their natural gas to using all of it as productive energy.

A Recent Case Study

Take, for example, this recent case study by EZ Blockchain.

This client’s goal was to eliminate gas flaring at their processing plant. They also wanted to monetize that natural gas through crypto mining, without requiring additional infrastructure.

The project was installed in a remote location, making it difficult to staff personnel. The internet signal was weak, too. Drastic temperature changes added new complications, as did a certain urgency the OAG had to meet new governmental requirements.

EZ Blockchain worked closely with the leaders of the company to invest in generator rewiring, making the unit capable of powering crypto mining hardware directly at 415/240V without any new transformer equipment.

A higher output wattage generator was acquired for the project, too, facilitating more efficient processing of the high-BTU gas. The EZ Smartbox installed was further equipped with VFDs to regulate the fan speeds based on the ambient temperature (given the wide range of temperatures in that part of the country).

EZ Blockchain used its existing network of hardware suppliers and distributors in addition to their in-house designers and leadership to price every component of the project just right. The result was a networking infrastructure that allowed the client to successfully transfer data at the existing low internet speeds.

A new revenue stream was successfully kicked off at the same time that the client reduced their CO2 emissions and gas flaring, opening a new chapter for the company in profitability and future-facing operations.

Read the full case study.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.