Stay up to date with the latest news, announcements, and articles.

To assess whether mining is a viable option for you, it’s crucial to evaluate its profitability. Profitability is influenced by both revenue and costs. In the realm of Bitcoin mining, revenue is affected by several key factors: the price of Bitcoin, the network’s hashrate and corresponding difficulty adjustments, block rewards (which include both the block subsidy and transaction fees), and the efficiency of your mining equipment (or fleet).

Costs can be divided into two categories. The first is the initial investment, or capital expenditure (CapEx). If you are using hosting services, this typically includes the cost of the ASIC miner along with any additional expenses like shipping and setup fees. The second category is operational expenses (OpEx), which encompass ongoing costs such as electricity, maintenance, repairs, and security. For those utilizing hosting services, these operational costs are often bundled into a single hosting service fee.

In essence, profitability is determined by subtracting costs from revenue. However, in the world of crypto mining, this calculation is not straightforward due to factors beyond miners’ control, such as Bitcoin price and block rewards. Let’s delve into the calculations and see if Bitcoin mining is still profitable.

Calculating Profitability in Bitcoin Mining

Profitability in Bitcoin mining involves comparing your revenue with your expenses. Here’s a how to calculate the revenue and expenses:

Calculate Revenue

Determine how much Bitcoin you expect to mine over a given period. This depends on your mining hardware’s hashrate, the network’s total hashrate, and the network difficulty. Estimate the revenue by multiplying the amount of Bitcoin mined by the current or projected Bitcoin price. The revenue can be calculated by multiplying the Bitcoin mined by the Bitcoin price.

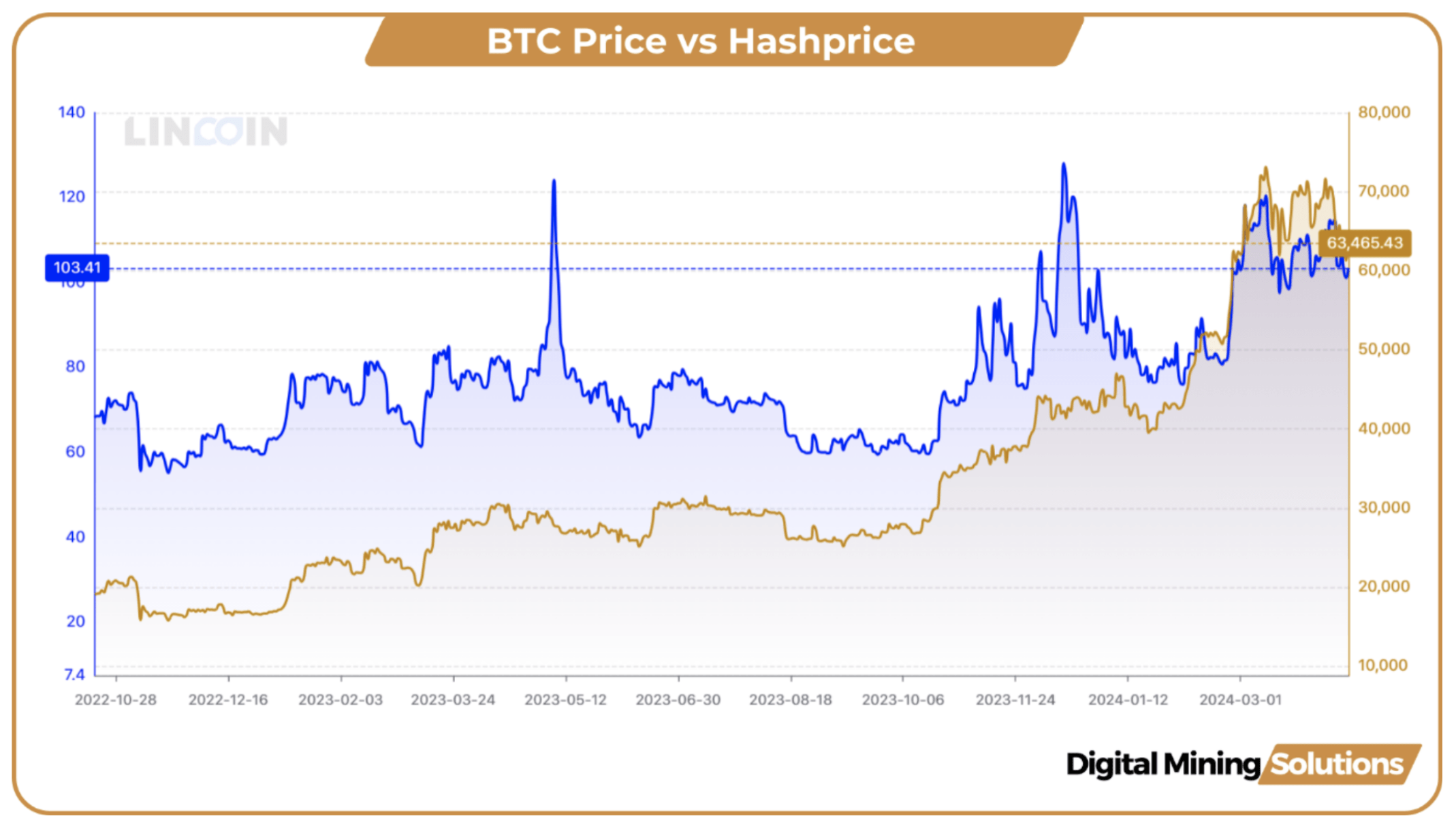

A simplified way to go about calculating revenue is to use an indicator called hashprice. Hashprice shows how much a miner can expect to earn in USD ($) per Petahash (PH/s) of computing power per day. This is a function of network difficulty, block subsidy, transaction fees and Bitcoin price. Hashprice is measured in $/PH/Day.

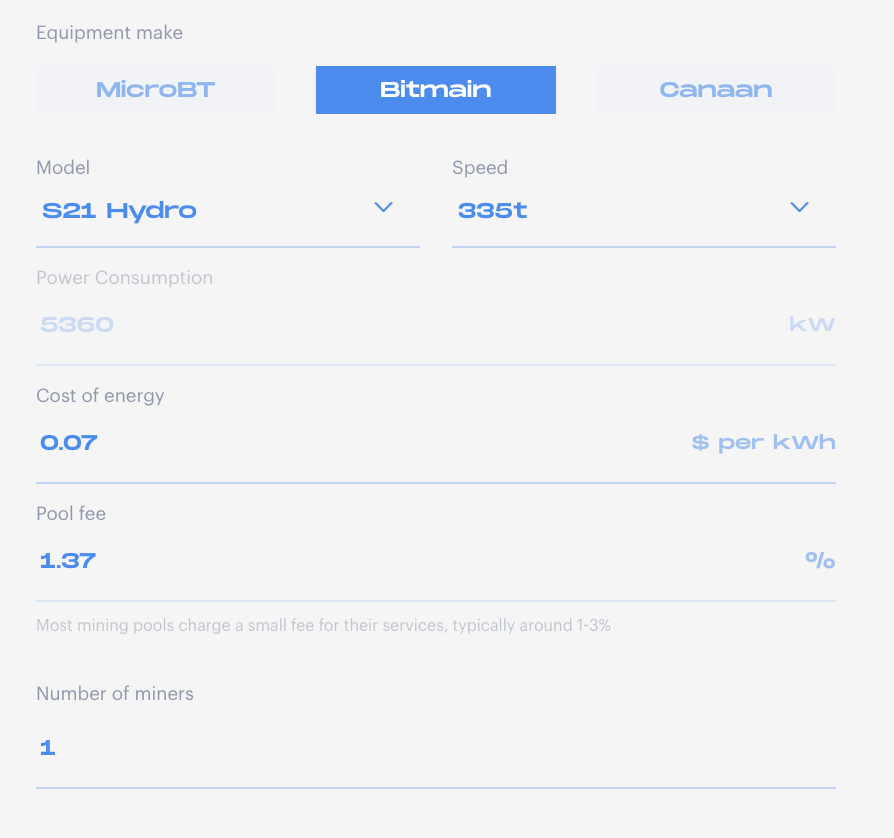

Bitcoin Mining Calculator

Use our Bitcoin Mining Calculator to estimate your monthly and yearly income based on the miner model, cost of energy, power consumption, number of miners, and pool fee. Alternatively, contact our expert for investment advice.

Find the Bitcoin Mining Calculator at the link provided.

Calculate Expenses

The operational expenditure will depend on the type of mining business you run. When your mining hardware are running at a hosting facility, the OpEx can be as straight forward as the hosting fee and costs for repair.

When you operate your own data centre infrastructure the expenses consist of different types.

- Operating Expenses (OpEx): Day-to-day costs of running a business (e.g. rent, energy bills, salaries, office supplies).

- Non-operating Expenses: Costs not related to core business operations (e.g., interest expenses, losses on asset sales).

- Depreciation and Amortization: Allocation of the cost of tangible and intangible assets over their useful lives.

Payback Period or ROI in Days

To calculate the Return on Investment (ROI) in days, you need to determine the time it takes for your investment to generate a return equivalent to the initial investment. This is often referred to as the “payback period.” Here’s how you can calculate it:

- Determine Initial Investment (CapEx): This is the total amount spent upfront to start the mining operation (e.g., cost of mining hardware, setup fees).

- Calculate Daily Net Profit: Daily Revenue – daily expenses.

- Calculate Payback Period (ROI in Days): ROI in Days = Initial Investment / Daily Net Profit.

When evaluating an investment in Bitcoin mining, calculating the payback period is often more important than the profitability. Main reason is the fact that the newest and most efficient machines often are sold for a premium. Depending on how big this premium is and what your operational expenses look like, it might be worth considering a lower capital expenditure per TH because the ROI in days might be shorter.

Crucial to Understand Market Cycles When Calculating Profitability

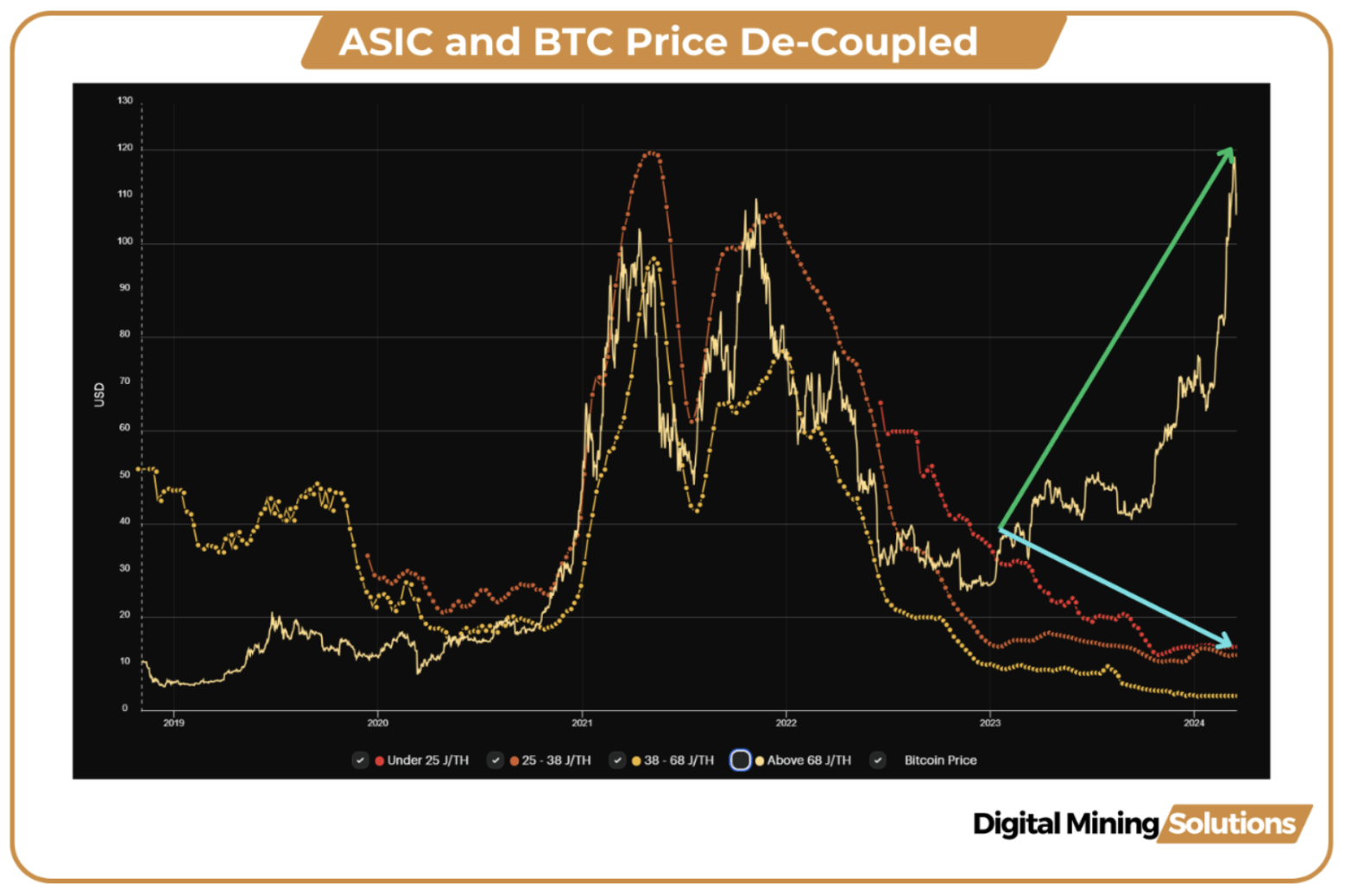

When investing in Bitcoin mining and calculating profitability, it is important to keep in mind that the industry is very cyclical. The cyclicality does not only apply to Bitcoin price, but also to hashprice, transaction fees and ASIC miners.

Revenue is highest during the later stages of the Bitcoin bull market when the price increase of BTC outpaces the amount of ASIC Bitcoin miners that can be deployed. When projecting return it is always important to be conservative. The period of high profitability is relatively short. In order to be a successful miner it is important to manage cashflow in such a way that bull market profits helps you to survive a crypto winter or even seize opportunities during a downmarket.

Transaction fees

Transaction fees have been spiking due to ordinals. Transaction fees as % of block rewards become more important. During short term periods profitability even doubled.

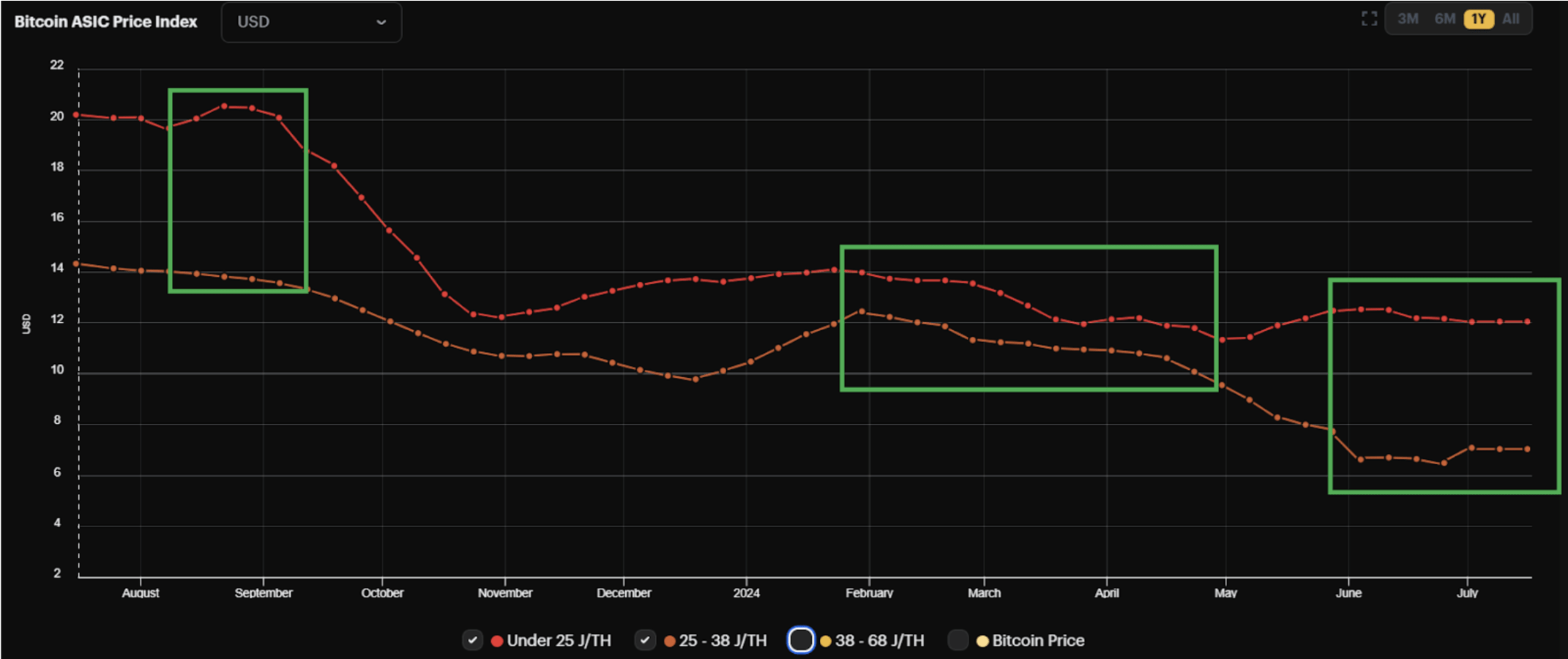

ASIC Prices

Timing the ASIC markets is crucial. Machines are cheap at the moment more TH per $ than two, three years ago. Miner prices are expected to go up again during the bull market as demand will pick up with increased profitability.

Determine Goal

Before calculating if mining is still profitable it is crucial to determining your goal when investing in Bitcoin mining. It helps you tailor your strategy, manage risks, allocate resources effectively, and measure your success. Different goals lead to different approaches, time horizons, and expectations, influencing decisions on hardware, energy costs, and operational scale. Here are some potential goals:

- Fiat profit maximization.

- Acquire BTC below market price.

- Diversification of an investment portfolio.

- Contribute to the security and decentralization of the Bitcoin network.

- Learn about Bitcoin mining and blockchain technology through hands-on experience.

Different goals require different levels of investment in hardware, software, and infrastructure. Clear goals help in assessing and managing risks, such as market volatility, regulatory changes, and operational challenges. Your objective influences operational decisions, such as whether to reinvest profits into new equipment or hold mined Bitcoin. It also affects your approach to cost management, including electricity costs and maintenance.

It is important to understand that while mining rewards are paid-out in BTC, it’s a world apart from simply buying Bitcoin. Buying Bitcoin offers straightforward exposure to price movements with minimal operational fuss, while mining requires investment in infrastructure to earn rewards through transaction validation, demanding more in terms of operations and maintenance. Both paths boast profit potential and risks, but the choice depends on individual investment objectives, risk appetite, and resources. EZ Blockchain explored the nuances between these investment opportunities in detail, click here to learn more.

Measure of the computational power used to mine and process transactions on the Bitcoin network.

Key Elements in Choosing Mining Equipment

In order to determine the profitability of your mining endeavour it is crucial to consider the following key elements when selecting mining equipment:

- Hashrate Output (TH/s): The computational power, or hashrate, is typically the primary specification to consider. The higher the amount of TH/s, the greater the computational power and higher the potentially revenue.

- Power Usage (W): The power is measured in watts (W) and dictates your electricity costs. Lower power consumption is preferable, as it results in reduced electricity bills and greater profitability.

- Efficiency (J/TH): Bitcoin miner manufacturers and resellers measure efficiency using J/TH. Joules (J) measure the total energy consumed. High efficiency means a low J/TH which is desirable.

- Cost ($/TH): ASIC miners are not only sold at a fixed total cost but are also priced in $/TH. The cost of an ASIC miner is driven by factors such as supply, demand and difficulty increase. Other factors that are of influence are spot market or future order and whether a machine is new or used.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.