Stay up to date with the latest news, announcements, and articles.

To make things easier, today’s mining pools let you compensate for a lack of hardware power and providers and platforms like EZ Blockchain to consult operations, launch without any mining hardware, or optimize processes.

One other thing you can do is merge your mining foutput, spreading your hash rate evenly for energy-efficient operations at a higher profitability rate. There are more benefits you can achieve through merged mining. What is merged mining all about?

Let’s figure things out from the beginning.

What is Merged Mining?

Merged mining is a technique where you run a single mining operation to validate blocks in two or more blockchains at once. Simply put, the merged mining gives miners an opportunity to dedicate the same hash computations to verifying blocks for two networks:

- a primary chain (like Bitcoin)

- and one or more auxiliary chains

This innovative, multi-chain approach enables miners to double the rewarding potential of mining. You can reap profits from each blockchain that you help secure, all without splitting or dividing computational resources. Essentially, this lets you maximize the mining output without any extra strain on your hardware.

As a side note, it is important to understand the distinction between mining pools and merged mining:

- Pools allows crypto miners to join forces for a higher mining capacity;

- Merged mining allows crypto miners to mine extra chains for higher profits.

To clarify things further, let’s go through some technical details and specifics of merged mining.

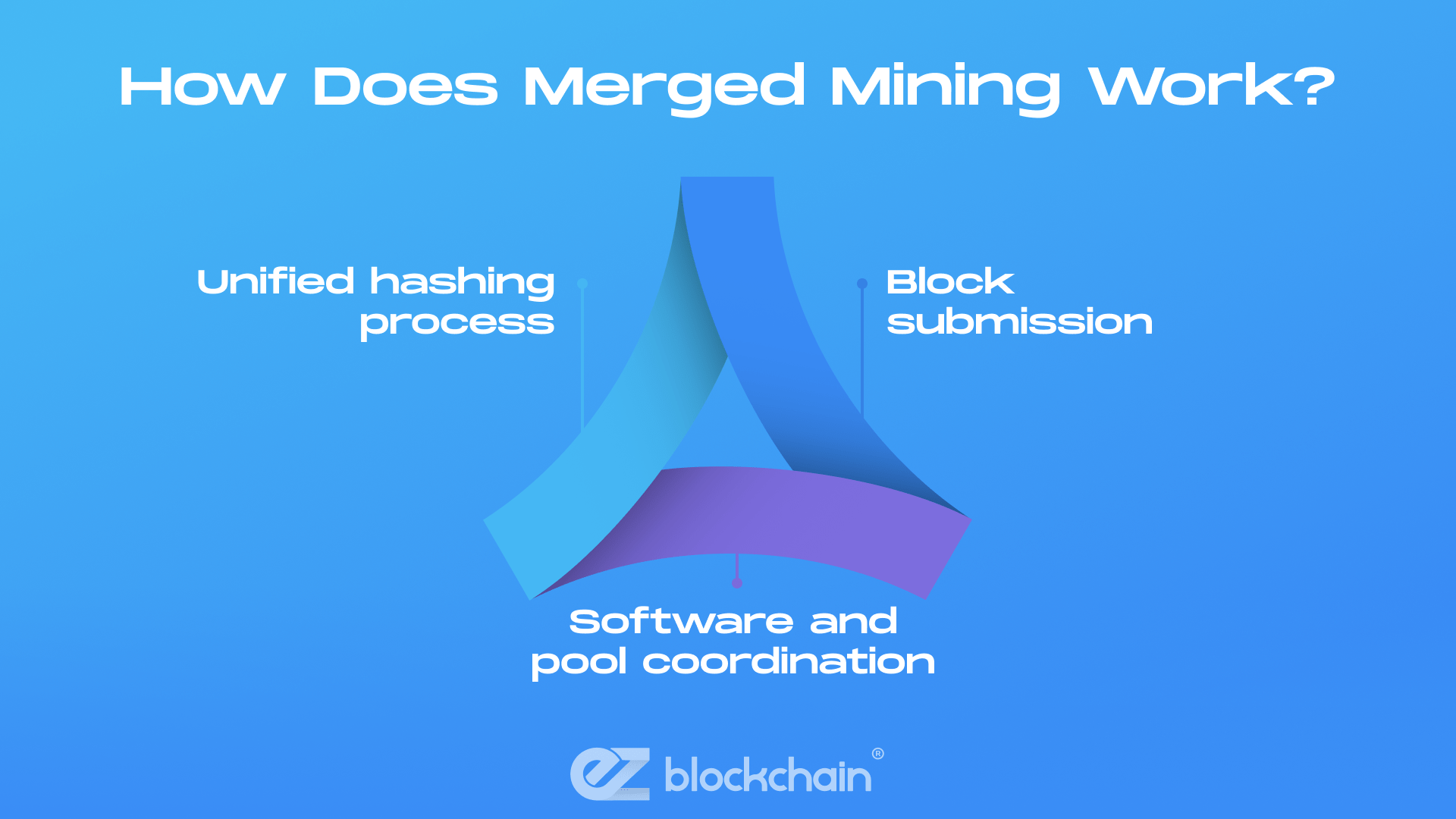

How Does Merged Mining Work?

If we look under the hood, the merged mining approach, in fact, embeds auxiliary chain data into the mining process of a primary chain. Here’s how this process breaks down:

- Unified hashing process

Miners generate a hash that must meet the difficulty requirement of the primary chain. If that hash also satisfies the auxiliary chain’s threshold, it becomes a valid block for both networks. - Block submission

When a miner finds a valid hash, it submits the block to the primary network (e.g., the Bitcoin network in case of BTC merged mining) while also including auxiliary information that confirms validity on the secondary blockchain. This means a single solution can work for both chains. - Software and pool coordination

Whether you’re joining a merged mining pool or setting up your own system, specialized software helps coordinate which chains are being mined. This software checks the hash based on any number of set difficulty targets and automatically distributes rewards across the chains.

The process isn’t limited to Bitcoin. With growing interest in Ethereum merged mining and other protocols, miners now leverage the same principles — often using a specialized merged mining Bitcoin pool or similar platforms — to expand their earning potential. And tools like a merged mining calculator can help mining operation owners determine the most profitable combinations of chains to target.

Key Benefits of Merged Mining

Increased Mining Efficiency Without Extra Costs

One of the most compelling advantages of merging mining objectives is the ultimate efficiency. Miners don’t need to double their energy consumption or invest in extra hardware. At the same time, with the same resources in place, they can secure two blockchains simultaneously. This means that every hash counts toward earning rewards on multiple networks.

Enhanced Security for Smaller Blockchains

For emerging or smaller blockchains, merged mining offers a way to gain a security boost. By piggybacking on the vast hash power of larger networks, these blockchains become more resistant to attacks. In many cases, the increased security provided by Bitcoin merged mining or even merged mining ETH boosts the overall trust and reliability within the ecosystem of the coin you mine.

Higher Profitability for Miners

It all comes down to a higher profitability bar for a crypto enthusiast indulging in merged mining methods. With merged mining, the same computational work is spread across the primary chain and auxiliary networks, doing the main job while generating more passive income.

For miners evaluating returns, a merged mining calculator is the tool to help approximate whether all the potential extra rewards justify the challenges and hurdles you’ll have to go over.

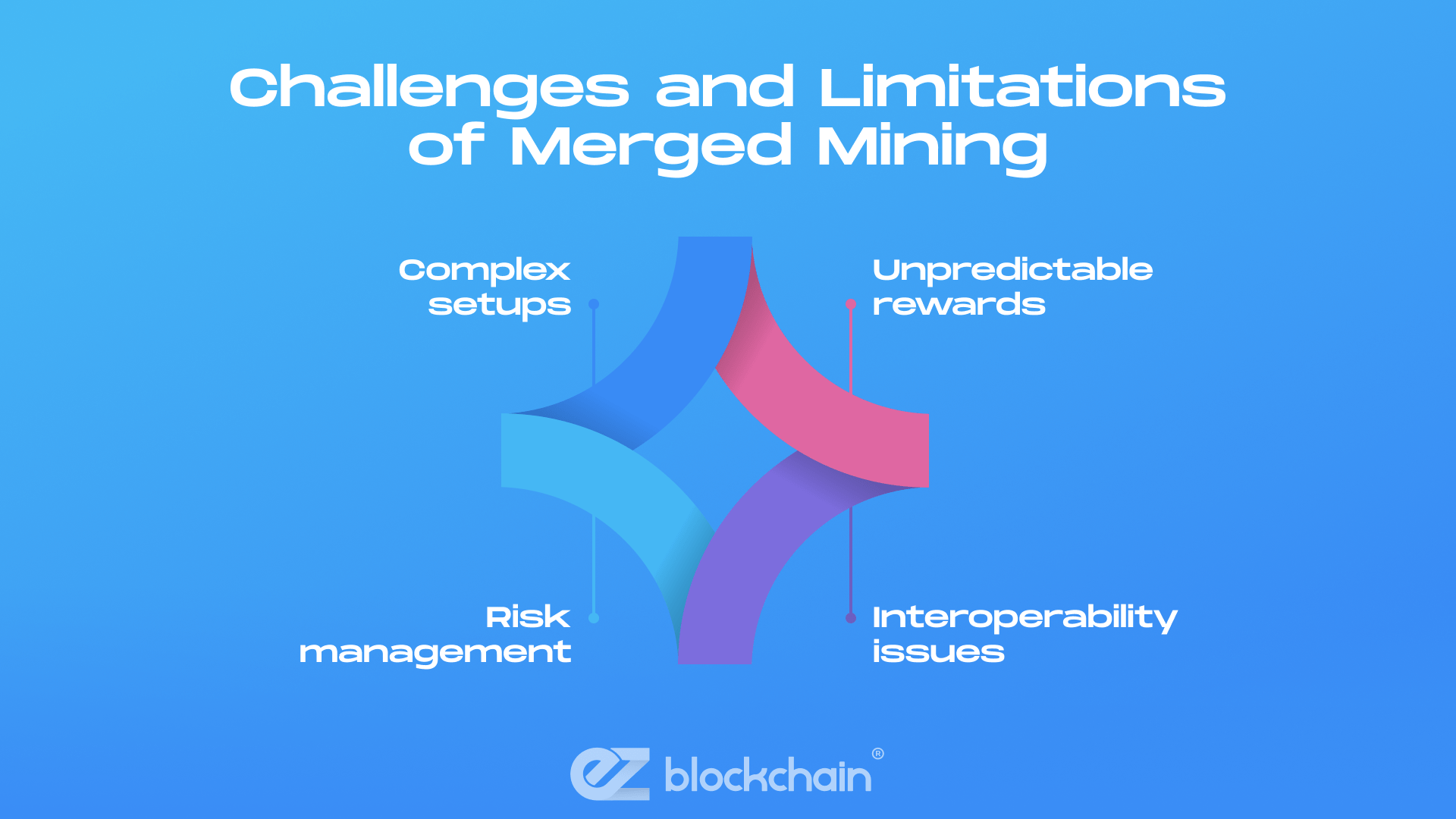

Challenges and Limitations of Merged Mining

Merged mining is a very forward-minded way to maximize one’s mining operations. However, it is not without its flip side of complexities and challenges, like:

- Complex setups

Implementing merged mining calls for an in-depth configuration of mining workflows that take time. Sometimes, you must also go and join a specialized merged mining pool. The integration of multiple protocols required for this technique to work requires custom optimization. A one-size-fits-all approach rarely works here. - Unpredictable rewards

The additional income from auxiliary chains can vary dramatically based on different specs. There’s the network difficulty, pre-ste block reward size, and other market conditions, like coin pricing, market cap, profitability, etc. Sometimes, the extra revenue may not always cover the added administrative overhead. - Interoperability issues

Differences in block times, consensus algorithms, or upgrade cycles between chains can lead to operational hiccups. For example, combining BTC merged mining with Ethereum merged mining might require constant adjustments to stay in sync with both networks’ evolving protocols. - Risk management

Although merged mining helps expand the range of security for smaller blockchains, it also introduces risks. Keep in mind that there is an additional chain being connected to the main flow of operations. Therefore, a failure or significant change on one chain could potentially impact the operation’s overall performance.

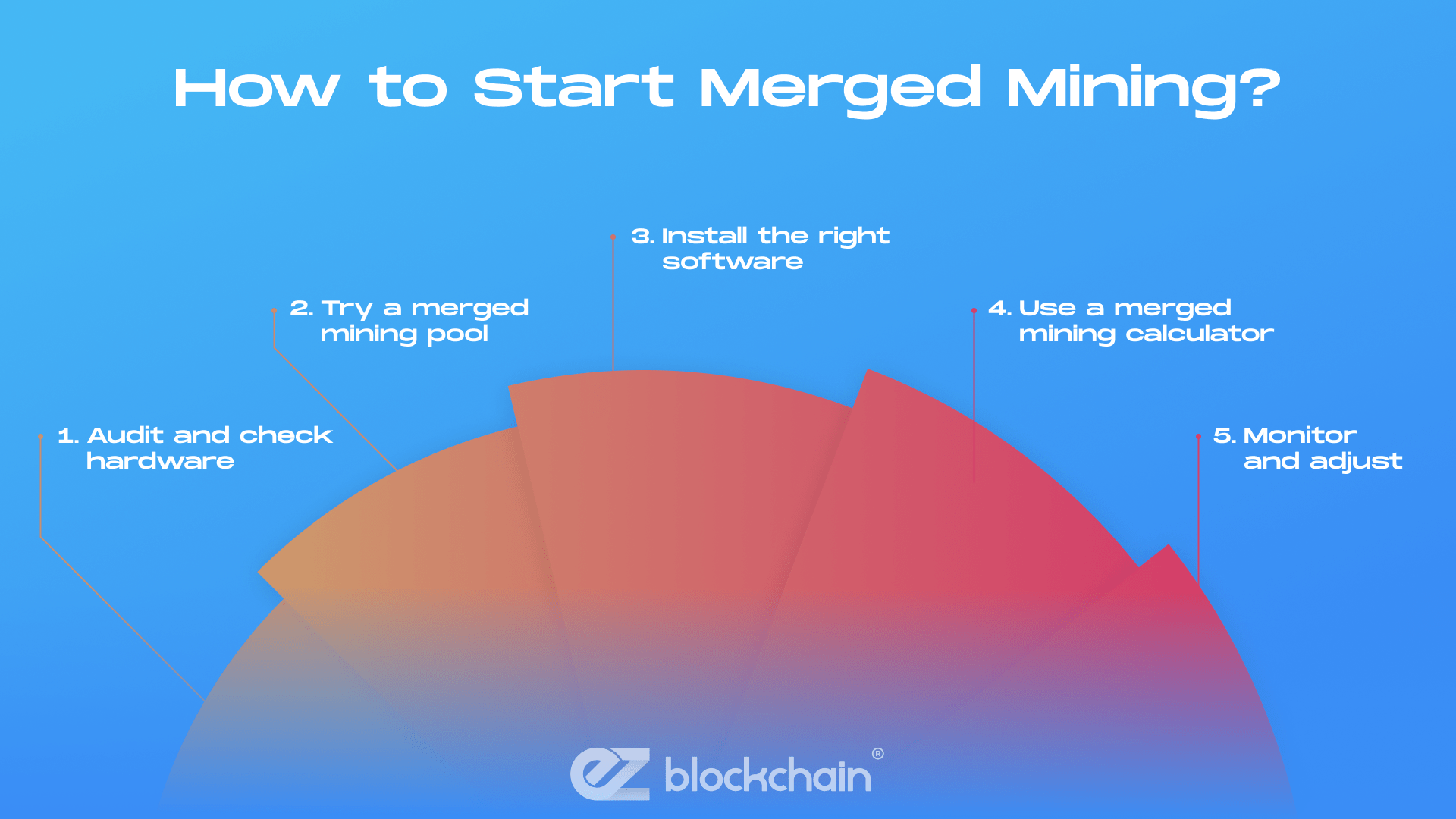

How to Start Merged Mining?

Now, you may already have a running mining operation of some scale or are looking to launch one. In both cases, merged mining can come in as an innovative way to expand your take on mining and try to reap more profits by covering more on-chain objectives.

In any case, it is crucial to start things off well-consulted and with knowledge of how the process goes. For starters, make sure to go through these preliminaries:

- Audit and check hardware

First thing first, make sure an existing mining rig or an ASIC you’re looking to buy has the capacity. It must have enough to handle the computational load of the primary chain plus some spare capacity to validate auxiliary chain blocks. - Try a merged mining pool

Many available mining pool platforms provide features for merged mining. Joining a specialized merged mining pool can be an easier way to integrate with multiple chains. Such pools can handle much of the complex coordination for you, as well. - Install the right software

Next thing you need is the mining software that explicitly supports merged mining. Many packages now include options for configuring multiple chains in a single operation. EZ Blockchain Dashboard, for instance, can help you centralize the outlook on all operations you need to manage in one app. - Use a merged mining calculator

Before going all in and actually investing tangible resources, use a merged mining calculator or an estimate service provided by a crypto agency. It can help you detail out and measure the potential profitability of merging operations based on current network conditions. - Monitor and adjust

Stay updated with the latest protocol changes on all chains you are mining or are looking to mine. The conditions on some chains can be beneficial enough to merge with. It is important to grab an opportunity that you can actually maximize.

Is Merged Mining Profitable?

Almost half of ALL bitcoins mined, 49-50% to be exact, have been mined while merging with other networks in some or another way. All in all, profitability in merged mining is shaped by various factors, including hash rate, network difficulty, and the current market value of the mined cryptocurrencies.

One thing’s for certain — while the concept of earning multiple rewards for the same energy expenditure is attractive, each miner must carefully calculate potential returns. The bottom-line pro tip here would be to use the available tools, plan things out, and consult with seasoned providers for more confident optimizations and improvements.

Should You Consider Merged Mining in 2025?

In 2025, merged mining is not so novel, yet it stands out for the reasons that are always relevant — it balances out expenses and grows profits by allowing you to leverage more power in a savvy way.

Whether you’re considering BTC merged mining or exploring opportunities in merged mining ETH, this is a great way to scale efficiency if you have enough hardware capacity. As the market around this and other forms of mining matures, new merged mining pools emerge, making it easier to join and indulge in such methods.

So yes, merged mining is totally a thing to consider in 2025 and beyond, bearing a lot of potential profitability for ingenious miners.

Bottom Line

There are numerous cryptocurrency networks and respective chains available to miners. Why limit our efforts to operating on just one chain? Merged mining is a clever evolution in mining workflows that helps cover more chains and grab higher profits.

By clarifying the questions about the merged mining basics and “how does merged mining work?”, miners can take advantage of increased efficiency, enhanced network security, and diversified revenue streams.

While challenges remain, the benefits and ever-expanding markets make merged mining pretty integral for today’s crypto mining. All you need to kick things off is a specialized tech provider to consult your merging and walk you through the first steps to optimize your setup.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.