Stay up to date with the latest news, announcements, and articles.

The natural gas released during drilling has a monetary value

Natural gas is used for heat and power and can be converted into electricity. The cost of collecting and moving it, however, is now higher than what it can be sold for.

Selling it assumes the companies have access to infrastructure, too. For most of the nearly 10,000 oil and gas companies in the U.S., natural gas pipeline infrastructure doesn’t reach them, anyway.

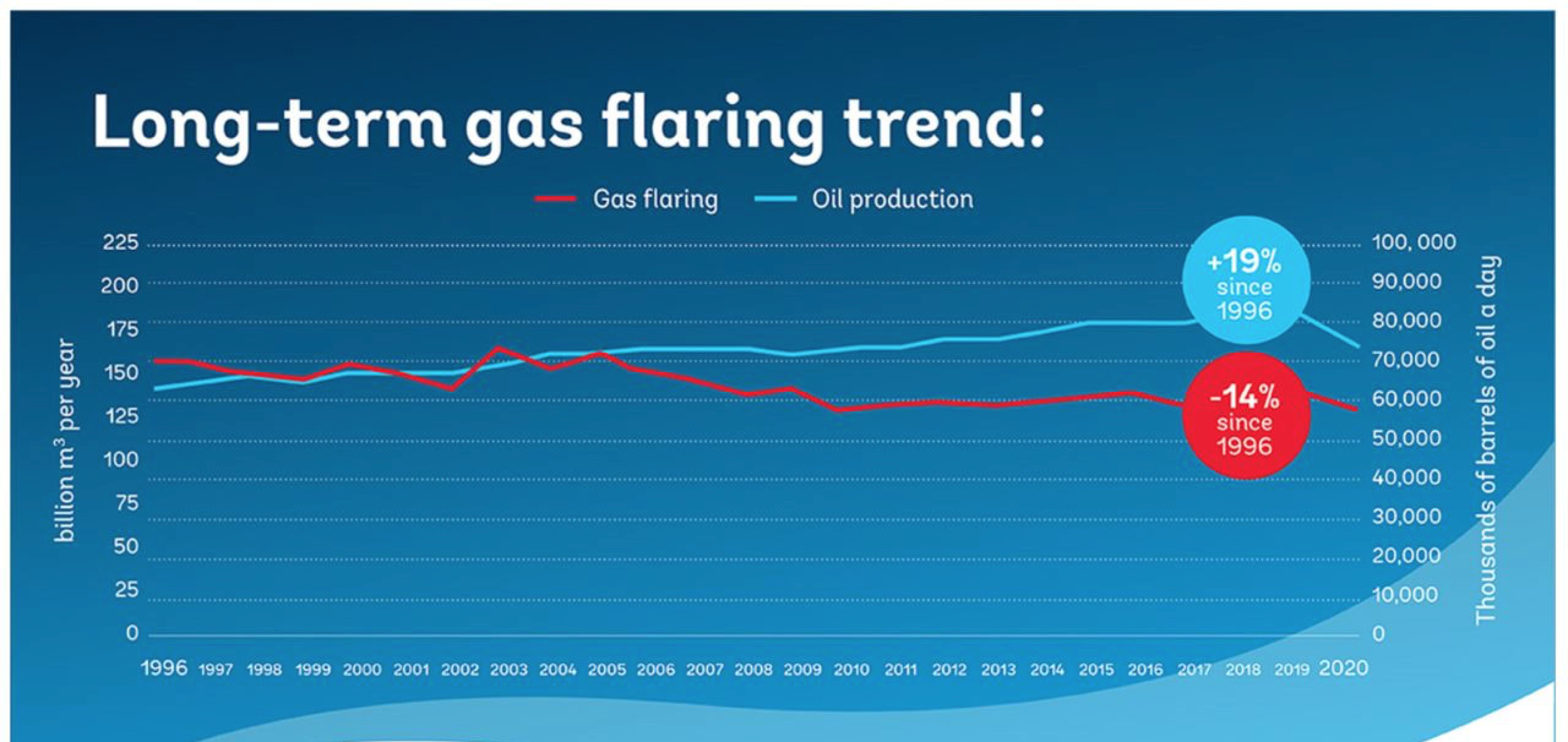

Over the last 10 years…

The United States oil and gas industry (OAG) has become one of the world’s top gas flaring countries, right behind Russia, Iran, and Iraq.

In roughly the same 10 years, a revolution has taken place in global currency, seemingly on the opposite end of the market. The invention of Bitcoin—the first cryptocurrency—created a new industry and revolutionized the tech in many unanticipated ways.

Now, Bitcoin and cryptocurrency mining could transform the OAG industry, starting with the complete eradication of natural gas flaring.

How bad is natural gas flaring for the environment?

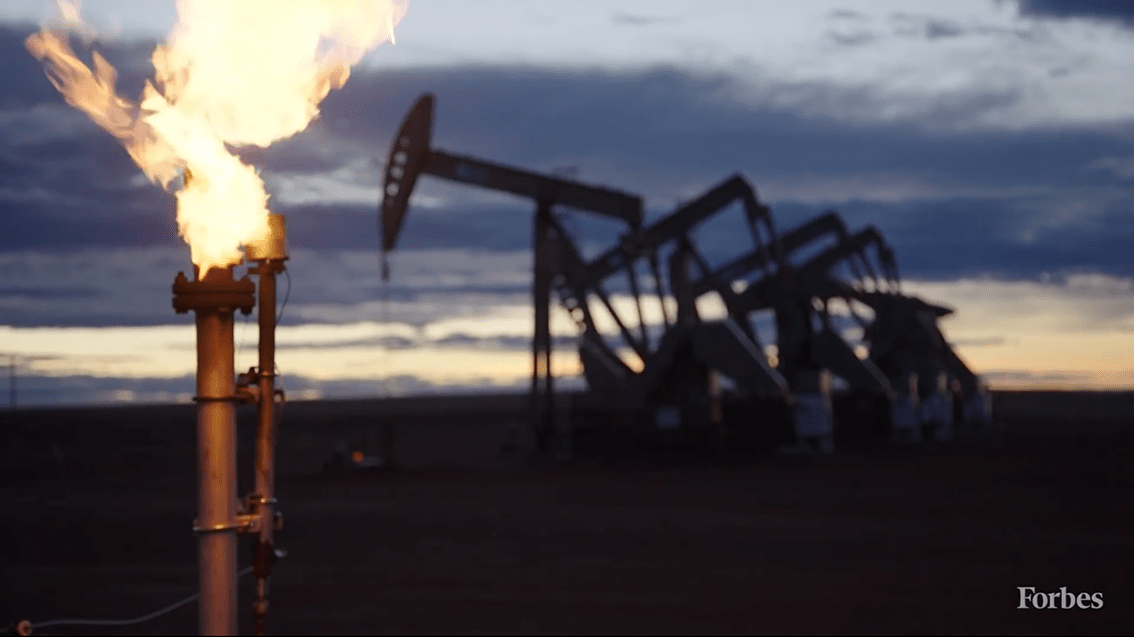

Natural gas flaring gives an onlooker a clear visualization of its impact on the environment. With flames dancing atop the burning gas stacks, global warming emissions have become an increasing point of interest as it relates to gas flaring.

Global warming emissions from the combustion of natural gas are lower than those from oil and coal, however. Natural gas combusted in a new and efficient power plant emits 60% less CO2 than a new coal plant.

At the same time, the natural gas flared today is burned as a loss to the OAG companies along with the local power grids who could have otherwise created more electricity.

OAG companies today are seemingly left with no options, however, because moving natural gas is either impossible or cost-prohibitive. That’s why flaring practices have grown.

In the Permian Basin (Texas) where a substantial percentage of the country’s gas flaring takes place, roughly $750 million worth of gas is wasted each year without any public or private benefit. All the practice does is keep OAG companies focused on their profitable revenue streams while sending more CO2 into the atmosphere.

And yet, even those dark emissions from the top of burn stacks don’t tell the full story

Oil drilling and the resulting release of natural gas—and even its transport in pipelines, wherever there is infrastructure in place—also causes the leakage of methane. This is one of the primary components of natural gas and is 86 times stronger than CO2 at trapping heat over a 20-year period.

Even though natural gas emissions account for less of the global warming crisis, these methane emissions cannot go ignored.

One recent study suggested that methane emissions must be kept under 3.2% for natural gas power plants to support a lower emission rate than a coal power plant, despite the fact that burned gas produces significantly less CO2. This is a result of methane’s propensity to store heat.

Technologies are available today to reduce the leakage of methane gas, of course. However, these are a Band-Aid over a problem that needs more attention.

Natural gas flaring continues to be the only viable solution for most OAG companies to dispose of immovable gas, and even a colossal investment in infrastructure would still carry the risks of methane leakage with the transport of that natural gas.

For years, building new infrastructures and exploring new methane-reducing technologies put OAG companies between a rock and a hard place with no foreseeable return on investment.

But then, Bitcoin mining hit the scene.

Bitcoin has been a game-changer to business models across industries, from financial services to media and real estate. The OAG narrative has recently attracted thought leaders in Bitcoin, too, due to the high energy requirements of cryptocurrency mining.

Among other reasons, Bitcoin and other cryptocurrencies gained popularity because of their reduction of fraud to nearly zero. This is because of the blockchain (or public ledger) technology used to validate transactions and coin ownership.

To keep these validations secure and, above all, infallible, sophisticated computers around the globe work 24/7 to process complex equations and encryption. When a coin or transaction is validated (or “mined”), it’s then posted publicly to the blockchain.

In search for sources of smarter and more sustainable energy, cryptocurrency miners set sights on the stranded natural gas at OAG fields.

What are the 3 biggest uses of natural gas?

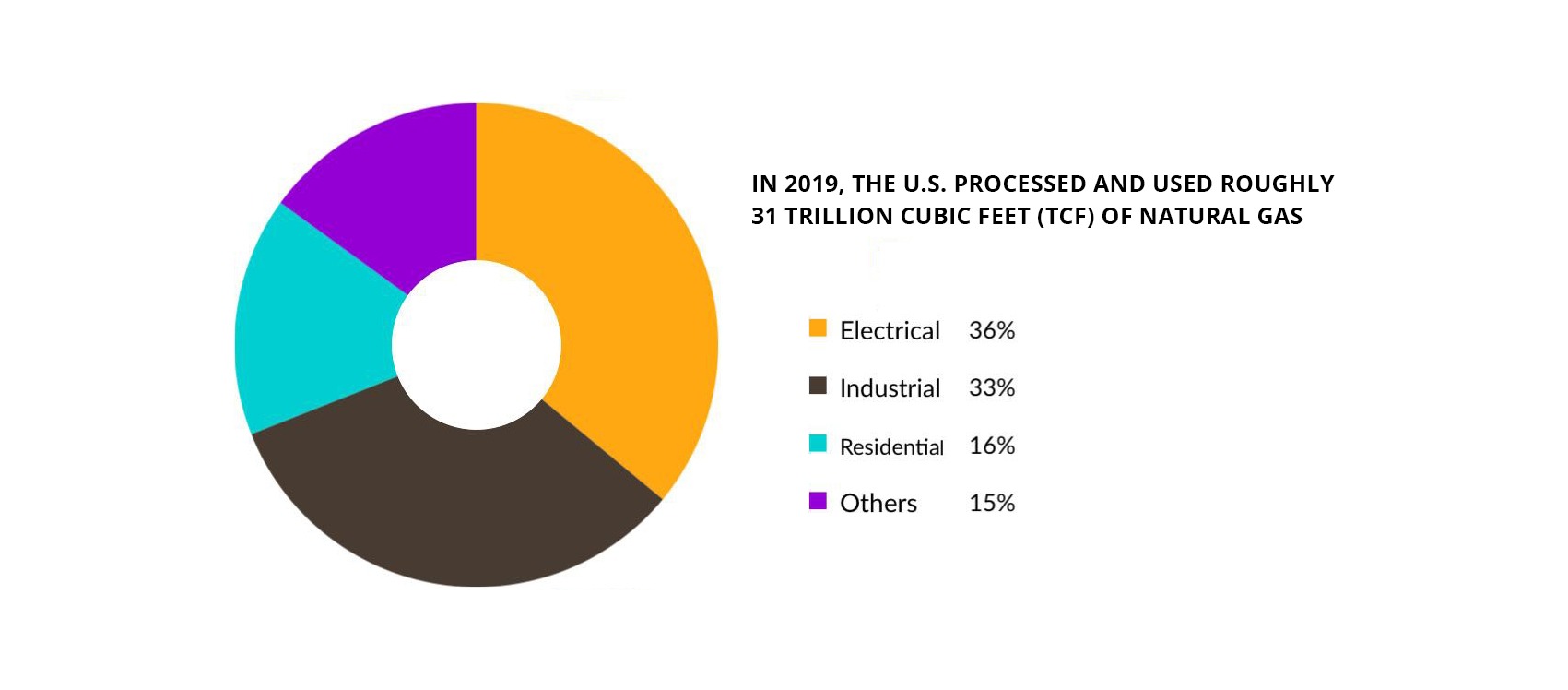

In 2019, the U.S. processed and used roughly 31 trillion cubic feet (TcF) of natural gas. This accounted for 32% of the total primary energy consumption across the country.

The specific sectors using that energy, however, differed significantly in their use of gas-powered energy.

- 36% of gas consumption was through an electrical power

- 33% of gas consumption was industrial

- 16% of gas consumption was residential

The electric power sector, which accounts for more than a third of natural gas consumption, uses gas to generate electricity

The electricity is then passed onto other sectors (such as industrial and residential).

The residential sector uses natural gas to heat buildings and water. It also uses gas to cook and dry clothes. Roughly 50% of homes in the U.S. use natural gas for one or more of these purposes. In 2019, natural gas was the source of about a quarter (24%) of U.S. residential energy consumption.

The industrial sector uses natural gas for processes that require substantial heating. It’s also used as a raw material to produce chemicals and fertilizers as well as hydrogen. Natural gas was the source of approximately 33% of the industrial sector’s energy consumption in 2019.

What is the process of mining for natural gas?

Natural gas is a commodity with great energy potential, especially in the eyes of residential homeowners. It burns cleaner than coal, and the technologies are out there to reduce any methane leakage to acceptable levels.

Natural gas flaring has grown in the last decade in part because of the increase in fracking practices. OAG companies don’t only release natural gas as a byproduct of oil drilling, either. There are plenty of companies involved in mining natural gas, specifically.

Here’s how it’s done:

- Once a natural gas deposit has been reached, the temperature inside the deposit is dropped rapidly with liquid nitrogen to convert the natural gas into its liquid state (at -260 degrees Fahrenheit).

- The natural gas in liquid form is then transported to the surface by pumps where it’s stored in large tanks.

In the context of natural gas stores found and released as companies drill for oil the problem is that most of these companies have nowhere to send the natural gas after they store it.

Despite the challenge of stranded natural gas, gas has grown in popularity over other energy sources in recent years. Without the infrastructure investments to transport stranded gas, however, even eager consumers cannot benefit from all the natural gas at OAG company fields.

Bitcoin oil and gas mining has been a recent and rapid solution to this impasse. Bitcoin miners bring mobile data centers to the OAG fields and convert the stranded gas on-site into the electricity that powers cryptocurrency mining.

For many in the OAG industry, this solution came at the perfect time.

BTC to Gas: Conversion to Electricity

When natural gas is turned into electricity, it undergoes a fairly simple process:

- First, it travels through pipelines to a burner.

- Then, the burner heats the gas, which turns into its vaporous state and is then used to boil water.

- When the water releases steam, that steam builds up pressure in another chamber until it’s released suddenly.

- The high pressure forces a turbine to turn over, and then it starts to spin.

- The turbine is connected to a generator, which creates electricity with the turning motion of the turbine.

This process can take place in a mobile natural gas generator for bitcoin mining within cryptocurrency data centers, too. This is exactly how Bitcoin mining containers have come in to change everything for OAG companies with stranded gas.

How will natural gas help fracking companies?

Fracking companies who have dealt with decades of stranded gas problems are now able to turn that natural gas into a reliable revenue stream, while also eradicating a long-standing operational problem and complying with environmental concerns.

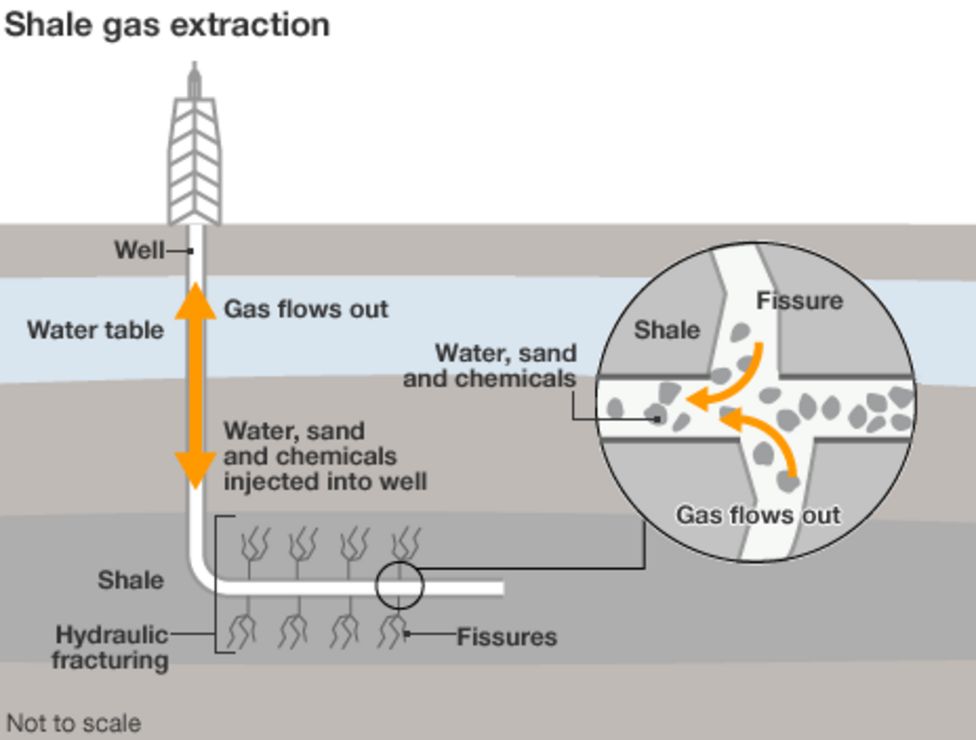

Hydraulic fracturing, or “fracking,” is the process of drilling deep for oil and then directing a high-pressure water mixture at the rock to release the natural gas inside. The water mixture includes water, sand, and chemicals that are injected into the rock so the gas can flow out of a controlled opening.

Fracking and excess natural gas, however, can also mean a more profitable partnership with Bitcoin miners – specifically, for bitcoin mining with oil and gas. The Wesco Operating case study, where the EZ Smartgrid Flaring Mitigation System was installed, for example, reduced flaring from 240,000 SCF per day to 0.

Fracking also releases higher quantities of natural gas more quickly, meaning OAG companies who already flared found gas now have even more gas to burn away at a loss.

Fracking and excess natural gas, however, can also mean a more profitable partnership with Bitcoin miners. The Wesco Operating case study where the EZ Smartgrid Flaring Mitigation System was installed, for example, reduced flaring from 240,000 SCF per day to 0.

The positive environmental impact was coupled with a 180-degree shift in natural gas being wasted and turning it into a reliable new revenue stream. These benefits are as good for OAG companies as they are for the environment.

Bitcoin prices are off the charts after growth of well over 600% from October 2020 to March 2021, and the demand has empowered Bitcoin miners to look for even better cryptocurrency mining practices.

With the stranded gas at OAG fields publicly called out as an inefficiency, it made sense for Bitcoin miners to come in and offer a win-win.

OAG companies don’t want to release natural gas into the atmosphere or flare it away. Instead, OAG drillers want to sell this commodity on a market just like they sell their oil.

Thus, oil and gas crypto mining has become the new solution of the future.

EZ Smartbox Mobile Mining Unit

Bitcoin natural gas is the gas processed on-site at OAG companies to power the energy requirements of a crypto mining box.

After more than a century and a half of natural gas waste (through release into the atmosphere and flaring), there’s finally a technology that not only processes natural gas safely at OAG sites, it also moves the industry into the future with a technology that promises to grow in global relevance.

The cost-benefit of a smart cryptocurrency oil and gas miner is easy to see. A flare stack costs as much as $62,500 annually when factoring in its design, installation, and overhead. A mining container costs a fraction of that and then generates instant and reliable revenue for the direct sale of on-site natural gas to the miner.

If you consider, for example, mining bitcoin in Texas using natural gas, you can deploy your hash power anywhere, where you can secure a source of energy. You will produce the same value for the Bitcoin they “mine” no matter where they’re located.

If doing so at an OAG field means they can access a more economic source of electricity, this is a solution worth their every investment. This is why the development of mining containers like the EZ Smartbox has taken a turn for the highest-tech and highest-quality designs.

All the data centers are also fully scalable to consume any vent or flare gas volume and are totally modular in nature.

Bitcoin natural gas provides OAG companies with access to liquidity with minimal barriers to entry. Contact EZ Blockchain today to discuss your company’s oil and gas cryptocurrency mining needs and goals.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.