Stay up to date with the latest news, announcements, and articles.

- Is Bitcoin Mining Profitability Changing?

- What Determines Bitcoin Mining’s Profitability?

- Block Rewards

- Bitcoin Mining Equipment

- Energy Costs

- Can Bitcoin Mining Be Profitable?

- Selling Electricity Back to the Grid

- Participating in Demand Response Programs

- Gas Flaring

- Affordable Bitcoin Mining Equipment

- In Summary

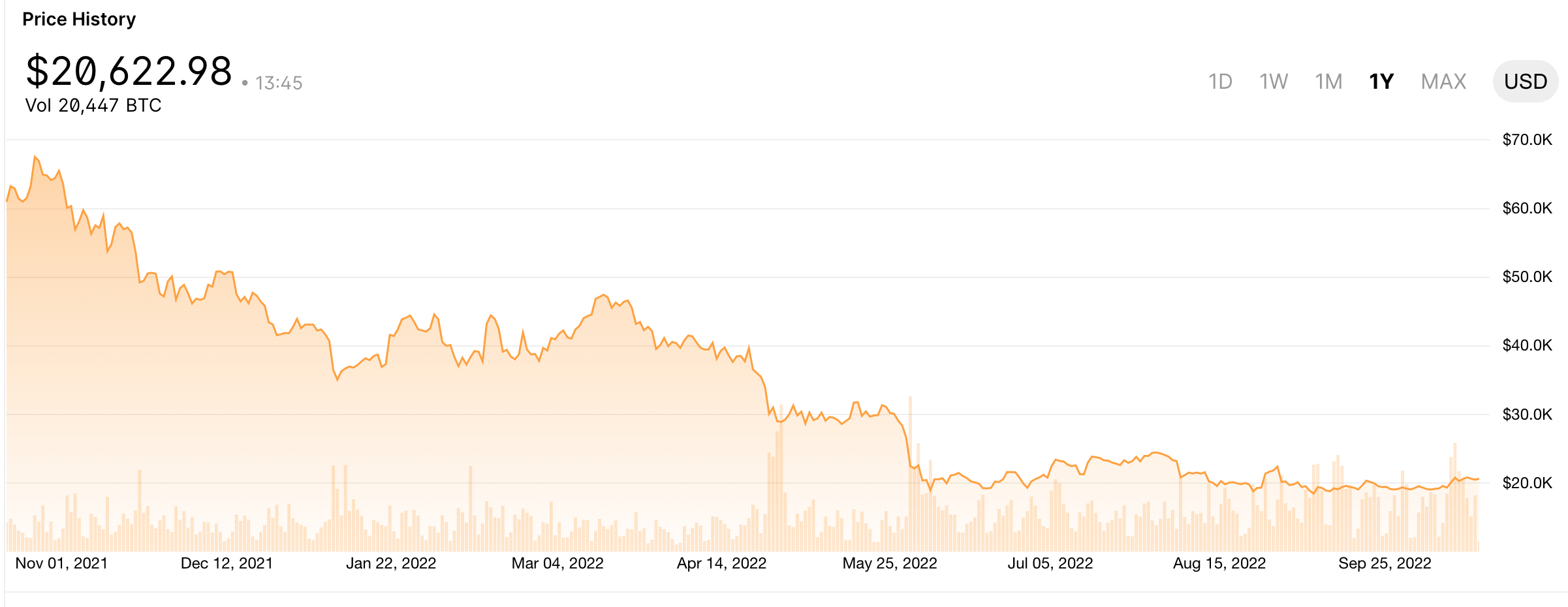

Generally, miners have let go of the largest amounts of Bitcoin holdings since last year. The trend tends to signal that they are selling to meet ongoing expenses, raising concerns over Bitcoin mining activities' profitability.

But when you can buy a miner at $1,500 per piece, could it possibly be the best time to buy in when the equipment is so cheap? Realistically, miners’ prices have dwindled to their lowest, but they are still not cheap for everyone. Bitcoin mining experts like Mattia Pintus, the Nova Mining Labs CEO, argue that interested miners should first analyze how much profit they can make depending on their energy costs.

Gryphon Digital’s CEO, Rob Chang, also feels that despite the miners’ price tumble, ASICs are still not cheap and would cost a miner hundreds of dollars, if not thousands. Matthew Lohstroh, the CEO of Giga Energy, thinks that miners could still profit, but it will take around 18 months for the average retail miner to break even.

Is Bitcoin Mining Profitability Changing?

Bitcoin has a fixed supply of 21 million coins. Over 19 million BTC has been verified and recorded on the Bitcoin Blockchain through the mining process. It involves solving complex cryptographic puzzles known as hashes using powerful computers. Usually, miners across the Bitcoin network compete to be the first to crack the hash. Computers with the highest processing power or hash rate have higher chances of cracking the code first, and the winner receives a reward of 6.25 BTC.

Initially, Bitcoin mining was a lucrative affair. Technically, anyone could mine Bitcoin at home. However, with cryptocurrency prices faltering and power costs persisting for the better part of the year, profiting from Bitcoin mining has become quite difficult. Bitcoin mining activities are much more challenging and costly compared to the early days. Even if miners still thrive in their activities, it’s not entirely clear if they will eventually profit. Large companies now do most mining activities with specialized servers and data centers.

What Determines Bitcoin Mining’s Profitability?

There are different reasons why people decide to mine Bitcoin. Some are simply Bitcoin enthusiasts who want to serve and protect the network, while others fancy the privacy associated with using virgin Bitcoin. However, their chief motivation is the yields the activity promises. Currently, miners receive a reward of 6.25 BTC per block, which is about $130,000, and a new block is created every ten minutes on the Bitcoin blockchain.

Furthermore, the reward could be worth much more depending on the price of Bitcoin at a given time. As such, many people perceive Bitcoin mining as a lucrative venture, although several factors determine whether the process is profitable.

Block Rewards

The Bitcoin network offers a block reward for every block mined. The prize is the primary source of income for the miners and a significant factor in determining mining profitability. While the reward stands at 6.25 BTC for now, it’s notably not the original figure and could change soon.

At the beginning of Bitcoin in 2009, the block reward was 50 BTC. However, the network follows a protocol known as Bitcoin halving, which happens for every 210,000 blocks. It’s typically an event when the supply of new coins and the block reward is halved. It cuts the rate at which new Bitcoin is mined by half, and the reward gets reduced by half. The current block reward is thus a result of three halving events, meaning the reward will still drop in the fourth halving event due in 2024.

Bitcoin Mining Equipment

The profitability of Bitcoin mining depends mainly on the choice of mining equipment. Mining rigs with higher hash rates can crack the cryptographic codes faster, meaning the miner has a greater chance of success. However, they are more costly than mid-tier miners and consume enormous power. Home mining has become almost impossible since most mining rigs also require a dedicated facility. The high initial cost of mining equipment and the energy costs could undermine mining profitability.

Energy Costs

Bitcoin mining has a name for its high energy consumption. It’s part of the reasons behind Bitcoin prices’ tumble after the 2021 bullish trend. On average, Bitcoin mining consumes about 139 terawatt-hours of electricity annually, equivalent to the annual energy requirements of individual countries like Norway.

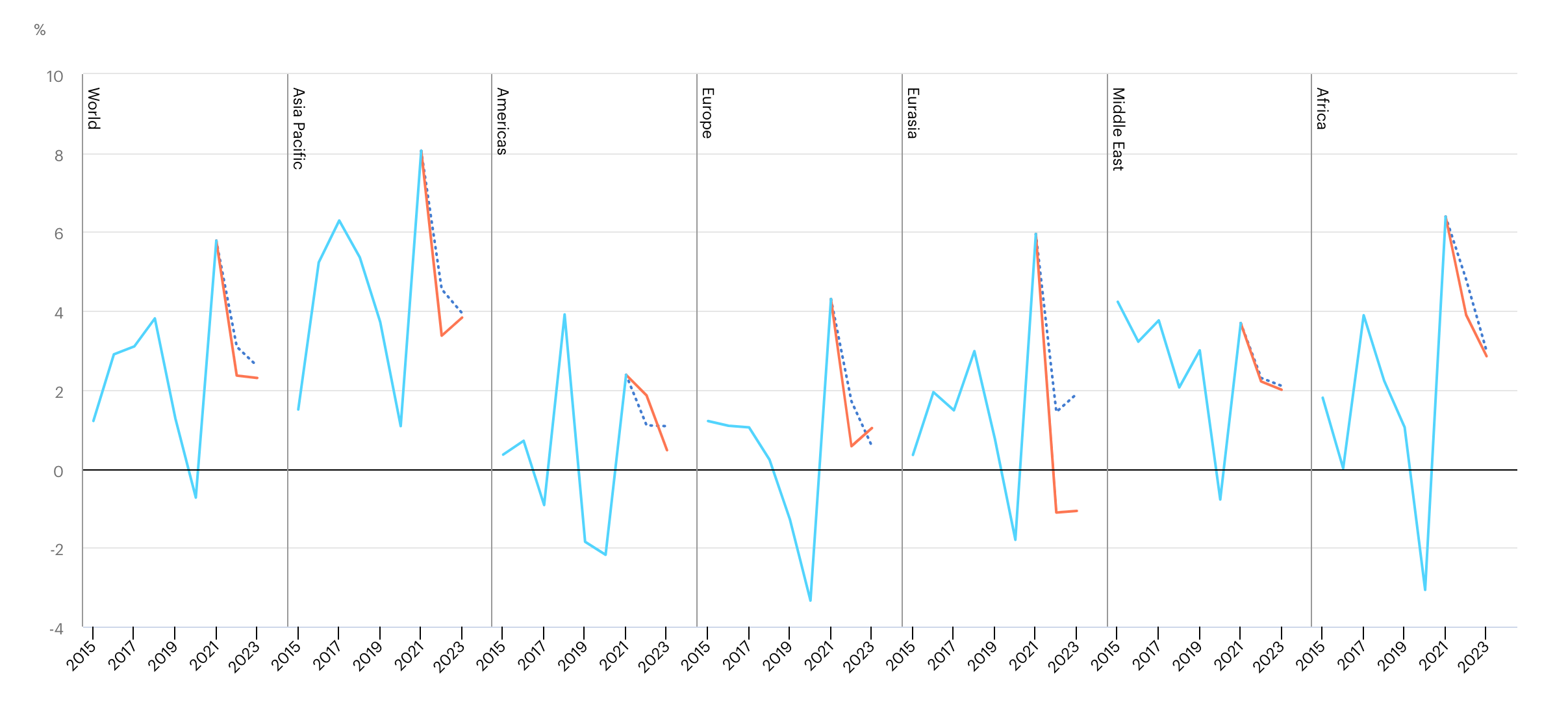

Notably, energy prices have been skyrocketing throughout the year. According to the International Energy Agency’s (IEA) report in July 2022, electricity prices tripled within the year’s first half in many regions worldwide. In Europe, the price of coal rose more than threefold, while gas rose fourfold in the first half. A recent Forbes report also noted that natural gas and oil prices in the US also increased by about 12.6.

As energy prices rise, mining becomes more expensive, which means fewer profits for Bitcoin miners.

Can Bitcoin Mining Be Profitable?

Bitcoin has had its share of ups and downs since its introduction by the anonymous Satoshi. But one of its significant drawbacks is the energy-intensive nature that not only makes it have run-ins with governments like Algeria and China but also undermines mining profitability. There is a crisis of falling Bitcoin prices, skyrocketing energy costs, and a need for sustainable Bitcoin mining.

However, at least a few trends are taking the right direction for the community of Bitcoin miners. First, there are many alternative energy sources for Bitcoin mining and innovative companies like EZ Blockchain that give a glimpse of hope for profitable and sustainable Bitcoin mining.

Selling Electricity Back to the Grid

Today, utility companies and power plants suffer a significant problem balancing power loads. They generate more excess power than their power demands and find it difficult to predict revenues accurately.

Since energy is one of the significant issues undermining the profitability of Bitcoin mining, the energy investors with excess power have an excellent opportunity to balance off their power load and, at the same time, make Bitcoin mining profitable by selling the excess and wasted energy. Blockchain companies like EZ Blockchain can buy all the excess energy and use it for Bitcoin mining.

Participating in Demand Response Programs

In January 2022, the IEA reported a surge in electricity demand that has strained power systems worldwide. Eventually, the strain touched major markets, pushing energy prices to all-time highs.

As a sector that is heavily dependent on and a significant power consumer, Bitcoin mining has been hit hard by soaring prices. A possible solution for easing the grid of demand is to participate in a demand response program. Under the program, willing energy consumers agree to lower their energy use during peak times or when there is a strain on the grid.

Although demand response programs look primarily into the larger economic view, they will impact energy prices and impact Bitcoin mining’s profitability indirectly.

Gas Flaring

Gas flaring is an ancient practice involving the burning of natural gas, which is a by-product of oil extraction. The World Bank estimates that about 144 billion cubic meters of gas are flared yearly. That’s enough power for sub-Saharan Africa.

While it has been considered a safe practice for a long time, there are innovative solutions that can end the environmental hazards of gas flaring and put wasted energy into better use.

EZ Blockchain provides a unique solution for the oil fields that converts the flared gas into electricity for Bitcoin mining. It’s a mobile flaring mitigation system deployable on the oil well pads. It harnesses the wasted gas and uses the electricity to power data centers. It’s an innovative power generation system that can improve the profitability of Bitcoin mining by providing cheaper energy alternatives.

Affordable Bitcoin Mining Equipment

Even as the bear market continues to wreak havoc for Bitcoin miners, the trend still has direct impacts that provide opportunities for small miners to profit. As more miners close their positions and others slow their mining activities, the demand for mining rigs also drops massively, which means mining equipment is available at lower prices. With low initial costs and cheaper alternative energy sources available, Bitcoin mining could still be profitable.

In Summary

Although Bitcoin miners’ revenues have fallen to unprecedented lows, miners are still cashing in on the activities. Reports place their earnings at around $20,000 daily. GPU prices are also set to drop further, while innovations such as EZ Blockchain are still around to save the situation.

EZ Blockchain provides Bitcoin miners with cheaper alternative energy sources and offers them its innovative mining solutions of air-cooled Smartboxes and immersion-cooled Smartboxes at excellent and competitive deals.

Despite the ongoing crypto winter, EZ Blockchain is still opening new locations in 2022, probably because it’s not the first time crypto prices are plummeting.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.