Stay up to date with the latest news, announcements, and articles.

First, there have been changes in the pricing options and billing structures, making it difficult for consumers to understand energy costs and effectively compare natural gas prices and electricity bills. Second, and among other factors, are the environmental sustainability concerns that are forcing energy investors and consumers want to shift to net zero.

The information that follows in this write-up will help you understand the changes in energy costs and the correlation between natural gas and electricity prices.

Understanding Electricity Prices

For many businesses and individual consumers, it’s easy to assume that electricity prices have remained consistent for years. At least for the period until the 2021 turbulence that cut across the entire energy market. The Energy Information Administration (EIA) owes the rising electricity prices to increased natural gas prices. Most of them do not understand that the total figures on their monthly bills never portray an accurate picture. The truth is that electricity transmission and distribution costs have risen steadily over a few years. At the same time, the energy portion of the total cost fell consistently, owing to the falling natural gas prices.

Typically, on-site electricity generation using turbines or natural gas for the baseload power provides an alternative to the rising power costs. It eliminates the need for grid transmission and distribution and associated costs, whether purchased via an energy services agreement or by a consumer.

Usually, three components determine the price of electricity. They include commodity costs, taxes and surcharges, and transmission and distribution costs. The transmission and distribution costs are the expenses associated with electricity distribution via the national grid network connecting homes and organizations. These costs have been rising consistently over the years, accounting for up to two-thirds of the utility bill. They are expected to keep growing as distribution companies invest in modern grid infrastructure and respond to unforeseen circumstances.

For instance, grid infrastructure maintenance and replacements will be a growing need as many components are past their intended lifetime. In 2019, a gas and power company in California, Pacific Gas and Electric’s transmission towers were 68 years old and overdue for replacement. Additionally, electricity transmission companies incur huge expenses from time to time due to catastrophic events. Pacific Gas and Electric also requested a 12.4% rate increase in 2020 to provide for the extensive wildfire mitigation procedures. Overall reports indicate that expenses on transmission and distribution recorded a 54% increase between 1997 and 2018.

Taxes do not come as a surprise and contribute a small proportion to the monthly bills. State and local taxes may increase or reduce depending on circumstances, but the amounts are often negligible. However, some states have implemented surcharges to balance the cost of closing and decommissioning existing power generation assets, supporting green state incentives, and infrastructural upgrades.

The commodity cost relates to the electricity generation expenses, measured in kWh. The wholesale market prices determine the price per kWh. In some states, the price is transparent as consumers can buy electricity directly from power providers in the market.

Correlation between Natural Gas and Electricity Prices

The electricity transmission and distribution prices are tied to expenses on physical infrastructure. In most states, they are regulated by agencies such as the Board of Public Utilities in New Jersey.

On the other hand, the commodity price is directly proportional to the cost of natural gas because of its unique role in the wholesale electricity generation market.

Entities with natural gas-powered electricity cogeneration plants know that as gas prices fall, the commodity cost section on their monthly bills also reduces. In the US, natural gas has been considered cheap for a couple of years, with the impacts of low gas prices manifesting in lower bills for consumers.

Ideally, after the US Shale revolution more than 15 years ago, hydraulic fracturing and drilling technologies emerged, increasing oil and gas production. Natural gas gained traction to become an increasingly used alternative for electricity generation, ultimately overtaking coal in 2016. By 2018, natural gas accounted for 35% of the United States’ electricity. However, the economic power of natural gas has little to do with its dominance as an alternative fuel and much about the energy bidding process.

Usually, electricity in the grid system is determined hourly following a day-ahead bidding auction. Each power generator on the grid places a bid with the price and number of kilowatt hours available. The offers are accepted, beginning with the cheapest option until the national electricity demand is met each hour. The generators then receive the price set by the last bidder, usually known as the clearing price, to meet the demand.

Since the power generation sources are selected following the marginal cost order, hydroelectric and nuclear power generators with low operating costs are dispatched first. Large hydroelectric and nuclear power plants are ineffective in ramping up generation quickly when needed, so they are set to run continuously at the maximum capacity. Wind and solar can also not be inclined to demand-based production since weather conditions significantly influence their electricity generation. Coal has consistently been effective as an alternative fuel source, although it’s not a viable option with the net zero goals. Besides, coal costs are incomparable to the low cost of natural gas, leaving natural gas as the marginal electricity production on the grid that determines electricity prices.

The Case for Natural Gas

Undeniably, natural gas power plants provide unmatched marginal capacity because of their price and are much more flexible. The gas power plants and some coal plants serve as the optimal plants, meaning they can be stepped up and down to meet changing demands at any time. It explains why natural gas electricity generation increases and decreases daily, even as other power sources remain stable.

Since wholesale electricity prices are determined by the generation asset dispatched last, natural gas power plants and natural gas prices significantly impact the overall cost of electricity.

What’s Behind the Current Gas Price Increase?

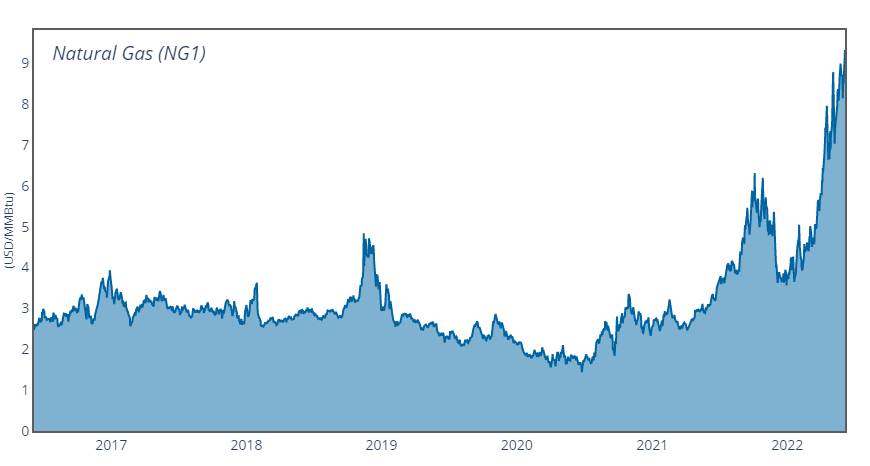

Consumers have experienced some of the lowest electricity prices due to the gas-powered electricity generation up until the 2021 energy sector turbulence. However, natural gas prices have jumped significantly, and the current trends indicate a prolonged period of higher natural gas prices. Not like natural gas price rises are unprecedented.

Over the past years, the prices have shot, but severe weather changes, lack of pipeline infrastructure, and production disruptions, among other concerns, for short periods. However, the current skyrocketing prices have created a sense of a crisis and have had a considerable impact. The prices have recorded the most significant increase, with Asian and European gas prices hitting an all-time high over ten times higher than the prices a year ago. In the US, prices have been at the highest level since 2008.

Typically, the global energy crisis results from a mix of factors. First, the international energy consumption levels plunged to record lows when COVID-19 struck. The pandemic pushed energy prices to the lowest levels in decades. However, the demand strongly rebounded with the global relaxation of lockdowns and the rapid economic recovery phase. It has created a more robust than anticipated demand, putting upward pressure on the prices. The lockdowns also triggered maintenance works among energy investors, which further weighed down on the energy supply when the market rebounded.

Second, in territories such as the US, the energy infrastructure experienced disruptions from Hurricane Ida in 2021. A third of the country’s natural gas output remained offline for over three weeks. Additionally, the country experienced a hotter than usual summer that resulted in more prolonged use of natural gas for electricity generation and a subsequent increase in demand and prices.

Finally, the Russia-Ukraine war is also weighing on energy prices. Russia is the world’s largest oil exporter to global markets, and its natural gas runs the European economy. There has generally been an allure of cheap energy from Russia. However, the European Union and the United States, among other countries, are imposing sanctions against Russia, which means they will have to look for alternative sources of energy. In the meantime, the economic sanctions mean a sharp shortage of energy supplies, which is bound to impact prices significantly.

Summing It Up

Generally, as the prices of natural gas decrease, so do the electricity commodity costs, resulting in lower energy bills across institutions and households that depend on the national grid. Whether the natural gas prices go up or down, the cost of the electricity commodity will follow. The critical question should be how policymakers in the energy sector can leverage this effect of natural gas on electricity prices to pass the savings to consumers. At the same time, they should ensure the electricity supply remains consistent and complies with the net zero goals.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.