Stay up to date with the latest news, announcements, and articles.

- The Pros of Crypto Mining

- Crypto Mining Earns Profits Through Mining Rewards

- What Is a Crypto Mining Facility?

- Crypto Mining Creates Job Opportunities

- Crypto Mining Provides Investment Opportunities

- Crypto Mining Utilizes Unexploited or Underutilized Resources

- Crypto Mining Triggers Innovation

- The Cons of Crypto Mining

- Crypto Mining is a High-Cost Investment Due to Mining Equipment

- Crypto Mining Has a Massive Carbon Footprint Due to High Energy Consumption

- Crypto Mining Lacks a Stable Regulatory Framework

- Cryptocurrencies Are Highly Volatile

- Wrapping Up

We weigh the pros and cons of crypto mining, and examine crypto's impact on humanity. Does it create more problems or make the lives of people better?

You decide.

The Pros of Crypto Mining

For a long time, crypto mining has been a lucrative venture. However, with many changes happening in the market, many people are wondering about the pros and cons of mining and whether there’s any good in crypto mining. Let’s check the benefits of Bitcoin mining.

Crypto Mining Earns Profits Through Mining Rewards

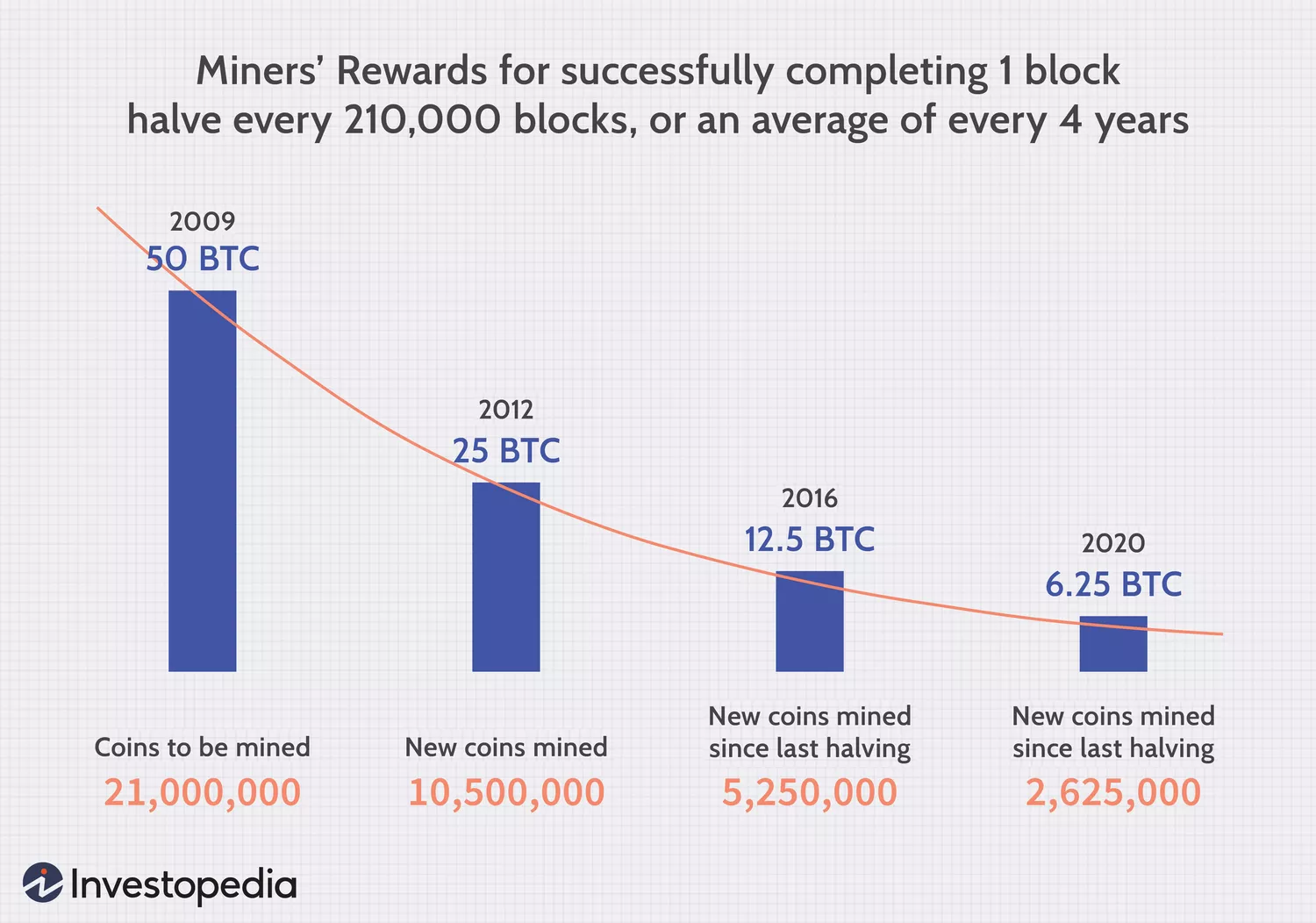

There are over two million crypto coins that you can mine today, however, what crypto is worth mining? Bitcoin remains the most valuable and profitable coin, although you can still mine other established cryptos like Bitcoin Cash, Ethereum, and Litecoin. Despite the profitability, to mine Bitcoin, one must consider challenges such as high electricity costs, the need for specialized hardware, and the decreasing rewards over time due to the halving process. With its value at around $42,000, miners earn handsomely from the 6.25 BTC in mining rewards they receive. Mining Bitcoin involves validating and recording transactions on the blockchain using high-powered computers to solve cryptographic problems. In the USA, for instance, the cost of mining a single Bitcoin is estimated to be $21,089. At that cost, it means miners will have an excess of $20,911 if they sell Bitcoin at the current value and settle all their mining costs.

What Is a Crypto Mining Facility?

A crypto mining facility is a specialized data center designed for cryptocurrency mining. These facilities house large-scale mining operations, providing the necessary infrastructure, cooling systems, and power supply to support high-performance mining rigs. Mining facilities play a crucial role in ensuring maximum efficiency and uptime, enabling miners to optimize their earnings.

Many investors and mining companies establish crypto mining facilities in regions with lower electricity costs, renewable energy sources, and favorable regulations. These facilities often operate at an industrial scale, utilizing advanced cooling technologies and efficient power distribution to maximize profitability while minimizing operational risks.

Crypto Mining Creates Job Opportunities

For some miners, crypto mining is a part-time job and an extra source of income besides the regular 5-9 routine. For others, mining is a full-time job. In essence, for mining to be profitable, your ASICs must have maximum uptime. You must set up your miners and monitor them actively to ensure no downtimes. As a result, some miners end up being on their mining machines for most of their time, making it their full-time job.

Crypto Mining Provides Investment Opportunities

The rise of crypto mining presents a new set of economic opportunities, especially for tech-savvy individuals and companies. For instance, since Bitcoin mining requires the maximum possible uptime and enormous amounts of power, some miners need help to operate their mining equipment, thus seeking the help of third parties. Investing in top mining hardware, such as GPUs or ASICs, is crucial for successful mining. As a result, mining hosting services like EZ Blockchain and Marathon Digital emerged, providing hosting solutions for Bitcoin miners. Joining a mining pool can also increase the chances of receiving rewards by sharing resources and reducing individual payouts.

These companies provide all the necessary infrastructure and other resources required in a mining setup for a fee. Additionally, mining hosting companies provide further employment opportunities for marketers, developers, technicians, and other professionals involved in setting up and running a mining hosting company.

Crypto Mining Utilizes Unexploited or Underutilized Resources

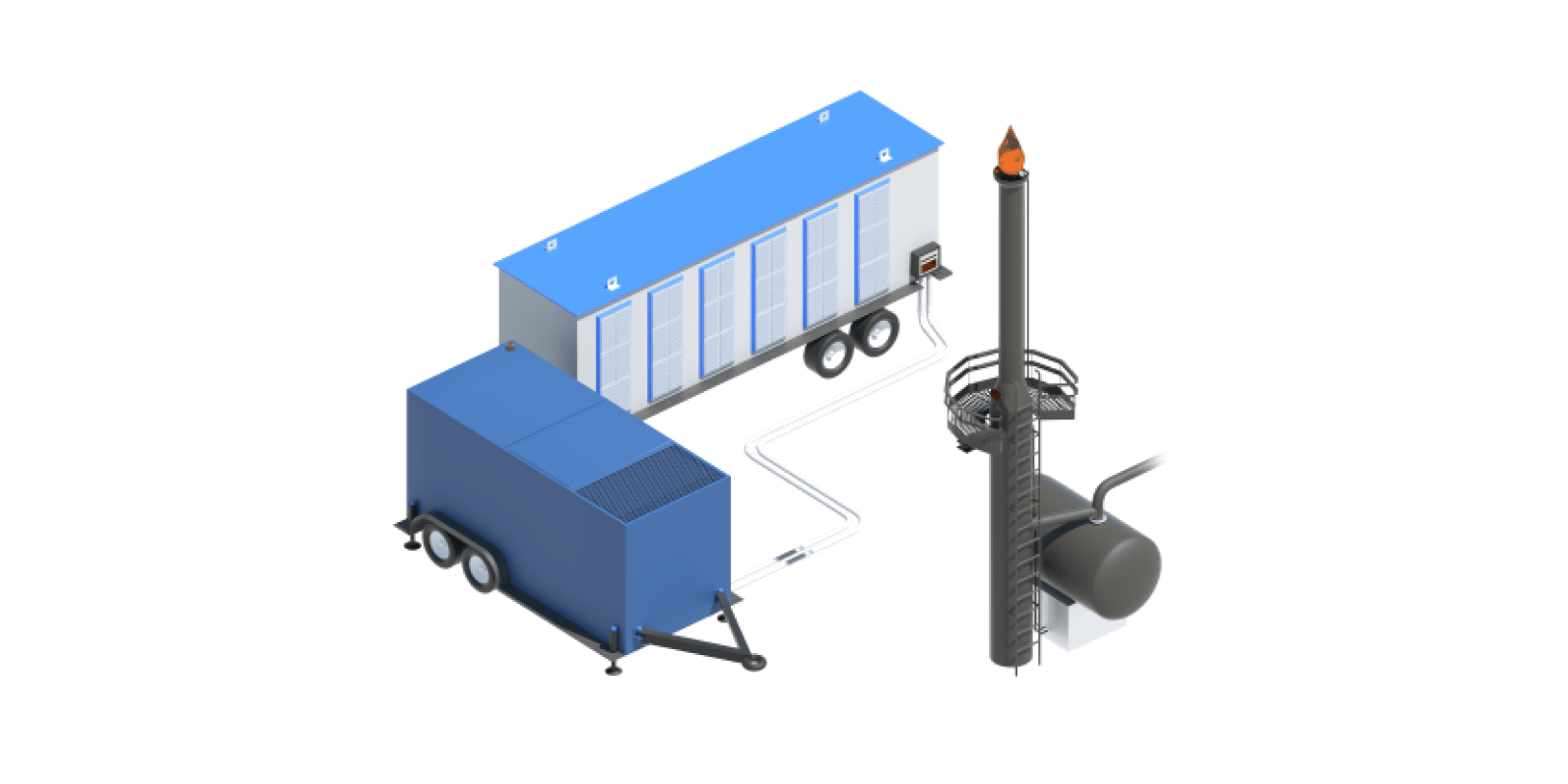

The need for sustainable crypto mining triggers miners to find workable solutions, forcing them to exploit some wasted or underutilized resources for crypto mining. For instance, EZ Blockchain, a leading mining hosting company, invented a permanent solution for stranded and flared gas in oil fields. The company works with oil companies to tap initially flared gas and uses it for Bitcoin mining.

Consequently, the company helps oil investors meet their environmental sustainability goals and opens up a new revenue stream through Bitcoin mining. Further, the need to mine cryptocurrency more sustainably triggers investment in and exploitation of alternative and renewable energy sources such as wind, solar, nuclear, and gas.

Crypto Mining Triggers Innovation

Mining is an energy-intensive and painstaking process for some coins, especially those using the proof of work consensus algorithm like Bitcoin. Driven by the profitability of crypto mining, miners are forced to look for innovative solutions to crypto mining challenges to keep mining. High computing power is necessary for successful crypto mining, leading miners to build more advanced data centers and crypto mining containers. The containers also use advanced technologies like immersion cooling technology.

Additionally, with the increasing complexity of mining, developers are developing more advanced and dedicated mining rigs. Crypto miners compete to solve mathematical puzzles encrypted within each block on the blockchain. Initially, mining cryptocurrency like Bitcoin could be done with a CPU. However, mining difficulty has been gradually increasing, leading to the invention of GPU, FPGA, and ASIC miners.

The Cons of Crypto Mining

Crypto mining is a profitable and worthwhile venture. However, it still comes with many shortcomings that every potential miner ought to know.

Crypto Mining is a High-Cost Investment Due to Mining Equipment

Although the cost of mining equipment dropped to record lows post the crypto winter, crypto mining is still a high-cost investment. First, mining with one or a few miners is not profitable. The Bitcoin network’s mining capacity and the process of ensuring legitimacy require miners to invest in a series of mining rigs to increase their chances of cracking the code first and get the block rewards. The miners’ hashing power determines how likely they are to solve the puzzle fast, so miners with more powerful miners will be in a better position. Mining pools, such as AntPool, allow miners to share resources and increase their chances of receiving rewards by working together. However, the bigger the hashing power a miner has, the more expensive it is to acquire.

Second, mining requires several other resources and facilities like cooling, internet, power, and cabinets, which are expensive to assemble. Ultimately, the mining operations of investors who do not mine efficiently become unprofitable.

Crypto Mining Has a Massive Carbon Footprint Due to High Energy Consumption

It’s undebatable that most digital currencies have a massive carbon footprint, threatening environmental sustainability and net-zero emission goals, and it is one of the biggest disadvantages of crypto mining. For instance, Bitcoin, the largest cryptocurrency, consumes exceptionally large amounts of energy to mine, and more than 60% of the energy comes from fossil fuels. As a result, as more Bitcoin and other proof-of-work coins are mined, more fossil fuels are burnt, leaving a considerable carbon footprint.

Crypto Mining Lacks a Stable Regulatory Framework

Cryptocurrency has been around for over a decade but still lacks a concrete regulatory framework within which miners can operate. The regulation of crypto mining activities is shallow and varies among countries. For instance, mining cryptocurrency in the US is legal, whereas everything related to crypto is prohibited in China. As a result, there are limitations regarding crypto mining in certain jurisdictions, and even where mining is legal, there are no clear provisions to protect industry players.

Cryptocurrencies Are Highly Volatile

Typically, cryptocurrencies lack intrinsic value. The value of digital currencies largely depends on how much the buyer is willing to pay. This makes crypto a highly speculative asset class whose value can change with huge margins quickly. Since miners earn rewards in cryptocurrency, the volatility of this asset class affects the profitability of mining significantly, holding all other variables constant. Additionally, mining operations may be unprofitable for digital assets like Bitcoin that embed halving in their design when the reward diminishes, even as the mining difficulty increases.

Wrapping Up

Like with most investments, crypto mining is a high-risk venture with the potential for massive returns. Understanding the advantages and disadvantages of mining is crucial for making informed decisions. While mining profitability depends on market conditions, electricity costs, and equipment efficiency, the industry’s future looks promising as technological advancements and regulatory frameworks evolve.

For instance, the US is on a mission to ensure responsible development of digital assets with a focus on minimizing risks and ensuring consumer and investor protection. Additionally, cryptocurrencies like Ethereum transitioned successfully from the PoW algorithm to the less energy-intensive PoS consensus. As a result, as the regulatory landscape stabilizes, blockchain networks transition to better algorithms, and the focus shifts to renewable energy, most of the shortcomings will be old times.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.