Stay up to date with the latest news, announcements, and articles.

Crypto Mining Blog

How to choose bitcoin mining equipment 2025

With Bitcoin mining margins at historic lows, is the Antminer S19 generation dead? Upgrading your bitcoin mining equipment is crucial for staying profitable, but what are the latest trends and model releases in ASIC technology? Explore how new innova [...]

Can Kaspa mining make you $680 / mo with KS-5?

Is Bitcoin mining truly dead? Enter Bitmain’s Kaspa Miner KS5 – you can still earn around $22 or more in Bitcoin daily. The process involves a lot of important factors that influence success. Let’s dive into the details to explore how to mine w [...]

List of Top Crypto Mining Companies in the US

Bitcoin mining companies are part of a lucrative industry, with over $1 billion in revenue generated monthly. Investors looking to capitalize on this growth have several options, from using the services of hosting companies to investing in bitcoin mi [...]

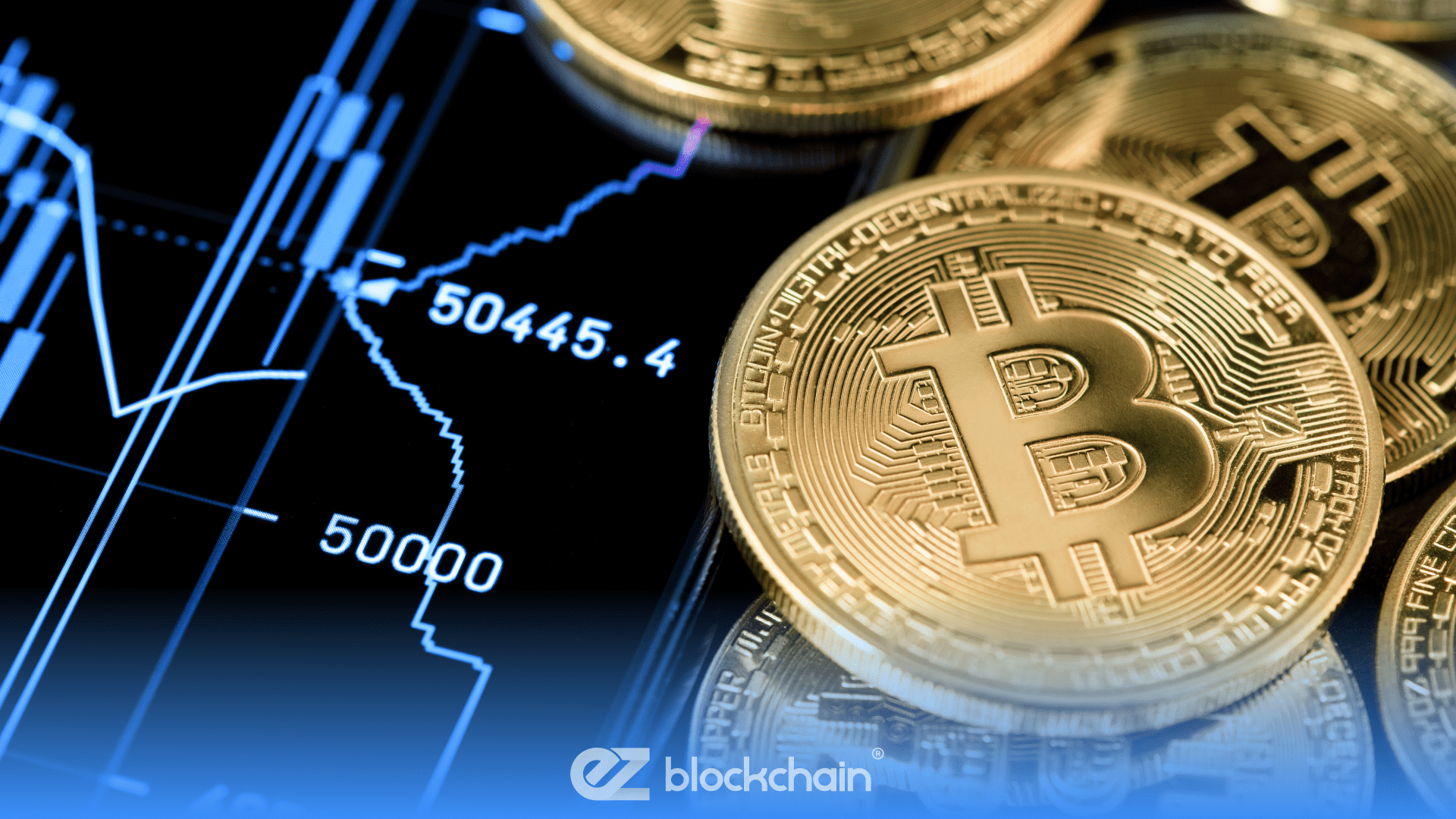

Is GPU Mining Still Profitable?

In the months after the 2024 halving, ASIC bitcoin miners experienced historic low margins. the popular S19j Pro became unprofitable when mining with an electricity cost of $0.06 kWh or more. Whether mining Bitcoin using ASICs or mining other crypto [...]

&videos