Stay up to date with the latest news, announcements, and articles.

- These techniques release natural gas through a controlled opening, where it’s then stored on-site at the OAG producer’s field

- What is fracking and why is it bad?

- What percentage of natural gas comes from fracking?

- How much natural gas is flared in the United States?

- Using natural gas waste to produce cryptocurrency is a win-win

- To the surprise of many in the OAG industry, the solution lies in a natural gas generator for Bitcoin mining

- EZ Smartbox: what is it and how does it work?

- EZ Smartgrid: what is it and how does it work?

- How can fracking companies work with flare Bitcoin mining?

- Choose your natural gas flaring alternative solutions

The two principal factors contributing to this are:

1. The lack of infrastructure for the more than 9,000 OAG companies in the U.S.

2. And the increase in fracking practices

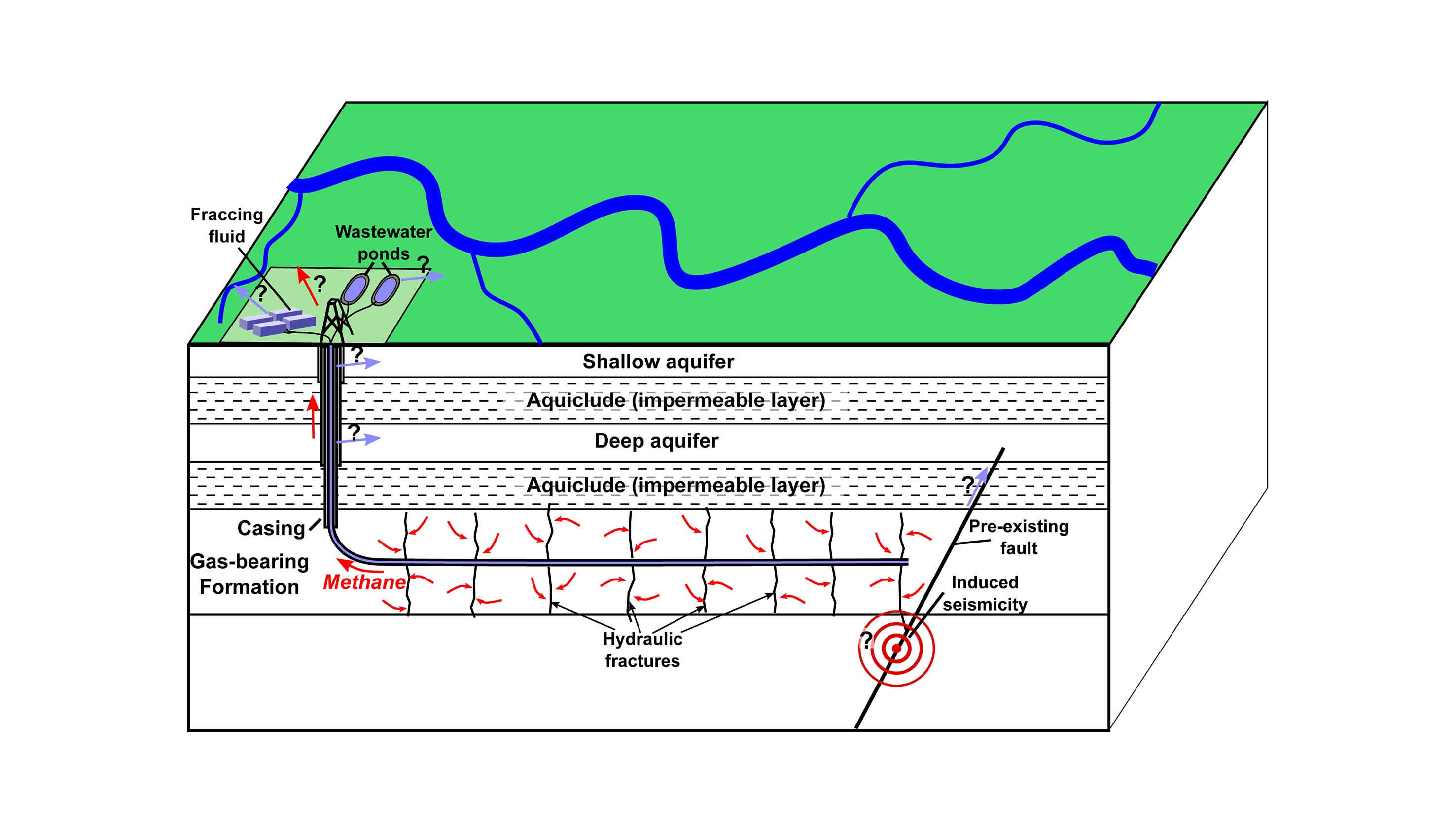

Fracking, in particular, has caused a spike in new and more efficient drilling. Fracking (or “hydraulic fracturing”) is the practice of releasing natural gas deposits with high-pressure blasts of water mixtures deep below the earth’s surface.

These techniques release natural gas through a controlled opening, where it’s then stored on-site at the OAG producer’s field

Fracking is so efficient that OAG companies have increasingly used this technology, even where their drilling efforts focus on crude oil (and the gas they encounter is just a byproduct of drilling).

The trouble with the released natural gas is the lack of gas infrastructure. Once that gas is released at a site not designed for natural gas, it has nowhere to go. Natural gas is normally transported in pipelines to electric plants where it can be processed.

These pipelines, however, do not reach the overwhelming majority of OAG miners in the U.S.

The resulting analysis of fracking and what to do with stranded natural gas now has an answer. Surprisingly to some, that answer is found through Bitcoin mining on flared gas.

What is fracking and why is it bad?

Fracking company crypto mining sounds like a thing of the future.

What does one have to do with the other?

Understanding fracking and why OAG companies adopted the technology tells some of the stories.

High-pressure fracking has revolutionized OAG drilling in the last decade. U.S. production of both oil and natural gas increased as a result.

Fracking has created jobs, too, with more personnel needed at OAG sites and more storage solutions required at fields where more natural gas deposits are being released.

Fracking comes with its disadvantages, however. Without careful and conscientious safety regulations, the natural gas released can poison both groundwater and surface water.

Methane, one of the principal ingredients in natural gas, also threatens wildlife and retains heat 86 times better than CO2, meaning natural gas cannot just be released into the air.

OAG companies spent generations simply “venting” (releasing) natural gas into the atmosphere because they had nowhere else to put it. Storage containers were quickly filled, and the infrastructure of natural gas pipelines left gas stranded.

These companies also faced costs with the endless storage of natural gas and had to willingly choose to vent (and later flare) gas at a loss. The resulting CO2 and methane emissions have been one of many complex factors in the global warming crisis.

What percentage of natural gas comes from fracking?

Both fracked and unfracked natural gas are released when drilling for oil. Fracking enables OAG companies to drill more efficiently, meaning more natural gas deposits will be found.

The question has been asked, “what percent of natural gas comes from fracking?” No one seems to have an exact answer since few disclosure requirements are made to OAG companies about the gas they unearth.

Here’s what we do know:

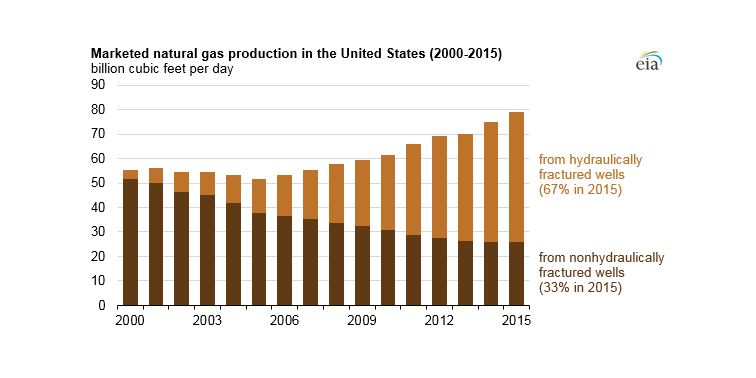

- Fracking produces approximately two-thirds (67%) of the natural gas used in the U.S., and about half of the country’s oil.

- With flaring practices and the lackluster natural gas infrastructure, however, a colossal portion of that natural gas is never converted into usable energy.

- Natural gas producers frack more than 90% of the gas wells in the U.S., meaning those producers who do specialize in natural gas are primarily using fracking to get to it.

- This has improved these companies’ efficiency, however, the demand for natural gas has consistently been dropping for almost a decade.

How much natural gas is flared in the United States?

One-third of the natural gas released during drilling is flared away. This comes at a massive cost to the companies who lose that revenue and has equally stark implications for the environment.

Methane, in particular, is a component of natural gas that’s come to concern governments around the world. This greenhouse gas is 86 times more potent than carbon dioxide over a 20-year period. Over just a decade, it could contribute significantly more to global warming than either coal or gasoline.

OAG companies do report how much gas they flare, however they are not required to disclose the composition of the natural gas they frack. A lack of independent data has contributed to the uncertainty around how much natural gas is being wasted each year.

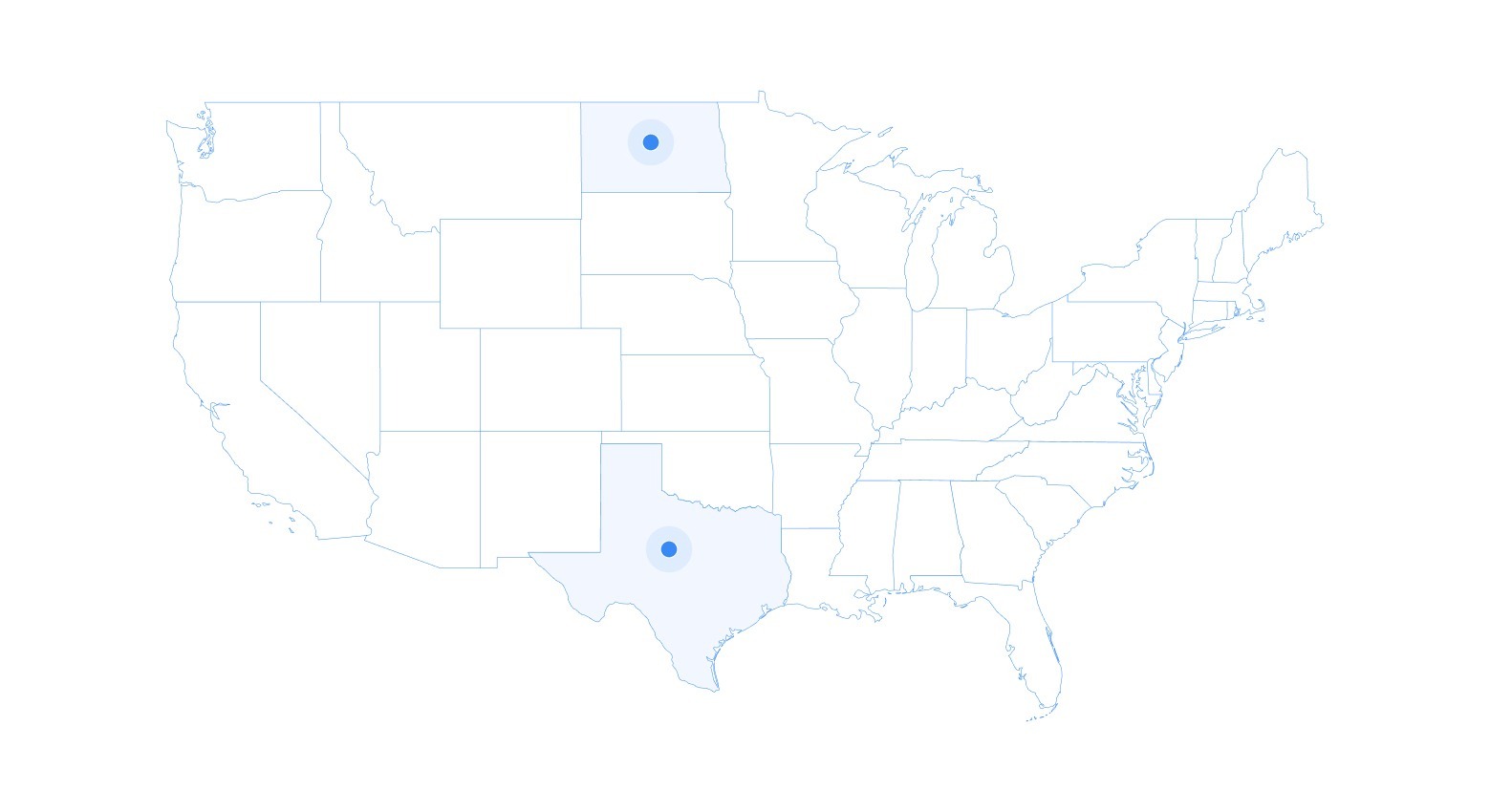

Two states stand out in the overall trends of gas flaring in the U.S., and those are North Dakota and Texas.

- North Dakota and Texas accounted for a total of 85% of the natural gas vented and flared in the U.S. in 2019

- Texas alone accounted for 47%

- North Dakota accounted for 38%

- State agencies are working with OAG producers in both states to limit flaring without shutting down production from new wells

Natural gas produced in the Bakken region of North Dakota accounts for 98% of all the natural gas produced in the state. To give you an idea of the volume of the natural gas released there as a result of fracking, the Bakken production grew from 0.2 Bcf/d in 2010 (when fracking was first introduced) to 2.9 Bcf/d in 2019.

Natural gas infrastructure and processing capacity, in contrast, have not grown in that time.

The Permian Basin and Eagle Ford area in Texas play a similar role in that state’s OAG production.

Using natural gas waste to produce cryptocurrency is a win-win

Much like the high-pressure water mixtures used to blast through deep-earth rock, the OAG industry has been under mounting pressure to address the environmental issues related to natural gas.

Governments have banned or restricted natural gas venting and have incrementally restricted gas flaring. This has been the only foreseeable avenue to reduce emissions, however, it comes at the cost of making smaller rigs unviable.

To the surprise of many in the OAG industry, the solution lies in a natural gas generator for Bitcoin mining

Bitcoin values have grown by over 600% in the last six months. This growth dwarfs even the biggest booms in other industries that are seeing a post-pandemic surge, and it outstrips all other commodities by a long shot.

Cryptocurrencies require a type of “mining” of their own, which refers to sophisticated computers processing complex equations to validate the transactions and ownership of Bitcoin and other cryptocurrency coins.

This computer processing, however, requires energy. In fact, its energy consumption has been a blemish on Bitcoin’s recent claims to fame.

With OAG companies trapped between a lack of infrastructure and government requirements, stranded natural gas can instead be turned into electricity to power mobile crypto miners.

EZ Smartbox: what is it and how does it work?

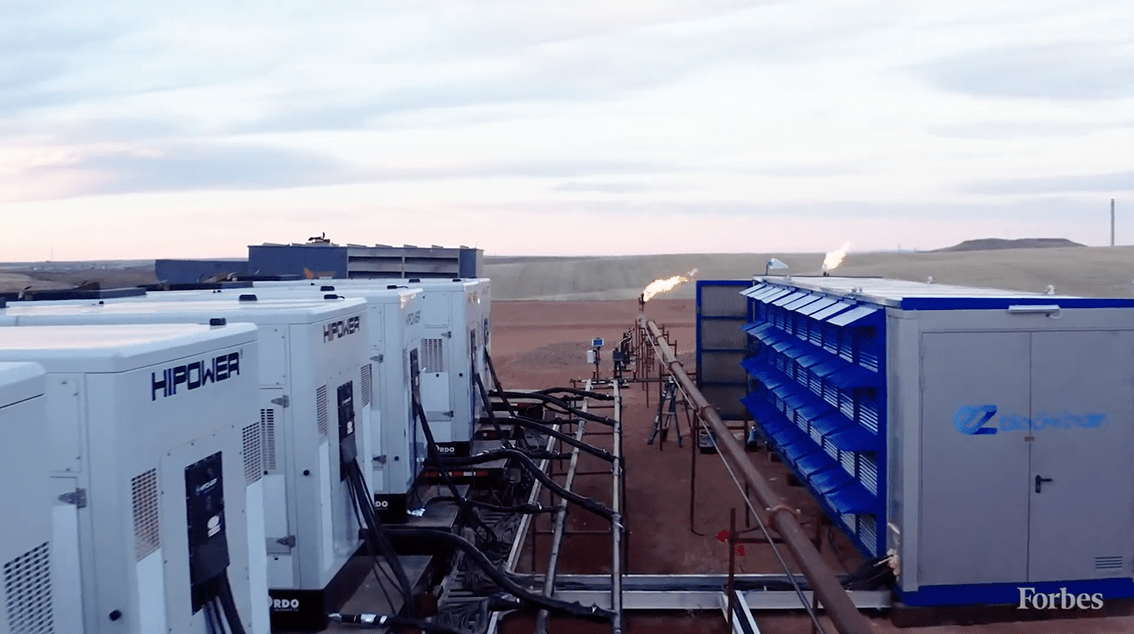

Bitcoin mining operations come to oil fields with the EZ Smartbox technology, which is a natural gas cryptocurrency mining container installed directly at OAG production sites.

The first reaction of many OAG producers might be, what is a cryptocurrency and how does it impact my drilling?

With the electricity needs of Bitcoin mining, this symbiosis has been transformative for the future of the industry. After installing an EZ Smartbox and powering cryptocurrency mining with otherwise-stranded natural gas, the benefits to OAG producers include:

- Flaring and venting reduced to 0

- A new and reliable revenue stream

- Greater efficiencies in natural gas storage

- Greater scalability for the business

- Total portability of crypto mining containers

- No interruption to operations

EZ Blockchain mobile data centers are used on-site, and EZ Blockchain handles all logistics and installation at no upfront cost to the OAG companies. Installation takes two to three days.

EZ Blockchain has partnered with companies like KTS Engineering and Silver Energy in the long-term design and evolution of their Smartboxes and their rollout. The innovation in their data center design has spearheaded this opportunity for OAG companies with superior ROI after installation.

The EZ Smartbox has evolved as the technology has, too, and the company’s experience across North American drilling sites has informed even more inventive solutions to meet every possible optimization.

EZ Smartgrid: what is it and how does it work?

Mobile Bitcoin mining containers are installed at OAG fields as a flaring mitigation service. This has empowered OAG producers large and small to eliminate flaring at their locations with a minimum of 350 MCF flared a day.

No flaring means no CO2 emissions and easy compliance with laws and regulations.

The EZ Smartgrid System, specifically, has been deployed at sites around the U.S. and Canada to meet rapidly growing regulation and environmental guidelines while also providing a new revenue stream for the hosting OAG companies.

The installation is even done without interruption to operations.

EZ Smartgrid technology turns stranded natural gas into usable electricity with an on-site generator. There are zero upfront costs to producers. Additional royalties are paid to landowners by bringing flared gas to market without adding any new pipeline infrastructure required.

More than 400 million tons of CO2 equivalent are emitted into the atmosphere annually. With EZ Smartgrid, OAG companies can individually do their part to apply the winning technologies that reduce their own impact to 0.

How can fracking companies work with flare Bitcoin mining?

Across the OAG industry, fracking companies can mitigate gas flaring with Bitcoin mining. Traditionally, flaring itself was a “solution” to the problem of stranded and vented gas. The enormous loss of potential revenue and environmental consequences, however, brought many smaller producers to a breaking point in their business.

Was there adequate infrastructure to transport that gas, it could be transported and sold? Most OAG producers, however, don’t have access to the infrastructure they need, and storing gas indefinitely isn’t an option, either.

Fracking companies work with Bitcoin miners who, themselves, are “end consumers” of electricity. This partnership allows a mobile data center to process stranded gas on-site so OAG companies make money on what they would otherwise spend money to either store or flare.

Power generation from stranded gas offers the optimal partnership for OAG companies and Bitcoin miners. It can be said that Bitcoin is a unique solution for gas flaring—and now that it’s been introduced, OAG producers will have to adopt the solution or risk other external pressures forcing them out of the industry entirely.

Choose your natural gas flaring alternative solutions

Choosing your gas flaring solution comes down to the track record of the cryptocurrency data center manufacturer you partner with.

The idea of building small, local electric grids have been around for decades. But OAG producers haven’t had enough power consumers in remote areas to make the idea work.

While the industry waits for that idea to come to fruition, stranded gas flaring is quickly phasing out as a viable option due to environmental concerns.

The remaining solution is the most cooperative one: partner with a Bitcoin mining service.

Not all mobile mining containers are created equal, however. Some of the key factors to consider are:

- The container structure

- The construction materials

- The power strips and breakers

- The cooling design

For help assessing these factors and other issues specific to your business, contact EZ Blockchain. Our projects in oil fields around the U.S. and Canada are proof that there’s no need to build a multibillion-dollar gas pipeline or wait until more local grids are built out.

Take action today and start mining Bitcoin with natural gas for a reliable and competitive new revenue stream.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.