Stay up to date with the latest news, announcements, and articles.

- What is the Halving?

- Next Halving Estimated End of April

- How does the Halving Impact Bitcoin Price?

- Will Miners Capitulate Again in 2024?

- The Impact on Mining Revenue

- 5 Reasons Why This Time It’s Different

- PART 2: HOW TO PREPARE FOR HALVING. MINERS SURVIVAL GUIDE

- What is Bitcoin Halving?

- Who Will Stay in the Game After 2024 Halving?

- So, What Can We Do to Prepare?

- Bitcoin Mining Operational Costs?

- Demystifying Bitcoin Mining Costs

- Mining Equipment

- The Solution. How To Prepare For Bitcoin Halving As Miner?

- How Should You Approach the Upcoming Halvings Differently Compared to Previous Cycles?

- Don’t Just Wait for Your Mining Equipment

- Mine More Efficiently

- Overclocking

- Should I Buy More Equipment and When?

- Why Work with EZ Blockchain?

But how exactly does the halving work, and has this event always triggered price appreciation? Moreover, when the block subsidy is cut in half, how does it impact the miners? In this article, we will delve into these topics, exploring the mechanics of the halving and examining how price, hashrate, and miner revenues have been affected in previous cycles.

Will we witness another significant mining capitulation, or will this time be different? Let’s find out…

What is the Halving?

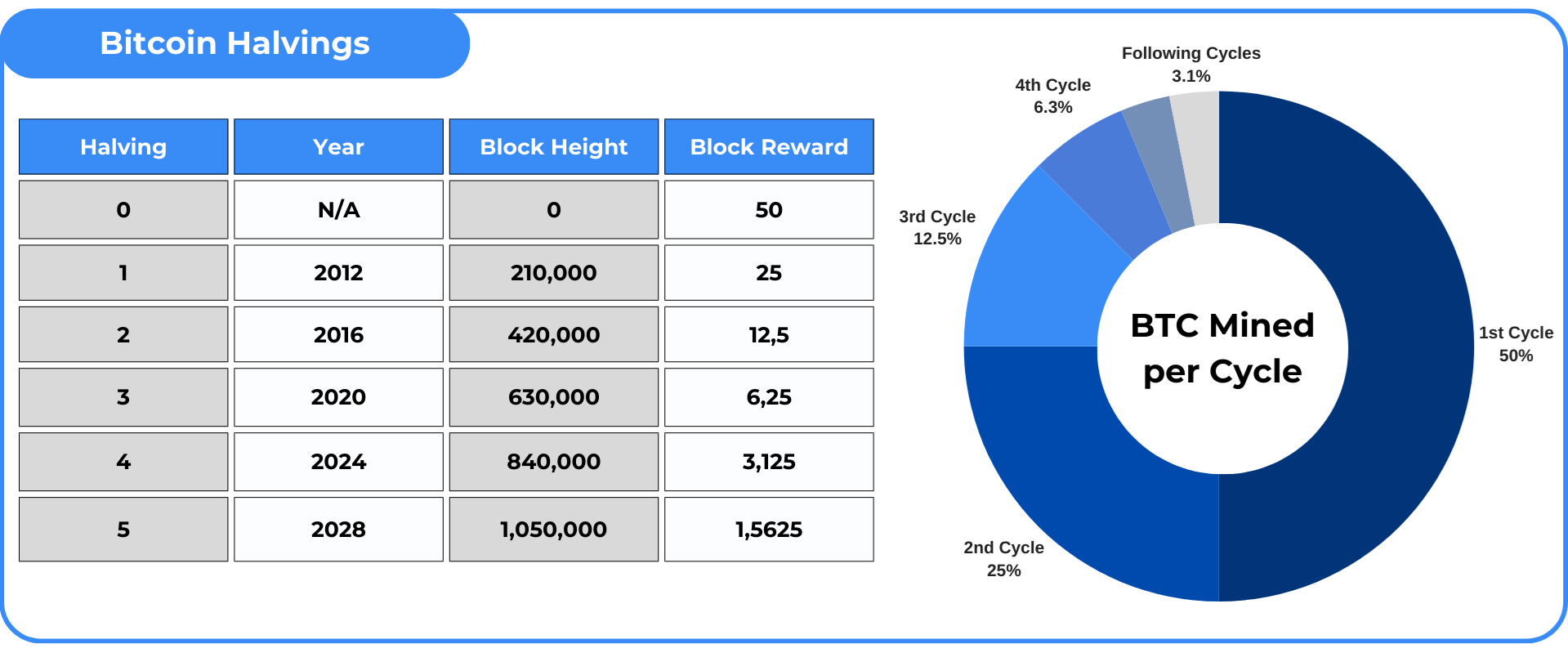

The Bitcoin halving is an event that takes place exactly every 210,000 blocks, which equates to roughly four years. It marks a programmed reduction in the subsidy awarded to miners for validating transactions and generating new blocks on the network.

At the launch of the Bitcoin network in 2009, miners were rewarded with 50 BTC for each block they validated. Subsequently, in 2012, the first Bitcoin halving occurred, reducing the block subsidy to 25 BTC. Another halving took place in 2016, further reducing the block subsidy to 12.5 BTC. The most recent halving, in May 2020, decreased the subsidy to 6.25 BTC.

In total, there will be 32 Bitcoin halving events. After that point, no more Bitcoin will be created, as the maximum supply will have been reached. The last Bitcoin is projected to be mined around the year 2140. At that stage, miner revenue will rely solely on transaction fees.

Next Halving Estimated End of April

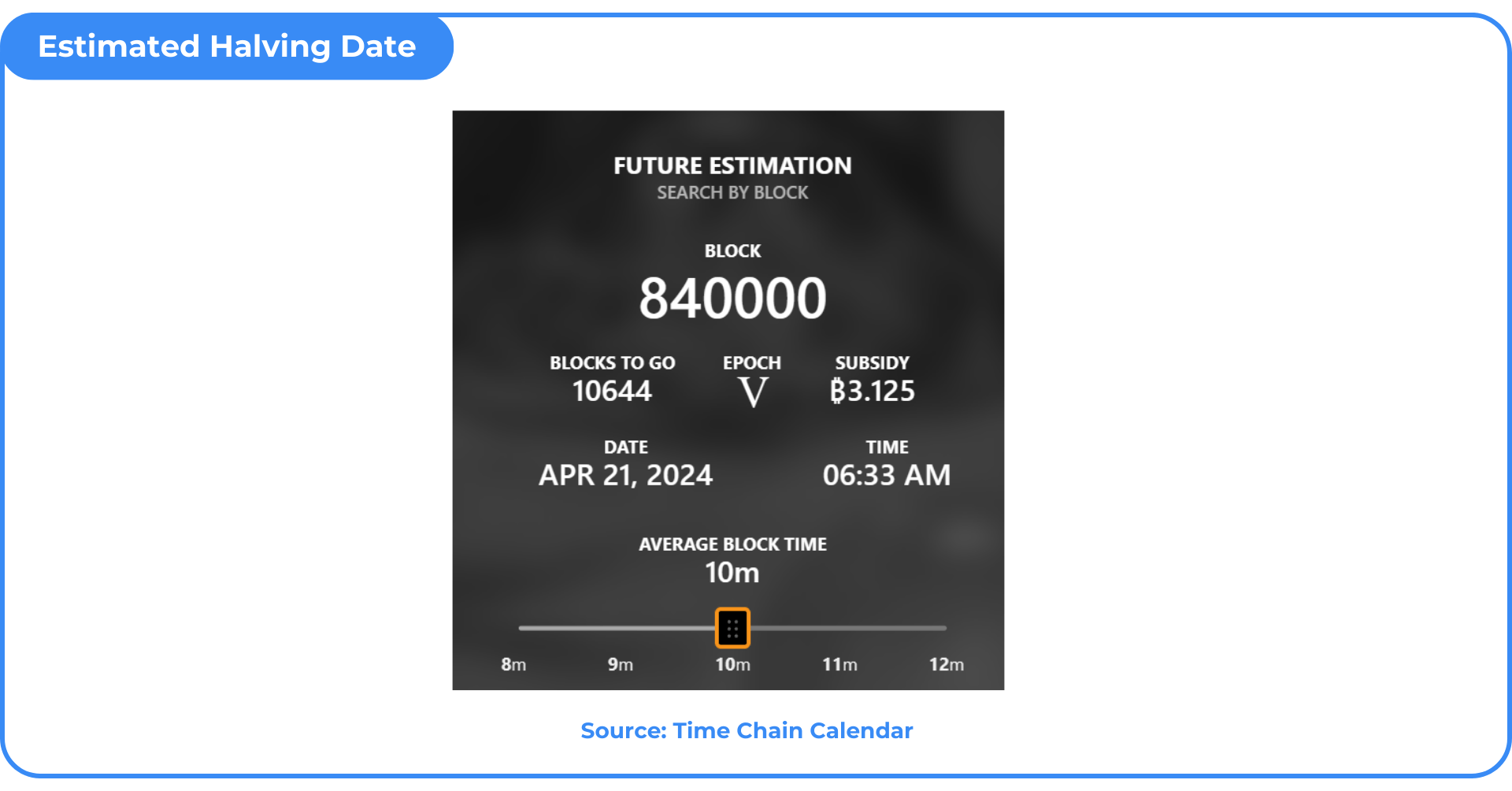

The next halving is estimated to occur by the end of April 2024. The exact timing of the halving event depends on the speed of block production, which is influenced by the amount of computing power (hashrate) added to or removed from the network. As more machines join the network, blocks are solved more quickly, which can bring the halving event forward.

The difficulty of mining adjusts every epoch, or every 2,016 blocks (approximately every two weeks), to maintain a consistent block time and limit the movement of the halving dates. Various Bitcoin halving countdown clocks are available to track the expected day and time of the halving. Closer to the halving the estimation of the actual date is becoming increasingly precise.

How does the Halving Impact Bitcoin Price?

The impact of the halving event on Bitcoin’s price is a topic of frequent discussion among cryptocurrency enthusiasts. Some argue that the halving is already priced into the market, meaning that investors and traders anticipate the event and adjust their strategies accordingly. On the other hand, others believe that the decrease in the supply of new Bitcoin, coupled with constant or increasing demand, can lead to an increase in price, following the principle of price equilibrium.

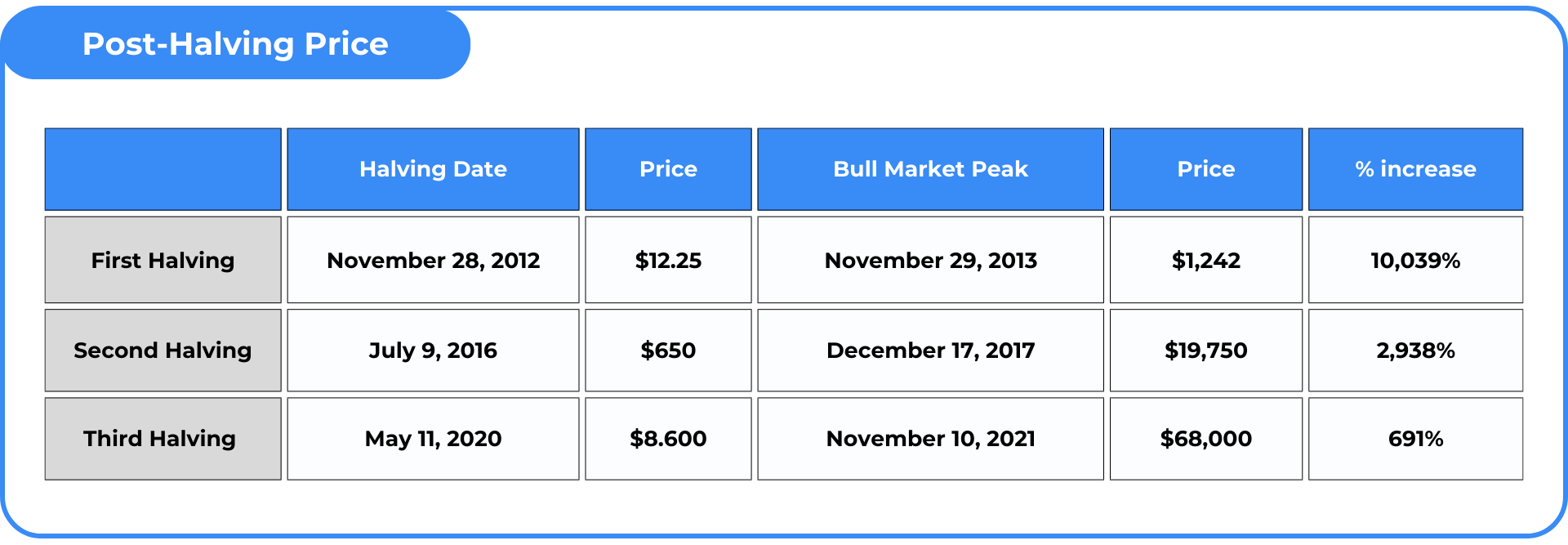

Looking back at the last three halvings, we observe that each event served as a catalyst for significant price movements. For instance, during the 2020 halving, Bitcoin was trading around $8,600, after which it experienced a remarkable surge, reaching an all-time high of $68,000. This represented an impressive 691% increase in price following the halving event.

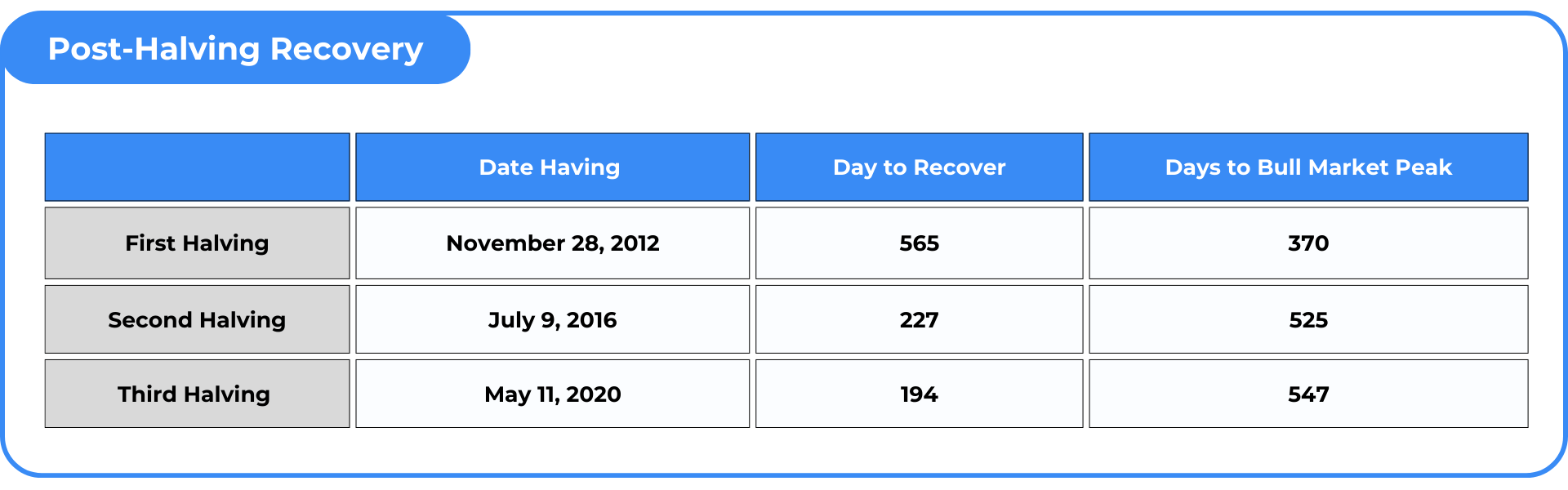

While previous halvings have indeed been followed by surges to new price highs, it’s important to note that this upward movement has typically occurred with a delay. For instance, after the 2020 halving, it took approximately 194 days for Bitcoin to reach its all-time high level of around $19,750, which was attained on December 17, 2017. Interestingly, the time it took to achieve new record price levels shortened with each successive halving event.

The last two halvings, it took approximately 525 and 547 days (equivalent to 17 to 18 months) before the price of Bitcoin reached the peak of the bull market. Therefore, if the upcoming halving occurs at the end of April, and we extrapolate from past trends, we might anticipate reaching the peak of the next bull market around September or October 2025.

Will Miners Capitulate Again in 2024?

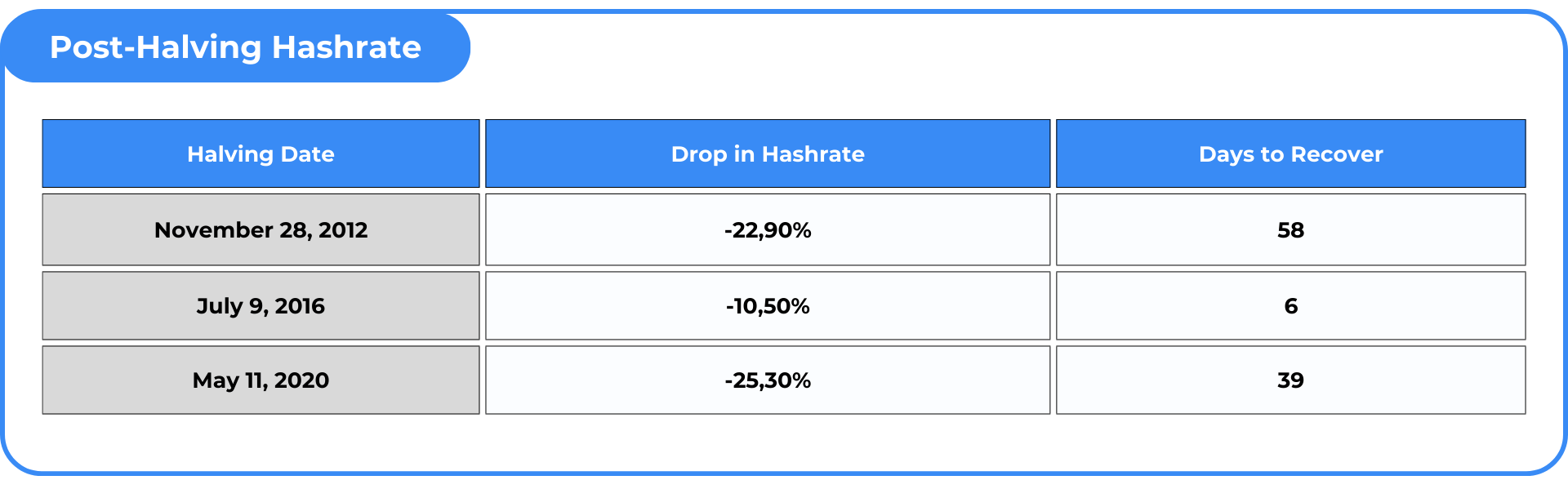

The reduction in the block subsidy, coupled with the lag in Bitcoin price appreciation following halving events, has significant implications for the mining industry. Historically, each halving has led to a decline in hashrate, indicating that miners are forced to take machines offline as they become unprofitable to operate.

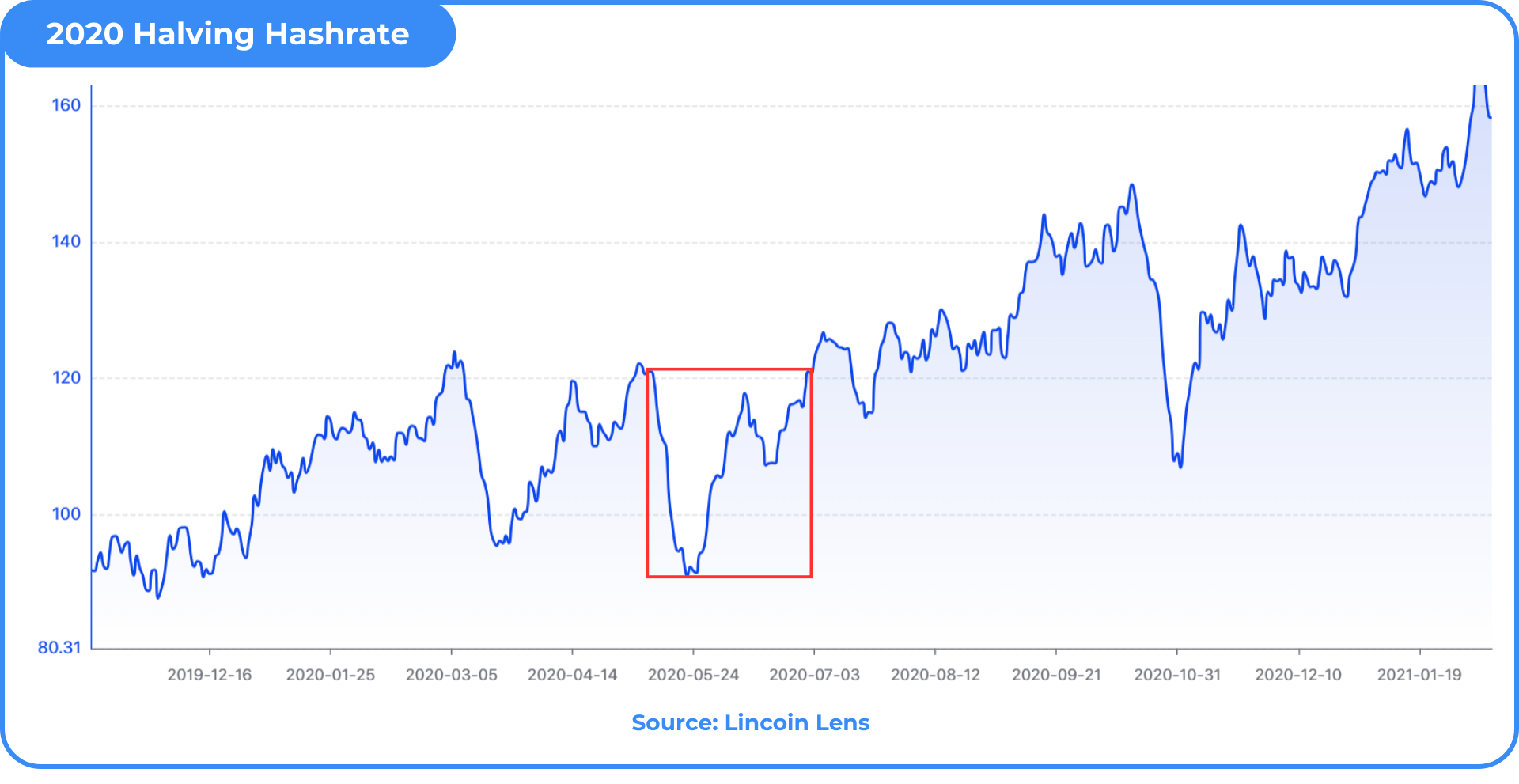

For instance, following the last halving in May 2020, there was a notable drop in hashrate. In just 11 days, the hashrate 7-day moving average, experienced a decrease of approximately 25.30%.

Historical data suggests that hashrate tends to recover to previous levels relatively quickly following halving events. For instance, in 2020, it took approximately 39 days for hashrate to rebound, and in 2016, the recovery occurred even more swiftly.

Considering the upcoming halving, it’s reasonable to anticipate a similar response in hashrate. However, it’s important to note the substantial growth in the size of the network since the last halving. By the end of January 2024, the network’s hashrate had expanded to approximately 525 EH/s, a significant increase from around 120 EH/s leading up to the 2020 halving.

Given these figures, a 25% drop in hashrate would translate to approximately 131 EH/s coming offline. To put this into perspective, this would be equivalent to approximately 1.3 million Antminer S19J Pro 100TH machines being taken offline.

The Impact on Mining Revenue

Hashprice serves as a crucial metric for miners, indicating the expected earnings in USD ($) per Petahash (PH/s) of computing power per day. It’s influenced by Bitcoin price, network difficulty, block subsidy, and transaction fees.

Unsurprisingly, the halving has a significant impact on hashprice, primarily due to the halving of the block subsidy. Following the 2020 halving, hashprice experienced a notable decline, dropping from $160/PH/Day to $73/PH/Day, representing a decrease of 54%. Subsequently, hashprice remained at a lower level for approximately six months. However, it rebounded to pre-halving levels once Bitcoin price surged to new all-time highs towards the end of 2020. Throughout much of the 2021 bull market, hashprice remained elevated, reaching peaks as high as $422/PH/Day.

If historical patterns repeat themselves, miners should brace for a period of narrow profit margins following the 2024 halving. Currently, hashprice stands at approximately $80/PH/Day. In a scenario where transaction fees are minimal and Bitcoin price and hashrate remain unchanged, hashprice could plummet to around $43/PH/Day.

Surviving these challenging months will be pivotal for miners, positioning themselves to capitalize on the opportunity should Bitcoin experience a parabolic surge, as seen in previous halving cycles.

EZ Blockchain CEO, Sergii Gerasymovych, shared his invaluable experiences and strategies for not only surviving but thriving during crypto winters. With a proven track record of successfully navigating through challenging times, Sergii offers practical advice and visionary insights to help crypto miners stay resilient in a volatile industry. (Source: “Surviving Crypto Winter”)

5 Reasons Why This Time It’s Different

While historical data is useful for projections, past performance is not indicative of future results. Here are five reasons why this time might be different in the context of Bitcoin halving:

- Increased Demand from ETFs: The emergence of ETFs has significantly increased demand for Bitcoin. In the beginning of February ETFs purchased approximately 4,000 Bitcoin per day (net – inclusive of $GBTC outflows), while daily production is expected to halve to 450 BTC after the halving, this heightened demand could lead to faster price appreciation. ETFs may leverage the halving as a selling point, attracting more institutional investors who are still evaluating various offerings.

- Refinancing Running Operations: Despite several mining companies facing bankruptcy during the 2020 bear market, many of them kept their rigs operational while undergoing refinancing or acquisitions. A similar scenario post-halving might play out which reduces the impact of bankruptcies on network hashrate.

- Miners Operating at a Loss: Some miners may choose to continue operating at a loss post-halving, anticipating better margins in the future due to expected price appreciation. Factors such as contractual obligations with power provider, tax considerations, and the potential impact on share prices for publicly traded companies may incentivize miners to endure temporary losses.

- Dynamic Mining Strategies: Miners have become more sophisticated, employing techniques such as running machines at low-power mode to enhance efficiency. This adaptability allows miners to maintain profitability even in challenging market conditions, mitigating the need to shut down operations entirely. Here, strategies to lower power consumption in mining farms become critical for survival.

- Potential Spikes in Transaction Fees: In 2023 transaction fees spiked a couple of times because of ordinal inscriptions competing for block space. The uniqueness of the first blocks post-halving could further elevate transaction fees as users compete for block space. Miners may be incentivized to add hashrate, even at a potential loss, to increase their chances of mining these unique blocks and capturing the associated transaction fees and unique sats.

These factors collectively suggest that the dynamics surrounding the upcoming halving may diverge from previous cycles.

PART 2: HOW TO PREPARE FOR HALVING. MINERS SURVIVAL GUIDE

On November 15th, EZ Blockchain CEO Sergii Gerasymovych hosted a webinar about Bitcoin halving. Sergii is considered a thought leader in Bitcoin mining and has seen the last two halving events and survived two crypto winters. He is sharing his expertise and ideas regarding practical tips about how to make money on halving, the biggest crypto event in 2024.

His webinar focused on Bitcoin mining and halving events, who will stay in the game after 2024 halving, what miners can do to prepare, mining equipment and whether it’s time to buy more, and why miners should work with EZ Blockchain.

What is Bitcoin Halving?

Typically, bitcoin halving is an event that happens around once in four years, and that’s when the reward block is slashed in half. The amount of Bitcoin admitted into circulation becomes 50% lower, making Bitcoin so attractive.

The third halving was the biggest change to the whole micro, micro level of the Bitcoin industry. That’s when Bitcoin started running to a very high number, and it started to attract people from many industries. There started talks about establishing Bitcoin futures and options began to trade on exchanges. Bitcoin became more institutionalized and that’s mostly what drove its price to $69,000.

So, what’s going to happen to miners? What will become of mining companies, big or small, after that event?

And how will it influence them?

Well, the most important part is that now Bitcoin miners, instead of 6.25 Bitcoins per block gonna start making 3.1.25, and that’s a big difference.

So, suppose you look into perspective here, for any miner to stay in business with the same crypto mining equipment, the same inputs on power, and the exact operating cost today. In that case, the Bitcoin price during the halving has to be around $70,000 to make the same profit that you guys are making now.

Through the last couple of years, we have seen what the halving does to Bitcoin miners. It is sometimes brutal because many companies or players don’t survive.

Who Will Stay in the Game After 2024 Halving?

Most people who don’t survive have high hosting fees or electricity costs. They have debt, don’t have a strong operational team, and their equipment is inefficient.

So obviously, only those who have a very reasonable electricity cost and hosting fees, are low on debt and have a strong operational team will be able to stay in the game. It’s one of the most important parts to have efficient equipment.

Unfortunately, the Bull Run of 2021 to 2022 has driven the cost of cryptocurrency mining rig ROI to insanity. Many people did buy the bitcoin mining equipment on the top, so that means that those players are still sitting with that equipment. They have not sold it because that equipment has not made any money yet and is far from making any money, and that’s a big issue. They will not survive the halving if they don’t throw more capital, small or big.

So, What Can We Do to Prepare?

The most important aspect for companies is that operational costs must stay low.

The costs matter for survival through tough times, bad times, and good times. The margins can be so low that sometimes you will not be able to operate, and in the bitcoin mining business, the most important part is to stay online. If you stay online, you can always catch a high Bitcoin price and keep mining. But if you turn off the facility, bringing you back online is very tough.

Bitcoin Mining Operational Costs?

According to JP Morgan’s recent report on Bitcoin, the industry operating cost is equal to miner power consumption plus data center power consumption multiplied by power price plus other operational costs. It seems pretty straightforward, and it is. However, the biggest drivers of running a cryptocurrency mining farm are miner power consumption and price. The power price could be so volatile that it can change your margins in Bitcoin mining at any minute.

Demystifying Bitcoin Mining Costs

In reality, bitcoin mining is a very low-margin business, contrary to popular belief.

It’s not really virtual money; it’s very hard work from infrastructure development and operation, electrical power lines development, land development, and running operations.

Besides the power cost you can control only by having a good power contract or hosting contract with your counterparty who offers you hosting services, it’s very important to focus on other operational costs. The costs matter because there are so many details in how you run a particular facility where your mining equipment is being hosted.

So there are facility maintenance operational costs such as spending money on network operation, changing filters, changing fans, upgrading electrical breakers, and controlling board plans that are always breaking. We need human capital to do that work.

Further, it’s not enough to put the miner on the shelf. You have to configure your miners, maintain their uptime, ensure the internet is flowing correctly, and, most importantly, ensure that all changes when you have not three miners online but up to 30,000. The networking scale becomes different, meaning the problems are different, and the approach should differ.

Additionally, when you have networking and electrical equipment operators, you need team leaders who manage all those people. With a larger operation, the team management focuses on making all work efficient.

Ultimately, power costs usually equal 85 to 90% of all costs, but there is another 10%, and this would be the other operational costs. Therefore, it’s important to stay focused and ensure these costs stay in line. Because you can have the cheapest power in the world, for example, 3 cents per kWh, but if your operational cost equals another 2 cents per kWh, then your cost of power is not really 3 cents. It goes to 5 cents.

Mining Equipment

After 2024 halving, many miners will become unprofitable, but not all will be unprofitable to turn off immediately. Usually, there is a period when miners will accumulate enough Bitcoin and hold with the hope the price goes up so they can sell those Bitcoins and power their costs. However, that strategy doesn’t work because you usually have no idea how long the price stays where it is, and it may never go up.

So, running at a negative level is always a problem, and many mining companies with all the equipment, high input power costs, and very high operational costs will be running negatively. But since there is again a human emotional factor here, they will run for at least a month or two close to negative or maybe at negative to see what happens.

The market participants who have updated their equipment for a new one would be in a good spot. But it depends on which cost they update that equipment because, at the end of the day, bitcoin mining is a business like everything else. If you spend $1,000 to make $300 and then spend another thousand dollars to keep making $300, that doesn’t do anything for you.

The Solution. How To Prepare For Bitcoin Halving As Miner?

What’s important is to ensure that if you have all the equipment you need, it runs as long as possible at a low power cost until it actually breaks.

“I think that those market participants who do not have equipment higher than a hundred tera hash per second will not make money within the 6 months after halving, unless, of course, Bitcoin price goes up.”

But if the Bitcoin price goes up, there will be more demand and fewer rewards to share amongst everyone. So, if you are a new miner, the only mining equipment that you should buy is with an efficiency of less than 21 Joules per tera hash. That equipment will be very competitive, and you will stay in a game for quite some time.

Not only that, you will be able to stay afloat even if the price goes down after halving, and the price of that cryptocurrency mining equipment is not that high anymore.

How Should You Approach the Upcoming Halvings Differently Compared to Previous Cycles?

Don’t Just Wait for Your Mining Equipment

First, you should not wait for your equipment for a long time. You don’t spend money upfront and wait for equipment in six months. Your return on investment doesn’t start when your equipment arrives. It starts the moment you get money out of the bank account. So, if you started today and your equipment arrives in 6 months, you have not made money for six months. Between those 6 months, cryptocurrency prices may go up or down.

Mine More Efficiently

Also, you need to stay within 21 Joules per tera hash because new equipment doesn’t mean the best results. New equipment is good because it mines more Bitcoin, but at the end of the day, remember, it’s business; you have to calculate your return on investment.

You want to think about efficiency in terms of how many Joules per tera hash and cooling the chip. Between 2021 and 2022 was the era of immersion hype. Immersion cooling is great on the operational level but is very expensive on the capital expenditure level.

Overclocking

It makes sense to mine in immersion only if you want to overclock your machines. If you have machines with special software and special control boards that allow you to squeeze as much as possible from that, that’s the best way to do immersion cooling, and EZ Blockchain offers both of those services.

We provide hosting in air and immersion cooling infrastructure, but air cooling is easier. It’s easier to set up, quicker, and, most importantly, three times cheaper, and we can work with more types of equipment in the same facility.

Should I Buy More Equipment and When?

All of that depends. What is your strategy? What is your strategy to get into new business? Is your strategy to survive with what you have or is your strategy to do this for fun?

For every answer to each question, there is a different strategy.

“There is a lot of positive sentiment, and I think bitcoin has become much stronger after the FTX saga than any other crypto asset because it has something behind it. It has infrastructure behind it, it has people behind it, and it is finite.”

“Bitcoin is not printing from thin air, so it always makes sense to buy more equipment, obviously, depending on your budget. When you do buy more equipment, you need to make sure that equipment is the right equipment for your specific stretch.”

Why Work with EZ Blockchain?

- We have been in this hardware and crypto mining business for a long time.

- We provide the lowest industry prices for Bitcoin mining

- We operate facilities on a large scale, and develop facilities quickly, and we have had six years of experience in doing that.

- We are a professional data center operational team, and we are the only company with a specifically assigned engineering department focused on uptime and hash rate.

- We are the suppliers of low, low-cost, clean power. Our facilities are very much diversified.

- We have locations in Georgia, South Carolina, and Kansas.

- We’re building more facilities across the country; most importantly, we control our destiny.

- We have our own mobile data systems supply chain, which helps us be very effective during tough times.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.