Stay up to date with the latest news, announcements, and articles.

Gas flaring takes a useful natural resource and instead turns it into harmful waste. It’s a multifaceted problem facing countries from the U.S. to Nigeria to Russia and around the world.

Over decades, natural gas flaring has resulted in an environmental calamity and a multi-billion-dollar loss to the oil and gas industry (OAG). Only recently has it become a greater focus of conversation, however, and most of those conversations have focused on flaring bans.

After all, if it’s both harmful and wasteful, why do it?

What causes gas flaring? Is gas flaring illegal?

Natural gas is brought to the surface throughout drilling for oil. As rocks shift and oil wells are sprung, pockets of natural gas below the surface of the earth are discovered.

This natural gas could be turned into a useful power supply if brought to the surface, treated, and sold to the market. However, looking at the U.S. OAG market as an example, the majority of the 9,000+ national producers don’t have access to infrastructure to treat or transport natural gas.

Therefore, natural gas brought to the surface that can’t be easily used is burned for disposal, or “flared.” Not only is this a loss to OAG producers (and to the grid in potential energy), but the flaring process itself is costly, resulting in a double loss for producers.

Beyond the clear economic loss, natural gas flaring is also toxic to the environment.

The extraction of the highly-flammable liquids and gases from the earth carries an inherent risk. If left unflared and simply “vented” away, natural gas released into the atmosphere is far more dangerous. Natural gas flaring was itself, a “solution” to the problem of unusable and stranded natural gas.

As a growing number of countries and key industry players have now increased talks of how to reduce gas flaring, the default posture has been to put total bans on flaring.

Unfortunately for the OAG industry, for consumers, and even for the environment, natural gas flaring bans just don’t work.

An Anecdotal History of Natural Gas Flaring

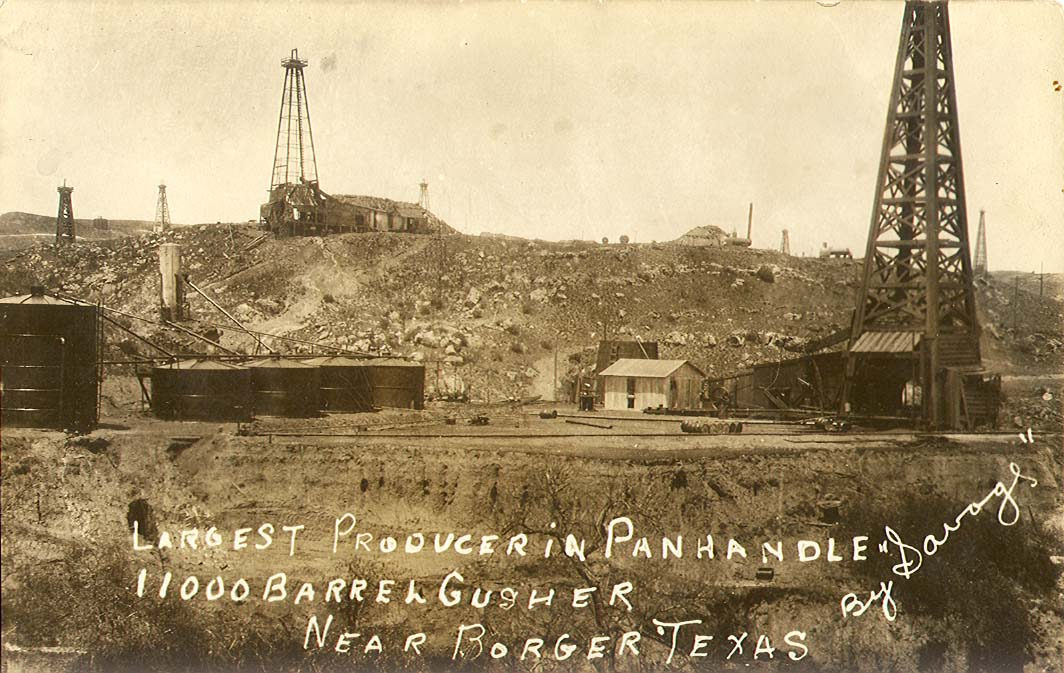

Let’s turn to Texas, USA. Natural gas flaring has been around for decades and practiced all over the world, but unquestionably it’s had a greater impact on areas with more oil drilling. The EZ Blockchain team is especially mindful of the history of natural gas flaring in Texas since the team recently opened a new office there, so let’s look to the Lone Star State for a brief history of natural gas flaring.

Controversy over natural gas flaring is as old as the practice itself. Back in the 1940s, the Texas Railroad Commission fought and won a battle to reduce natural gas flaring. The concern at the time was not environmental, but economic. The Commission was committed to “reducing this waste of one of Texas’s most valuable resources.”

The Beginnings of Natural Gas

Before that, natural gas was hardly seen as much of a boon. It could not be stored at all, but instead had to be transported by pipeline. The development of these pipelines had little incentive, though, as the demand for natural gas was low. Oil at the time was worth approximately five times more than natural gas (when comparing the energy generation potential by weight and sale price).

When the giant Panhandle Gas Field was developed in 1918, there were no buyers to be found for natural gas at all. The city of Amarillo even offered free gas for five years for anyone in the industry willing to move to Amarillo to develop a pipeline. No one bit.

The Beginnings of Natural Gas Sales

Just over a decade later, there were finally a few gas pipelines that enabled the movement and sale of natural gas around the USA. The markets were far from Texas, but dozens of new processing plants had been built. There were finally buyers.

Nonetheless, the number of local oil wells was too much for the sparse network of pipelines. Most oil producers were too far away to access the pipelines and sell their natural gas to market.

By the start of 1930, operators were starting to flare the natural gas they could not store, could not move, and could not sell.

Years before that even, natural gas flaring had been a foreseeable problem. As early as 1899, the state of Texas had passed a conservation law that prohibited the flaring of natural gas. For practical purposes, however, that law was amended in 1925 to allow the flaring of natural gas at oil wells after the new pipelines came up short.

Up to Modern Day

By the early 1990s, the Texas state legislature’s motivations had changed. Natural gas continued to be one of Texas’s richest commodities (at least in theory), but the practice of flaring natural gas was having measurable impacts on the environment.

It had to stop. Or at least get better.

In 1993, Panhandle operators were permitted to continue flaring natural gas, but only under certain conditions. A federal court put additional restrictions on the Texas Railroad Commission’s authority to regulate the industry as they once had, too.

The subsequent hand-over of legislation rights to the federal powers took place when conversations about environmental conservation rose in the public interest.

Why Flaring Bans Don’t Work

Natural gas flaring has been in practice for more than a century, and flaring bans have been in place as early as 1984 (with the first ban in Nigeria). Deadlines for ending the practice in Nigeria and elsewhere have come and passed since then, but eradicating the practice of flaring is an end that OAG producers have had no means to.

The domestic natural gas market is underdeveloped around the world. Even in nations where natural gas-powered energy accounts for about 40% of the electricity on the grid, such as the United States, thousands of OAG producers without access to natural gas pipelines are forced to flare away gas that could have powered thousands more homes and businesses.

OAG producers aren’t able to develop natural gas infrastructures themselves because a pipeline would cost several times more than the market value of natural gas. Plummeting natural gas prices has made that even more challenging in recent years.

Governments, as it turns out, have more at stake than meets the eye. Although bans initially come from environmental concerns, the income that nations are now receiving for flaring bans whose deadlines have passed now makes up a piece of governmental income.

It appears there is even less reason now for these governments to work with OAG producers to find natural gas flaring alternative solutions.

The current challenges that the industry is up against include:

- The OAG industry’s lack of gathering and transportation infrastructure: in remote basins and other areas where oil drilling is most common, the availability of pipelines is still sparse. The capacity to sell natural gas is not feasible without this infrastructure, which is cost-prohibitive to such remote areas.

- Drilling and routine maintenance: this complex industry challenge refers to “flow back” practices when a well is hydraulically fractured. This means the operator must push back proppant and other materials from the wellbore with enormous amounts of water so that well production can begin. This process overwhelms the gas and liquid separators, creating a challenge for worker safety and the integrity of the natural gas collected.

- The cost of natural gas treatments: unbeknownst to most professionals outside of the OAG industry, though natural gas treatments are possible, they are cost-prohibitive. Certain basins are further plagued with compounds in the natural gas released there that render the gas volatile, like hydrogen sulfide (H2S) and CO2. Even if this gas were sold to market, the processing to make it usable would result in astronomical costs to end consumers.

Top Gas Flaring Countries 2021

The seven countries that flared the most natural gas in 2020 were:

- Russia

- Iraq

- Iran

- The United States

- Algeria

- Venezuela

- Nigeria

These are countries rich in oil, meaning more natural gas is released during oil extraction. Where drilling for oil takes place, natural gas will be discovered and, without access to the necessary infrastructure, it will be flared.

These countries also share two other key characteristics:

- First, their geology is such that the re-injection of natural gas associated with drilling is not a viable option.

- Second, their local markets for natural gas are either underdeveloped or pay such low rates for natural gas that further developing the infrastructure isn’t possible.

The United States is a clear example. Look, for instance, to oil production in the Bakken region of the Midwest <add map image>. North Dakota has tapped so much oil potential that the natural gas byproduct has outpaced the construction of natural gas processing plants and pipelines. Without access to this infrastructure, natural gas has been flared in the Bakken at a growing rate.

In Russia and Iran, oil fields are so remote that the subsidized gas prices render infrastructure development infeasible.

Iraq, Algeria, Nigeria, and Venezuela represent countries rich in oil but with natural gas markets that are underdeveloped. No financial incentives exist to put natural gas to productive use.

Effects of Natural Gas Flaring

Living near a flare stack looks like something out of a post-apocalyptic film. There are villages in Nigeria, for instance, where it feels like the sun hasn’t funny set in decades. There are two million people in the Niger Delta who live within two and a half miles of a flare stack. For generations, they’ve endured the raging flame, the noise, and the smoke. Anyone near the stacks must shout to be heard.

Even in the United States, despite even greater volumes of flaring, the one advantage local communities have is living further away from flaring sites. OAG producers in the U.S. tend to be in more isolated areas, limiting the direct exposure to the effects of natural gas flaring. The real effects, however, are wreaking havoc on the world.

Natural gas flaring is a serious environmental problem. The CO2 from gas flaring creates what has been estimated to be at least 0.6% and up to 3% of greenhouse gas emissions, and what direct venting still takes place sends harmful methane into the atmosphere. Methane, the primary component of natural gas, becomes 80 times more harmful to the planet than CO2 over 10 years of reduction.

Pollutants like black carbon and carbon dioxide, both products of gas flaring, absorb sunlight and warm the atmosphere as well. When they land on snow and ice, they reduce their availability to reflect light. This is how the two carbon emissions have become the most prominent contributors to global warming.

On a more frightening and personal basis, the World Bank attributes over seven million deaths each year to air pollution.

Natural gas flaring is a serious economic loss for the OAG and electricity industries, too. The World Bank reported that 140.6 bcm (or 5 billion MMBtu) of natural gas was flared in 2017. The productive use potential of that natural gas represents over $20 billion in revenue at 2017 natural gas prices.

Nonetheless, local regulations dictate the feasibility of natural gas alternative flaring solutions and their viability. For example, in the Bakken region in North Dakota, OAG producers are required to “clean” natural gas before flaring it. This results in another expense for the producer. The treatment reduces the required temperature to flare the gas, which results in a worthwhile reduction of emissions, but the economic burden to producers has climbed unsustainably high.

What would a perfect world look like?

In a perfect world, no natural gas flaring would take place. Every OAG producer would be able to sell all their energy to market to power the grid and the community with affordable electricity.

The infrastructure that a perfect world requires, however, includes treatment plants and pipelines that no one has built. It also requires more storage for natural gas on drilling sites. No OAG can make these investments alone with the current market price of natural gas.

The only real solution to natural gas flaring is to use the natural gas productively on-site instead of flaring it away or worrying about transporting it at all. Natural gas can be turned into electricity using a natural gas generator if used at the drilling pad. Many OAGs already do this to produce energy for their operational needs on-site.

What are some natural gas flaring alternative solutions?

Coming up with viable solutions for natural gas flaring means getting at the heart of the OAG industry’s challenges. The benefits will be reducing black carbon emissions around the world as well as eliminating local noise and air pollution around the tens of thousands of flare sites.

Methane from natural gas vented into the atmosphere will remain there for decades, but black carbon only remains in the atmosphere for days or weeks. This means that, as a short-lived climate pollutant, reducing it would show immediate benefits.

These are the options that have been developed:

- Liquefied Natural Gas (LNG) is a process where the temperature of natural gas is lowered to -160°C. Normally, natural gas is heated and burned. By lowering it, however, this makes it easy to transport to market—even if local access to a pipeline isn’t available.

Once the treated natural gas is delivered to the nearest pipeline, it’s regasified and distributed.

LNG reduces natural gas waste, however, its cost is so high that no OAG producer can make up that cost when the natural gas is sold to market. The process requires expensive cryogenic tanks, and as a result, LNG has not attained widespread use.

2. The other option that governments turn to persistently is the development of local gas markets. This includes building more natural gas processing plants and more natural gas pipelines.

Natural gas markets do need to be better developed. The most obvious end application of natural gas, after all, is power generation on the grid. The challenge of building out gas markets, however, is one that the OAG industry can’t afford to go alone.

Until market structures are allowing both OAG producers and power companies to recover the costs of building this infrastructure out, this option will not be a viable one.

3. The most innovative conversations of late for OAG producers have turned instead to a small-scale use of natural gas at the source. There hasn’t been an option like this before, but new technologies (and opportunities) have presented themselves. Namely:

- Local natural-gas-fired power plants could supply power for oil drilling or hydrocarbon operations, or even local industrial use or residential electrification. This option requires a smaller infrastructure investment but requires local processing partnerships.

- In a similar vein, compressed natural gas (CNG) units can be built on-site to fuel OAG or industrial vehicles. These CNG solutions could theoretically be built in mobile boxes, too, meaning they could be moved and deployed anywhere there is flaring.

Both the above options still require significant development and investment. Most recently, new plug-and-play gas flaring solutions have finally been engineered.

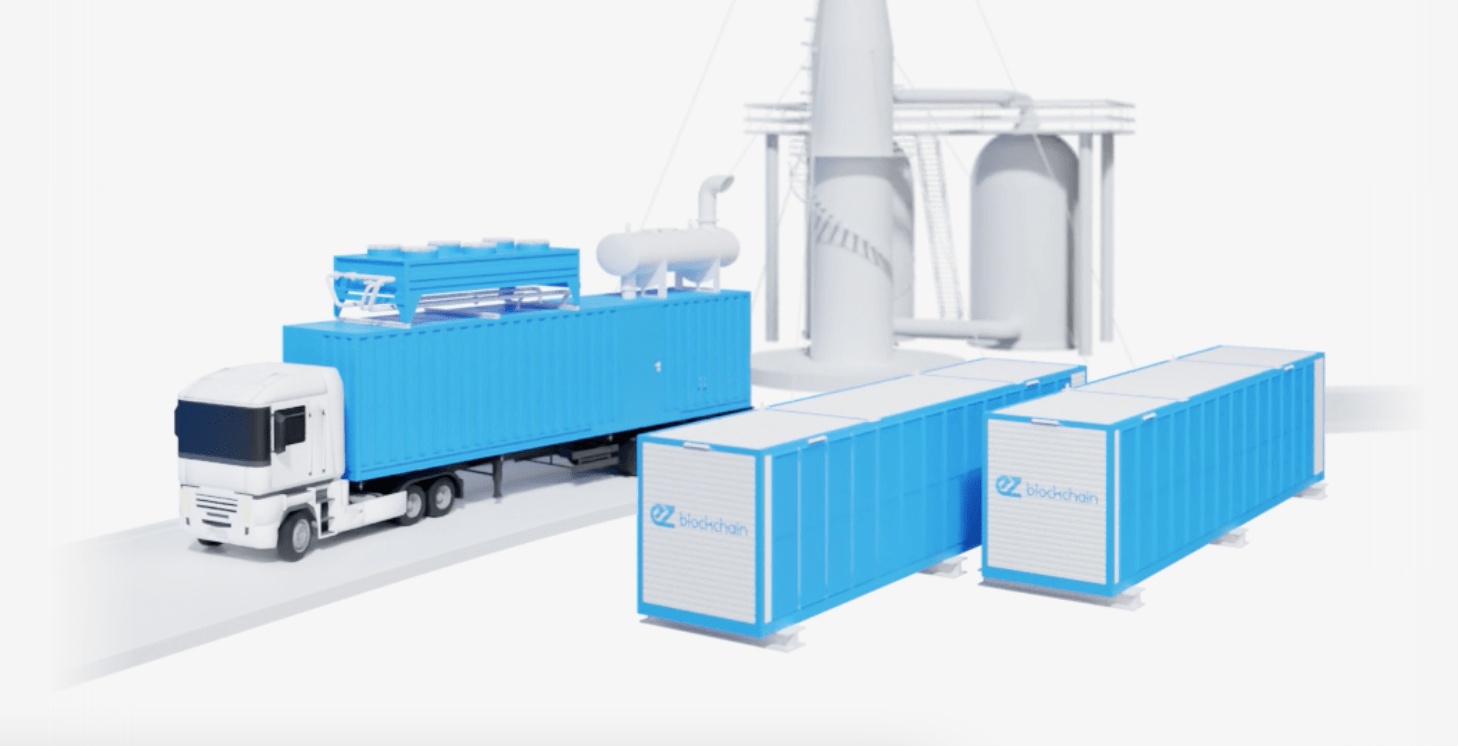

Specifically, a mobile data center deployed to oil fields to process natural gas into energy for high-performing computers in crypto mining operations. Manifested as the EZ Smartgrid, this solution has introduced a new partner into the equation that will change the industry forever.

Our Mission: How the EZ Smartgrid Works

Mobile data center is the EZ Blockchain name for what some producers call crypto-mining containers. Their original manifestation was an adapted shipping container to support large-scale mining operations. The containers were filled with high-performance mining machines (called “mining rigs”) so that each bitcoin miner could move operations anywhere.

Why?

The most crucial competitive edge a cryptocurrency miner has is access to affordable energy. The computing power and power supply needed to run dozens (or hundreds) of high-powered mining rigs and mining software 24/7 is enormous.

Any mining rig that’s set up in a fixed warehouse location, therefore, is tied to the local grid. If prices go up, that bitcoin miner can be priced right out of business.

Mobile data centers like those installed by EZ Blockchain are the sophisticated version of the original crypto-mining containers. Instead of retrofitting shipping containers, the EZ Smartbox—the focal part of the EZ Smartgrid—was engineered specifically to house each high-performance mining rig in its optimal environment.

EZ Blockchain mobile data centers with mining rig infrastructure included are installed right at oil wells to convert natural gas into a local power supply. The electricity is used to support the computing power required by each mining rig.

This innovation in using natural gas on a hyper-local basis requires no additional infrastructure from the OAG producer. The natural gas is processed using a natural gas generator that comes as part of the EZ Smartgrid.

This plug-and-play solution resonates with OAG producers who can now do away with natural gas flaring altogether. Those OAG producers turn waste into a new revenue stream almost overnight while also meeting greater regulatory requirements.

A solution like the EZ Smartgrid is unprecedented. It first seemed too good to be true: turn wasted, flared energy into instant revenue? Do it without investing in infrastructure? Meet and beat all regulatory deadlines for reducing gas flaring?

The opportunity, however, has come. It’s real. And a growing number of OAG producers are now getting in on it.

This unlikely partnership between the OAG industry and Bitcoin cryptocurrency mining operations have moved the needle toward a sustainable future. This is part of EZ Blockchain’s mission, in which the company is poised to play a key part.

The EZ Smartgrid system is extraordinarily easy and refreshingly straightforward. The only shift OAG producers have to make now is in their thinking.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.